Global Biochar Market Size, Share, Trends & Growth Forecast Report Segmented By Application (Farming, Agriculture, Livestock and Others), Technology (Cook stove, Pyrolysis, Microwave pyrolysis, Gasification and Batch pyrolysis klin), and Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), Industry Analysis From 2025 to 2033

Global Biochar Market Size

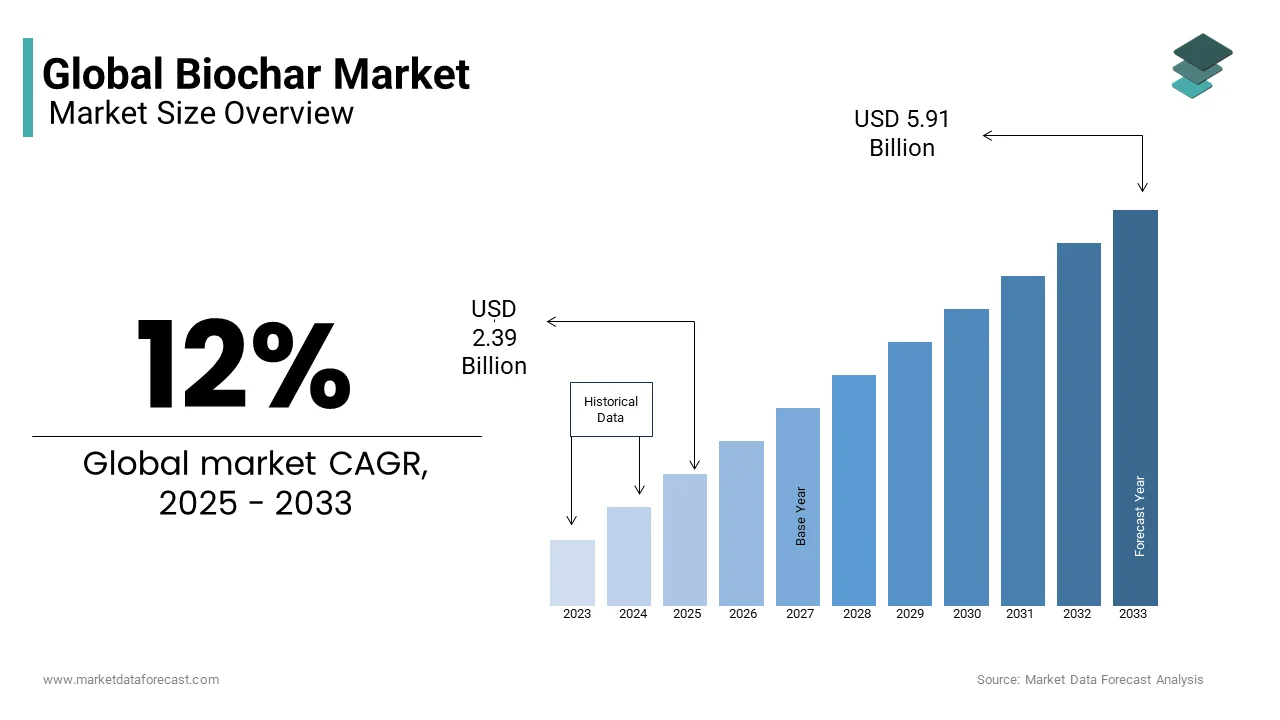

The global biochar market size was valued at USD 2.13 billion in 2024 and is expected to reach USD 2.39 billion in 2025, from USD 5.91 billion by 2033, growing at a CAGR of 12% during the forecast period from from 2025 to 2033.

Biochar is mentioned as a type of charcoal produced by heating waste materials such as agricultural waste, wood waste, forest waste, and animal dung under controlled conditions. It is frequently used as a soil amendment to reduce pollutants and hazardous materials, as well as to avoid moisture loss, soil leaching, and fertilizer runoff, among other applications. Environmental awareness, lower raw material costs, and consistent government waste management policies are expected to open more opportunities to the market participants. Biochar’s full potential in fields other than agriculture has yet to be realized. It's utilized in the textile business as a fabric additive, as a raw material in the construction sector, and as a shield against electromagnetic radiation in the electronics industry. Growing demand from the food industry is predicted to be a major element in the biochar market's expansion. Although the market was affected by the coronavirus crisis, the stakeholders are still encouraging farmers to install reactors in their fields to speed up the process of turning stubble into biomass. This tendency is particularly noticeable in India, where stakeholders and farmers are stepping up efforts to enhance crop productivity despite the pandemic's hurdles.

MARKET DRIVERS

The increasing demand for the agriculture sector is the primary factor propelling the growth of the global biochar market. Because of its capacity to improve the physical and chemical properties of soil, as well as boost soil fertility and production, biochar is becoming more popular in developing countries. This results in increased crop strength and growth while generating fewer pollutants. Biochar has the unique capacity to retain nutrients and water in the top layers of the soil. Biochar is beneficial to agricultural crops and plants because it reduces nutrient leakage from the crop root zone and fertilizer requirements while also improving land cultivation. Biochar has a liming function that balances acidic soil towards a neutral pH. Biochar is being pushed by governments in underdeveloped countries to reduce greenhouse gas emissions like nitrous oxide and methane, which further propels the global biochar market forward.

Sustainable agriculture appeals to developed countries because of its benefits. The demand for biochar from both developed and developing countries has been continuously increasing as technological advancements in sustainable agriculture have increased. Aside from pyrolysis and gasification, advanced biochar production methods are gaining prominence, such as continuous feed pyrolyzers, which help to enhance energy efficiency and biochar outputs. These pyrolyzers assist in the recovery of co-products, lowering pollutant emissions and increasing process efficiency. Therefore, these characteristics further increase the growth of the global biochar market in the next six years. On the other hand, continuous-feed pyrolyzers are being used by biochar producers to regulate operating conditions to improve biochar characteristics and allow for changes in co-product yields. Continuous feed pyrolyzers are used to convert both woody and herbaceous biomass, such as crop leftovers or grasses, into rich biochar.

The growing public awareness of environmental issues is another notable factor contributing to the growth of the global biochar market. The global biochar market is extremely fragmented, and significant players have employed a variety of techniques to expand their footprint in respective markets, including new product launches, expansions, agreements, joint ventures, partnerships, and others. Companies are projected to remain focused on enhanced production techniques for a variety of economical replacements for activated carbon applications, as low-emission, low-cost biochar products have recently captured the interest of biochar market participants.

MARKET RESTRAINTS

High costs associated with the production of biochar are one of the significant restraints to global market growth. Limited awareness and understanding of biochar among potential users, lack of standardized quality and specifications, and insufficient support and subsidies from the governments of several countries are affecting the biochar market growth negatively. Limited availability of feedstock, competition from other soil amendment products, technical challenges in large-scale production, uncertain regulatory environment, limited research, and development funding, and the variability in the effectiveness of biochar based on soil type and conditions are further hindering the growth of the biochar market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12% |

|

Segments Covered |

By Application, Technology, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Airex Energy, ArSta Eco, Biochar Industries, Biochar Supreme, Carbon Gold, Diacarbon Energy Inc, Karr Group, Phoenix Energy, Sunriver Biochar, Swiss Biochar GmbH and Others. |

SEGMENTAL ANALYSIS

By Application Insights

Based on application, the agriculture segment tends to have the largest biochar market share during the forecast period. Biochar demand from agriculture accounted for 71.1% of overall biochar consumption in 2018. Biochar improves the biological productivity of soil and increases water and nutrient-holding capacity, which aids in crop nutrition and growth. However, a substantial percentage of farmers are still unaware of the product's advantages. General farming is a major segment in agricultural applications that is predicted to grow significantly and augment total market demand as a result of increased awareness among farmers by research groups and institutes. In agricultural applications, livestock farming accounts for a significant share of total consumption. The product's capacity to offer critical nutrients and preserve livestock health has led to an increase in its use in livestock farming, including poultry, cattle, and meat production. In the future years, growing government support for organic farming is likely to provide enormous potential.

Other important uses, such as water and waste treatment, have seen increased demand in emerging economies like China and India, as well as a growing desire for enhanced water infrastructure and hygiene awareness. Organic farming is expected to develop rapidly in the next years because of factors such as rising demand for organic food, more consumer health consciousness, and increased consumer spending capacity. Traditional farming, on the other hand, is still practiced in numerous rural regions because it produces higher yields. With government and corporate sector assistance, the use of biochar in mixed farming, zero tillage farming, and biodynamic agriculture will develop rapidly.

By Technology Insights

The pyrolysis segment dominates the global biochar market during the forecast period. Pyrolysis is the most efficient production technique among the numerous manufacturing technologies available. Due to the high end-product yield of high carbon content and process stability, it is predicted to witness a CAGR of 13.8 percent in terms of revenue over the projection period. The use of gasification technology has increased moderately in response to the growing need for energy generation. The technique is likely to lose market share over the forecast period since it does not produce stable biochar that can be used in agricultural applications. Small manufacturers profit from additional industrial processes such as hydrothermal carbonization and acid.

REGIONAL ANALYSIS

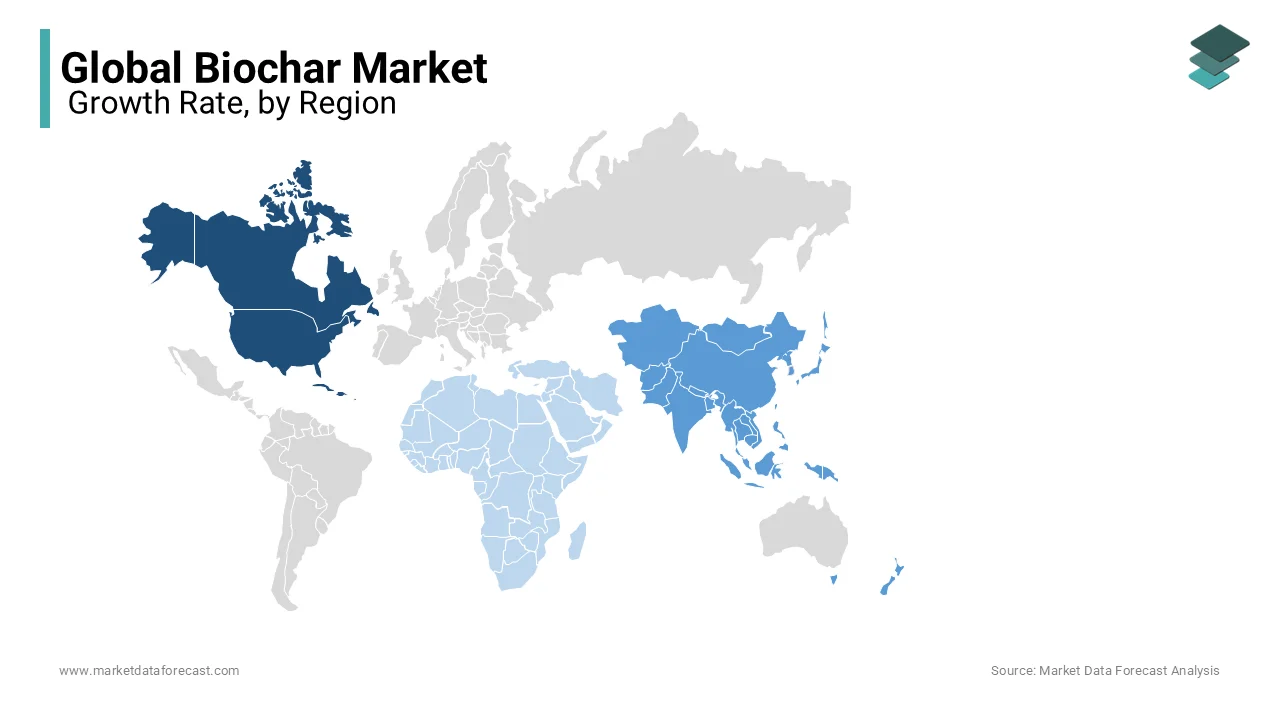

North America is the top-performing region in the global market and held 32.9% of the worldwide market share in 2023. It is anticipated to grow at a prominent CAGR during the forecast period. The growth of the North American biochar market is primarily driven by the growing awareness of sustainable agricultural practices, the increasing number of initiatives by the governments of North American countries to promote the usage of biochar, and technological advancements in production methods of biochar. For instance, according to the American Chemical Society, more than 70% of biochar produced in North America is used for soil amendment and carbon sequestration. The growing investments in the R&D of biochar in North America are further boosting regional market expansion.

The Asia-Pacific is anticipated to be the fastest-growing regional segment in the global market. The presence of a large agricultural sector, an increasing number of soil degradation issues, and favorable policies from the governments of Asia-Pacific countries for biochar are propelling the Asia-Pacific market growth. For instance, as per the Asian Development Bank, China and India are the leading producers of biochar in Asia-Pacific. The governments of Japan and South Korea have taken initiatives to provide subsidies for the production and usage of biochar.

Europe was the second biggest regional segment for biochar in the global market in 2023 and is predicted to grow at a healthy CAGR during the forecast period. The presence of stringent environmental regulations, increasing carbon farming practices, and growing demand for organic farming solutions are majorly propelling the growth of the European biochar market. Germany and the UK are the largest producers of biochar in Europe and these countries are likely to account for the major share of the European market during the forecast period.

Latin America accounted for a considerable share of the global market in 2023 and is projected to grow at a steady CAGR over the forecast period. The growing agricultural activity, increasing number of initiatives to improve soil fertility, and rising focus of the Latin American governments on sustainable farming practices are promoting the biochar market growth in Latin America. Brazil is the largest producer of biochar in Latin America.

The biochar market in the Middle East and Africa is still in a nascent stage and is predicted to grow at a moderate CAGR during the forecast period. An increase in the number of initiatives by the governments of Latin American countries to combat desertification, improve soil fertility, and enhance agricultural sustainability is majorly boosting the biochar market growth in the Middle East and Africa. South Africa and Kenya are the leading producers and users of biochar in the Latin American market.

KEY MARKET PLAYERS

Airex Energy, ArSta Eco, Biochar Industries, Biochar Supreme, Carbon Gold, Diacarbon Energy Inc, Karr Group, Phoenix Energy, Sunriver Biochar, and Swiss Biochar GmbH are some of the key market players that dominate the global biochar market.

RECENT HAPPENINGS IN THIS MARKET

- Airex Energy and SUEZ recently established a cooperation that will allow the firms to enhance biomass-to-biochar production. Biochar is being used in a range of industries to reduce carbon emissions and carbon footprints.

MARKET SEGMENTATION

This research report on the global biochar market is segmented and sub-segmented based on application, technology and region.

By Application

- Farming

- Agriculture

- Livestock

- Others

By Technology

- Cookstove

- Pyrolysis

- Microwave Pyrolysis

- Gasification

- Batch Pyrolysis Kiln

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global biochar market?

The global biochar market is expected to be valued at USD 2.39 billion in 2025.

Which regions are leading in terms of market share for biochar production?

North America and Europe currently lead in market share for biochar production, driven by increasing awareness of sustainable agricultural practices and government support for biochar utilization.

What are the key trends driving growth in the biochar market in Asia Pacific?

In Asia Pacific, the increasing adoption of biochar for soil amendment, water filtration, and carbon sequestration is driving market growth, particularly in countries like China and Australia.

How is the biochar market in North America responding to the growing demand for organic farming practices?

In North America, the biochar market is witnessing increased adoption in organic farming systems due to its ability to improve soil fertility, water retention, and crop yields.

What factors are hindering the growth of the biochar market in Latin America?

In Latin America, factors such as limited awareness about biochar benefits, lack of infrastructure for large-scale production, and competition from traditional soil amendments are hindering market growth.

Who are the key players dominating the biochar market in Europe?

Companies such as Biochar Supreme LLC, Cool Planet Energy Systems, and Diacarbon Energy Inc. are among the key players dominating the biochar market in Europe.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com