Global Clinical Laboratory Services Market Size, Share, Trends & Growth Forecast Report By Test Type, Service Provider, Application and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Clinical Laboratory Services Market Size

The size of the global clinical laboratory services market was worth USD 235 billion in 2024. The global market is anticipated to grow at a CAGR of 5.1% from 2025 to 2033 and be worth USD 367.7 billion by 2033 from USD 247 billion in 2025.

MARKET DRIVERS

The growing demand for diagnostic testing primarily drives the growth of the clinical laboratory services market.

Diagnostic testing is crucial in modern healthcare and helps healthcare professionals to diagnose diseases correctly and aids in the development of personalized treatment plans for patients. The need for accurate and timely diagnostic testing has increased significantly in recent times due to the rising demand to improve patient outcomes and reduce costs. The growing patient population and increasing incidence of age-related disorders among the aged population are primarily accelerating the need for accurate and timely diagnostic testing. To meet the growing demand for diagnostic testing, healthcare providers have been increasingly depending on clinical laboratory services and contributing to the market growth.

The rising awareness among consumers regarding the importance of preventive healthcare further fuels the growth rate of the clinical laboratory services market. In the wake of COVID-19, health awareness among people has grown significantly, and many are showing interest in taking preventive measures to put their health in the best condition. In recent years, the preference of people using clinical laboratory services to assess their health status and identify potential health risks has increased notably and this trend is likely to accelerate in the coming years and boost the market’s growth rate.

Technological advancements are expected to contribute to the growth rate of the clinical laboratory services market during the forecast period. In addition, growing demand for diagnostic testing and monitoring from the rapidly growing chronic disease patient population, rising need for healthcare services including diagnostic testing from the aging population worldwide and increasing spending by governmental and non-governmental organizations to improve healthcare services including diagnostic testing boost the clinical laboratory services market growth.

In addition, factors such as increased coverage by insurance companies for diagnostic testing and the growing preference to outsource their laboratory services to specialized clinical laboratory service providers by healthcare providers favor the growth rate of the market. Favorable government initiatives to promote the adoption of clinical laboratory services and a rising emphasis on personalized medicine are anticipated to add fuel to the growth rate of the market. The rising use of POC testing, increasing demand for companion diagnostics and growing use of automation in clinical laboratory services further support the market's growth rate.

MARKET RESTRAINTS

High costs associated with diagnostic testing, especially specialized or advanced tests are one of the key factors hampering the clinical laboratory services market growth. The lack of reimbursement for certain tests in some counties is another notable obstacle to the growth rate of the market. The scarcity of skilled laboratory professionals to perform testing and analysis further impedes market growth. In addition, factors such as lack of standardization in diagnostic testing and concerns about data privacy and security hinder the growth rate of the clinical laboratory services market. Stringent regulatory requirements for diagnostic testing are further negatively impacting market growth.

Impact of COVID-19 on the global clinical laboratory services market

The clinical laboratory services market has experienced a mixed impact from the COVID-19 pandemic. On one side, the demand for COVID-19 testing has grown significantly during the COVID-19 pandemic and has offered numerous growth opportunities to the existing providers and offered scope for new participants to enter the market. In addition, the usage of remote patient monitoring and telemedicine has increased dramatically during the COVID-19 pandemic due to the measures imposed by the governments to limit the virus spread and the unwillingness of patients to visit the hospitals. The market participants of clinical laboratory services have leveraged this opportunity and started offering remote testing services and collaborated with telemedicine providers to maximize their sales and revenue. Furthermore, the adoption of new testing technologies such as rapid antigen tests and point-of-care testing has grown significantly, and this has offered opportunities to market participants to increase their revenue and launch new testing services. Such factors have favored the clinical laboratory services market. On the other hand, the COVID-19 pandemic has disrupted laboratory services for non-COVID-19 testing as researchers and healthcare professionals have shifted their focus toward COVID-19 testing and developing the COVID-19 vaccine. This has resulted negatively in the clinical laboratory services market. The COVID-19 pandemic has also caused severe disruptions in the global supply chains and resulted in a shortage of laboratory equipment and services. Likewise, the clinical laboratory services market has also experienced an unfavorable impact from the COVID-19 pandemic.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.1% |

|

Segments Covered |

By Test Type, Service Provider, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Qiagen, OPKO Health, Inc., Abbott, Quest Diagnostics, Inc., Arup Laboratories, Charles River Laboratories International, Inc., Laboratory Corporation of America Holdings (LabCorp), Fresenius Medical Care, NeoGenomics Laboratories, Inc., and Siemens Healthcare GmbH., and Others. |

SEGMENTAL ANALYSIS

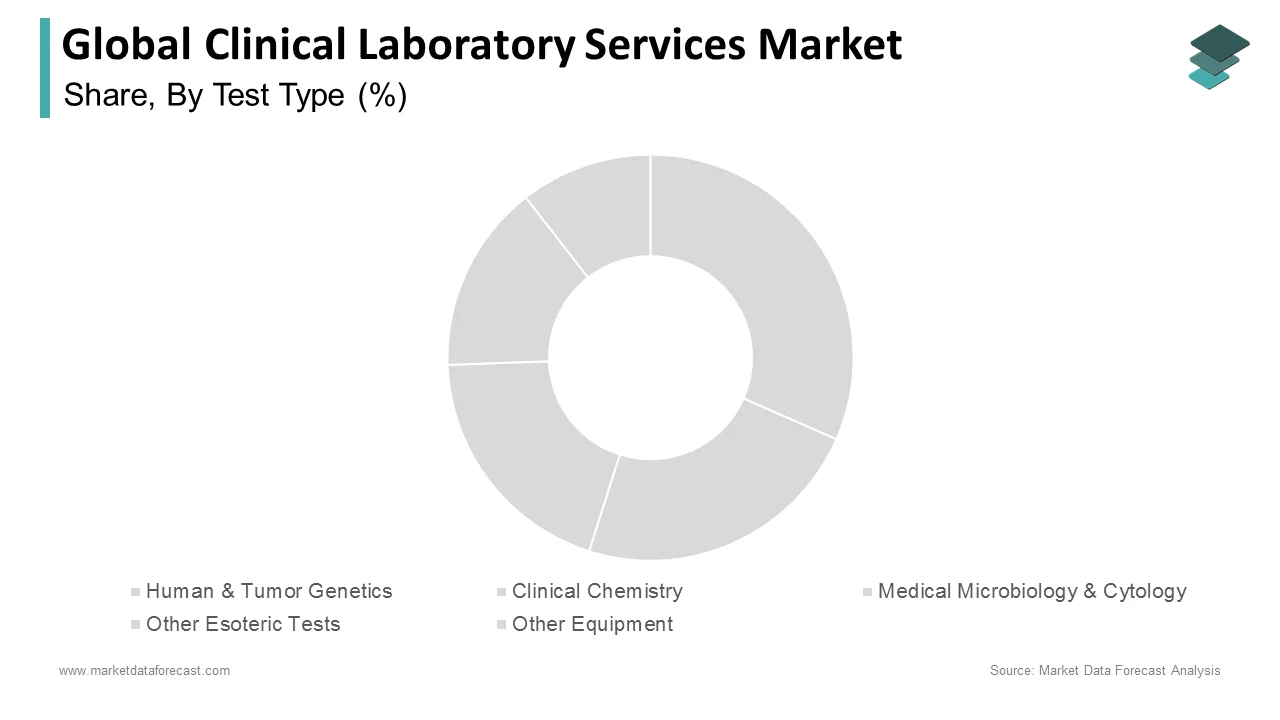

By Test Type Insights

Based on the test type, the clinical chemistry segment accounted for 49.2% of the worldwide market share in 2024 and the domination of the segment is likely to continue throughout the forecast period. Factors such as the growing of chronic diseases such as diabetes, cardiovascular diseases and kidney diseases and the rising aging population worldwide majorly drive the segmental growth. The rising adoption of point-of-care testing and automation in clinical chemistry testing further contribute to the growth rate of the segment.

The medical microbiology & cytology segment captured a substantial share of the global market in 2024 and is expected to grow at a notable CAGR during the forecast period owing to factors such as the rising prevalence of infectious diseases, the growing awareness and adoption of preventive healthcare, the advancements in molecular diagnostics and the availability of rapid testing.

The human and tumor genetic segment is anticipated to account for a considerable share of the global market during the forecast period. Factors such as the growing prevalence of genetic disorders and cancers, as well as advancements in genomics technologies and the availability of personalized medicine and targeted therapies favor segmental growth.

By Service Provider Insights

Based on the service provider, the hospital-based laboratories segment had the largest share of the global market in 2024 and is anticipated to continue its domination in the global market throughout the forecast period. The growing demand for healthcare services due to the aging population and the rising prevalence of chronic diseases is one of the major factors propelling segmental growth. The rising adoption of automation and point-of-care testing by hospitals to improve the efficiency and accuracy of laboratory services further contribute to the growth rate of the segment.

By Application Insights

Based on the application, the bioanalytical & lab chemistry services segment held the major share of the worldwide market in 2024 and is estimated to grow at a promising CAGR during the forecast period. The growing demand for diagnostic testing, the increasing aging population, the rising prevalence of chronic diseases and the increasing adoption of preventive healthcare primarily propel the segmental growth. Technological advancements and rising demand for personalized medicine contribute to segmental growth. Furthermore, the increasing investments in R&D and the growing number of research and developmental activities for drug discovery and development, preclinical and clinical trials, and toxicology testing by the pharmaceutical and biotechnology industries drive the demand for bioanalytical and lab chemistry services and boost the growth rate of the segment.

REGIONAL ANALYSIS

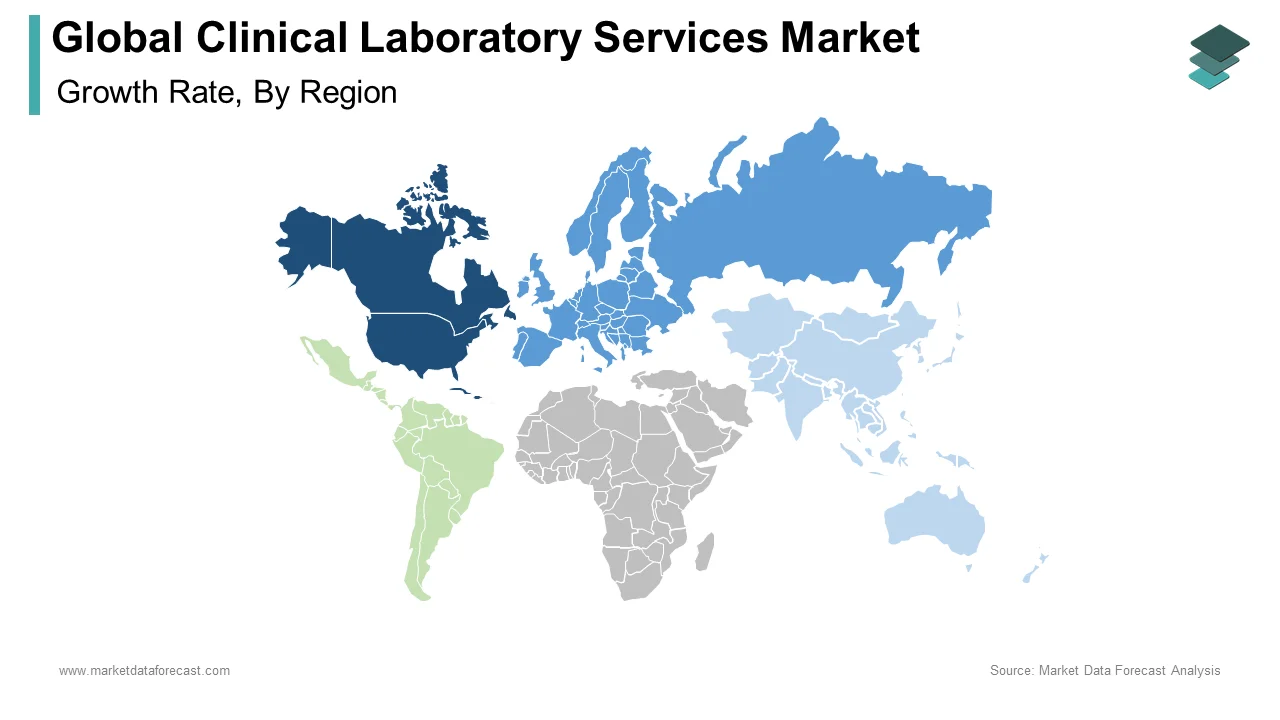

Geographically, the North American clinical laboratory services market led the global market and accounted for the major share of the global market in 2024. The domination of the North American region is anticipated to continue throughout the forecast period. The favorable regulatory environment for clinical laboratory services, the rising trend of consolidation and the growing demand for molecular diagnostics majorly propel the North American market growth. In addition, rising emphasis on data analytics and rapid adoption of telemedicine boost the growth rate of the North American market. The U.S. accounted for the largest share of the North American market in 2024, followed by Canada and the same pattern is expected to repeat throughout the forecast period.

The European clinical laboratory services market captured the second-largest share of the global market in 2024 and is anticipated to grow at a promising CAGR during the forecast period. Factors such as the growing adoption of point-of-care testing and rising demand for companion diagnostics majorly support the European market growth. The growing prevalence of chronic diseases, rising focus on preventive healthcare and increasing demand for personalized medicine further contribute to the growth rate of the European market. Germany held the leading share of the European market in 2024.

The Asia Pacific clinical laboratory services market is one of the fastest-growing regional markets in the global market. It is expected to occupy a notable share of the worldwide market by the end of the forecast period. A large population base, rising disposable incomes and growing investments to promote the healthcare infrastructure in the Asia-Pacific region primarily fuel the regional market growth. The growing adoption of advanced laboratory technologies and increasing medical tourism further favor the growth rate of the APAC market. China was the largest regional segment in the APAC market for clinical laboratory services in 2024.

Latin America accounted for a considerable share of the global market in 2024. The Latin American market is estimated to grow at a healthy CAGR in the coming years due to factors such as the growing investment to develop healthcare infrastructure, the rising patient population of infectious diseases, growing demand for laboratory testing services, rising focus on preventive healthcare and an increasing number of government initiatives to promote healthcare access. Brazil led the clinical laboratory services market of Latin America in 2024.

MEA had a moderate share of the worldwide market in 2024 and is expected to witness a steady CAGR during the forecast period. The growing investments in healthcare IT and rising demand for laboratory testing services contribute to regional market growth.

KEY MARKET PARTICIPANTS

Companies playing a dominating role in the global clinical laboratory services market are Qiagen, OPKO Health, Inc., Abbott, Quest Diagnostics, Inc., Arup Laboratories, Charles River Laboratories International, Inc., Laboratory Corporation of America Holdings (LabCorp), Fresenius Medical Care, NeoGenomics Laboratories, Inc., and Siemens Healthcare GmbH.

MARKET SEGMENTATION

This research report on the global clinical laboratory services market has been segmented and sub-segmented based on test type, service provider, application, and region.

By Test Type

- Human & Tumor Genetics

- Clinical Chemistry

- Medical Microbiology & Cytology

- Other Esoteric Tests

By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Others

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- United Kingdom

- Germany

- France

- Spain

- Italy

- Rest of EU

- Asia Pacific

- India

- China

- Japan

- Australia

- New Zealand

- South Korea

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the current size of the clinical laboratory services market?

The global clinical laboratory services market is anticipated to be worth USD 235 billion in 2024.

Who are the major players in the clinical laboratory services market?

The major players in the clinical laboratory services market include Quest Diagnostics, LabCorp, Sonic Healthcare, and Eurofins Scientific, among others.

What factors are driving the growth of the clinical laboratory services market?

Factors such as an aging population, an increase in the prevalence of chronic diseases, technological advancements in laboratory testing, and the rise in demand for personalized medicine primarily drive the market growth.

What are the challenges facing the clinical laboratory services market?

The challenges facing the clinical laboratory services market include increased competition, a shortage of skilled laboratory professionals, and the need to maintain quality standards while keeping costs under control.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]