Global Laboratory Information System Market Size, Share, Trends & Growth Forecast Report – Segmented By Component (LIS Software, LIS Services and LIS Hardware), End-users, Delivery Mode (Cloud-Based and On-Premises) and Region - Industry Analysis From 2025 to 2033

Global Laboratory Information System Market Size

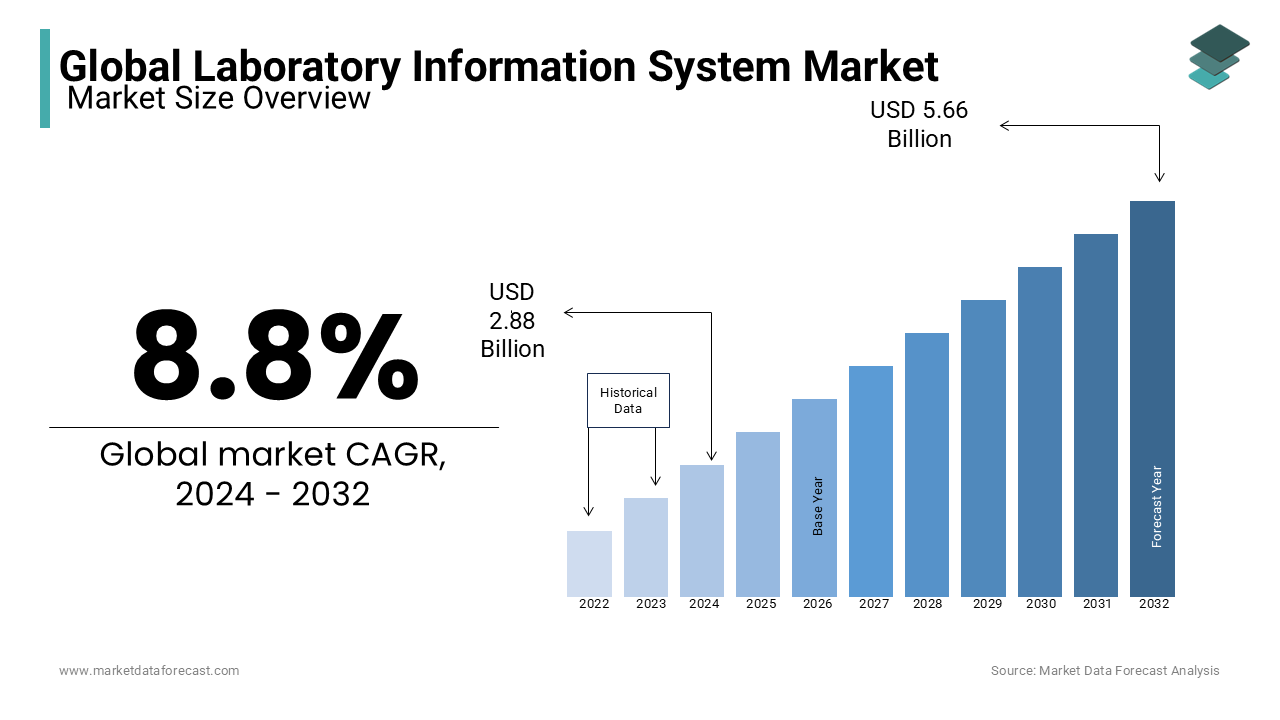

The global laboratory information system (LIS) market size was valued at USD 2.88 billion in 2024. The global market is estimated to grow to USD 6.15 billion by 2033 from USD 3.13 billion in 2025 and register a CAGR of 8.8% during the forecast period.

Laboratory information systems are used to manage various aspects of a medical laboratory. It is a computer system integrated with hardware and software to effectively manage healthcare information in laboratories. For instance, a laboratory information system manages, stores, and processes patient laboratory processes and test data, including all necessary information about the sample, to reduce the risk of contamination, expiration, and loss of samples. LIMS also has the capability of tracking the location of a sample.

MARKET DRIVERS

The growing need to reduce diagnostic errors and the YOY rise in the prevalence of chronic diseases is increasing the need for the laboratory information system market.

The primary factor driving the growth of the global laboratory information system market is the various advantages LIS offers. Some main benefits include better workload evaluation, faster communication, and reduced administrative burden, including decision support rules for efficiently guiding extension tools, workflow, data extraction capabilities, point-of-care testing support, and auditing capabilities. In addition, the scalability and flexibility of LIS facilitate an advanced level of configurability, helping the labs improve efficiency and integration, reduce errors, and provide improved information to the doctor regarding adapted reference values, comments, interpretation, faster billing, and improved collection operations. The rise in the adoption rate of laboratory information systems due to the beneficial features of these systems, such as integrating electronic records with the LIS, accurate subtyping of diseases, and better efficiency of clinical workflows, are significantly contributing to the growth of the laboratory information system market. In addition, increasing demand for innovative and advanced technologies led to rising R&D activities in genomics and precision medicine; these factors catalyze the growth of the global laboratory information system market.

The growing adoption of the laboratory information system market is further promoting the market’s growth rate.

The LIS market is also highly driven because of its installation in many areas such as student health centers, hospitals, provider groups and clinics, universities, pathology laboratories, public health, independent reference laboratories, veterinary laboratories, toxicology clinics, etc. since today's healthcare environment requires committed vendor support to manage the complexity and regulatory nature of lab testing. Additionally, LIS helps improve laboratory workflow efficiency, where lab technicians need not be concerned about oversights. Also, the technological advances in recent years have resulted in an increased demand for laboratory data to meet microbiological, clinical, and public health needs by the growing population, as a result of growing awareness for better, cost-effective, and efficient lab testing, along with their disease treatment, which not only guarantees maximum reimbursement but also facilitates decision-making to increase laboratory productivity since the system offers a wide frequency of security measures for ensuring the safety of sensitive data stored in the systems. Therefore, the emergence of novel and innovative laboratory information systems offering enhanced customer services and support is supposed to create lucrative growth opportunities for key market players in this industry during the forecast period. In addition, increasing demand for laboratory information systems in clinical research in countries like India, China, Brazil, Singapore, Malaysia, and Middle Eastern countries boosts the LIS market further. Furthermore, consistently increasing demand for personalized medicine will likely boost the laboratory information system market to climb new growth heights.

MARKET RESTRAINTS

High costs associated with the service and maintenance of laboratory information systems pose a significant challenge to the stakeholders in the market, resulting in restraining the growth of the global laboratory information system market. In addition, budget constraints in small and medium-scale laboratories limit the adoption rate of technologically advanced systems, limiting the growth of the laboratory information system market. The lack of stringent regulations and standards is another significant opportunity for the key players in economically emerging countries and is assumed to expand during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Component, Delivery Mode, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cerner Corporation, Mckesson, Epic System Corporation, Medical Information Technology, SCC Soft Computer, Sunquest Information Systems, Labware, Compugroup Medical, and Evident. |

SEGMENTAL ANALYSIS

By Component Insights

The LIS software segment is estimated to witness the highest CAGR during the foreseen period. The availability of advanced and automated laboratory software, the rise in focus of industry players to develop innovative LIS, and the growing demand for LIS software in emerging industries are majorly attributing to the growth of this segment. It is a software commonly used in routine sample-driven process analytical laboratories, which keeps track of samples, associated metadata, test results, experiments, laboratory workflows, and instruments.

The LIMS services segment is estimated to hold a considerable global market share during the forecast period. LIS services offer services for storing, processing, and managing lab-related patient data.

By Delivery Mode Insights

The cloud segment is estimated to register the dominance in the global market during the forecast period. Cloud-based models have become prominent and account for the most substantial portion of practical solutions, promoting the Global Laboratory Information Systems market growth based on delivery mode. Being a centralized and highly automated research lab, offering present life science experiments, helping scientists experiment with a remotely located computer, and allowing researchers to maintain complete control over experimental design.

By End User Insights

The hospital segment acquired the most significant market share in the global LIS market in 2025. Increasing usage of hospitals and hospital laboratories is the primary factor expanding the growth of this segment. In addition, LIS operates online to cover the entire corresponding hospital network, requiring massive database servers to store information about the drugs, manage patient payment records, and schedule online appointments for doctors.

The clinical laboratories segment will hold a considerable share of the global market during the forecast period. Clinical laboratories have been early adopters of computer technology, with the sharing of chemistry and hematology laboratories requiring similar information processing. In addition, due to increasing pressure to replace conventional models and the need for more sophisticated and powerful LAB systems, this segment is estimated to grow profitably.

REGIONAL ANALYSIS

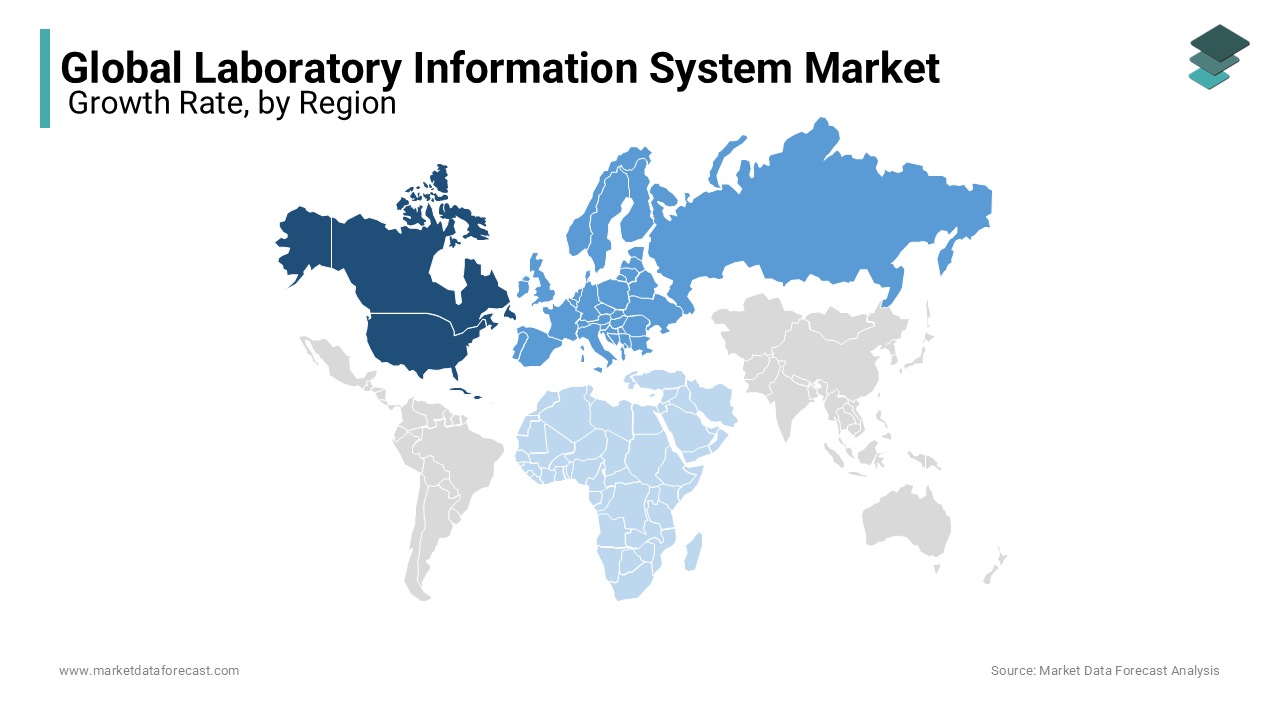

North America dominates the global laboratory information system market and is foreseen to multiply during the forecast period. Factors such as the rise in the prevalence of cancer, the presence of key market players in the region, the availability of advanced healthcare systems, and encouraging reimbursement policies in the area for pathology procedures.

Europe is expected to showcase promising growth during the forecast period. Factors such as the growing rate of chronic diseases and increasing awareness about new technologies associated with different laboratories drive the European market.

However, Asia-Pacific is estimated to witness the quickest growth rate during the forecast period owing to the growing healthcare expenditure and advancements in the IT sector. In addition, to enlarging the effectiveness of medical laboratories, the growing stipulation for error-free diagnosis is fuelling the growth. Japan dominates the region with the largest market share, which China and India follow. In emerging countries like Singapore, Australia, India, and China, the market is growing because factors like the increasing geriatric population, rising patient pool, and improving healthcare facilities are boosting the laboratory information system market growth during the analysis period.

Latin America is projected to grow steadily during the forecast period. Growing awareness about electronic healthcare record systems and their increasing prominence incorporated with assisting government programs and policies are predicted to surge the Latin American LIS market during the forecast period.

MEA is predicted to have a minor share of the global LIS market due to middle-income countries' existence driving the market growth. However, the need for healthcare awareness and advanced technology restricts the market growth. Of this region, Saudi Arabia and the UAE dominate the region regarding the market, which owes to a good economy, expert professionals, and the availability of new and recent technologies.

KEY MARKET PLAYERS

The list of key competitors in the global laboratory information system market profiled in this report is Cerner Corporation, Mckesson, Epic System Corporation, Medical Information Technology, SCC Soft Computer, Sunquest Information Systems, Labware, Compugroup Medical, and Evident.

The increasing initiatives from government and industry players in the healthcare IT sector and laboratory services aid the global LIS market.

RECENT HAPPENINGS IN THE MARKET

- In November 2022, a Hamburg-based manufacturer of laboratory products, Starlab, invented sterile TipOne to help scientists in their work by improving the sustainability of the lab, which also has been shortlisted for the 'Products of Sustainable Laboratory of category award of the year.

- In November 2022, Oracle ORCL Cerner partnered with Labcorp for increased management of hospital labs in 10 states, supporting complex needs of a laboratory operation to standardize workflows for greater efficiency and support information sharing across the entire laboratory system.

- In November 2022, Fluence Energy, Inc., a leading global provider of energy storage products, expanded its product testing facilities network through a new lab in Pennsylvania, serving as the primary location for system-level testing, supporting quality assurance with increased speed and flexibility.

- In July 2019, the Cerner Corporation announced that the company is looking to collaborate strategically with Amazon Inc. to improve its productivity and enhance business operations by adopting a cloud platform offered by Amazon Web Services. In addition, the company expects to boost its services and provide better solutions for its customers by integrating machine learning and artificial intelligence into healthcare.

- LabVantage Solutions, Inc. has developed a medical suite for laboratory solutions called LabVantage medical suite based not their laboratory information mage meant system platform. The medical suite is mainly designed to integrate significant laboratory disciplines such as genomics, microbiology, pathology, and other functions in the laboratory. The medical suite has witnessed an increasing adoption rate in Europe due to its benefits, such as efficient data exchanging options, scheduled workflows, and robust business intelligence tools available with the suite.

MARKET SEGMENTATION

This research report on the global laboratory information system market has been segmented and sub-segmented into the following categories.

By Component

- LIS Services

- LIS Software

- LIS Hardware

By Delivery Mode

- Cloud-Based

- On-Premises

By End User

- Hospitals

- Independent Laboratories

- Clinical Laboratories

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global laboratory information system market worth in 2024?

The global laboratory information system market size was valued at USD 2.65 billion in 2023.

Which segment by component led the laboratory information system market in 2024?

Based on the component, the LIS software segment dominate the laboratory information system market in 2024.

Does this report include COVID-19 impact on the laboratory information system market?

Yes. In this report, COVID-19 impact on the laboratory information system market has been discussed in a detailed manner.

Which are the major players in the global laboratory information system market?

Cerner Corporation, Mckesson, Epic System Corporation, Medical information technology, SCC Soft Computer, Sunquest Information systems, Labware, Compugroup Medical, and Evident are some of the notable players in the LIS market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com