Global Genomics Market Size, Share, Trends & Growth Forecast Report - Segmented By Product (Instruments/systems, Consumables and Services), Technology (Sequencing, Microarray Technology, PCR and Nucleic Acid Extraction), Process, Application, End User and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From 2025 to 2033

Global Genomics Market Size

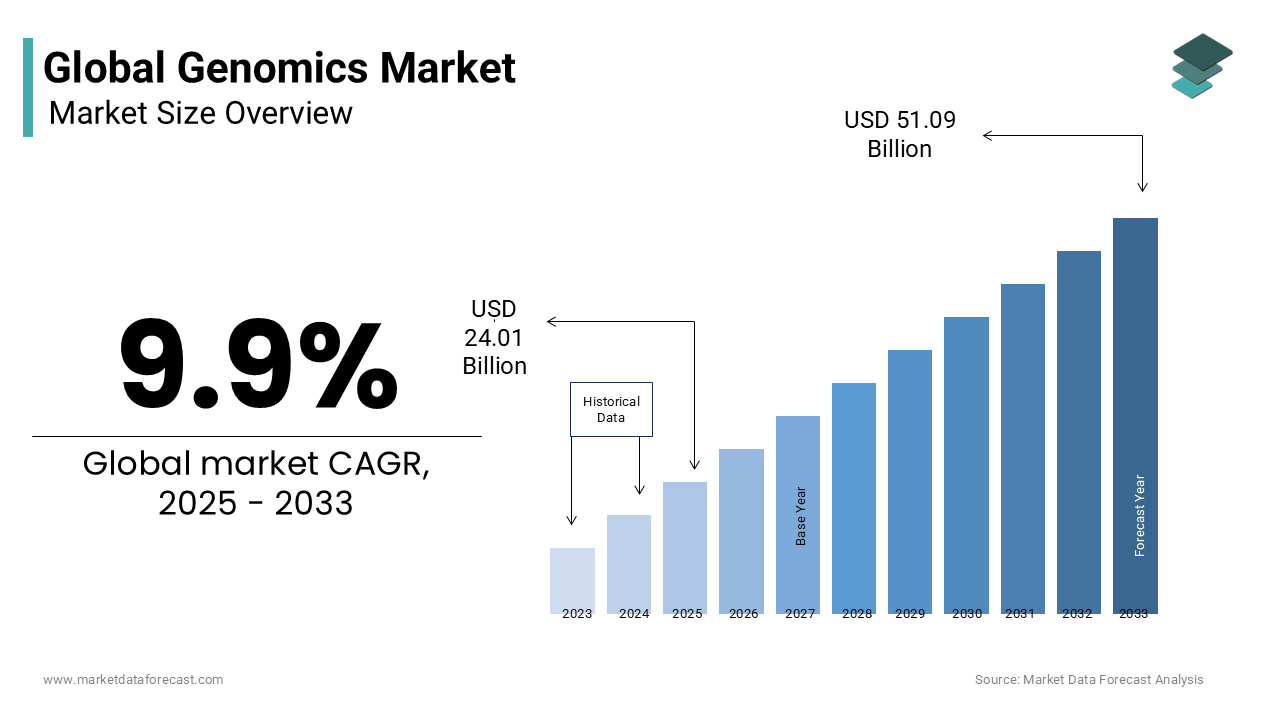

As per our research report, the global genomics market is predicted to be worth USD 51.09 billion by 2033 from USD 24.01 billion in 2025, growing at a CAGR of 9.9% during the forecast period. The genomics market size was valued at USD 21.85 billion in 2024.

MARKET DRIVERS

The growth of the genomics market is majorly driven by increasing technological developments and their rapid adoption among developed and developing countries.

Technological developments such as DNA sequencing have promoted the usage of genomics. In the olden days, genome sequencing consumed significant time and cost. Technological developments such as DNA sequencing have helped notably to reduce the time and cost involved in sequencing the genomes, which has resulted in the growing number of genomes that can be sequenced. In addition, CRISPR gene editing, synthetic biology, and bioinformatics are other notable technological developments that favored the adoption of genomics and have boosted the growth of the genomics market. Likewise, technological developments have generated numerous growth possibilities in the genomics market.

The rising adoption of personalized medicine is anticipated to fuel the genomics market growth.

The adoption and preference towards personalized medicine are growing significantly worldwide. Personalized medicine is a new approach in the healthcare industry. Genomics plays a vital role in developing personalized treatment plans for patients. In this process, the healthcare providers study the patient's genetic makeup and prepare the treatment plan that gives the best outcome and reduces side effects. Personalized medicine is believed to be cost-effective and deliver improved patient safety.

Growing support and investments from governments and private organizations for the R&D of genomics are fuelling the market's growth rate.

In addition, the growing patient population suffering from cancer is expected to boost the growth rate of the genomics market. According to the statistics published by the American Cancer Society, 1.9 million people new cancer cases were expected in 2022. Furthermore, according to the data given by the National Cancer Institute, an estimated 29.5 million people are anticipated to diagnose with cancer every year by 2040. Furthermore, the increasing awareness among healthcare providers regarding the advantages of genomics and the growing demand for genomic services are anticipated to result in market growth during the forecast period.

MARKET RESTRAINTS

The lack of training programs on genomics technologies in research centers significantly hinders the market's growth.

In addition, the high cost of genomic research equipment and the lack of trained technicians hamper the growth rate of the genomics market worldwide. In addition, people diagnosed with might be susceptible to developing some diseases in the future. Furthermore, people with genetic disorders may become under pressure not to have children as they can't pass the faulty gene to the next generation, and rigorous rules and regulations by the government regarding the overuse of genetics are some factors impeding the market's growth. Furthermore, concerns associated with ethics and privacy, limited awareness and understanding of genomics, and issues associated with reimbursements in some countries are inhibiting the growth rate of the global genomics market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Application, Technology, Process, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Affymetrix, Inc., Agilent Technologies, BGI, Thermo Fisher Scientific, Bio-Rad Laboratories Inc., G.E. Healthcare, Illumina Inc., Qiagen, Roche Diagnostics, Life Technologies, and Cepheid. |

SEGMENTAL ANALYSIS

By Product Insights

The consumables segment accounted for the leading share in the global genomics market in 2024 and is likely to display a high growth rate during the forecast period. The increasing number of patients with chronic diseases such as diabetes, cancer, and others is one of the key factors propelling segmental growth. In addition, the prevalence of R&D activities in developing new drugs escalates the segment's growth rate. Furthermore, the growing need for genomic services and rising usage of genomic technologies are expected to result in the segment's growth during the forecast period.

On the other hand, the instruments segment is predicted to witness a healthy CAGR in the coming years owing to the rapid adoption of technological developments to deliver effective genomic services.

The services segment is expected to have an improved occupancy in the global genomics market during the forecast period due to the growing need for data analysis in genomic research.

By Technology Insights

The PCR segment occupied the largest share of the global genomics market in 2024, and the domination of the segment is likely to continue during the forecast period owing to factors such as increasing adoption of PCR for DNA amplification at reduced costs, technological enhancements, and increasing research investments in genomics. In addition, the growing usage of PCR technology in genomic research is one of the notable factors contributing to segmental growth.

On the other hand, segments such as sequencing and microarray technology are anticipated to hold a considerable share of the global market during the forecast period.

By Process Insights

The data analysis segment captured the major share of the global genomics market in 2024 and is expected to continue its domination during the forecast period. The growing usage of genomic technologies releases a huge volume of data. In addition, the complexities associated with the genomics data and the increasing need for data analysis in research are majorly propelling the growth rate of the global genomics market.

The imaging segment is estimated to register a healthy CAGR during the forecast period owing to the rising importance of imaging in genomic research and the increasing number of developments in genomic technologies.

By Application Insights

The diagnostic testing segment held the major share of the global genomics market. Factors such as increasing health consciousness and growing deaths from genetic diseases are fuelling segmental growth. In addition, increasing disposable income and rising healthcare expenditure contribute to the segment's growth rate.

On the other hand, the personalized medicine segment is projected to showcase the highest CAGR in the global genomics market during the forecast period.

By End-User Insights

The hospitals and clinics segment occupied a major share of the global genomics market in 2024. The growing competition between the key market participants, the increasing number of hospitals and clinics, and improvements in the healthcare infrastructure in emerging economies are primarily propelling segmental growth.

On the other hand, the research centers segment is predicted to have a notable share in the global market during the forecast period owing to increasing R&D investments, and the growing focus of research centers and key market players to develop innovative technologies and products are the contributions to the growth rate of the segment.

REGIONAL ANALYSIS

The North American region was the largest regional segment worldwide in 2023 and is predicted to occupy the most significant share globally during the forecast period. An increasing number of initiatives and research funding by the North American governments are majorly fuelling regional market growth. In addition, the increasing incidence of genetic disabilities and abnormalities among the population of North American countries is booting the genomics market in North America. The presence of sophisticated healthcare infrastructure in North American countries is another notable factor promoting the genomics market growth in this region. In 2021, the U.S. had the largest share of the North American market, followed by Canada.

Europe captured a substantial share of the worldwide genomics market in 2023 and is forecasted to register a noteworthy CAGR between 2024 to 2029. The rapid adoption of technological developments in the genomics field, availability of substantial funding for genomic R&D, and increasing adoption of personalized medicine propel the European genomics market growth. In addition, the rising patient population suffering from chronic diseases is contributing to the growth of the European market. Companies such as Illumina, QIAGEN, and Thermo Fisher Scientific play a notable role in the European genomics market.

The Asia Pacific region is a potential market for genomics and is anticipated to showcase the fastest CAGR during the forecast period. The presence of a large patient population and the increasing adoption of technological advancements in the healthcare industry is favoring the market growth in APAC. In addition, increasing government support in investments and favorable policies for genomic research is promoting the growth rate of the genomics market in the APAC region.

The Latin American market is predicted to grow steadily during the forecast period. The Brazilian and Mexican genomics markets are expected to account for most of the share in this regional market during the forecast period.

The MEA market is standing at a nascent stage. Still, they will show inclined growth in the future because of growing investment by government bodies, funding agencies, and biotechnology companies anticipated to drive the market in this region.

KEY PLAYERS IN THE GENOMICS MARKET

In this report, companies playing a promising role in the global genomics market are Affymetrix, Inc., Agilent Technologies, BGI, Thermo Fisher Scientific, Bio-Rad Laboratories Inc., G.E. Healthcare, Illumina Inc., Qiagen, Roche Diagnostics, Life Technologies, and Cepheid.

RECENT HAPPENINGS IN THIS MARKET

- In February 2023, Complete Genomics, a U.S.-based firm, announced the launch of DNBSEQ-T20, a genetic sequences that claimed it would generate the first sub-$100 genome with low to mid-range throughput.

- In July 2020, Illumina launched TruSight Software Suite, which supplies ready-made infrastructure to recognize the potentiality of whole-genome sequencing for odd diseases.

- In June 2019, BGI Genomics and Eluthia partnered to develop reproductive genetics for the German market. The agreement offers the noninvasive prenatal NIFTY test in Germany in the name of PreviaTst.

DETAILED SEGMENTATION OF THE GLOBAL GENOMICS MARKET INCLUDED IN THIS REPORT

This research report segmented and sub-segmented the global genomics market based on the product, application, technology, process, end-user, and region.

By Product

- Instruments/systems

- Consumables

- Services

By Technology

- Sequencing

- Microarray Technology

- PCR

- Nucleic Acid Extraction

By Process

- Library Preparation

- Sequencing

- Imaging

- Data Analysis

By Application

- Diagnostics

- Drug Discovery and Development

- Personalized Medicine

- Agriculture & Animal Research

By End User

- Research Centres

- Hospitals and Clinics

- Pharmaceutical Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much was the global genomics market worth in 2023?

The global genomics market size was worth USD 19.89 billion in 2023.

Which region is growing the fastest in the global genomics market?

The APAC market is estimated to grow at the fastest CAGR in the worldwide market during the forecast period.

Who are the leading players in the genomics market?

Affymetrix, Inc., Agilent Technologies, BGI, Thermo Fisher Scientific, Bio-Rad Laboratories Inc., G.E. Healthcare, Illumina Inc., Qiagen, Roche Diagnostics, Life Technologies, and Cepheid are some of the notable companies in the global genomics market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]