Global Cocoa and Chocolate Market Size, Share, Trends & Growth Forecast Report Segmented By Chocolate Type (Dark Chocolate, Milk Chocolate, White Chocolate and Filled Chocolate), Cocoa Type (Cocoa Butter, Cocoa Liquor and Cocoa Powder), Application (Cosmetics, Pharmaceuticals, Food And Beverage and Confectionery) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis (2025 to 2033)

Global Cocoa and Chocolate Market Size

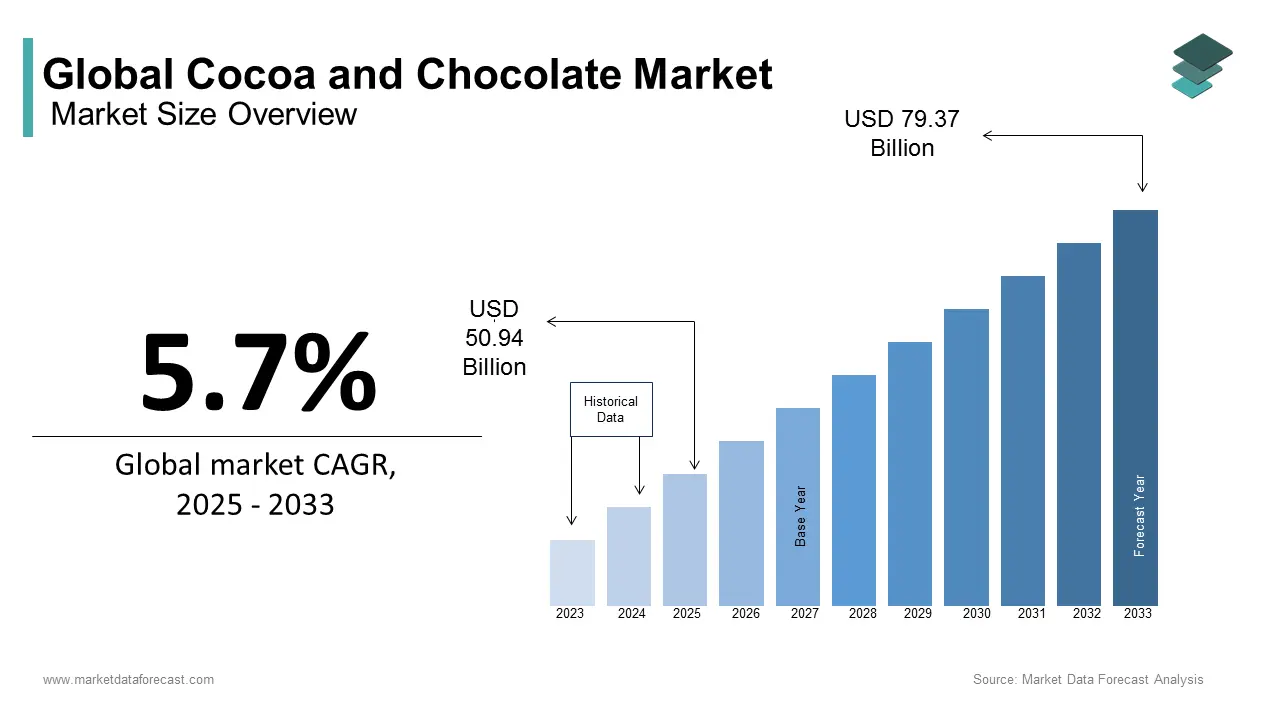

The global cocoa and chocolate market size was calculated to be USD 48.19 billion in 2024 and is anticipated to be worth USD 79.37 billion by 2033 from USD 50.94 billion In 2025, growing at a CAGR of 5.7% during the forecast period.

It is mainly driven by the growing consumer awareness about cocoa's health benefits and extensive usage as a coloring and seasoning agent. Cocoa is a dark brown powder that is produced by grinding beans of a Theobroma tree. It is utilized to make chocolate and helps in delivering this taste to drinks and foods. To be honest, cocoa beans are nothing but fermented seeds. Apart from this, large amounts of sugar, fats, and additives are present in commercial chocolate and related products which makes them unhealthy.

Cocoa liquor, butter, and powder are commercially available products as well as chocolate products filled with dark white milk are also consumed. Moreover, these products are widely used in confectionery, food and beverages, cosmetics, pharmaceuticals, and other industries. They are obtained by processing raw cocoa beans which are distributed to companies both domestically and internationally. And in this, the primary raw materials are cocoa beans, sugar, and milk. In addition, the changes in the price of upstream final goods affect the production costs of cocoa and chocolate. The cost of making cocoa and chocolate is also an essential factor affecting the output quality. So, Cocoa and chocolate suppliers are planning to cut down production expenses by implementing innovative methods.

MARKET DRIVERS

Growing Demand for Cocoa & Chocolate in the Confectionery and F&B Industries

The cocoa and chocolate market is experiencing substantial growth due to a consistent yearly rise in demand. The extensive consumption in Europe and North America is driving the industry forward. Moreover, the widespread use of cocoa because of its antioxidant properties and health benefits is another major growth factor for the world market. Also, the increased application in several industries, including confectionery, food and beverage, cosmetics, pharmaceuticals, and others, fuelled the demand for cocoa and chocolate. In December 2023, according to the American Journal of Clinical Nutrition, chocolate contains special properties that can improve brain function and significantly help in mental health. The research also states that it contains a powerful compound called “cocoa flavanol.” It is known to enhance concentration, memory, and brain working in total. It contains antioxidants to reduce blood pressure, improve heart health, blood flow, and cholesterol levels, and fight obesity, constipation, bronchial asthma, cancer, chronic fatigue syndrome, and various neurodegenerative diseases. So, the awareness regarding these health benefits is increasing the demand for chocolate-based foods and drinks.

The introduction of new flavors to healthy chocolate is increasingly becoming a trend. The growing popularity of chocolate for boosting mood is surging, and its demand across the globe is growing. Customers are continuously looking for intense indulgence in chocolate feeling, along with mindful indulgence. These generally have a lighter approach to health. These factors will accelerate the growth of worldwide cocoa and chocolate markets during the forecast period.

Similarly, the market is believed to register an upward growth trajectory in the coming years owing to the increased consumption of dark, organic, and sugar-free chocolate as consumer health awareness increases. One such recent progress in the chocolate market is the adoption of the unique and attractive shape and color of the packaging. As people came to know about the anti-aging and medicinal properties of cocoa, the demand increased worldwide. In terms of per capita consumption of chocolate, Switzerland holds the top spot with 8.8 kg annually. The country is famous for its variety, finesse, and love for chocolate products. The second position is captured by Germany with 8.4 kg, followed by Ireland, the United Kingdom, and Norway with 8.3, 8.2, and 8 kg yearly, respectively. In the US, around 15 percent of customers need to treat themselves daily. Surprisingly, the trend hasn’t changed much but has raised consumption. Several prominent companies in the region take advantage of their lifestyle and traditions to celebrate the occasion with chocolates.

MARKET RESTRAINTS

Disrupted Supply and Consistently Rising Demand

This is clear from the fact that cocoa bean prices in London attained a historic level at 3385 pounds per ton in October 2023 and in New York, it was a multi-decade high at 3880 dollars per ton. The factors increasing the costs are global undersupply in 2022-23, followed by a reduction in cocoa bean output in West Africa in the 2023-24 period. Farmers have stopped crop production, stating that because of high purchase costs, they cannot afford beans. In the 2023- 24 season, cocoa bean production in the Ivory Coast is projected to be around 1.8 million tons, which is 25 percent lower than in the previous year. To make matters worse it further stated that contractual obligation 2023-24 main cocoa yield between the Coffee and Cocoa Council (CCC) and exporters cannot be fulfille.r

MARKET OPPORTUNITIES

Sustainable Cocoa Cultivation

From an ecological point of view, the extension of cocoa farming is an important factor causing biodiversity loss and deforestation because virgin forests are cut down for fresh planting. This is the method used for a long time which is making the market challenging to navigate smoothly owing to social and natural factors. To overcome these problems, several schemes, policies, and certifications have been launched by the regional countries. This includes Fairtrade, the Cocoa & Forests initiative, and the Rainforest Alliance are the targeted actions to encourage sustainable practice, improve cultivators' living standards, and drive environmental preservation.

MARKET CHALLENGES

Rising Awareness of Related Health Risks

Another factor restricting the market growth is the negative health effects of chocolate, which include undeclared allergens, toxic elements, saturated fats, harmful bacteria, weight gain, and heartburn. As per the American Society for Gastrointestinal Endoscopy, chocolate reduces esophageal sphincter levels and this modification can cause you to be susceptible to heartburn. Also, the National Institute of Diabetes and Digestive and Kidney Diseases suggested stopping eating chocolate to impede symptoms of gastroesophageal reflux.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.7% |

|

Segments Covered |

By Chocolate Type, Cocoa Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ADM, Cargill, Bunge, Barry Callebaut, Indcresa, Blommer, JB Foods Limited, Plot Ghana, Dutch Cocoa and Cocoa Processing Company Limited |

SEGMENT ANALYSIS

By Chocolate Type Insights

The milk chocolate segment is expected to grow further at an elevated growth rate and accounts for more than half of the market share under this category. According to a study conducted in 2023, over 51 percent of adult customers' preferred choice of chocolate is milk chocolate, while 35 percent of people like dark chocolate and just 8 percent favor white chocolate. Also, consumers are now aware that eating chocolate boosts happiness due to the availability of information on their mobile phones. This is also supported by research that found that there are several elements present in chocolate that stimulate happiness, joy, and pleasure. One such component is tryptophan, an amino acid that benefits the brain by producing serotonin. This, in turn, is a neurotransmitter that gives us good feelings.

By Cocoa Type Insights

The cocoa liquor segment holds a significant market share as compared to the other two subcategories. It is also known as chocolate liquor in the market. The market is moving forward because customers worldwide are demanding more rich and delightful experiences in the form of flavor, texture, and color. However, as of now, in 2024, the current market situation of cocoa prices is volatile due to yield-related issues in West Africa. This resulted in the surge of cocoa liquor prices in several countries. For instance, in India, the cost of cocoa

liquor has almost doubled to Rs. 1200 per kg from Rs. 500 per kg, and cocoa butter has seen a threefold rise to Rs. 1600 per Kg.

By Application Insights

The food and beverage segment is the biggest contributor to the growth of the cocoa and chocolate market because of its extensive range of applications. Chocolate is the most preferred flavor choice for new beverages, confectionery, and bakery launches. In addition, it continues to be one of the most commonly added ingredients in the desserts and drinks industry. So, this consumption pattern will further boost the requirement for cocoa powder and butter in the coming years. Moreover, cocoa butter is broadly used in the cosmetic industry and the popularity of fully natural or organic personal care goods is expanding its market share.

REGIONAL ANALYSIS

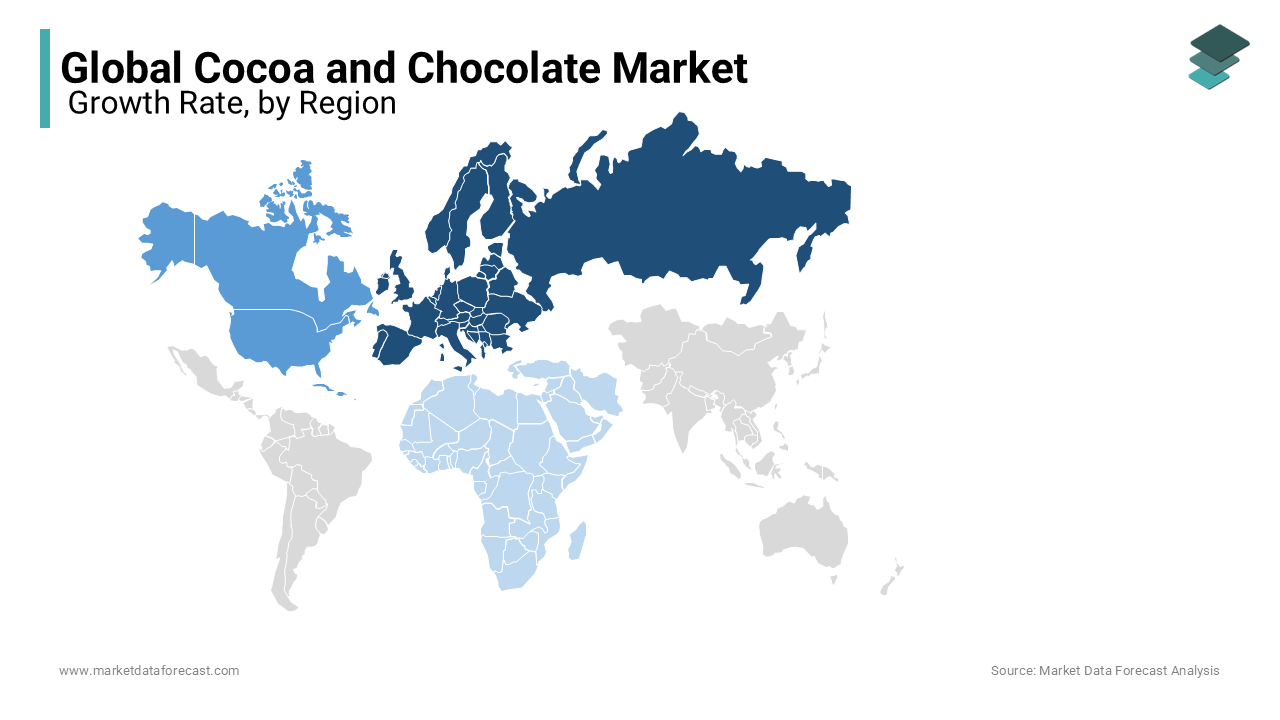

Europe is leading the cocoa and chocolate market and has captured a significant industry share in the last few years. The primary reason behind this is its substantial chocolate production capacity and a long list of export destination countries. The main attraction point is the presence of diverse markets for both bulk and specialty cocoa. Besides this, the region imports more than 56 percent of overall imports around the world. Likewise, in 2021, more than 2.2 million tons of cocoa beans were purchased from outside the continent. Out of this, close to 79 percent directly came from the countries cultivating it, which is 1.8 million tons.

North America is another key trade center for the cocoa and chocolate market. The economies in the region together imported around 16 to 17 percent of global cocoa beans. The United States was the third-largest importer of cocoa beans in 2021. On the contrary, there has been a decrease in cocoa consumption in recent years due to instability in global trade patterns, changes in customer buying behavior, and a rise in its production in other marketplaces. Furthermore, the region’s compound chocolate industry is a major player in the market, and this provides competitive and operational advantages over pure cocoa-based chocolates. This includes low costs, a simple production process, and composition flexibility for innovative product development.

Asia Pacific is witnessing a surge in the demand for cocoa and chocolate products. The bulk of the demand is from India and China. This is because of rapid urbanization, an increase in disposable income, and the upliftment of the middle class in developing economies. Another factor fuelling consumption is the growing population of office-going people, and among those, a substantial number skip breakfast due to tight schedules and work. In addition, APAC imports around 26 percent of the world's cocoa imports.

Middle East and Africa are anticipated to experience a higher CAGR in the forecast period. This can be credited to the rising desire for comfort, value, and lavishness in chocolate gifts, which has considerably increased the application of cocoa butter in the ME region. On the other hand, in the first quarter of 2024, many prominent African cocoa factories in Ghana and Ivory Coast have halted and, in some areas, have reduced the processing due to the high procurement cost of beans.

KEY MARKET PLAYERS

Companies playing a major role in the global cocoa and chocolate market include ADM, Cargill, Bunge, Barry Callebaut, Indcresa, Blommer, JB Foods Limited, Plot Ghana, Dutch Cocoa and Cocoa Processing Company Limited. Cargill, Incorporated, will see significant growth in the healthy, premium, and sustainable chocolate-only market, and in the near future, regular candy will be replaced by healthy options. To stay ahead of the competition, companies must come up with innovative ideas. Cadbury's sales growth is anticipated to have a positive impact on the global cocoa and chocolate markets.

RECENT HAPPENINGS IN THIS MARKET

- In April 2024, Macalat was presented the NEXTY award for chocolate mushroom mycelium technology and the latest chocolate bar.

MARKET SEGMENTATION

This research report on the global cocoa and chocolate market has been segmented and sub-segmented based on chocolate type, cocoa type, application, & region.

By Chocolate Type

- Dark

- Milk

- White

- Filled

By Cocoa Type

- Cocoa Butter

- Cocoa Liquor

- Cocoa Powder

By Application

- Cosmetics

- Pharmaceuticals

- Food & Beverage

- Confectionery

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. Name any three global Cocoa and Chocolate Market key players?

Olam International, Barry Callebaut, AG and Cargill, Incorporated are some of the key market players in the global Cocoa and Chocolate Market.

2. Which region is the largest importer of cocoa beans?

The Cocoa and Chocolate Market is studied from 2023-2028.

3. What is the growth rate of the Global Cocoa and Chocolate Market?

The region that is the largest importer of cocoa beans is Europe.

4. What are the key drivers of the Cocoa and Chocolate Market in the world?

The Cocoa and Chocolate Market is predicted to register a CAGR of 5% during forecast period

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com