Global Cold Pressed Juices Market Size, Share, Trends & Growth Forecast Report - Segmented By Nature (Conventional And Organic), Type, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2025 to 2033)

Global Cold Pressed Juice Market Size

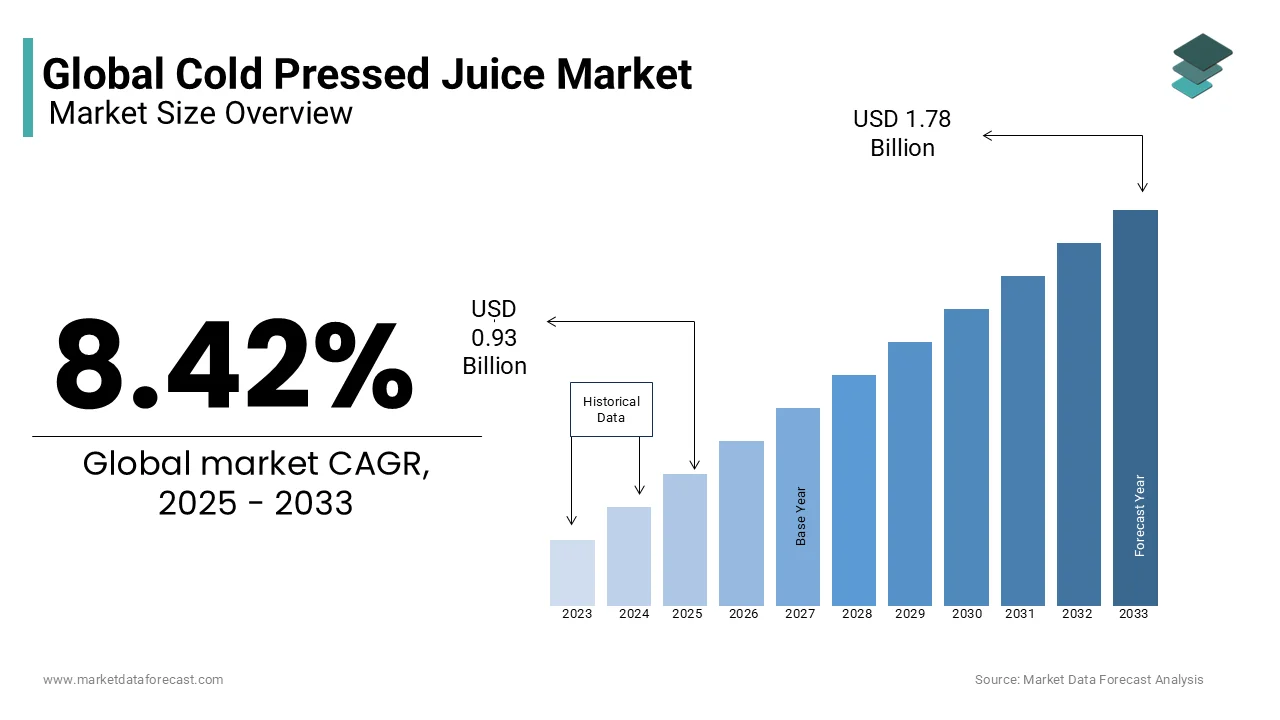

The global cold pressed juice market size was valued at USD 0.86 billion in 2024, and the global market size is expected to reach USD 1.78 billion by 2033 from USD 0.93 in 2025, with a CAGR of 8.42% between 2024 and 2032.

MARKET OVERVIEW

Cold-pressed juices are made by pressing or masticating vegetables and fruits to extract the juice. Such beverages are healthy and safe due to the presence of all required nutrients, such as minerals, vitamins, and antioxidants. Once the liquid is prepared, it is placed and sealed in bottles. These bottles are then stored inside a vast chamber, where high pressure is applied to terminate pathogens. Including juices in daily routines assists with weight loss, wrinkle prevention, anti-aging, and used as hangover-free cocktails. Including juices as an integral part of the modern diet, and the rising popularity of organic edible products by buyers are the factors driving the development of the global cold-pressed juice market.

MARKET DRIVERS AND RESTRAINTS

The demand for cold-pressed juice from mixed fruits and vegetables has increased significantly due to growing concerns about various health problems, as well as the health benefits associated with consuming these juices. The process of making cold-pressed juices involves the use of a hydraulic press to extract 100% of the liquid from fruits and vegetables. Also, no additional heat or oxygen is used, meaning no nutrients are lost during the process. The available nutrients, amino acids, phytonutrients, minerals, trace elements, and enzymes are not lost in the extraction procedure of cold-pressed juices. These aspects drive the growth of the mixed fruit and vegetable segment in the global cold-pressed juice market. Growing consumer awareness of health regularly leads to a shift in preference towards safer, more practical, healthy, and refreshing drinks without calories, caffeine, and artificial ingredients, which creates a robust development in the mix of the fruit segment and vegetables of the cold-pressed juice market. The growing demand for green drinks is also expected to increase during the projection period. Manufacturers are also introducing more and more flavors, such as green juice with coconut water, cucumber, leafy vegetables, and sprinkled pineapple, to take advantage of and meet the growing demand of health-conscious consumers of the increasing market demand for natural and healthy juices. Additionally, the introduction of soft green blends with pineapple, apple, mint, and cucumber should stimulate revenue growth in the global cold-pressed juices business during the outlook period. The growing demand for juices made from superfruits such as acai, cranberry, pomegranate, blackcurrant, maqui, baobab, cranberry, and wolfberry are also contributing to market growth in the cold-pressed juice market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.42% |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Pressed Juicery, Suja Life, PepsiCo Inc, Liquiteria, Evolution Fresh, Evergreen Juices Inc, Hain BluePrint, Inc., LLC, JustPressed, Juice Generation, Organic Avenue |

SEGMENTAL ANALYSIS

By Nature Insights

REGIONAL ANALYSIS

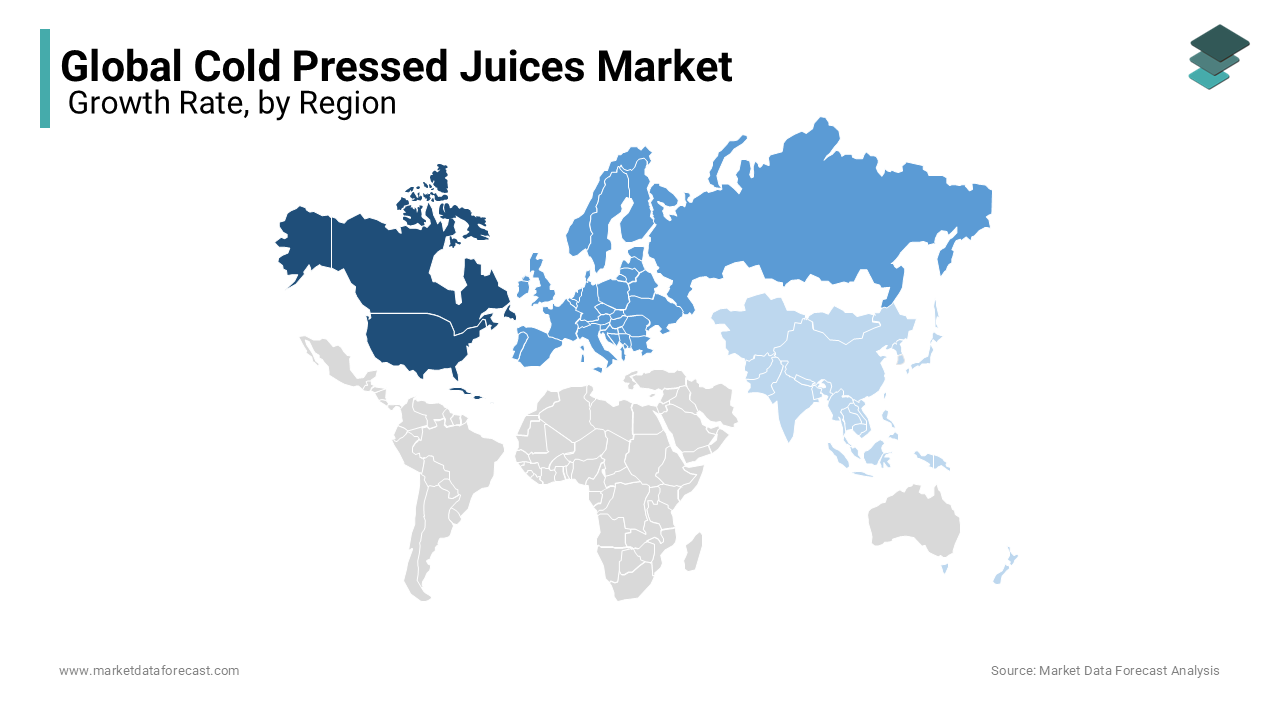

North America dominated the market in 2023 globally and accounted for 35% of the global market share. On the basis of the geographical segmentation, the global cold-pressed juice market is segmented into different regions: North America (U.S. and Canada), Europe (U.K., France, Germany and Rest of Europe), Asia Pacific (Japan, China, India and Rest of APAC), Latin America (Brazil, Mexico and Rest of Latin America), and Middle-East & Africa (GCC and Rest of MEA).

Europe followed closely with a market value share of almost equal. Additionally, a growing portfolio of cold-pressed juice products from leading manufacturers is among the notable factors driving the region's market. The United States is one of the leading manufacturers of cold-pressed juice in the world and is anticipated to account for 80.4% of the market in 2018.

Europe also represents a significant market share in the cold-pressed juice market due to the increasing focus on preventive healthcare and increased awareness of human health and well-being. Manufacturers in the region are also placing increasing emphasis on new product development and have also launched various products in recent years in advanced countries in European countries. France is the leading consumer of beverages in Western Europe due to the growing awareness of products that has stimulated the market for cold-pressed juices in the country.

Population growth in emerging economies, as well as the increasing level of disposable income of the population, should influence the progress of the cold-pressed juice market in the Asia-Pacific region. Furthermore, the impact of emerging countries such as China, India and Indonesia is one of the main factors in the growing development of the cold-pressed juice market in the Asia-Pacific region.

KEY PLAYERS IN THE GLOBAL COLD PRESSED JUICES MARKET

Pressed Juicery, Suja Life, PepsiCo Inc, Liquiteria, Evolution Fresh, Evergreen Juices Inc, Hain BluePrint, Inc., LLC, JustPressed, Juice Generation, Organic Avenue, Organic Press Juices are some of the notable companies in the global Cold Pressed Juices market.

RECENT HAPPENINGS IN THE MARKET

- Raw Pressery released cold-pressed almond milk is available in three variants: cocoa, coffee, and turmeric. Derived from almonds directly from farms, it is 100% lactose and vegan free. Also, it does not contain sugar, preservatives, chemicals or dyes.

- 7 Eleven has added three new flavors to its product portfolio. All flavors, such as pomegranate, melon, and blackberry, are 100% unique juice varieties. Furthermore, Honeydrop Beverages, in collaboration with Evo Hemp, has launched a new range of lemonades that can be available in three different flavors, such as Revive (Matcha), Rehab (Turmeric) and Relax (Lemon).

- Tesco launched waste-not cold-pressed juices made from wonky vegetables and fruits. These drinks will be available in different flavors, such as orange, apple, beet, watermelon, cucumber, and mint. The company is likely to save tons of excess fruit and vegetables or waste.

MARKET SEGMENTATION

This research report on the global cold pressed juices market has been segmented and sub-segmented based on product, type, consumption, distribution channel, and region.

By Nature

- Conventional

- Organic

By Type

- Fruits

- Vegetables

By Distribution Channel

- Hypermarket/Supermarket

- Convenience Stores

- Specialty Outlet

- Grocery Stores

- Online Retailing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the expected CAGR for the cold-pressed juice market from 2024 to 2032?

The cold-pressed juice market is projected to grow at a CAGR of 8.42% from 2024 to 2032.

2. What are the main factors driving the growth of the cold-pressed juice market?

Key drivers include increasing health consciousness, rising disposable incomes, and the growing popularity of detox and cleanse trends.

3. Which region is leading the cold-pressed juice market?

North America is currently the largest market for cold-pressed juices, driven by high health consciousness and the presence of established brands.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com