Global Cookies Market Size, Share, Trends & Growth Forecast Report Segmented By Ingredient (Chocolate, Chocolate Chip, Oatmeal, Butter, Cream, Ginger, Coconut & Honey), Product Type (Bar, Drop, Fried, Molded, No-bake, Ice Box, Rolled & Sandwich), Distribution Channel (Supermarkets And Hypermarkets, Independent Retailers, Convenience Stores and Online Sales) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis (2025 to 2033)

Global Cookies Market Size

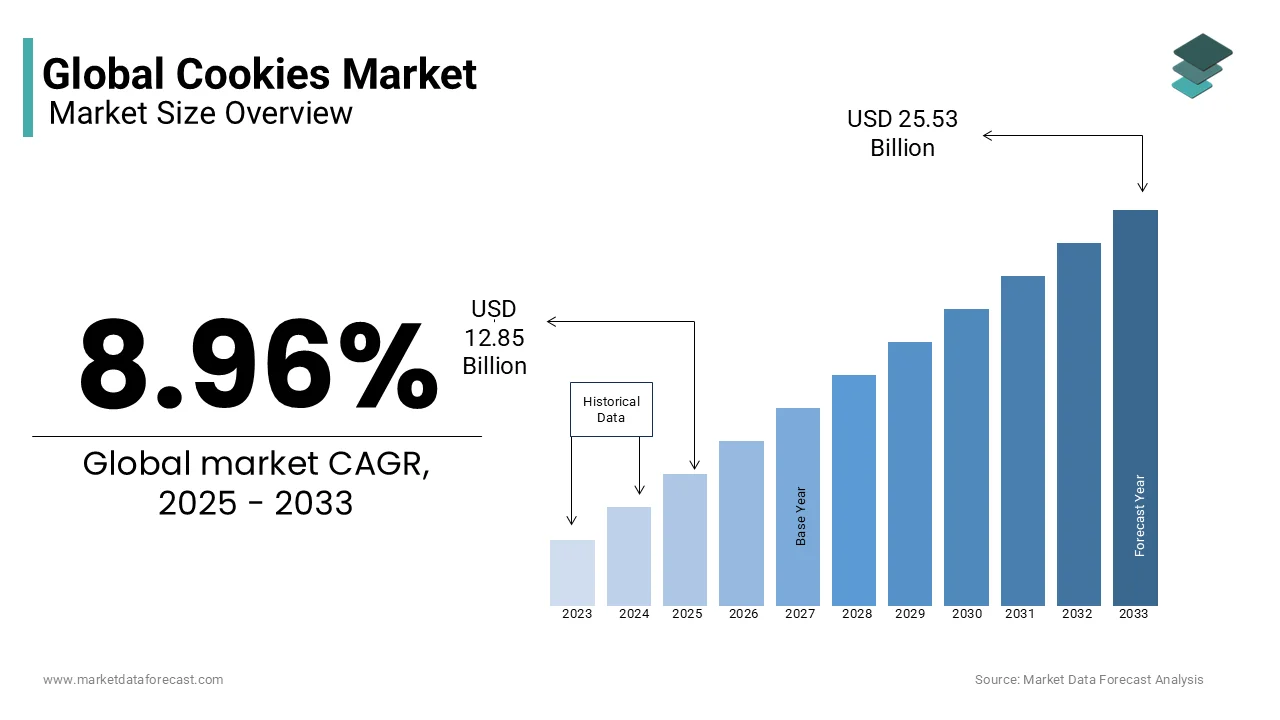

The global cookies market size was valued at USD 11.79 billion in 2024. The cookies market size is expected to reach USD 25.53 billion by 2033 from USD 12.85 billion in 2025. The market's promising CAGR for the predicted period is 8.96%.

Cookies are one of the food items that are widely popular worldwide. Due to regular value offerings in response to dynamic changes and customer demands, cookie demand is increasing. New kinds of creative packaging are drawing in more and more customers. Due to the use of safe ingredients as well as low-sugar and low-carb products, cookies are becoming more and more popular among consumers who are health-conscious. Since they give consumers essential nutritional nutrients like lipids, vitamins, minerals, and other ingredients, cookies are a very well-liked snack food all over the world. With the development of various styles and designs, as well as the appealing packaging of cookies by various players, the global market for cookies is anticipated to grow. Due to the variety of tastes available in cookies, including oats, raisins, almonds, and chocolate, the demand for cookies is increasing. People now prefer to eat cookies as snacks due to their growing health benefits.

The cookies market continues to grow and evolve, providing interesting new ingredients, innovations, and flavors. Today, Generation Z and millennials are the biggest consumers of this market. The Gen Zs aged between 13 and 24 years, are slated to become the largest and most influential customer group. This generation depicts a new viewpoint of brands, creativity and diversity, giving promoters and marketers a hard time figuring out the appropriate strategies to attract their target audience. According to a study published in Segmanta, for Gen Z customers, Oreo is among the favorite brands and commands the pre-packaged cookie category, with a humongous 83 percent of Generation Z-ers who frequently or sometimes eat Oreo cookies as a snacking option.

It is one of the major trends in this market. On the other hand, healthy indulgence and providing is another trend prevalent in this market. Customers are progressively paying more attention to ingredients mentioned on the back of bakery and snack products. So, brands and companies need to position their products by centering on nutritious and functional snacks and making them free from dietary evils. For instance, FMCG experts shed light on about 64 percent of consumers worldwide who look at or examine nutritional labeling at least quite a few times when selecting a snack.

MARKET DRIVERS

The growing product availability, particularly in developing regions, is one of the key factors propelling the global cookies market growth. Additionally, the global cookies market will be further boosted by the high demand for chocolate cookies in advanced economies, including the U.S., Germany, and the U.K. According to a survey conducted by US News, the United States has the strongest consumer brands, followed by China, then by Germany, and thereafter Japan, Italy, the United Kingdom, etc. In terms of top cookie exports, Mexico gained the top position with 940.8 million dollars of export, i.e. 10 percent of overall global exports, the Netherlands at second with 835.6 million dollars, Germany at third with 805.8 million dollars, and Belgium at fourth with 614 million dollars. Innovative packaging strategies used by bakery producers as well as the introduction of new taste options, like pineapple, help them draw in customers. Over the coming years, rising disposable income in emerging economies like China and India is expected to fuel product demand. The appeal of the product as a giving option is also anticipated to increase demand.

The main ingredients in cookies are oats and nutrients for digestion. Some cookies are both high in energy and gluten-free. As a result of shifting customer preferences, new flavors with novel additions are being introduced to the market. Cookies made with a hurried baking process are protein-based and free of fat. The market for gluten-free cookies is expected to rise due to growing worries about glutamate disorders and lactose intolerance in developed North America and Europe. As per research published by Rupa Health, in the United States, there could be 16 million people who have gluten sensitivity in the absence of a formal diagnosis, as several medical service professionals mainly test for celiac disease or wheat allergy. Manufacturing companies are being compelled to raise label standards by supportive rules intended to ensure organic labeling in the food and beverage industry for completed goods. These elements are also most likely to benefit global cookies market expansion.

On the other hand, the key market participants have been employing creative strategic marketing strategies to draw in new customers together, and rising levels of disposable income are anticipated to drive the market's expansion in the future. Additionally, it has been found that customers are choosing healthier alternatives when it comes to their diets in an effort to avoid health issues, including obesity and poor nutrition. Market players have introduced healthier cookies, including oatmeal cookies, vegan cookies, sugar-free cookies, gluten-free cookies, and others in response to this. Additionally, the market's availability of digestive cookies has given consumers a nutritious food option that improves digestion. Thus, this has provided the cookie market with numerous prospects to expand.

MARKET RESTRAINTS

The availability of substitute goods such as chocolates is the biggest restraint to the growth of the worldwide cookies market. Given the rising cases of obesity, diabetes, and other health-related issues, there is a rise in low-calorie chocolate snacks which impedes the expansion of this market. A wide variety of flavors and textures, regardless of craving for something smooth, chewy, or crispy, positioning these healthful chocolate snacks on top of the lists. Also, snacking on chocolate is popularly consumed in the evening, like the American dessert culture, which directs a confection after dinner. According to the CBI European Union, the average global consumption figure of chocolate is projected to be 0.9 kg per capita per year.

MARKET OPPORTUNITIES

Functional ingredients, sustainability, and wellness present potential opportunities for the expansion of the cookies market growth. Customers have accepted a more proactive approach to their wellness and health in the last few years. Consequently, they are selecting items that include active ingredients, coupled with claims regarding health advantages. For instance, several prominent health benefit assertions and functional ingredients are rich in fiber and digestive health foods, with 49 percent of customers worldwide shifting to these product types, as per industry experts. Consumers identify the relationship between their overall well-being and digestive health; hence, bakery brands and companies have the opportunity to encourage products supporting complete holistic and digestive health, and these will attract significant interest.

Another potential prospect for the growth of the market is sustainability. Customer worries about environmental challenges, and sustainability efforts have continued to rise in recent years. Few consumer interests are placed around the direct effect this is having on well-being and worry that companies are falling short of protecting the environment. This shows that bakery brands should prioritize sustainability as a fundamental aspect of their operations and implement sustainable strategies to regain customers’ trust. According to research, about 61 percent of customers around the world consider upcycled ingredients attractive.

MARKET CHALLENGES

High manufacturing costs raise the price of finished goods, which is impeding the cookies market growth. In the last few years, the baking industry has encountered a long array of serious and current challenges. After the arrival of COVID-19, makers, and partners have been compelled to wrangle with heightening inflation, supply-chain disruptions, and intensifying labor problems are all contributing to the escalating price of cookies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.96% |

|

Segments Covered |

By Ingredient, Product Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Parle Products Private Limited, Danone S.A., Mondelēz International, The Campbell Soup Company, Britannia Industries Ltd, PepsiCo, Nestlé S.A., and The Kellogg Company |

SEGMENTAL ANALYSIS

By Product Insights

The bar cookies segment is predicted to dominate the global cookies market during the forecast period. The primary reason propelling the industry is the growing popularity of these goods due to the numerous health benefits they provide, including enhancing blood circulation and heart health. By 2025, drop cookies are projected to bring in more than USD 8 billion in revenue. It is anticipated that new product introductions in this market sector by businesses like Dunkin' Donuts and Oreo through online channels and supermarkets would create growth opportunities. According to Segmanta, it was discovered that among the males between 16- and 18 years old, Oreo is the most favored one. Oreo ranks as a favorite brand for about 92 percent of males aged 16 to 18 who love cookies.

By Distribution Channel Insights

During the forecast period, offline channels are anticipated to account for the majority of distribution channels. The industry is expected to be driven by the high visibility of supermarkets and convenience stores as important selling channels in developing nations like China and India. However, due to the increasing popularity of e-commerce portals, the category for online channels is anticipated to increase at the quickest rate, 5.9%, during the course of the forecasted years. Additionally, the continued development of smartphones with cutting-edge internet apps by manufacturers like Xiaomi, Oppo, Nokia, and Apple is anticipated to fuel the segment's growth in the years to come.

REGIONAL ANALYSIS

The North American market outperformed all the other regions in the global market and accounted for the largest share of the global market in 2023. The regional market will be further driven by rising sandwich biscuit consumption, particularly among working-class populations in the United States and Canada. Additionally, the availability of tastes, including buttercream, chocolate, and peanut butter, is anticipated to support expansion. According to a study, people in the United States eat more than 2 billion cookies annually, i.e., approximately 300 cookies for each individual. On average, an American consumes 35 thousand cookies during his entire life. Moreover, in the United States, the most popular one is the chocolate chip cookie, with about 53 percent of US people stating it is their first choice. This is followed by the peanut butter cookie at 16 percent.

Asia Pacific is anticipated to continue to witness the highest CAGR during the forecast period. The demand for the product is anticipated to be driven by the rapidly developing economy brought on by increased disposable income, urbanization, and changing lifestyles in the years to come. Moreover, customer inclination towards clean labels and healthy eating is forming the development of new products in the Asia Pacific for well-being, including indulgent baked items. Industry experts discovered that around 31 percent of the adult population in Thailand, more than 45 years of age, are inclined towards biscuits and cookies having vegetable pieces, and 28 percent are keen on recipes with superfood components. In 2022, the Better cookies range was introduced by The No NastIies Project, a Melbourne-based brand, in the regions of New Zealand and Australia, which is another perfect illustration of this,

Europe is anticipated to hold the highest share of the global cookies market due to its substantial production and export of confectionery goods to other nations. In addition, with the rising cognizance of gut health in the region, customers have become more aware of the exact functioning of the gut and which elements they should choose. As per research, seven out of ten customers today accept that biotics (postbiotics, prebiotics, and probiotics) are trusted components to enhance digestion. Worldwide, there is a 7 percent growth in 2023 against that in 2021, with the largest transition witnessed in Europe, i.e., 65 percent in 2023 compared to 54 percent in 2021. However, due to the booming sales of the Brazilian baking sector, Latin America is predicted to experience good growth in the global cookies market.

KEY MARKET PARTICIPANTS

Parle Products Private Limited, Danone S.A., Mondelēz International, Campbell Soup Company, Britannia Industries Ltd, PepsiCo, Nestlé S.A., and The Kellogg Company are a few of the leading companies in the global cookies market. Edible Funfetti cookie dough brownie batter with all the classic flavors is now available from Nestle.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Lotus Bakeries, the owner of Biscoff and Mondelez International, reported that they have consented and collaborated to develop cookie and chocolate products that will have both the texture and taste of the well-known cookie with Mondelez’s Milka, Cadbury, and other popular brands in Europe.

MARKET SEGMENTATION

This research report on the global cookies market has been segmented and sub-segmented based on the product type, distribution channel, and region.

By Product

- Molded

- Rolled

- Bar

- Drop

By Ingredients

- Chocolate

- Chocolate chip

- Oatmeal

- Butter

- Cream

- Ginger

- Coconut

- Honey

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What can be the total Cookies Market value?

The global cookies market size was valued at USD 11.79 billion in 2024. The cookies market size is expected to reach USD 25.53 billion by 2033 from USD 12.85 billion in 2025. The market's promising CAGR for the predicted period is 8.96%

Mention the region which has the largest share in the Cookies Market?

North America region is expected have the largest market share of the global Cookies Market.

Name any three Cookies Market key players?

Mondelez International, Annas Pepparkakor, Nutrexpa are the global Cookies Market key players.

What is the major effecting factor in the global Cookies Market?

A challenge to the global cookies market from substitution is also anticipated to come from the availability of substitute goods like chocolates and cookies. Additionally, high manufacturing costs raise the price of finished goods, which could impede market growth.

Mention the latest driver in the global Cookies Market?

Growing product availability, particularly in developing regions, is anticipated to be the primary driver of the global cookies market expansion. Additionally, the global cookies market will be further boosted by the high demand for chocolate cookies in advanced economies including the U.S., Germany, and the U.K.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com