Global Sugar Decorations And Inclusions Market By Type (Jimmies, Quins, Dragees, Nonpareils, Single Pieces, Caramel Inclusions, And Sanding & Coarse Sugar), Colorant (Natural And Artificial), Application (Cereals & Snack Bars, Ice-Creams & Frozen Desserts, Chocolates & Confectionery Products, Cakes &Pastries, And Others), End-User (Food Manufacturers, Foodservice Industry And Home Bakers), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2025 To 2033

Global Sugar Decorations and Inclusions Market Size

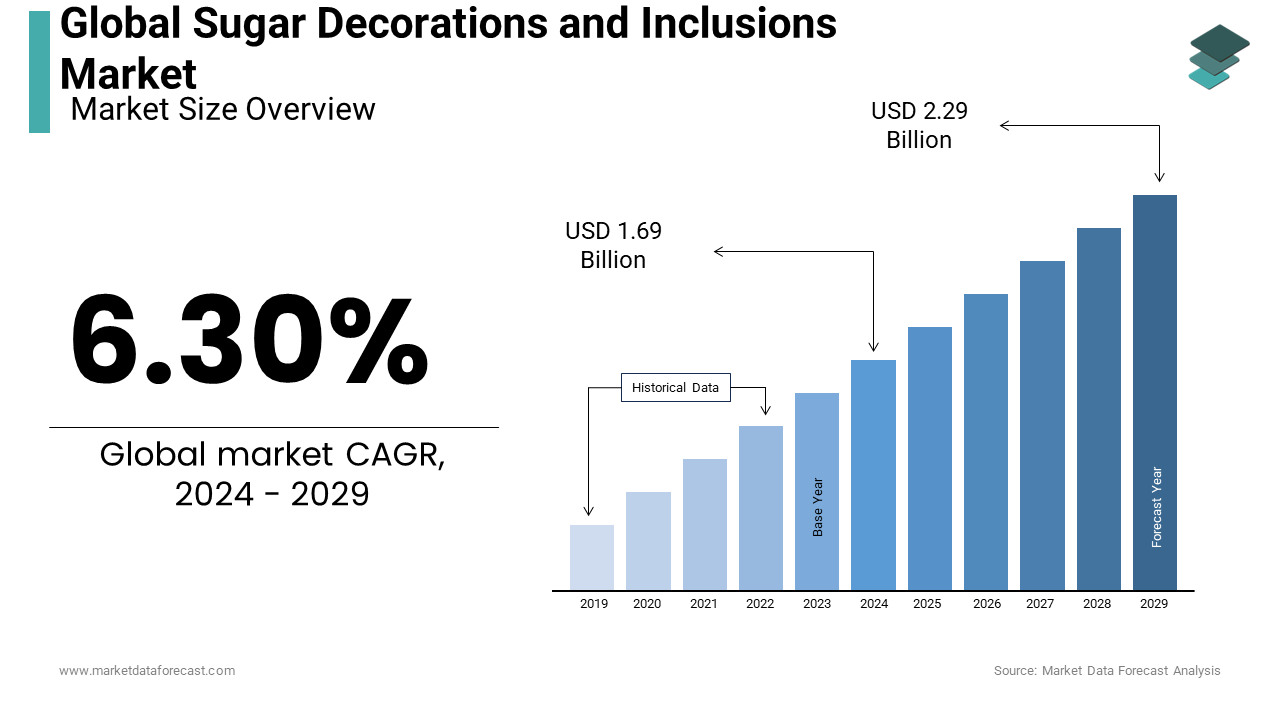

The global sugar decorations and inclusions market size was expected to be worth USD 1.69 Billion in 2024 and is anticipated to be worth USD 2.93 Billion by 2033 from USD 1.80 Billion In 2025, growing at a CAGR of 6.30% during the forecast period. Changes in consumer trends, such as a greater preference for attractive, textured and tasty foods, are expected to spur Sugar Decorations and Inclusions market growth.

Sugar decorations and inclusions are used to increase the texture and chocolate decorations to improve the overall appearance of food. They are attractive and tasty products that enhance the attractiveness of the product. Chocolate, bakery, confectionery, dessert and ice cream makers require a wide range of chocolate inclusions and decorations to add value to their products. These additional ingredients added to this product affect the final texture, taste and consumer appeal. Variations of chocolate bars with chocolate inclusions and decorations draw them together for innovative texture and flavor. Sugar inclusions and decorations come in different colors and sizes, and they can be used for icing, frosting, icing, and coating. Its use is increasing in cookies, ice cream and confectionery consumed in the demography. In addition to this, it is also used in cakes and muffins, cream cakes, and desserts. As the likelihood of cakes and deserts increased among adults, the demand for sugar inclusion and decoration increased. As demand for bakery and confectionery products increases across the world, it is expected to drive growth in the sugar decoration and inclusion market during the evaluation period.

MARKET DRIVERS

As consumption of baked goods and desserts increases and demand for flavored and textured foods increases throughout the world, demand for sugar decorations and inclusions is expected to increase.

Regional income growth and economic growth are factors that encourage consumers to choose attractive and textured products. In addition, the creation of low-calorie and healthy sugar decorations by leading players in the market is supposed to offer growth potential for major players. The increasing use of natural food dyes in sugar roots has increased as the demand for clean label products increases due to increased health awareness. This is expected to drive growth in this segment during the forecast period. Some scientific studies have shown the health benefits of consuming chocolate, positively affecting the growth of the chocolate inclusion and decoration markets. Drinking dark chocolate can help prevent cardiovascular problems and lower blood pressure. This is because dark chocolate is rich in nutrients like magnesium, manganese, iron, and copper. The factors influencing the growth of the sugar along with chocolate inclusion and decoration market are an increasing number of people who care about health, increase their knowledge of the benefits of chocolate and increase the demand for Sugar Decorations and Inclusions in the bakery and confectionery sectors market growth. The demand for organic and sugar-free chocolate is increasing as consumers consider using chocolate as inclusion and decoration rather than directly including chocolate.

Sugar Decorations and Inclusions give food additional texture and enhance flavor. Therefore, it is increasingly used in the dairy, bakery and confectionery sectors. Market demand for Sugar decoration and containment is largely driven by increased chocolate consumption. Sugar, especially brown sugar, has attracted worldwide demand for its many nutritional benefits, except for its unique flavor and aroma. Jimmies are rainbow-colored chunks and toppings used in cakes and ice cream. Jimmies are widely used for cake decorating. It is easy to put in bottles and jars packed in supermarkets and come in mixed colors. Therefore, the market is expected to dominate during the forecast period. The increasing use of natural food dyes in sugar roots has increased as the demand for clean label products increases due to increased health awareness. This is expected to drive growth during the forecast period. They contain antioxidants and rich nutrients. The myriad of benefits make inclusions and decorations containing Sugar Decorations and Inclusions increasingly attractive to consumers. They found that it has a positive effect on cardiovascular disease and helps control blood pressure. The surge in the number of health-conscious people across the globe, especially in emerging and developed economies, is a prominent trend in improving the worldwide Sugar Decorations and Inclusions Market. Recently, organic sugar, brown sugar and low-calorie sugar have garnered a huge boost among Sugar Decorations and Inclusions Markets. This has created a profitable perspective in the global market. The use of sugar decorations and inclusions in many end-use products improves the overall consumer experience and is increasingly in demand by people. This is an important factor in improving the absorption of sugar inclusions and decorations.

MARKET RESTRAINTS

Fluctuations in the price of raw materials such as sugar, starch and food coloring are important factors that hinder the growth of the Sugar Decorations and Inclusions Market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.30% |

|

Segments Covered |

By Type, Application, Colorant, End-User, & Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Dr. Oetker, Kerry Group, Barry Callebaut, The Kraft Heinz Company, Signature Brands LLC, Pecan Deluxe Candy Company, Hanns G. Werner GmBH + Co.KG, Carroll Industries NZ Ltd, Cape Foods, Paulaur Corporation and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The jimmies segment occupied the major share of the global sugar decorations and inclusions market in 202. Jimmies, which are long, thin sprinkles, are widely used for decorating baked goods, ice cream, cakes, and donuts. Their popularity is driven by their versatility, ease of application, and wide appeal in both consumer and commercial products. Jimmies are often chosen for their ability to maintain their shape and texture during baking, making them the preferred option for a variety of food products, particularly in the confectionery and bakery industries.

The caramel inclusions segment is projected to showcase the fastest CAGR in the global market during the forecast period. Caramel inclusions are becoming increasingly popular in a variety of desserts and baked goods due to their rich flavor and the texture they add to products. With the rise in demand for indulgent, premium, and artisan food products, caramel inclusions are gaining traction. They are widely used in chocolates, cakes, cookies, and specialty treats, contributing to their rapid growth as consumers seek unique and sophisticated flavors in their food choices.

By Application Insights

The chocolates & confectionery products segment accounted for the dominating share of the global market in 2024. Sugar decorations and inclusions are extensively used in chocolates, candy, and other confectionery products to enhance both appearance and taste. These ingredients add texture, color, and a visually appealing finish to confections like chocolate bars, pralines, gummies, and hard candies. The continued growth of the global confectionery industry, driven by innovations in flavors and product variety, contributes to the dominance of this segment in the sugar decorations and inclusions market.

The ice-creams & frozen desserts segment is estimated to witness the fastest CAGR in the global market over the forecast period. With the rising demand for premium ice creams, frozen yogurt, and other frozen desserts, there is an increasing need for creative and indulgent toppings. Sugar decorations and inclusions, such as sprinkles, candy pieces, and caramel chunks, enhance the sensory experience of these frozen products. The growing trend of customization and innovative dessert offerings is driving rapid growth in this segment, as consumers seek unique, fun, and flavorful additions to their frozen treats.

By Colorant Insights

The natural colorant segment is the most dominating segment in the sugar decorations and inclusions market currently. As consumers become more health-conscious and aware of the potential risks associated with artificial ingredients, the demand for natural colorants is on the rise. Natural colorants, derived from sources like fruits, vegetables, and spices, are preferred in the confectionery, bakery, and snack industries due to their cleaner labels and perceived health benefits. The increasing trend toward organic, clean-label products and natural food ingredients contributes to the dominance of natural colorants in the market.

The artificial colorant segment is projected to play a notable role in the global market over the forecast period. Artificial colorants offer vibrant, consistent, and stable hues that can withstand various production processes, making them a popular choice for manufacturers. The growing demand for visually striking, vibrant confections and decorative products, particularly in chocolates, cakes, and seasonal treats, is fueling the fast growth of artificial colorants. Their cost-effectiveness and ease of use in mass production contribute to their rapid expansion in the market.

By End-User Insights

The food manufacturers segment was the largest end-user in the sugar decorations and inclusions market and held the leading share of the market in 2024. Food manufacturers, including those producing packaged snacks, desserts, confectionery, and ready-to-eat products, are the primary consumers of sugar decorations and inclusions. These ingredients are used to enhance the visual appeal and flavor of mass-produced items such as candies, chocolates, cakes, and cereals. The large-scale production capabilities and high demand for innovative, aesthetically pleasing products drive the dominance of food manufacturers in this market.

The home bakers segment is estimated to register fastest growth in the market during the forecast period. With the rise of online baking tutorials, DIY baking kits, and an increased interest in at-home baking during recent years, home baking has surged in popularity. Home bakers use sugar decorations and inclusions to enhance their homemade cakes, cupcakes, cookies, and other baked goods. This growing trend, coupled with social media-driven challenges and the desire for personalized, visually appealing treats, is driving rapid growth in the home baker segment

REGIONAL ANALYSIS

North America and Western Europe are the main regions in the sugar inclusion and decoration market. The main factors contributing to the market growth are the expansion of the confectionery industry and the increased demand for bakery products. In the Asia-Pacific region, demand for sugar inclusion and decoration markets is increasing as the population grows and the number of food manufacturers in the region increases. The Asia Pacific region is expected to be the fastest-growing market during the outlook period. Market growth in the region is mainly driven by increased consumption of bakery products, such as cakes and pastries. Consumers in Asian countries are increasingly embracing international cuisine and tastes, encouraging them to invest in sugar roots in existing brands and new bakeries. In addition, driven by economic growth, increased demand for value-added products in the region is expected to drive Sugar Decorations and Inclusions Market growth.

KEY PLAYERS IN THE GLOBAL SUGAR DECORATIONS AND INCLUSIONS MARKET

Major Key Players in the Global Sugar Decorations and Inclusions Market are Dr. Oetker, Kerry Group, Barry Callebaut, The Kraft Heinz Company, Signature Brands LLC, Pecan Deluxe Candy Company, Hanns G. Werner GmBH + Co.KG, Carroll Industries NZ Ltd, Cape Foods, Paulaur Corporation and Others.

RECENT HAPPENINGS IN THE MARKET

- In October 2018, the Paulaur Corporation (USA) launched non-GMO certified dessert coverage after increasing consumer demand for cleanly labeled natural products.

- In October 2018, Pecan Deluxe Candy Company, a pioneer in European inclusions, launched a newly improved and expanded manufacturing facility for its confectionery business at the UK headquarters in Yorkshire.

DETAILED SEGMENTATION OF THE GLOBAL SUGAR DECORATIONS AND INCLUSIONS MARKET INCLUDED IN THIS REPORT

This research report on the global sugar decorations and inclusions market has been segmented and sub-segmented based on type, application, colorant, end-user, and region.

By Type

- Jimmies

- Quins

- Dragees

- Nonpareils

- Single Pieces

- Caramel Inclusions

- Sanding & Coarse Sugar

By Application

- Cereals & Snack Bars

- Ice-creams & Frozen Desserts

- Chocolates & Confectionery Products

- Cakes & Pastries

By Colorant

- Natural

- Artificial

By End-User

- Food Manufacturers

- Foodservice Industry

- Home Bakers

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

1. What are the key trends driving the sugar decorations and inclusions market?

Trends include increasing consumer demand for customized and visually appealing baked goods, the rise of specialty bakeries and confectionery shops, and innovations in product design and technology.

2. What are the challenges faced by manufacturers in the sugar decorations and inclusions market?

Challenges include maintaining product quality and consistency, adhering to food safety regulations, managing costs of raw materials, and meeting diverse customer preferences.

3. What are the future prospects for the sugar decorations and inclusions market?

The market is expected to continue growing with increasing consumer interest in premium and personalized baked goods, expanding retail channels, and ongoing innovations in product design and functionality.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com