Global Cybersecurity Market Size, Share, Trends & Growth Forecast Report Segmented By Component (Hardware, Software and Services), Software (IAM, Encryption, Firewall, APT, Threat Intelligence Platform, Network Access Control, IDS/IPS and Others), Security Type, Deployment Mode, Organization Size, End-User and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Cybersecurity Market Size

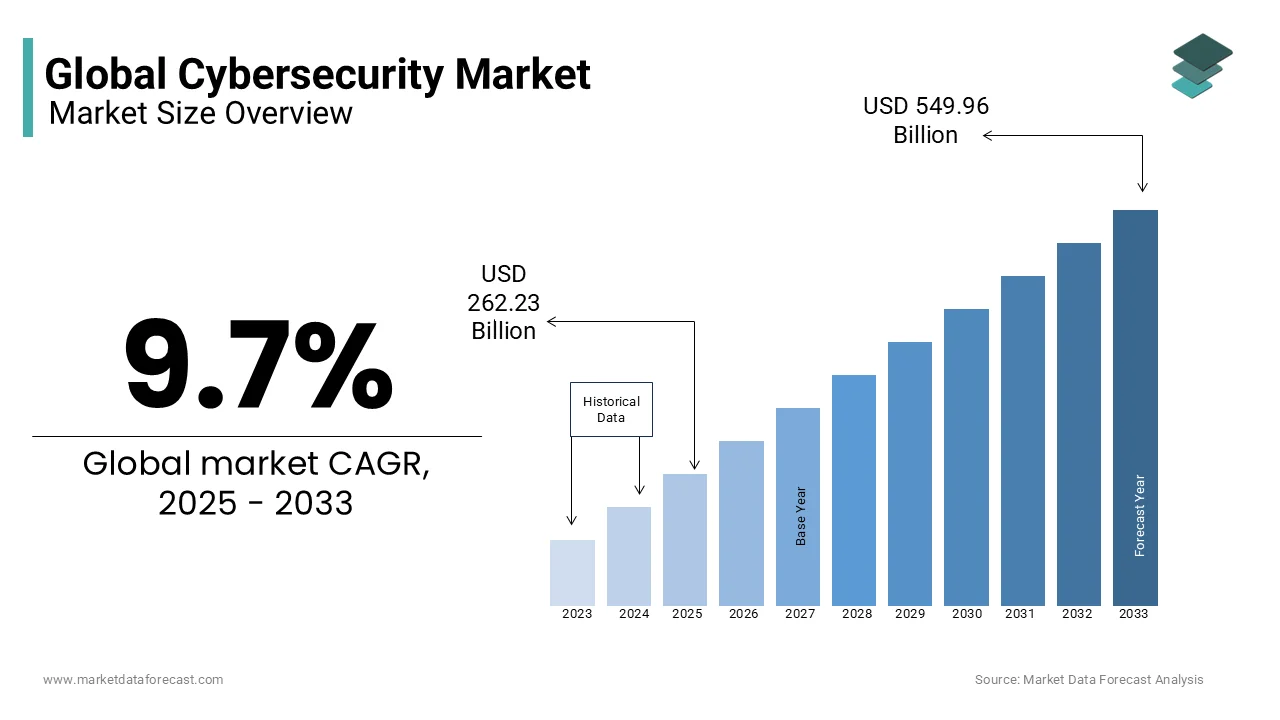

The global cybersecurity marketm was worth USD 239.04 billion in 2024. The global market is expected to reach USD 549.96 billion by 2033 from USD 262.23 billion in 2025, growing at a CAGR of 9.7% between 2025 to 2033.

Cybersecurity refers to a process to defend devices and services from electronic attacks by nefarious actors such as hackers, spammers, cybercriminals and others. These cyber-attacks are usually aimed at accessing, changing, or destroying sensitive information, extorting money from users, or interrupting normal business processes. A cyber security approach includes multiple layers of protection spread across the computers, networks, programs, or data that one intends to keep safe. Cyber security includes technologies, processes, and methods to defend computer systems, data, and networks from attacks. Cyber security is divided into a series of subdominants, such as Application Security, Cloud Security, Identity Management and Data Security, Mobile security, disaster recovery and business continuity planning, user education, network security, and others. The common cyber-attacks that require cyber security solutions are cyber terrorism, malware, trojans, botnets, adware, SQL injections, phishing, Man-in-the-middle attacks, denial of service and others.

The cybersecurity market is witnessing a swift expansion due to the increased intensity of online attacks. In 2023, the world saw a sharp divide in geopolitical order, various armed conflicts and hostilities, and a mix of doubt and enthusiasm regarding the effects of future technologies and economic instability worldwide. Against the backdrop of a complicated environment, the economy of cybersecurity surged remarkably faster, outpacing the growth of the technology industry and the full global economy. Moreover, a clear separation has emerged between cyber-resilient companies or institutions and those that are facing difficulties. This clear difference in cyber equity is worsened by the patterns of the threat landscape, industry laws, trends in macroeconomics, and early acceptance of paradigm-transitioning technology by a few organizations. Other distinct hurdles, involving the increasing expenses related to the availability of unique cyber expertise, skills, tools, and services, maintain an effect on the potential of the world’s ecosystem to create a significantly safer digital environment against various shifts.

The market is expected to expand at a higher CAGR due to the widening gap in cyber resilience among big, medium, and small companies. According to a study, the number of companies or establishments that keep a minimum feasible cyber defence capability has declined to 30 per cent. At the same time, big organizations illustrated a tremendous rise in digital resilience and Small and Medium Enterprises (SMEs) displayed a considerable drop. More than twofold as many SMEs as the big companies or institutions report they cannot defend or counter cyberattacks and ability to fulfill their important functional requirements.

Additionally, the market is rapidly expanding in North America, Western Europe, and Southeast Asian countries. In 2023, about 50 per cent of the United Kingdom witnessed some type of online or digital attack. The industry in 2022, on average, lost 4.35 million dollars on account of data breaches; this is a significant cost to the businesses.

MARKET DRIVERS

The rising number of targets based cyberattacks is one of the major factors propelling the global cybersecurity market growth.

The number of precise assaults has increased recently because they breach their targets' network infrastructure while remaining anonymous. Attackers that have a specific goal in mind typically target networks, endpoints, data, cloud-based apps, on-premises devices, and other IT infrastructures. The main goal of these attacks is to break into the network of the targeted company or organization and steal important data. These attacks harm an organization's business-critical activities, resulting in financial loss, disruptions to business, and theft of sensitive and vital customer data. Targeted cyberattacks have an impact on both local and international clients in addition to the targeted organizations.

The evolving landscape of cyber threats is further boosting the global cybersecurity market growth.

Cybersecurity is important for people, businesses and governments to be at par or ahead of the attackers in protecting their digital assets because the threat environment has changed and grown. The risks are continually evolving, consisting of sophisticated nation-state cyber warfare to devastating ransomware attacks and phishing frauds. The risks associated with cyber warfare, ransomware attacks and phishing frauds are constantly evolving and posing significant threats to various sectors.

The conflict between Russia and Ukraine has significantly impacted cybersecurity, leading to increased cyberattacks on private companies, governmental institutions, and vital infrastructure, thereby promoting global market growth. The war has led to a surge in attacks targeting critical infrastructure including energy grids, water supplies and transportation systems using various techniques like DDoS, intrusion attempts, malware and others. Stricter requirements for compliance and data privacy by governments around the world are contributing to the global cybersecurity market growth. For instance, in August 2023, the Digital Personal Data Protection Act was passed by the Indian parliament.

MARKET RESTRAINTS

Limited budgets by small and medium enterprises and startups are limiting the global cybersecurity market growth.

Smaller companies are more susceptible to attacks because they cannot afford sophisticated cybersecurity measures. Also, the shortage of skilled professionals is further restricting the market expansion. The scarcity of cybersecurity capabilities has severely affected more than 70% of firms which is a substantial increase from the 57% in a prior study. As a result, cybersecurity teams now must deal with greater workloads of over 6%, unfilled positions of around 49% and high rates of employee burnout of 43%. Furthermore, 72% of customers agree that the lack of exposure to the field at a young age, the false perception that applicants must hold a four-year college degree and the absence of cybersecurity education and training in schools are the main causes of the talent shortage facing the cyber security market.

MARKET OPPORTUNITIES

Russia presents a good opportunity for companies in the Asia Pacific and MEA to enter and expand their share in the global cybersecurity market. Primarily due to the withdrawal of Western technology companies from the market Russian state actors great need to avoid either falling behind on their technological debt from software upgrades that are delayed because of hardware shortages or turning to other options. Emerging technologies such as blockchain and quantum computing have the potential prospects for the market to grow further. Blockchain can be used for securing identity and data management and post quantum cryptography must be used to safeguard sensitive data from future attacks.

MARKET CHALLENGES

Though legal frameworks and data security laws are being introduced and implemented complexity and fragmented regulatory requirements are posing significant challenges to the global cybersecurity market. In 2022, a plethora of rules on cyber security formed in Europe and its strict and convoluted regulatory framework is an adaptation of a tech sector largely rooted in the USA and China. Moreover, the primary contributors to these compliance challenges are regulatory fragmentation, organization and administration concerns, third-party compliance management and the absence of talent and skills for effective cybersecurity compliance.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.7% |

|

Segments Covered |

By Component, Software, Security Type, Deployment Mode, Organization Size, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Broadcom (Symantec Corporation), Cisco Systems, Inc., Check Point Software Technology Ltd., IBM, McAfee LLC, Palo Alto Networks, Inc., Trend Micro Incorporated, Norton LifeLock, Rapid7, Micro Focus among others |

SEGMENTAL ANALYSIS

By Component Insights

Based on the component, the services segment is expected to hold the major share of the global cyber security market during the forecast period. The adoption of cybersecurity services across various sectors and industries is driven by organizations' strong demand for implementing appropriate cyber security solutions based on organizational structure. With their tight budgets, small and medium-sized enterprises (SMEs) tend to consult before setting any solutions into place, which helps them boost market sector growth. Several organizations are investing in cybersecurity services as a component of their endeavors to establish a strong security framework to mitigate cyberattacks.

By Software Insights

Based on software, the identity and access management (IAM) segment had the largest share of the worldwide market in 2023. Security Information and Event Management became an extremely prevalent tool among businesses globally in 2023.

By Security Type Insights

Based on security type, the application security segment is projected to flourish at the highest CAGR during the forecast period. Security solutions such as IAM, web filtering and application whitelisting help enterprises protect their business-sensitive applications from external and internal threats like web attacks, DDoS, site scraping and frauds. Organizations frequently ignore applications, which leads to security lapses. Cybersecurity solutions shield user applications from unwanted activity and threats by gathering and analyzing data from online applications.

By Deployment Mode Insights

Based on the deployment mode, the on-premises segment was the leading segment in the global cybersecurity market in 2023. Many large businesses prioritize full control of the solutions to guarantee the highest level of data protection, which is fueling the expansion of the segment. Furthermore, the use of on-premises security solutions reduces reliance on outside providers of data protection and monitoring. Microsoft Azure is preferred for Windows applications and large-scale web app deployments while Amazon Web Services and Google Cloud Platform are preferred for large-scale web app deployments due to their analytics capabilities.

By Organization Size Insights

Based on the organization size, the large enterprise segment captured the major share of the worldwide market in 2023 and is predicted to hold a promising occupancy in the worldwide market throughout the forecast period due to rising expenditures on IT infrastructure by major businesses to fortify digital security and safeguard their massive data storage volumes. Large companies are also more susceptible to significant financial losses from cyberattacks since they have multiple servers, storage devices, endpoints, and networks. To prevent these kinds of problems, big businesses are concentrating on implementing cyber security solutions to protect their data and encourage market expansion.

By End-User Industry Insights

Based on the end-user, the healthcare segment is expected to expand at the greatest CAGR during the forecast period. Healthcare organizations maintain huge patient data including contact information, insurance information, social security numbers, biometric information, emails and clinical records. Additionally, they keep track of their client’s payment information which makes them vulnerable to hacking attacks.

REGIONAL ANALYSIS

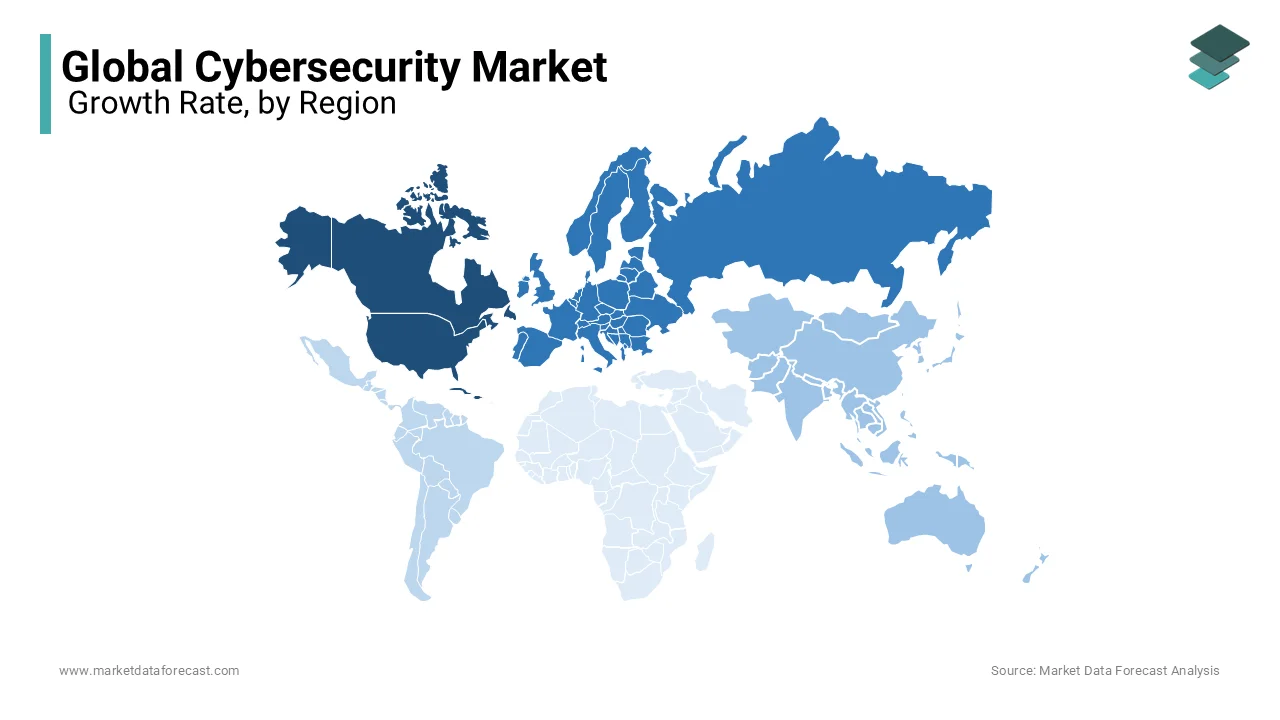

North America currently holds the maximum share of 36% in 2024, of the global cybersecurity market. Cybersecurity continues to evolve in North America together with ongoing advancements in cutting-edge technology like big data and the Internet of Things. In addition, the demand for endpoint gadget security is driven by the region's growing number of IT organizations and their diverse commercial ventures. In October 2023, In an alliance headed by the United States, forty nations are committed to pledging never to give money to cyber criminals and also to work towards removing the source of income for these hackers.

The European cybersecurity market is expected to propel further at an exponential rate. Increased digital transformation and cloud adoption are driving the regional market. Software as a Service and other cloud-based services are rapidly growing popular which expands the attack surface and emphasizes the importance of robust security measures throughout the digital ecosystem.

Asia Pacific is the fastest-growing market and is anticipated to achieve a higher CAGR during the forecast period. The need for security solutions has been boosted due to the expanding number of connected devices which range from smart homes and smartphones to critical infrastructure and industrial sites. These gadgets provide new access points and weaknesses for cyberattacks.

Latin America is estimated to grow at a steady pace in the coming years. It has made uneven progress in cyber security field but there are some encouraging developments. The Latin American market requires regional governments and regional organizations to coordinate efforts and raise awareness of cyber risks.

The Middle East and Africa market will elevate further in the future. The region's geopolitical unrest is contributing to the persistent activity of skilled hacker groups known as advanced persistent threats, or APT who launch focused cyberattacks and engage in cyber espionage. MEA nations are rapidly digitizing, utilizing cloud computing, smartphones, and mobile internet, thereby increasing the attack surface, and necessitating robust cybersecurity solutions for businesses and individuals.

KEY MARKET PLAYERS

Broadcom (Symantec Corporation), Cisco Systems, Inc., Check Point Software Technology Ltd., IBM, McAfee, LLC, Palo Alto Networks, Inc., Trend Micro Incorporated, Norton LifeLock, Rapid7 and Micro Focus are some of the major companies in the global cybersecurity market.

RECENT HAPPENINGS IN THE MARKET

- In December 2023, to improve client’s end to end security postures and handle changing threats Palo Alto Networks and IBM Consulting broadened their strategic alliance which made Palo Alto Networks the leading security services partner. IBM also bought Polar Security for 60 million dollars in May 2023.

- In September 2023, Cisco Systems acquired Splunk for roughly 28 billion dollars. Cisco and Splunk will merge to form one of the world's largest software companies, growing Cisco's business transformation and generating more revenue.

- In February 2022, IBM announced its multi-billion-dollar investment in its resources to help businesses prepare for and manage the growing threat of cyber-attacks to various organizations across the Asia-Pacific region.

MARKET SEGMENTATION

This research report on the global cybersecurity market is segmented and sub-segmented into the following categories.

By Component

- Hardware

- Software

- Services

By Software

- IAM

- Encryption

- Firewall

- APT

- Threat Intelligence Platform

- Network Access Control

- IDS/IPS

- Others

By Security Type

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others

By Deployment Mode

- Cloud

- On-Premises

By Organization Size

- Large Enterprises

- Small & Medium Size Enterprises

By End-User

- Aerospace & Defense

- Government

- BFSI

- IT & Telecommunication

- Healthcare

- Retail

- Manufacturing

- Energy & Utilities

- Telecommunications

- Media and Entertainment

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key factors driving the growth of the cybersecurity market?

The key drivers include the increasing frequency and sophistication of cyber-attacks, growing digital transformation across industries, rising adoption of cloud computing, and stricter data protection regulations like GDPR in Europe and CCPA in California.

Which industries have the highest demand for cybersecurity solutions globally?

Financial services, healthcare, government, and retail industries have the highest demand for cybersecurity solutions due to the sensitive nature of data and increased targeting by cybercriminals. Critical infrastructure and manufacturing are also emerging as sectors with growing needs for cybersecurity protection.

What is the role of AI and machine learning in the cybersecurity market?

AI and machine learning are playing an increasingly critical role in cybersecurity by enhancing threat detection and response capabilities. These technologies can analyze vast amounts of data, identify anomalies, detect zero-day threats, and automate responses to mitigate attacks in real-time, making them essential in modern cybersecurity strategies.

How is the cybersecurity market expected to evolve in the next 5-10 years?

In the next 5-10 years, the cybersecurity market is expected to see continued growth, driven by increasing digital transformation, cloud adoption, and the expansion of 5G and IoT networks. Zero-trust architectures, AI-driven security, and extended detection and response (XDR) solutions will become more prevalent. The rise of quantum computing will also spur demand for quantum-resistant encryption and other advanced security measures.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]