Global Digital PCR and qPCR Market Size, Share, Trends & Growth Forecast Report By Product (Consumables & Reagents and Instruments), Technology (Quantitative PCR and Digital PCR), Application (Tumors, Blood Testing, Pathogen Detection and Research & Forensics), End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Digital PCR and qPCR Market Size

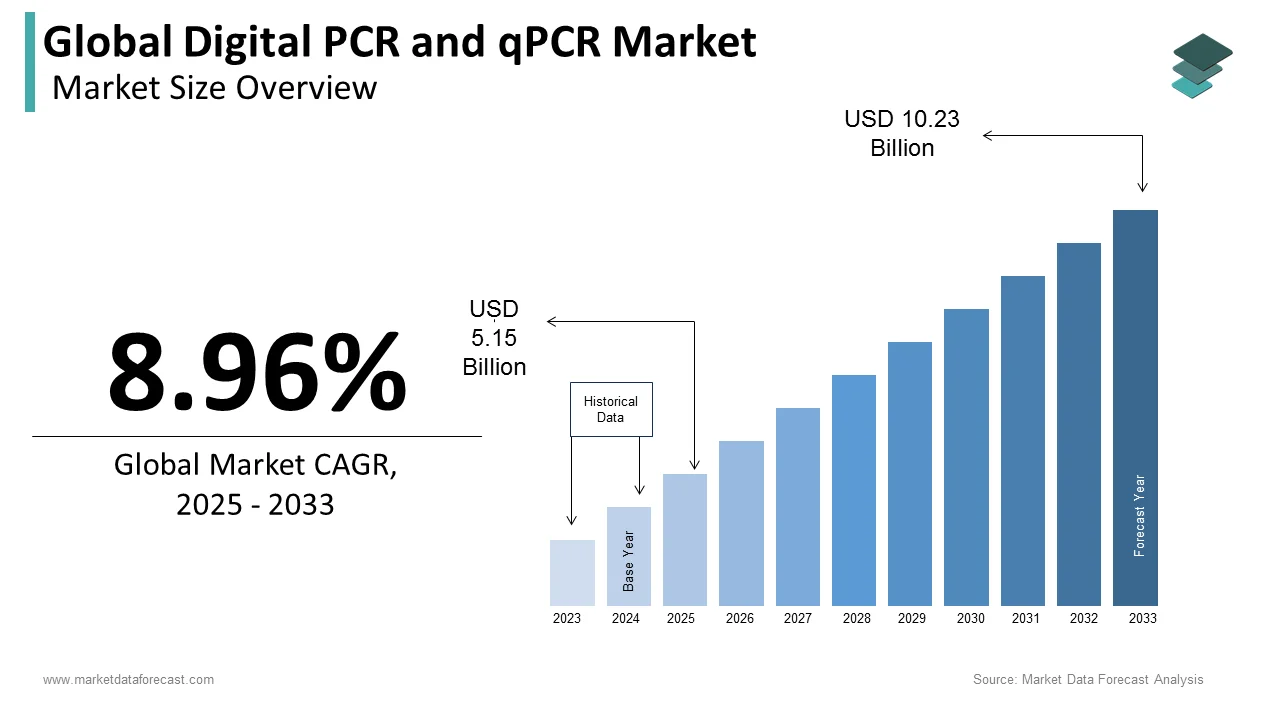

The size of the global digital PCR and qPCR market was worth USD 4.73 billion in 2024. The global market is anticipated to grow at a CAGR of 8.96% from 2025 to 2033 and be worth USD 10.23 billion by 2033 from USD 5.15 billion in 2025.

MARKET DRIVERS

The increasing adoption rate of real-time PCR and digital PCR to diagnose genetic disorders and infectious diseases such as tuberculosis, malaria, and others is propelling the global digital PCR and qPCR market growth.

Digital PCR and qPCR devices are highly efficient for estimating disease-causing microbes and diagnostics analysis. The emergence of innovative and advanced genomic analysis products worldwide and the growing focus of government and private organizations to develop novel and innovative digital PCR and qPCR products are favoring the market growth.

In addition, the growing incidence of genetic disorders and other chronic diseases such as cancer and technological advancements, growing healthcare expenditure, and emerging economies such as China, Canada, India, U.K, Japan, and other developed and developing countries across the world are anticipated to support the growth rate of the digital PCR and qPCR market. Benefits offered by digital PCR over traditional PCR, such as accuracy, better sensitivity, and enhanced flexibility, are estimated to promote the global digital PCR and qPCR market growth during the forecast period. In addition, increasing qPCR consumables, reagents, and other clinical applications is a plus to the market's growth rate.

In the recent past, the increasing demand for fast diagnostics, the frail population, growing patient count suffering from infectious and genetic disorders such as cancer, HIV, and Hepatitis are expected to have a favorable impact on the global digital PCR and qPCR market growth. In addition, the growing investments from market participants to conduct R&D and develop advanced PCR products are expected to favor the market’s growth rate in the coming years.

MARKET RESTRAINTS

However, technical glitches and the high initial costs associated with digital PCR & qPCR are restraining the market growth. In addition, the high costs associated with the instrument's need for capital investments on a large scale to develop advanced devices further limit the market’s growth rate. Technical limitations related to PCR also control the adoption rate, another major factor challenging the growth of the global digital PCR and qPCR market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Technology, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

SEGMENTAL ANALYSIS

Global Digital PCR and qPCR Market Analysis By Product

- Consumables & Reagents

- Instruments

Based on product, the consumables and reagents segment dominated the global market in 2024 and is anticipated to be contributing significantly to the growth of the global digital PCR and qPCR market during the forecast period owing to factors such as increased applications of qPCR reagents such as assay kits and master mixes and increasing investments from private and public organizations.

Global Digital PCR and qPCR Market Analysis By Technology

- Quantitative PCR

- Digital PCR

Based on the technology, the quantitative PCR segment is expected to account for the largest share during the forecast period due to the rising focus on enhancements of Point of care (POC) platforms, the ongoing stipulation in areas like genetic variation analysis, and gene expression analysis and genotyping.

On the other hand, digital PCR is expected to showcase a healthy CAGR in the coming years. Digital PCR is a next-generation testing process that assists inaccurate quantification of nucleic acids. These systems provide better sensitivity and precision related to other PCR strategies based are likely to strengthen the growth during the forecast period.

Global Digital PCR and qPCR Market Analysis By Application

- Tumors

- Blood Testing

- Pathogen Detection

- Research & Forensics

Based on the application, the research and forensics segment is projected to lead the global digital PCR and qPCR market during the forecast period owing to the increased government and other private organizations for the research and the funds and investments offered.

The blood testing segment is also anticipated to perform well during the global digital PCR and qPCR market forecast period. Increasing the utilization of qPCR in disease diagnosis, the swelling of infectious and genetic diseases, and mounting public attention on early and efficient disease diagnosis and treatment make this segment grow higher.

Global Digital PCR and qPCR Market Analysis By End User

- Hospitals

- Research & Forensic Centers

- Pharmaceutical & Bio-Technological Firms

- Academic Institutions

Based on end-user, the pharmaceutical and biotechnological companies segment is forecasted to hold a significant share of the global digital PCR and qPCR market during the forecast period. It is expected to register a healthy CAGR.

REGIONAL ANALYSIS

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

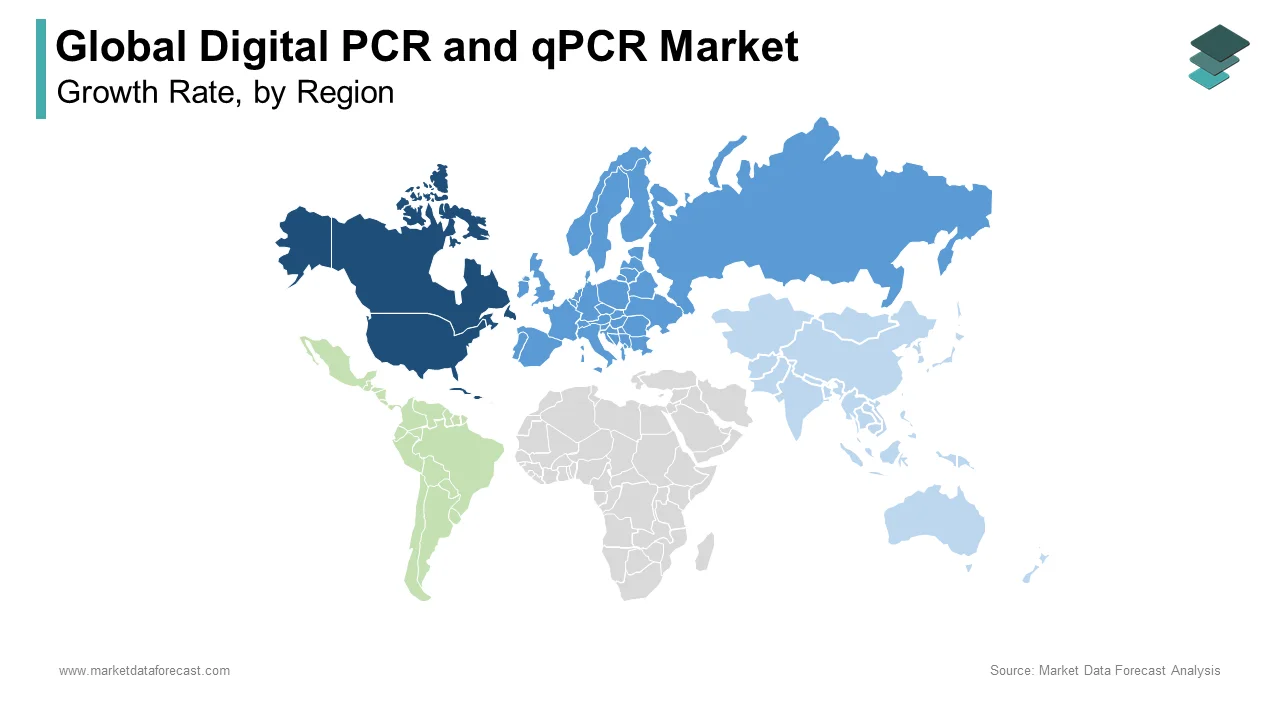

Geographically, the North American market led the global market in 2024, followed by Europe and the Asia Pacific. Owing to technological developments and increasing investments from the private sector, investments are anticipated to fuel the market’s growth rate in the North American region. In addition, the growth of the North American market is further driven by factors such as growing support and funding from governments to upgrade qPCR and digital PCR technology, increasing cancer patient count, and an ongoing cutback in the average price of gene sequencing.

Europe held the second-largest global market share in 2024 and is anticipated to hold a substantial share of the global market during the forecast period. A wide range of applications of qPCR and digital PCR technologies utilized in areas such as human genetic testing and forensic sciences are some factors propelling the market growth in the European region.

The Asia-Pacific region is predicted to grow at a prominent CAGR during the forecast period. An increase in the patient count suffering from chronic and infectious diseases integrated with growing alertness amid patients regarding early diagnosis of the disorders is projected to boost the market growth globally. India is projected as one of the capable markets in the APAC in digital PCR and qPCR market, especially for the country's everyday importance of cancer and cardiovascular diseases. According to the International Agency for Research on Cancer, the country reported 1.2 million cancer cases in 2018, the country's primary cause of death rate.

Latin America is projected to have a steady growth rate during the forecast period. YOY growth in the aging population, a considerable number of vital regional players, and growing R&D applications. The Brazilian market is predicted to lead the Latin American market during the forecast period due to the growing demand for quick diagnostics and quickly advanced technologies.

The Middle East & African market is anticipated to have a minimal share during the forecast period. However, rapid technological advancements like high-performance development bolstered the region's market growth.

KEY MARKET PARTICIPANTS

Some of the notable companies dominating the Global Digital PCR and qPCR Market profiled in this report are Thermo Fisher Scientific Inc., F Hoffman-La Roche Ltd., Bio-Rad Laboratories, Qiagen N.V., Taraka Bio Inc., Affymetrix Inc., Agilent Technologies Inc., Fluidigm Corporation, Danaher Corporation, and Becton & Dickson Company.

HAPPENINGS IN THIS MARKET IN THE RECENT PAST

- Recently, HDPCR multiplexing technology has been developed that combines proprietary data science algorithms that enrich the multiplex levels of common real-time and digital PCR to detect 5-50 target sites in a reaction at a low cost. In addition, a profusion of bacterial allosteric transcription factors (sTF) has been discovered to study various tiny molecules. A TF-based nicked DNA segment-assisted signal transduction system (a TF-NAST) is used.

- Agilent technologies inc. completed the acquisition of scientific co. Ltd. in 2018. With this deal, Agilent Technologies Inc. expanded its distribution channel in South Korea and other Asian Markets.

- Abbott Company collaborated with the Japanese Red Cross Society in 2019. As a result, Abbott has locked the agreement to supply plasma screening and blood screening devices and consumables for tests and serological instrumentation in Japan. This collaboration helps Abbott expand its distribution network and share the company's value in Japan.

- Qiagen Company started developing a series of technically advanced systems for digital PCR in 2019.

Frequently Asked Questions

How big is the global digital PCR and qPCR market?

The global digital PCR and qPCR market was valued at USD 4.73 billion in 2024.

What is the growth rate of the digital PCR and qPCR market in the future?

The global digital PCR and qPCR market is expected to grow at a CAGR of 8.96% from 2025 to 2033.

Which region held the major share of the digital PCR and qPCR market in 2024?

North America dominated the digital PCR and qPCR market in 2024.

What are the companies dominating the digital PCR and qPCR market?

Thermo Fisher Scientific Inc., F Hoffman-La Roche Ltd., Bio-Rad Laboratories, Qiagen N.V., Taraka Bio Inc., Affymetrix Inc., Agilent Technologies Inc., Fluidigm Corporation, Danaher Corporation, and Becton & Dickson Company are some of the notable companies in the digital PCR and qPCR market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com