Europe Point-of-Care (POC) Diagnostics Market Size, Share, Trends & Growth Forecast Report By Product, End-User and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Point-of-Care (POC) Diagnostics Market Size

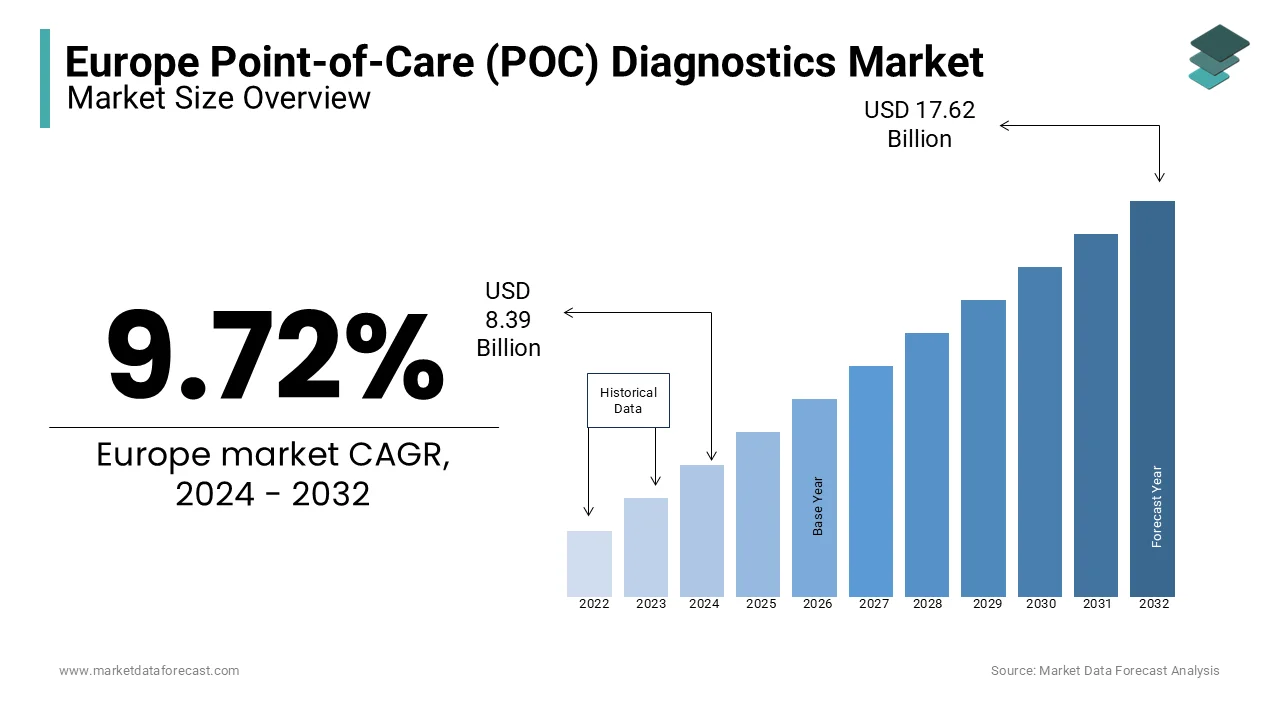

The POC diagnostics market in Europe was worth USD 8.39 billion in 2024. The European market is estimated to grow at a CAGR of 9.72% from 2025 to 2033 and be valued at US 19.34 billion by the end of 2033 from USD 9.21 billion in 2025.

MARKET DRIVERS

YOY growth in the patient volume suffering from chronic diseases across the European region promotes the demand for POC diagnostics and propels the regional market growth. Sedentary lifestyles, bad eating habits, and environmental concerns are some of the leading factors that could result from a cancer diagnosis. The population suffering from chronic diseases, such as cancer, diabetes, and heart disorders, from various countries of the European region has seen a spike in recent days. According to The Cancer Atlas, an estimated 3.9 million new cancer cases were recorded in the European region in 2018. Breast cancer, prostate cancer, lung cancer, and colorectal cancer are the most common cancers among diagnosed patients. Due to the growing mortality rate from chronic diseases, researchers and market participants are working to develop point-of-care devices that can give immediate results. For instance, due to increasing heart-related diseases, people now use blood pressure monitoring devices, which are point-of-care devices that are easy to operate and can be used at home.

In addition, the growing adoption of technological advancements to further enhance the quality of POC diagnostics is resulting the regional market growth. For instance, sensor-based technology and AI are being used in medical devices to promote the accuracy rate of the results. The increasing prevalence of infectious diseases such as HIV, hepatitis, tuberculosis, and influenzas among the European population is predicted to result in the growing demand for POC diagnostics and boost European market growth. According to the statistics published by the European Centers for Disease Prevention and Control (ECDC), there were 49,752 TB cases in 29 European Union and European Economic Area (EU/EEA) countries in 2019. Providing appropriate treatment to patients suffering from infectious diseases is essential to avoid critical situations. These infections can be detected rapidly using point-of-care testing devices, which are performed near the patients to see the changes in the patient for a quick diagnosis. Taking the test result helps to reduce the spread of the disease to another person in the surroundings.

YOY growth in the geriatric population across the European region further propels the POC diagnostics market in the European region. People who are aged are much more prone to diagnosing various infectious and chronic diseases that require POC testing. For instance, during the COVID-19 pandemic, aged people prefer to have tests and treatment at home to limit the possibility of contracting the coronavirus. In addition, aged people with diabetes require glucose levels test at regular intervals to reduce the risk situation in their lives. For this, they are using glucose monitoring devices which can be done at home on their own. These devices can also be linked to the smartphone application, where data is stored and sent to the healthcare provider for treatment suggestions.

Furthermore, the growing need for efficient, easy-to-use, and faster consumer products and these portable personal care devices is expected to drive the European POC diagnostics market. In addition, the integration of automated techniques in healthcare is expected to increase the rise of new product launches of home testing cancer kits at regular intervals and enhanced laboratories. As a result, the key market players have created significant research and development activities to create innovative point-of-care tests and devices for rapid disease diagnosis and monitoring.

MARKET RESTRAINTS

However, the high costs associated with POC testing devices are one of the major factors hampering the market’s growth rate in the European region. In addition, factors such as industry resistance to modifying established norms, numerous product recalls, a strict regulatory environment, and an unfavorable reimbursement scenario hamper the growth of the POC diagnostics market in the European region.

REGIONAL ANALYSIS

The European market had a substantial share of the global market in 2023 and is expected to hold decent occupancy in the global market during the forecast period owing to the well-established healthcare infrastructure, favorable reimbursement scenarios, and high healthcare affordability in this region. Moreover, the high levels of awareness amongst the patient population base and the physicians associated with fast disease diagnosis support the industrial revenue. The Healthcare system in Europe focuses on the improvement of healthcare delivery and reducing the cost. They also focus on quality diagnosis and treatment for positive outcomes. For example, unnecessary hospital admission increases the hospital's burden during the pandemic. Therefore, a point-of-care diagnostic test is done on the patient at their home; based on the result, further treatment will be given to avoid such burdensome situations.

The UK market accounted for a significant share of the European market in 2023 and is predicted to grow at a prominent CAGR during the forecast period.

The French market is expected to play a vital role in the European market during the forecast period due to the prevalence of unhealthy lifestyles, a high number of chronic diseases, increased FDA approvals, and government laws connected to healthcare development. In addition, France is one of the world’s most significant users of pharmaceutical products and one of the most complex to sell.

The German market is estimated to grow at a promising CAGR during the forecast period. Increased government initiatives aimed at reducing hospital stays and improving healthcare infrastructure and favorable reimbursement policies are expected to cause a rise in the use of POC diagnostics in Europe.

KEY MARKET PLAYERS

A few of the notable companies operating in the Europe Point of Care (POC) diagnostics/testing market profiled in this report are Abbott Laboratories, Inc., Danaher Corporation, Roche Diagnostics Limited, BioMerieux, Siemens Healthcare, Beckman Coulter, Inc., Becton, Dickinson and Company, Johnson & Johnson, Alere Inc., and PTS Diagnostics.

MARKET SEGMENTATION

This research report on the European point-of-care (POC) diagnostics market has been segmented and sub-segmented into the following categories.

By Product

- Infectious Diseases

- Cardiac Markers

- Oncology Markers

- OTC Diagnostic Tests

- Drugs Of Abuse

- Blood Gas Testing

- Fertility Testing

- Urinalysis

- Coagulation

- Hematology

- Glucose Monitoring

- Ambulatory Chemistry

- Decentralized Clinical Chemistry

By End-User

- Clinics

- Hospitals

- Home Healthcare

- Ambulatory Care Settings

- Laboratories

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What was the size of the POC diagnostics market in Europe in 2023?

The Europe POC diagnostics market was valued at USD 8.39 billion in 2023.

Which year is considered as the base year for this research report?

2023 is the base year is developing this market research report.

Which country led the Europe POC diagnostics market in 2023?

The UK had the leading share of the European market in 2023.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]