Europe Seed Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report, Segmented By Seed Trait, Crop Type and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Seed Market Size

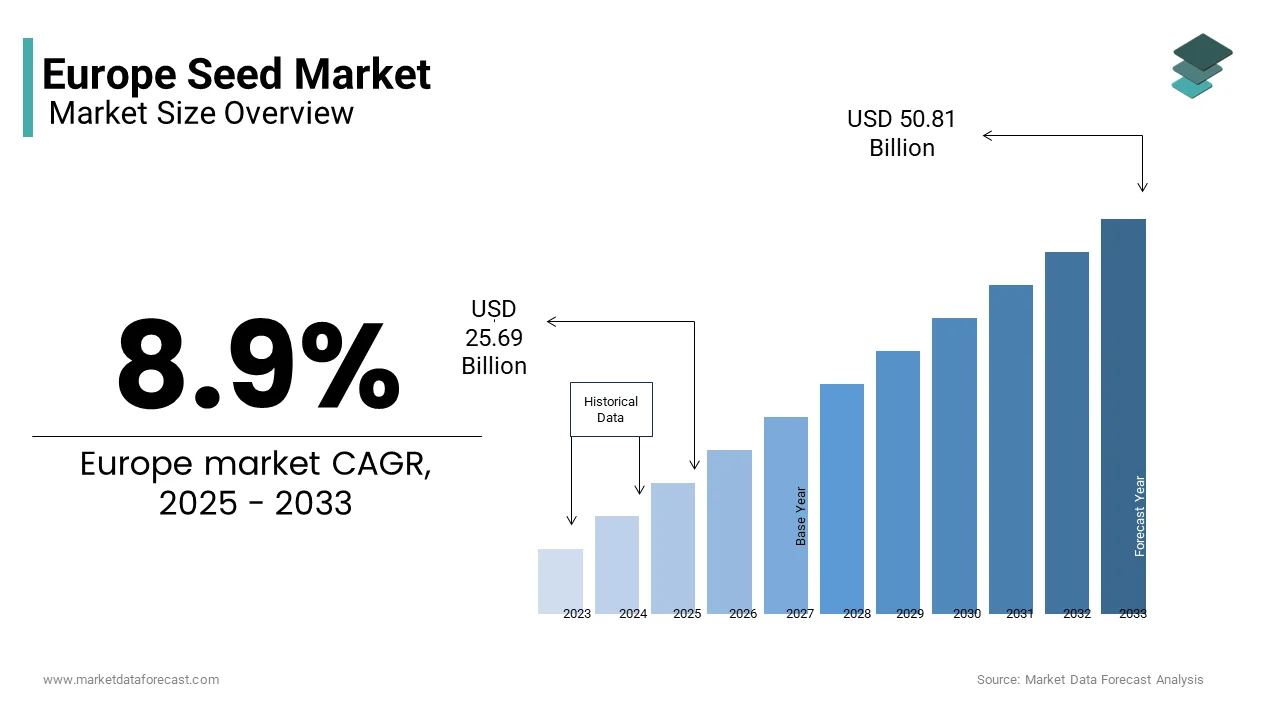

The European seed market was valued at USD 23.59 billion in 2024 and is anticipated to reach USD 25.69 billion in 2025 from USD 50.81 billion by 2033, growing at a compound annual growth rate (CAGR) of 8.9% during the forecast period from 2025 to 2033.

The European seed market has experienced significant growth, driven by the pressing challenges of a burgeoning global population and escalating food demand. With the need to enhance crop yields to sustain this expanding demographic, there has been a notable adoption of advanced agricultural technologies, prominently including genetically modified seeds. These seeds, developed through biotechnological innovations, offer traits such as resistance to pests, diseases, and adverse weather conditions. As European farmers grapple with the imperative to produce more food efficiently and sustainably, the seed market has responded by providing solutions that align with these demands. Moreover, government initiatives, supportive regulations, and increasing awareness of sustainable agricultural practices further propel the growth of the seed market in Europe.

Technological advancements have witnessed transformative growth in the European seed market by biotechnology and genetic engineering. It has yielded genetically modified (GM) seeds, revolutionizing agriculture with traits such as pest and disease resistance, herbicide tolerance, and heightened yield potential. The relentless pursuit of improved varieties has not only bolstered the competitiveness of the European seed market but has also played a pivotal role in meeting the escalating global demand for food production. As technology continues to shape the agricultural landscape, the seed market in Europe stands at the forefront of innovation, driving sustainable solutions to ensure food security in the face of evolving challenges.

A stringent regulatory environment is a significant restraint in the European seed market, creating hurdles for the development and widespread adoption of certain seed varieties. Public concerns regarding the safety and environmental impact of GMOs contribute to a climate of caution, further hindering the acceptance of genetically modified seeds. The intricate approval processes and compliance requirements add layers of complexity and time to bringing innovative seed technologies to market. Consequently, these regulatory constraints not only impact the pace of seed variety advancements but also influence market dynamics, limiting the range of options available to European farmers.

MARKET DRIVERS

The demand to increase crop productivity, along with the enormously increasing population in Europe, is a major factor that is escalating the growth rate of the seed market. The concern about the rising food production rate is drastically increasing, so there is a huge necessity to improve crop production. Improving the quality of seeds with the latest technology has the prominence for higher crop production. Therefore, the necessity to improve the high-quality seed production is certainly to amplify the Europe seed market.

In addition, the use of refined oil seeds in the animal feed industry is ascribed to leverage the growth rate of the market. EU permits partial use of meat and bone meal in animal feed, eventually raising the need to look for plant-based protein sources. Refined oil seeds are rich in protein sources, which is good for the overall well-being of the animals and is prompting the market’s share. According to the EU Agriculture and Rural Development, 27% of total feed protein for animals is from oilseed. The total 27% share of oil seed meals is completely for the livestock sector. EU Commission already published a statement in support of plant-based protein sources for animal well-being in March 2022. The agricultural and rural development activities in Europe take much privilege in maintaining support for the cultivation of various crops in favor of the end users, which is greatly influencing the growth rate of the Europe seed market.

Increasing investments from the government and non-government organizations to produce high-yield crops is elevating the market value. The need to push up the agricultural economy in European countries is a major goal for the government authorities, which further increases the prominence of producing quality seeds. The efforts to reduce the food insecurity concern in more effective ways are solely to lavish the growth rate of the market in the coming years.

Rapid urbanization in developed countries is also attributed to fuelling the need to launch high-quality seeds with improved mechanisms that can produce high quantities eventually to elevate the growth rate of the market.

The trend towards the adoption of advanced techniques in growing crops in limited space with improved quality seeds is certainly a huge growth opportunity for the European seed market. People are inclined to produce more crops by gaining knowledge about cultivating plants with advanced technologies, especially in urban areas. These technologies are subjected to increase the crop production rate irrespective of the exterior climatic changes that eventually produce stable crop yield annually.

MARKET RESTRAINTS

However, lack of standardization is one of the factors that is limiting the growth rate of the European seed market. The availability of various low-quality local brand seeds is subjected to hindering market value. Local brands usually do not follow the norms imposed by the government and sell them at very low prices to attract customers, which creates a negative impact on the environment. Therefore, stringent actions by government authorities to minimize the local brands and reduce the negative impact on the environment will eventually limit the growth rate of the European seed market.

Impact of COVID-19 on the Europe Seed Market

The COVID-19 pandemic has brought about several challenges for the European seed market as the demerits include disruptions in the supply chain, with restrictions on movement affecting the transportation and distribution of seeds. Lockdowns and social distancing measures have impeded the fieldwork crucial for seed production, testing, and research, potentially delaying the introduction of new varieties. Furthermore, economic uncertainties and reduced purchasing power among farmers may lead to a decline in seed demand. But on the positive side, the pandemic has underscored the importance of food security, prompting increased interest in resilient and high-yielding seed varieties. The crisis has accelerated the adoption of digital technologies in agriculture, facilitating online transactions and communication in the seed industry. Despite initial setbacks, the pandemic has driven innovation and awareness, reshaping the European seed market to be more responsive to future challenges.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.9% |

|

Segments Covered |

By Seed Trait, Crop Type, and Country Analysis |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Germany, UK, France, Italy, Spain |

|

Market Leaders Profiled |

Biochar Products Inc., Diacarbon Energy Inc., Agri-Tech Producers LLC, Genesis Industries, Green Charcoal International, Vega Biofuels Inc., The Biochar Company, Cool Planet Energy Systems Inc., Full Circle Biochar, and Pacific Pyrolysis Pty Ltd. |

SEGMENT ANALYSIS

By Seed Trait Insights

The herbicide-tolerant segment is leading with the dominant share of the market. Herbicide-tolerant plants have the genetic ability to resist herbicides applied to crops. These varieties of plants are usually naturally tolerant to reproduction after herbicide treatment. Crops like cotton, canola, maize, soybean, alfalfa, and sugarbeet, among others, fall under this category. These crops always remain the highest planted trait every year, which eventually increases the growth rate of the herbicide-tolerant segment. Insect resistant segment is likely to have the highest CAGR by the end of 2029.

By Crop Type Insights

The oilseed segment is gearing up with the dominant share of the Europe seed market. The increasing use of plant-based sources in manufacturing animal feed is ascribed to boost the growth rate of this segment. The grain seed segment is likely to have a prominent growth rate throughout the forecast period. Grain is the staple food in every country, and the demand to produce these crops at a higher rate is very important to provide food for the growing population. The rising hunger bells in economically low countries are certainly a key factor in increasing the crop production rate that is set to propel the European seed market value. The fruits and vegetables segment is deemed to have huge growth opportunities during the forecast period. Nowadays, people are more likely to eat healthy foods like fruits and vegetables to maintain health and fitness and combat the risk of various diseases. The rising number of vegan people in major countries like the UK, Germany, and Italy is expected to surge the market’s growth rate to an extent.

COUNTRY ANALYSIS

Europe is a promising regional market in the worldwide seed market and accounted for a substantial share of the worldwide market in 2022. Europe is marked by a balance between traditional and advanced seed technologies. It also has an emphasis on organic farming and the conservation of biodiversity influences seed preferences. The market dynamics are shaped by a commitment to environmental stewardship and resilience to climate change.

The France seed market is anticipated to account for a notable share of the European market during the forecast period. France is a major agricultural powerhouse that plays a pivotal role in the European seed market. The emphasis is on developing seeds that align with sustainable and environmentally friendly agricultural practices. Research and innovation thrive, emphasizing improving crop yields and resilience. The market also reflects a commitment to addressing climate change through the development of seeds resilient to diverse weather conditions.

Spain is expected to register a prominent CAGR in the European market during the forecast period, which reflects a balance between conventional and genetically modified seeds, with a focus on enhancing crop productivity. The market is dynamic, driven by the demand for seeds resilient to drought and heat.

Germany is estimated to showcase a noteworthy CAGR during the forecast period in the European market, boasting advanced agricultural technology and a robust research and development sector. The market is characterized by a focus on sustainable and precision farming practices. Stringent regulations on genetically modified organisms (GMOs) impact seed development, but the emphasis on high-quality seeds for various crops, including cereals and oilseeds, remains.

The UK seed market is also influenced by a diverse agricultural landscape. The market prioritizes research in climate-resilient and disease-resistant varieties. A growing interest in organic farming and sustainability shapes seed preferences.

The Italian seed market is marked by a blend of traditional and modern agricultural practices. The sector places importance on adapting to climate change and sustainable farming. Italian farmers seek high-performance seeds, particularly for fruits, vegetables, and specialty crops.

KEY MARKET PLAYERS

Monsanto, Syngenta, Limagrain, KWS, Bayer CropScience and DLF-Trifolium are some of the major players in the European seed market. Key strategies such as investments in R&D are being employed by major companies to meet the growing seed demand.

MARKET SEGMENTATION

This research report on the European seed market has been segmented and sub-segmented into the following categories.

By Seed Trait

- Herbicide Tolerant

- Insect Resistant

- Other Stacked Traits

By Crop Type

- Oilseed

- Soybean

- Sunflower

- Cotton

- Canola

- Grain Seed

- Corn

- Wheat

- Rice

- Millet Crops

- Fruit & Vegetable

- Tomato

- Melon

- Carrot

- Onion

- Pepper

- Lettuce

- Other Seed

- Alfalfa

- Turf

- Clover & Forage Plants

- Flower Seed

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the expected value of the seed market in Europe in 2025?

The Europe seed market is predicted to be worth USD 25.69 billion in 2025.

What are the key challenges faced by the Europe seed market?

Concerns over genetic engineering, the need for large-scale investments in research and development, and addressing the complexities of international trade are some of the key challenges to the Europe seed market.

What are the future growth prospects and emerging trends in the Europe seed market?

The advancements in biotechnology, increased adoption of precision agriculture, and a continued focus on sustainable and climate-smart farming practices are some of the emerging trends in the Europe seed market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com