Global Food Flavors Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Chocolate, Vanilla, Fruits & Nuts), Origin (Natural, Synthetic), Application (Beverages, Savory & Snacks, Bakery & Confectionery, Dairy & Frozen Products, Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis (2025 To 2033)

Global Food Flavors Market Size

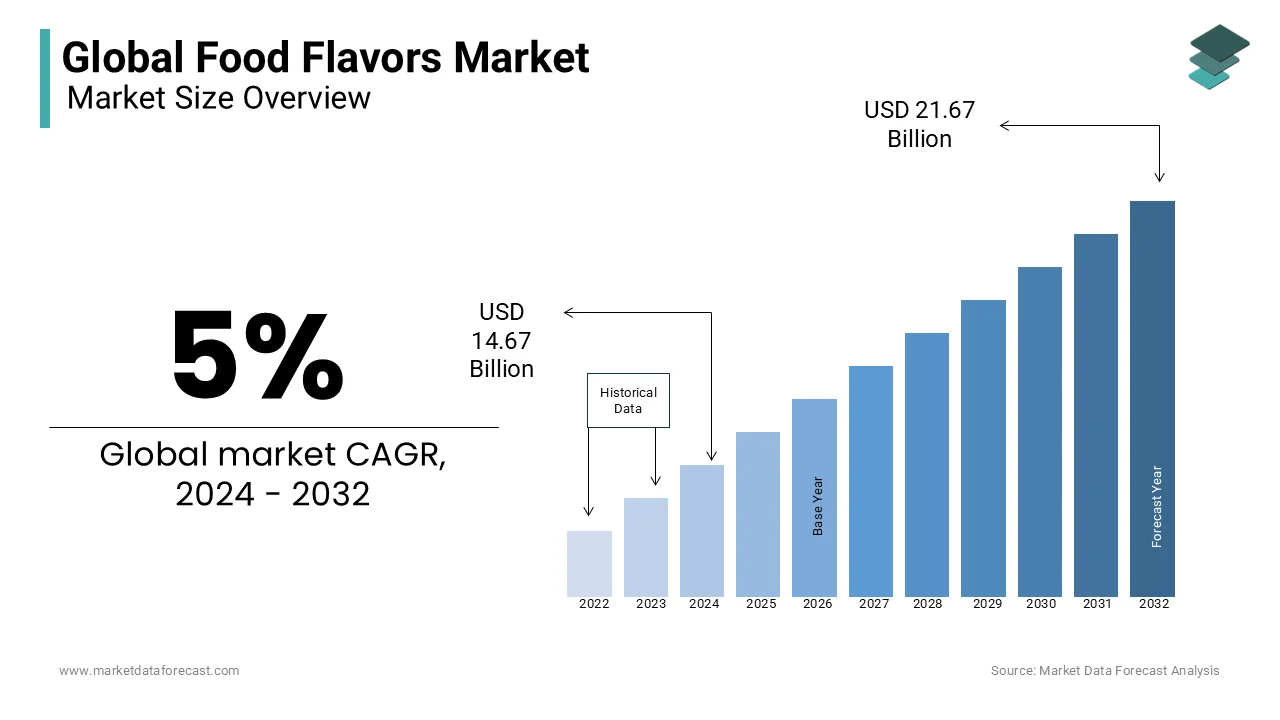

The global Food Flavors Market size was assessed to be USD 14.67 billion in 2024, and is anticipated to be worth USD 22.75 billion by 2033 from USD 15.40 billion In 2025, growing at a CAGR of 5% during the forecast period. The increasing demand for natural food flavors in a variety of applications is driving the growth of the worldwide food flavors market.

Food flavoring is used as an additive to alter and enhance the flavor of regular food products. Food flavors change the properties of solutes, causing sweetness, acidity, and opacity. Change or improve the flavor of natural foods like meat and vegetables, or create a flavor of foods that don't have what you want. Food flavor is an additive used during food preparation to alter or improve the taste and odor of food products. These additives are in demand in small proportions and are not expected to be consumed alone. Certain spices derived from fruits, spices, and herbs are used to achieve flavors such as sweet, sour, and salty. The aroma is extracted from the natural raw materials of plants and animals through several procedures. Fractional distillation and chemical manipulation are a few processes used for the synthesis of artificial fragrances. As health awareness increased among consumers, demand for clean-label products increased, increasing the sale of food flavors from natural sources.

MARKET DRIVERS

In the food and beverage industry, the growing demand for food flavor is a key factor driving the growth of the global food flavor market.

In addition, changes in consumer lifestyle and high demand for convenient foods are other factors that are expected to fuel growth in the global food flavor market during the forecast period. In addition, market participants launching new products and developing new food flavors are other key factors supposed to accelerate growth in the global food flavor market during the outlook period. Marketing with clean labels is common in the natural flavors industry. As health awareness increases, consumers are moving towards natural food. Natural flavors offer a variety of health benefits and are widely accepted by consumers who are ready to pay higher prices for natural foods. It has been observed that the majority of the population carefully reviews the product label before buying it. Among consumers, this perception required manufacturers to replace synthetic flavors with natural food flavors. The food and beverage industry needs spices for a variety of purposes, such as developing new products, adding new product lines, and changing the flavor of existing products. Besides, technological progressions, the launch of innovative flavors, and the high investments in R&D activities are other aspects that fuel the expansion of the global food flavors market.

As health awareness increases, there is more demand for the use of natural flavors. The high demand in the food industry for new flavors and continuous innovation are driving the growth of the global food flavors market. In addition, growth in demand in the fast-food industry is expected to provide growth opportunities in the food flavoring market during the prediction period. As consumer concerns about the long-term health effects of artificial food ingredients and additives increase, the demand for natural and healthy food ingredients increases, leading to the growth of the flavor market for the food. Other major market drivers include increased demand for processed foods and beverages as disposable income increases, increased demand for unique flavors in a variety of food applications, and increased popularity of exotic flavors. In addition to this, food fragrance manufacturers are adopting new technologies to produce a wide variety of natural and artificial fragrances to increase stability. In addition, technological advancements contribute to the growth of the food flavor industry by developing innovative flavors that can adapt to changes in customer flavor requirements. The market has growth opportunities during the estimated period due to the increasing number of sources of new raw materials, Greenfield companies in Asia Pacific and Latin America, color tones and multifunctional flavors, and preserves the flavor and quality of the spices used.

MARKET RESTRAINTS

The high price of raw materials needed to produce food flavors is a key factor in slowing the growth of the global food flavors market.

Additionally, artificial food flavorings are made by adding ingredients that can cause allergies and other health-related disorders in some people, which can hinder the growth of the global food flavoring market during the forecast period. Typically, perishable natural fragrances are unstable during processing, handling, and storage compared to synthetic fragrances. Also, changes in pH, temperature, and light are not stable. Natural flavors are volatile in the heat and are likely to lose flavor at high temperatures. The dose of natural spices used in frozen and baked products is higher to compensate for losses at low and high temperatures. This serves as a deterrent to the global food flavor market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5% |

|

Segments Covered |

By Type, Origin, Application, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Kerry Group, Givaudan, Archer Daniels Midland Company, DohlerGroup, AGRANA Group, SVZ International B.V., SunOpta, Inc., Sensient Technologies Corporation, Symrise AG, and Frutarom Industries. |

SEGMENTAL ANALYSIS

Global Food Flavors Market Analysis By Type

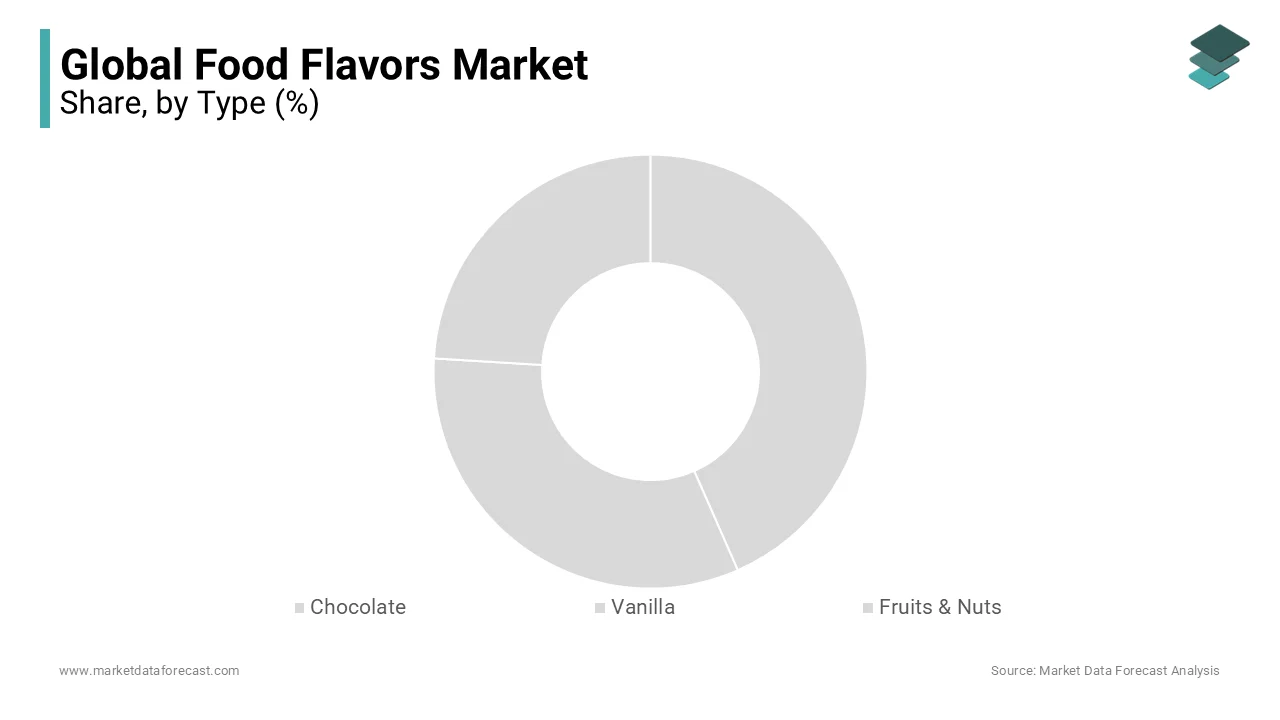

The chocolate segment is leading with the largest share of the market owing to the growing number of people interested in eating chocolates irrespective of age. People tend to eat chocolates every day. Where some studies clearly show that eating chocolates boosts learning skills, especially among adults, and also improves memory. For instance, 21% of Indians eat chocolates daily, according to a study conducted by Mintel in 2023. 3 in 5 people consume chocolate in India, which escalates the growth rate of the food flavor market.

The vanilla segment is attributed to hitting the highest CAGR by the end of the forecast period. This flavor is very commonly used in various bakery food products for prominent taste and texture. From traditional days, vanilla food products have had more demand than any others, which keeps the segment growing during the forecast period as well. In addition, the rising cultivation of vanilla due to its high demand across the countries is leveraging the growth rate of the market.

The fruits and nuts segment is likely to have prominent growth opportunities in the coming years due to rising consumer awareness of healthy food options. Fruits and buts have high nutritional value, which is why many consumers are likely to fall for these products, especially in urban cities.

Global Food Flavors Market Analysis By Origin

Natural origin is leading the largest share of the market. Naturally, abstracted flavor has a higher aroma, which is also healthy and does not pose any further side effects. Penetration of the social media platform where there is speculation about eating healthy by using naturally abstracted products is so far ascribed to bolster the growth rate of the market.

The synthetic segment is solely to have the highest growth opportunities due to the growing demand to produce high amounts of food products with the rising population eventually across the globe. The need to fulfill the demand for food requirement from the population in various aspects is greatly influencing the growth rate of the synthetic segment in the coming years.

Global Food Flavors Market Analysis By Application

The beverages segment is expected to have the dominant share of the food flavors market. Key strategies by companies to launch innovative flavored beverages in accordance with people’s preferences are attributed to highlighting the growth rate of the food flavors market.

Dairy and frozen products are most likely to hit the highest CAGR by the end of the forecast period. Dairy products have immense protein value, which is why people are inclined to depend on them. These products are effectively manufactured with raw materials of natural origin. Therefore, the food flavors market growth rate is expected to have potential opportunities in the coming years as well.

REGIONAL ANALYSIS

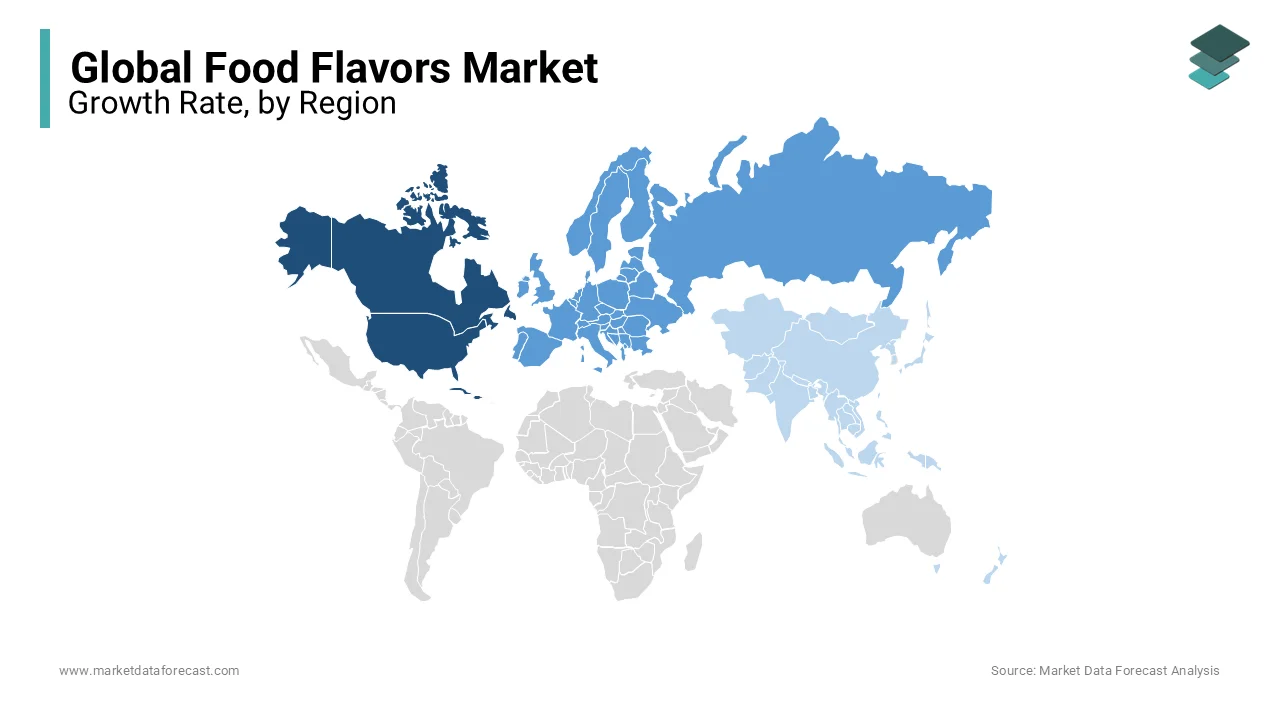

The North American market accounted for the largest share of sales in the global food flavor market as demand for food flavors from the food and beverage industry increased. The European market is foreseen to occupy the second largest contribution of revenue share in the world market for food flavors, followed by the markets of Asia Pacific, Latin America, and the Middle East and Africa, respectively. The United Kingdom is determined to rule the natural food flavoring sector because of the rising call for organic items. The French food and beverage industry has witnessed a decline in synthetic food flavors as the application of natural flavors has increased in the beverage bakery and confectionery industries. The Asia Pacific market is deemed to witness the fastest growth in terms of sales due to the availability of ingredients rich in natural flavorings such as saffron, cardamom, etc. In China, food flavoring is increasing demand and the food and beverage industry is growing. With the rising call for frozen and processed foods, fragrance manufacturers have many opportunities to expand their brands and strengthen their relationship with Brazilian consumers.

KEY PLAYERS IN THE GLOBAL FOOD FLAVORS MARKET

Major key Players in the Global Food Flavors Market are Kerry Group, Givaudan, Archer Daniels Midland Company, DohlerGroup, AGRANA Group, SVZ International B.V., SunOpta, Inc., Sensient Technologies Corporation, Symrise AG, and Frutarom Industries.

RECENT HAPPENINGS IN THE MARKET

- In February 2019, Atlanta-based Coca-Cola announced a new flavor launch under the names Orange Vanilla Cola and Orange Vanilla Zero Sugar Cola.

- Sensient purchased Mazza Innovation in July 2018, which is operating via a plant extraction facility in the UK. This acquisition combines Sensient's expertise with Mazza technology to extract botanical gardens using ecological extraction methods.

- Firmenich extended its operations to California, USA in May 2018, providing customized flavor and nutrition solutions to consumers with distinct organic items.

DETAILED SEGMENTATION OF GLOBAL FOOD FLAVORS MARKET INCLUDED IN THIS REPORT

This research report on the global food flavors market has been segmented and sub-segmented based on type, origin, application, & region.

By Type

- Chocolate

- Vanilla

- Fruits & Nuts

By Origin

- Natural

- synthetic

By Application

- Beverages

- Savory & Snacks

- Bakery & Confectionery

- Dairy & Frozen Products

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the current trends driving the global food flavors market?

Current trends include a shift towards natural flavors due to increasing health consciousness among consumers, the popularity of exotic and ethnic flavors, and the rise of clean-label products without artificial additives.

2. What are some emerging flavor trends in the global food market?

Some emerging flavor trends include botanical flavors, plant-based alternatives, global fusion flavors combining multiple cuisines, and innovative flavor combinations such as sweet and savory blends.

3. What are the challenges facing the food flavors market in terms of regulatory compliance?

Regulatory compliance is challenging due to stringent regulations on flavor ingredients, labeling requirements, and restrictions on certain additives. Companies need to ensure compliance while maintaining product quality and innovation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com