Kombucha Market Size, Share, Trends & Growth Forecast Report By Type (Natural & Flavoured), Distribution Channel, Nature, Packaging, Region, and Industry Analysis (2025 to 2033)

Kombucha Market Size

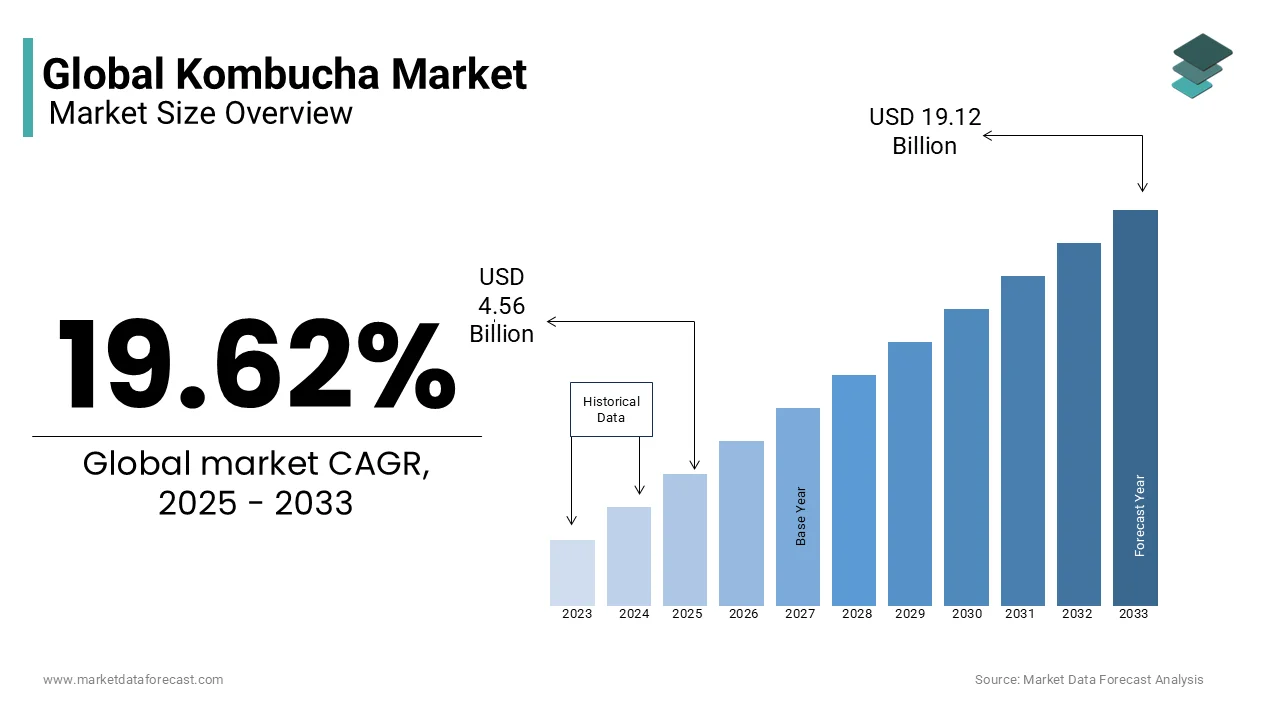

The global kombucha market size was valued at USD 3.81 billion in 2024, and the global market size is expected to reach USD 19.12 billion by 2033 from USD 4.56 billion in 2025, growing at a CAGR of 19.62% from 2025 to 2033..

The drink is fermented using a symbiotic culture of bacteria and yeast strain (SCOBY), which produces a light, fizzy tea beverage with a slight alcohol content of 0.5% due to the natural fermentation process. Kombucha is often manufactured with black or green tea. The beverage is a prospective probiotic drink that provides customers with several health advantages, including promoting the development of their gut flora, nourishing their bodies, and lowering their risk of heart disease.

The global kombucha market is expected to be stimulated by consumers' growing awareness of the beverage's health advantages. The government's social exclusion and lockdowns to impede the virus's COVID-19 pandemic outbreak have caused the closure of numerous factories and warehouses throughout countries. However, this kombucha market has seen a minor improvement due to the continued operation of convenience stores and drug stores, which offer customers vital medical goods. For Instance, according to the data provided by the U.S. consumer survey, about 14.1% of respondents stated that they consumed kombucha within the last five years.

MARKET DRIVERS

Rising Popularity of Functional Beverages

Consumer interest in and demand for beverages like kombucha have increased due to consumers' preference for functional beverages with good health impacts. Moreover, the availability of numerous favorable options also propels the global kombucha market share during the forecast period. The increasing awareness among the people regarding the importance of nutritional and organic beverages, which impact overall health and well-being, is fueling the market growth.

Various advantages provided by kombucha, such as eliminating toxins, boosting energy and the immune system, and helping in weight loss, are gaining traction among consumers, enhancing the frequency of consumption and expanding global kombucha market revenue. Most people are seeking healthy beverages rather than artificial, flavorful, preserved ones for healthy hydration, which is a primary market growth factor.

According to a study report published by the National Center for Biotechnology Information (NCBI), kombucha consumption supports the immune system due to its antioxidant, anti-inflammatory, and cholesterol-reducing properties, further prompting sales during the pandemic. The growing investments by the market players in research and development activities to develop innovative, effective, and tasteful flavors that meet consumer needs are gaining traction. They are expected to enhance the market growth opportunities in the forecast period. The growing trend for healthy diet consumption involves the consumption of healthy beverages with probiotics, as the probiotics are necessary for good gut health, which drives the market.

This has prompted manufacturers to add fresh flavors and ingredients to their products to attract customers. Some new enticing tastes are hibiscus lime, lavender, blueberry, guava, and many more. Various spices, herbs, fruits, and juices are used. For the flavor kombucha instance, Kombrewcha introduced two new varieties in the United States in July 2020: mango pineapple and blood orange. These innovative initiatives by the market players are augmenting the global market expansion.

Additionally, people are enticed to buy them because of the beverage's availability in cans and bottles due to the expanding mainstream trends of on-the-go convenience. The efficient labeling and packaging induce the consumers to be aware of the practical and promising labeling of products, which positively impacts market growth.

MARKET RESTRAINTS

Specific side effects associated with kombucha consumption, such as excess calorie consumption, bloating, and digestive distress, are expected to hamper the market expansion. The need for awareness regarding the benefits of the kombucha and the limited adoption among the people due to alcohol content are hindering the market growth opportunities. There are various risks in the supply chain and storage, as there is a high risk of contamination and spoilage, restraining the market size growth with a limited adoption rate worldwide.

Various limitations to the consumption of kombucha, such as in pregnancy and breastfeeding, among people with alcohol use disorder, diabetes patients, and in liver toxicity cases, these limitations may lead to restricted market growth. The high-calorie count in the kombucha market may create restrictions in the adoption rate among people who are calorie-conscious and gym people, which restrains the market revenue expansion.

MARKET OPPORTUNITIES

The escalating demand for organic products is expected to enhance the market growth opportunities for the kombucha market due to its preparation using the natural fermentation process. The increasing investments by the market players to introduce various flavors of kombucha are expected to gain traction among consumers, driving market size growth over the forecast period. The growing awareness and demand for healthy and probiotic food to maintain overall health and well-being are augmenting the market growth.

In September 2020, Equinox Kombucha surveyed 2000 people in the U.K. about their thoughts on healthy food and beverages. It stated that 39% of people ate healthier foods, 27% ate more natural foods, and 23% read food labels more often. Nearly 33% of people knew kombucha and 12% considered it food. Around 48% believe that probiotics are good for improving gut health.

MARKET CHALLENGES

Regulations that are Too Strict on Alcohol Content

As alcohol poses a risk to the public, numerous regulatory organizations have been closely regulating the alcohol content of various beverages. The consumption of high alcohol levels, which may interfere with persons taking medication, is a primary hazard. These stringent regulations for the products lead to product delays, which hampers the market growth. In addition, secondary fermentation may cause changes in the alcohol ratio when the beverage is transported from the factory to the merchant.

In some cases, flavorings may have an impact on the beverage's concentration as well. Regulatory organizations implement rigorous regulations limiting the alcohol level of beverages to address these problems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

19.62% |

|

Segments Covered |

By Type, Distribution Channel, Packaging, Nature, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Remedy Drinks, GO Kombucha, Vigo Kombucha, BB Kombucha, Equinox Kombucha, GT’s Living Foods, Brew Dr. Kombucha, Health-Ade LLC, Humm Kombucha LLC, Kobenhavn Kombucha. |

SEGMENTAL ANALYSIS

By Type Insights

The flavored segment held a significant share of the global market in 2023, and its domination is expected to continue throughout the forecast period. Owing to customers' preference for novel and creative beverages. The increased public knowledge of the negative consequences of synthetic flavors creates several opportunities for producers to use natural flavoring agents and botanicals.

Probiotic beverage preferences are evolving, and consumers are more open to trying novel flavors. These factors will support segment growth, leading to market expansion. Additionally, several producers are introducing fresh beverage tastes, which is anticipated to further fuel global kombucha market expansion.

The natural segment is gaining traction among the people and is projected to record notable growth during the forecast period. The increasing consumer preferences for natural and organic food products are estimated to provide growth opportunities for the segment in the coming years.

By Distribution Channel Insights

The supermarkets and hypermarkets segment is predicted to hold the most significant global kombucha market share during the forecast period. Mass merchandisers like supermarkets and hypermarkets aim to offer a wide selection of probiotic and functional beverages to consumers. Their aggressive strategy influenced the stores to fill up freezers and chillers with products offering flavorsome options in various price ranges and brands. They additionally use enticing price reductions, product-specific aisles in stores, and various bundling strategies to persuade customers to buy the goods.

The online retailer segment is estimated to grow the fastest during the forecast period due to the increasing adoption of digital platforms for shopping. The upsurge in e-commerce during the pandemic is expected to increase opportunities over the forecast due to its advantages, such as price offers, ease of payment, and door delivery, all augmenting the adoption rate among consumers.

By Nature Insights

The organic segment dominated the global kombucha market with a significant share due to the vast demand of consumers for organic products that consider health, sustainability, and environmental impact. The U.S. Food and Drug Administration certification of kombucha positively impacts gaining consumer trust in product authenticity, which drives the segment's growth.

The inorganic segment is predicted to record considerable growth during the forecast period. The affordability and lower cost of the raw materials for the preparation of inorganic products are influencing organizations, especially small and middle organizations, to promote the adoption rate, which drives segment growth.

By Packaging Insights

The bottling segment holds a significant share of the global market due to its convenience and portability among consumers. Bottles are considered a good storage option because they protect against light and air, enhancing their adoption among consumers and leading to market growth in this segment.

The cans segment is expected to grow considerably in the coming years. Safe and efficient packaging enhances the consumer base, and ease of carrying promotes segment expansion. The modernization of cans packaging and the wider adoption among the younger adults fuel the segment growth.

REGIONAL ANALYSIS

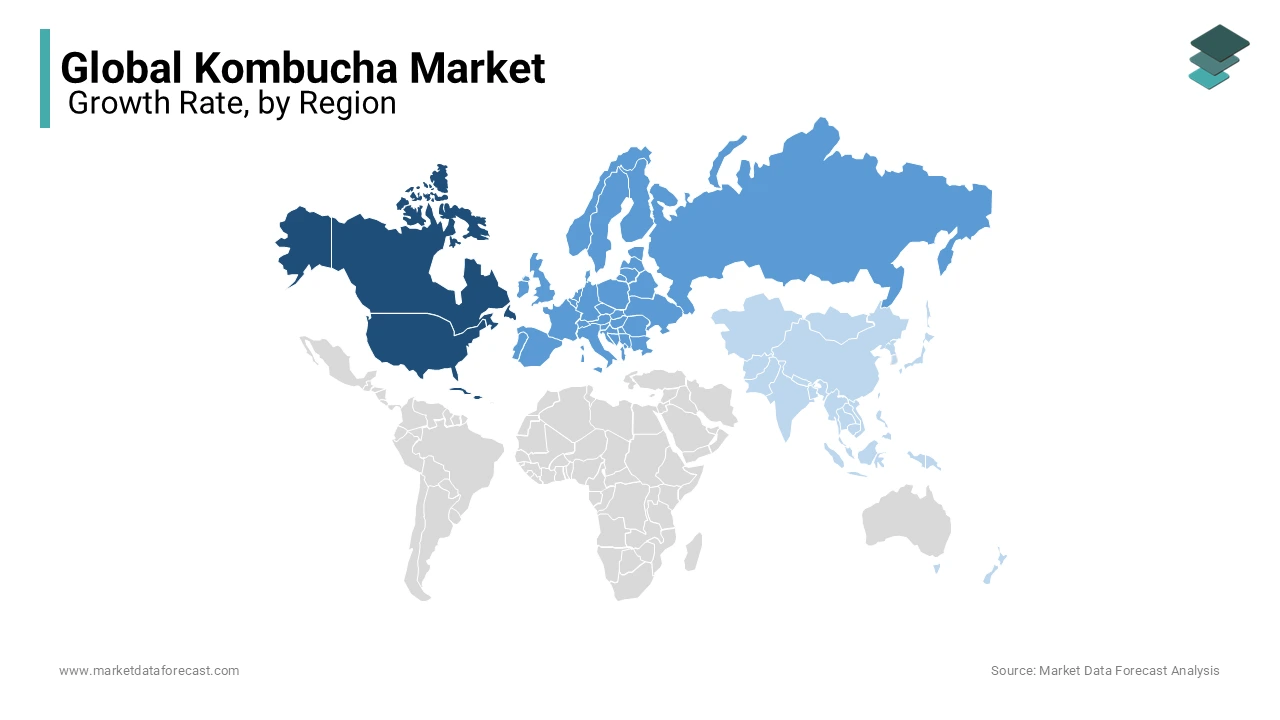

North America presently holds the largest market share for kombucha and is predicted to keep that position during the projection period. The increasing demand for beverages, growing consumer health consciousness, and the availability of organic beverages as a nutritious substitute for soft drinks and sodas in the United States and Canada have expanded the regional market. The USDA has certified that certain ingredients used in organic kombucha are safe to consume, which enhanced the demand for organic kombuchas in the North American region. Significant market players in the region are expected to propel the market growth opportunities over the forecast period.

Europe will account for the second-largest kombucha market share. The consumption of probiotics and functional beverages has fueled the regional market. The growing popularity of organic beverages and escalating demand for different flavors are boosting the market growth. The increasing health-conscious people across the region is escalating the adoption rate of kombucha in the region leading to regional market share growth.

The rapid urbanisation, busy lifestyles of people is enhancing the adoption of healthy beverages among people especially among the middle-aged population is promoting the market revenue growth. The growing sales of kombucha across the regional countries fuels the market revenue. For Instance, in 2023, the U.K supermarket sales of kombucha were of worth 19.3 million Euros, which is of 31% increase in value and 28.45 increase in volume.

The Asia Pacific region is estimated to have the fastest growth during the forecast period as kombucha is a traditional beverage drink in China and is also known as the "elixir of life," which would give the global market significant expansion in the Asia Pacific region. Growing disposable incomes, increased health and wellness consciousness, and its ability to improve gut health and immunity are projected to drive regional market expansion.

Japanese consumers consider kombucha as a native drink, and they require drinking mild brownish and sweet fermented tea. The Japanese kombucha market is expected to gain traction among consumers due to high product innovations and growing market players.

KEY MARKET PLAYERS

København Kombucha, MOMO KOMBUCHA, Brothers and Sisters, GO Kombucha, Lo Bros., Equinox Kombucha, GT’s Living Food, BB Kombucha, Remedy Drinks, Real Kombucha, Læsk, and VIGO KOMBUCHA are playing dominating role in the global kombucha market.

RECENT HAPPENINGS IN THE MARKET

- In July 2024, Sbooch, a groundbreaking kombucha brand, announced its official entry into the Indian market with a launch event. Smooch aims to bring the ancient tradition of kombucha, a fermented tea with a history of 5000 years, to modern India. The brand offers diverse culinary flavors that reflect the landscape of India.

- In June 2024, Leon, a known fast-food chain in the United Kingdom, announced its partnership with the UK kombucha brand Remedy. The major aim of the partnership is to provide consumers with a healthier drink alternative. Remedy launched Wild Berry and Ginger Lemon flavors in the Leon Chains – the first and only no-sugar kombucha brand to be made available within the healthy fast-food chain.

- In 2023, Les Jardins de Gaia, a popular organic tea brand, announced its collaboration with the organic kombucha brand Jublies. The major aim of the collaboration is to launch a new drink in France ahead of Christmas.

- In February 2022, Brew Dr. Kombucha launched peach-flavored kombucha made of high-quality loose-leaf green tea and blended in five varieties of organic peaches.

- In February 2022, Superfoods launched an instant kombucha formula in various flavors. The kombucha is infused with black tea and provides enough recipes for 30 drinks.

- In February 2022, Remedy Drinks extended its product line by launching a wild berry-flavored product in the U.K. The "Remedy K "matcha Wild Berry beverage will be stocked exclusively at Tesco stores. Introducing these innovative flavor products is estimated to enhance the company's portfolio.

MARKET SEGMENTATION

This research report on the global Kombucha Market has been segmented and sub-segmented based on Type, Distribution Channel, Packaging, Nature, & region.

By Type

- Natural

- Flavored

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

By Packaging

- Bottles

- Cans

By Nature

- Organic

- Inorganic

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the size of the global kombucha market in 2024?

The global kombucha market was valued at USD 3.81 billion in 2024.

2. What is the expected CAGR of the global kombucha market from 2025 to 2033?

The global kombucha market is projected to grow at a CAGR of 19.62% during the forecast period 2025–2033.

3. What is driving the growth of the global kombucha market?

Rising health awareness and demand for functional beverages are fueling the global kombucha market.

4. Which type of kombucha is most popular in the global kombucha market?

Flavored kombucha dominates the global kombucha market due to its variety and taste appeal.

5. What consumer trends are shaping the global kombucha market?

Trends such as organic, low-sugar, and probiotic-rich beverages are influencing the global kombucha market.

6. Which regions are leading the global kombucha market?

North America and Europe are the top contributors to the global kombucha market revenue.

7. Who are the major players in the global kombucha market?

Key players in the global kombucha market include GT’s Living Foods, KeVita, Health-Ade, and Brew Dr. Kombucha.

8. How does kombucha’s probiotic content impact the global kombucha market?

The probiotic content supports digestive health, boosting demand in the global kombucha market.

9. How is e-commerce influencing the global kombucha market?

Online platforms are expanding consumer access and visibility in the global kombucha market.

10. What challenges does the global kombucha market face?

The global kombucha market faces challenges like short shelf life, regulatory concerns, and product consistency.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com