Global Probiotics Market Size, Share, Trends, Growth Report & Analysis By Ingredient (Bacteria, Yeast), Application (Food & Beverages, Dietary Supplements, Dairy Products, Non-Dairy Beverages, Infant Formula, Cereals, Feed), Form (Dry, Liquid), End-User (Human Probiotics, Animal Probiotics), Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Online Stores), And Regional Forecast 2025 To 2033

Global Probiotics Market Size

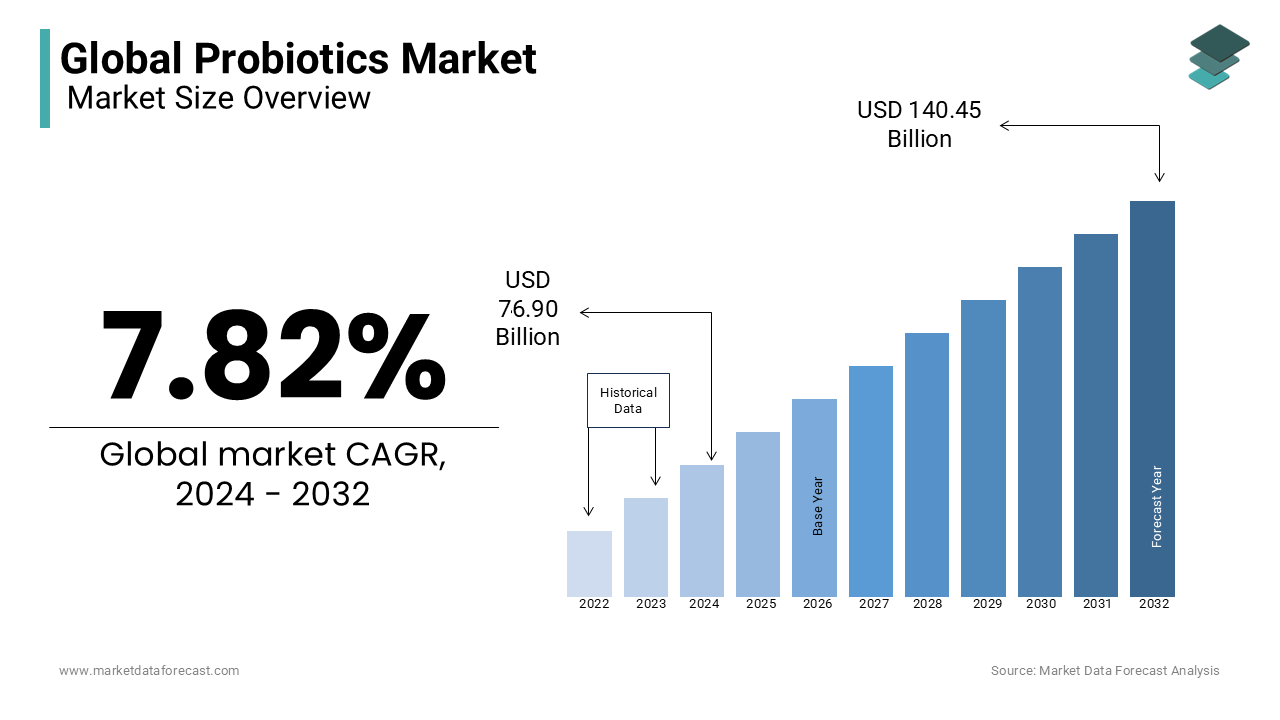

The global probiotics market was worth USD 76.90 billion in 2024. It is estimated to grow at a CAGR of 7.82% from 2025 to 2033 and be worth USD 151.43 billion by 2033, up from USD 82.91 billion in 2025.

Probiotics are live microorganisms that have health benefits when consumed or applied to the body. These are widely found in yogurt, other fermented products, dietary supplements, and beauty products. Probiotics influence the body's immune response, help the body maintain a healthy community of microorganisms, and produce specific substances that have valuable effects on the body's health. Probiotics are highly beneficial to the digestive system and are estimated to maintain good gut health.

MARKET DRIVERS

The growing health consciousness among people worldwide is enhancing the demand for healthy foods like probiotics, contributing majorly to the global market growth.

The increasing consumption of functional and dietary supplements that have probiotics among people is due to rising health consciousness across the global population. The rising prevalence of digestive disorders and the growing geriatric population highly prone to digestive issues is accelerating the global probiotics market. The pandemic has influenced people to adopt healthy food habits, and the intake of functional foods has witnessed remarkable post-pandemic growth, positively impacting the global probiotic market growth. Increasing awareness among people regarding health and well-being is expanding the consumption of functional foods and healthy beverages, leading to substantial market growth. The escalation in the prevalence of lifestyle-related disorders such as obesity, digestive issues, gastrointestinal infections, and others due to unhealthy diets allows the market players to focus on developing probiotic-rich products that help control the disease, propelling the global market opportunities over the forecast period. According to the World Health Organization 2022 report, one of the significant risk factors for several noncommunicable diseases in Europe is obesity, and over 60% of adults, 29% of boys, and 27% of girls who are children are overweight. Consumers across the globe are mainly focusing on improving gut and microbiome health and expanding the market size. According to survey data by the International Food Information Council (IFIC) in 2021, 70% of the respondents consumed yogurt for general health and wellness. It also stated that 60% of the consumers believed that yogurt is good for enhancing digestive health. Various researchers stated that probiotics in dairy products, like yogurt, can control the intestinal flora, which is expected to grow substantially during the forecast period. The growing investments by the market players in research and development for a better understanding of the mechanisms of action and potential health benefits of different strains of probiotics enhance the probiotic companies to accelerate the market revenue of probiotics by continuous product launches. The increasing demand for probiotics in the food and beverages industry will provide various growth opportunities over the forecast period. The consumer demand for food with high nutritional and fiber content has recently increased. Most consumers seek alternatives to pharmaceuticals, driving the demand for natural and holistic solutions. This has enhanced the probiotic companies' focus on developing innovative and effective probiotic strains for health concerns, creating lucrative growth during the forecast period.

MARKET RESTRAINTS

The primary factor restraining the probiotics market growth is the risks associated with the consumption of probiotics in specific cases like people with low immunity, people having immunosuppressant drugs, infants born prematurely, and patients with critical illnesses.

These cases are estimated to limit the market growth opportunities in the forecast period. Severe cases of fatal infections were reported in premature infants who were given probiotics.

Then, the U.S. Food and Drug Administration (FDA) warned healthcare providers about the risks associated with probiotics in infants. Probiotics' possible harmful effects include infections, the production of harmful substances by the probiotic microorganisms, and the transfer of antibiotic resistance genes from probiotic microorganisms to other microorganisms in the digestive tract, hampering the adoption rate of probiotics, leading to restricted market growth. The high costs associated with the R&D activities for developing new probiotic strains are expected to impede market expansion due to limited adoption rates by the manufacturers. The limited awareness among the people regarding the benefits of probiotics is estimated to hinder market growth opportunities.

Stringent regulatory requirements and variations in accepting probiotics as drugs, dietary supplements, or food vary according to the region's regulations, which pose challenges for manufacturers in expanding the market size. Developing and commercializing functional food products involves complexity, high cost, and other hurdles expected to hamper global market growth during the forecast period. Various challenges were induced during the research and development of the probiotic strains, majorly the selection and production processes for the researchers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.82% |

|

Segments Covered |

By Ingredient, Application, Form, End User, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Arla Foods, BioGaia, Kerry Group plc. Mother Dairy Fruit & Vegetable Pvt. Ltd., Chr. Hansen Holding A/S, Probi AB, Nestle S.A, Yakult Honsha Co. Ltd., Lifeway Foods Inc., DuPont De Nemours Inc. |

SEGMENTAL ANALYSIS

Global Probiotics Market Analysis By Ingredient

The bacteria segment dominated the global probiotics market, with a significant market share of 86.3% in 2023. The bacterial-based probiotics are estimated to provide considerable benefits to human and animal health as they serve aflatoxin adsorbents, which help prevent colon cancer and induce the prevention of oral diseases, urinary tract infections, and others. These products help the vent and treat various bacterial infections in the body, gaining traction among people. Increasing popularity and demand for functional foods, the vast adoption of probiotic ingredients, and the growing disposable incomes drive the global market revenue in this segment.

The yeast segment is expected to grow significantly and fastest during the forecast period. Yeast-based probiotics possess several advantages, especially in treating intestinal manifestations, gastric acidity, and diarrhea. They are widely taken as dietary supplements as they contain significant amounts of proteins, amino acids, vitamin B, and peptides that can be consumed across all age groups. All these factors are expected to enhance the market growth opportunities through this segment during the forecast period.

Global Probiotics Market Analysis By Application

The food and beverages segment held over 60% of the global probiotics market share in 2023. The growing consumer demand for high nutritional and fiber content food products drives the segment growth. The manufacturers are focusing on developing food and beverage products with enzymes and probiotics to seek health for consumers and gain traction among consumers. The probiotics are highly used in fish oil and yogurt, which minimizes gut health issues. The increasing awareness among consumers regarding the quality of health and rising disposable incomes is inducing them to invest in healthy foods, contributing to the global market expansion.

The dietary supplements segment is estimated to grow fastest, with a prominent CAGR during the forecast period. The growing awareness programs regarding lifestyle-related problems such as hypertension, unhealthy diets, and obesity are all encouraging consumers to choose nutritional and dietary supplements, which are propelling the market growth. Most people in the U.S. take dietary supplements like probiotics daily to get adequate amounts of essential nutrients for the body, enhancing health.

Global Probiotics Market Analysis By Form

The dry segment witnessed the highest market share in the global probiotics market in 2023 and is estimated to maintain its dominance during the forecast period. Most probiotic supplements are available in powder or granule form, driving the segment growth. The

Dietary supplements are available in chewable or tablet form; the probiotics used in food are highly preferred in powder or granule format, enhancing segment revenue growth.

The liquid segment is estimated to grow prominently over the forecast period due to the increasing use of probiotics in beverages and growing yogurt consumption, which will provide market growth opportunities in the coming years.

Global Probiotics Market Analysis By End-User

The human probiotic segment dominated the global market revenue, with the most significant share of around 86% in 2023. The growing geriatric population, prone to various chronic diseases, demands nutritional and fiber food products. The probiotics are used to treat conditions like colon cancer, inflammatory bowel disease, and diarrheal diseases, augmenting the market growth. Most manufacturers invest in human probiotics, and incorporating technological, commercial, and production capabilities boosts market growth opportunities.

The animal probiotics segment is projected to grow with significant CAGR during the forecast period as probiotics have been widely adopted in animal feed in past years. Probiotics in animal feed have shown significant benefits such as improved immune systems, animal performance, and digestion. Animal welfare's ongoing focus on reducing antibiotic use for animals fueled the probiotics market.

Global Probiotics Market Analysis By Distribution Channel

The hypermarkets/supermarkets segment dominated with a prominent market share due to a wide variety of probiotics in one place, and the ease of purchasing increased the segment's dominance.

The online stores segment is expected to grow the fastest during the forecast period due to the increased adoption of digital technology. The convenience and accessibility offered by online shopping have contributed to the rising popularity of online purchases, which will augment in the coming years.

REGIONAL ANALYSIS

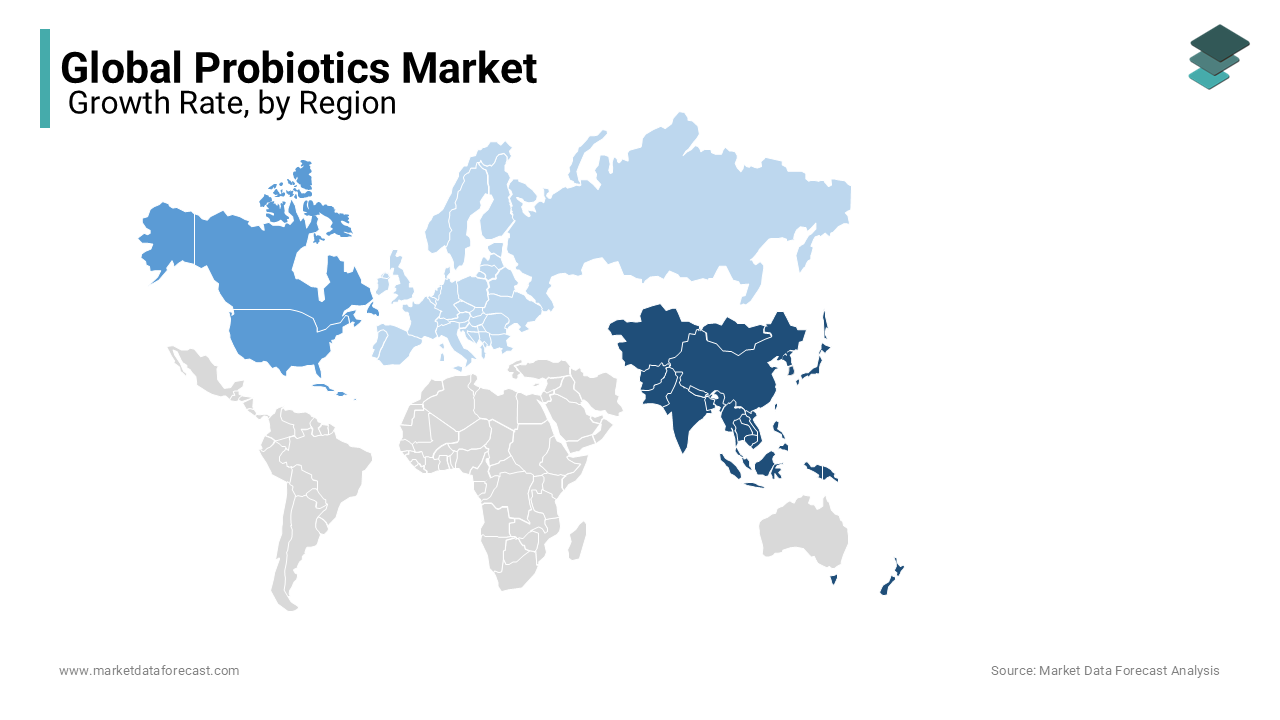

The Asia Pacific region dominated the global probiotics market, with a significant % market share of 42% in 2023. The growing awareness among consumers regarding the benefits of nutritional foods and their desire to maintain quality of life is majorly driving regional market growth. The rising disposable incomes, increasing acceptance of functional foods, and the importance of gut health are accelerating the demand for probiotics, leading to market size expansion. The massive demand for probiotic-based foods in China and India is primarily creating opportunities for market growth in the region. The inclusion of probiotics in infant formula is witnessing vast demand in China. The growing innovations in the formulations and wide adoption of probiotics in food and beverages are expected to provide substantial growth of probiotics.

The North American region is expected to have the fastest growth rate during the forecast period, with a prominent CAGR. Rising awareness, improved government initiatives to educate people, and growing investments by market players are driving market growth in the region.

The European market is estimated to register prominent growth in the coming years due to growing initiatives undertaken by the European Probiotic Association (EPA), which provides guidelines and organizes awareness programs boosting the market growth opportunities across the region.

KEY PLAYERS IN THE GLOBAL PROBIOTICS MARKET

The Major Players in the probiotics market are Arla Foods, BioGaia, and Kerry Group plc. Mother Dairy Fruit & Vegetable Pvt. Ltd., Chr. Hansen Holding A/S, Probi AB, Nestle S.A, Yakult Honsha Co. Ltd., Lifeway Foods Inc., DuPont De Nemours Inc.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, KeVita, a Tropicana-owned brand, expanded its line of Sparkling Probiotic Lemonade with mango flavor in addition to the existing classic and peach probiotic lemonade.

- In April 2023, the FDA approved Seres Therapeutics, a live oral microbiome capsule Vowst, which Nestle will commercialize using its gastroenterology sales force.

- In April 2023, BioGaia, a biotechnology company that develops and markets a range of probiotic products, launched a probiotic food supplement that can be used in women before and during pregnancy.

- In November 2022, Nestle made a discovery and launched a product in infant microbiome under the brand WYETH-26 ULTIMA in collaboration with Pennington Biomedical Research Center and Rhode Island Hospital, USA.

- In September 2022, Nestle Garden of Life launched its first probiotic food product in China, which can be used in infant foods.

- In July 2022, BioGaia launched a new product, BioGaia Pharax, a probiotic product to support children's respiratory health, in the U.K. market.

- In April 2022, Symrise and Probi collaboratively launched SymFerment, a sustainable probiotic skincare ingredient.

- In August 2021, Hansen, a supplier of bacteria cultures, probiotics, enzymes, and human milk oligosaccharides, launched science-based probiotics for pets. These can be used in pet foods and supplements, empowering the pet's life stage with good bacteria.

DETAILED SEGMENTATION OF THE GLOBAL PROBIOTICS MARKET INCLUDED IN THIS REPORT

This research report on the global probiotics market has been segmented and sub-segmented based on ingredient, application, form, end user, distribution channel, and region.

By Ingredient

- Bacteria

- Yeast

By Application

- Food and Beverages

- Dietary Supplements

- Non-dairy beverages

- Dairy Products

- Infant Formula

- Feed

- Cereals

By Form

- Dry

- Liquid

By End User

- Human Probiotics

- Animal Probiotics

By Distribution Channel

- Hypermarkets/Supermarkets

- Speciality Stores

- Online Stores

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current market trend for probiotics?

The probiotics market has been experiencing steady growth due to increasing consumer awareness of the link between gut health and overall well-being. Key factors driving market growth include rising demand for functional foods, dietary supplements, and probiotic research and product development advancements.

2. What are the key factors driving the growth of the probiotics market?

Factors include increasing consumer awareness about gut health, rising demand for functional foods, and growing research validating the health benefits of probiotics.

3. What challenges does the probiotics market face?

Challenges include regulatory complexities, the need for strain-specific research, and concerns regarding the stability and viability of probiotics in products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com