Global Glucose Syrup Market Size, Share, Trends & Growth Forecast Report - Segmented By Grade (Food, Pharmaceuticals), Application (Sweetening Agent, Wine) Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Glucose Syrup Market Size

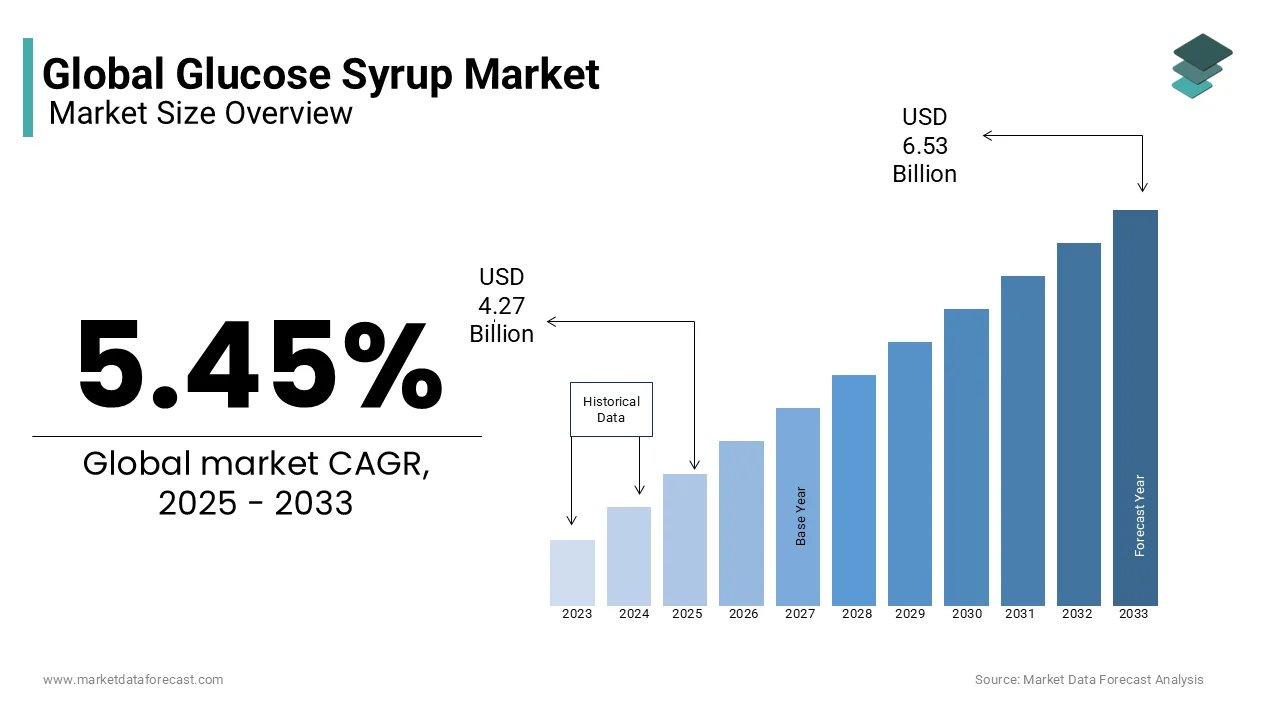

The Global glucose syrup market size was valued at USD 4.05 billion in 2024 and market size is predicted to reach about USD 6.53 billion by 2033 from USD 4.27 billion in 2025, rising at a CAGR of over 5.45% over the calculated period (2025 to 2033)

Glucose syrup is a sweetener with glucose molecules, corn, rice, wheat, and potatoes as they are hydrolyzed and rich in starch. Glucose syrup is normally extracted using the hydrolysis process of glucose molecules, which are usually wheat, corn, rice and potatoes. This syrup is used to make frozen desserts, sweets, and baked goods to add sweetness. This type of syrup is fat-free and contains large amounts of calories. In addition, glucose syrup prepared from cornstarch includes a small amount of minerals like zinc, thiamine, and calcium. It is also used in beer production and as an ingredient in homemade iced tea or lemonade drinks. Glucose syrup is used to make frozen desserts and sweets. It is further used to make baked goods to add sweet foods. Glucose syrup is generally fat-free, but it contains a lot of calories. Sometimes glucose sugar is also utilized in beer manufacturing process. At the household level, glucose sugar is a common ingredient to make lemonade or iced tea. Many world-class chefs use glucose sugar to enhance the taste of food.

MARKET DRIVERS

Increased demand for baked goods like waffles, pancakes, etc., is a crucial factor driving the growth of the global glucose syrup market. Increased consumer awareness of the health benefits associated with consuming glucose syrup is another factor that is expected to drive growth in the global market in the foreseen years. It is also assumed to drive growth in the world market as the use of glucose syrup to make sweets increases, helping to prevent the crystallization of sweets. By raising the integration of glucose syrup in baked goods, the moisture retention ability is touted to improve, preserving freshness. Increased use of glucose syrup in the manufacture of confectionery products to prevent rough texture is presumed to support the growth of the global glucose syrup market. The increased demand for prepared foods and the increased use of glucose syrup in baked goods such as sweets are some of the factors driving the growth of the market. End-user sectors like confectionery, pharmaceuticals, food and beverages need this glucose syrup as a sweetener. Glucose syrup is also used in the production of ice cream, chewing gum, chocolate, and canned foods as the demand for sugar substitutes increases. Glucose syrup is gaining prominence because of its long shelf life. It also offers a better alternative to conventional granulated sugar. Due to the rise in product shelf life, glucose syrup can be stored for an extended period.

The moisture content of glucose syrup is suitable for the manufacture of gelatin and sweets used as wetting agents. Glucose syrup prevents crystallization, making it widely used in the ice cream industry as well. The application of glucose syrup as a thickener is also increasing. Glucose syrup also adds enamel to foods, improving the sensory value of the product. Additionally, the consistency of glucose syrup helps prevent crystallization, making glucose syrup very popular in candy making. Glucose syrup does not affect the appearance of the product and improves water retention, so baked foods stay fresh and chefs prefer them. The use of glucose syrup in the manufacture of confectionery articles has increased because it avoids the rough texture and maintains a smooth texture. As glucose syrup provides energy sources for yeast, its application in the brewing industry has also increased. Glucose syrup provides glazes for tarts and fruit jams, so its use in the food industry has also increased. Glucose syrup has shorter carbohydrates, making it easier for the elderly and babies to digest. All of these factors together will contribute greatly to the popularity of glucose syrup, which will promote market growth over the outlook period.

RESTRAINTS

Due to changes in food consumption habits and increased health awareness, growth in the food and beverage sector in developing countries is projected to drive growth in the world market in the coming years. The side effects of excessive glucose syrup consumption are negatively affecting the growth of the business. Moreover, the public food system, sugar diversification because of inefficient rations, and fewer prices owing to segmentation are posing as threats to the industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.45% |

|

Segments Covered |

By Grade, Application and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill,Inc, Agrana Group, Avebe U.A, Bakers Kitchen, Beneo, DGF Service, Ingredion, Karo Syrup, Dr. Oetker, Grain Processing Corporation, L'Epicerie, Queen of Fine Foods, Roquette Freres, Tate and LYLE. |

REGIONAL ANALYSIS

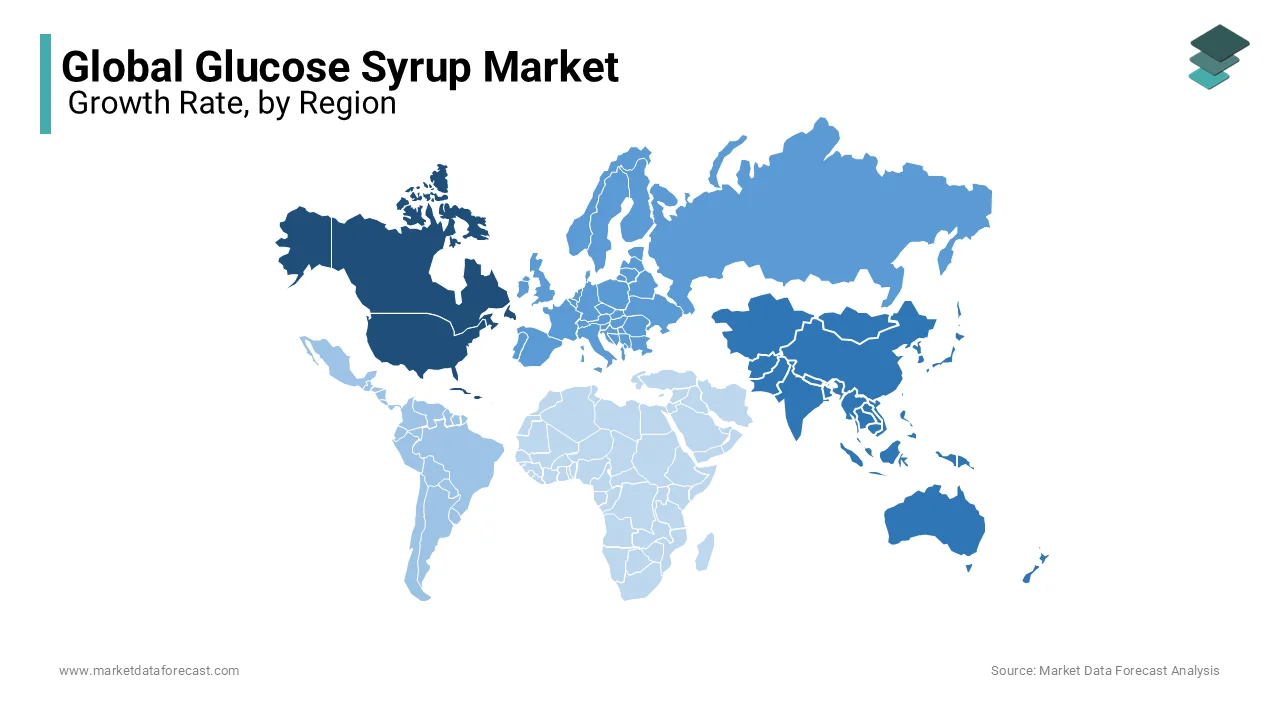

The North American glucose syrup market is anticipated to have a high share of sales over the next decade. It is expected to drive growth in the North American market as consumption of ready-to-drink beverages in this region increases and demand for bakeries, baked goods and desserts increases.

The Asia Pacific market accounted for the most substantial portion of over 30.0% in terms of revenue. The region continues to lead the market, driven by the growing demand for glucose syrup in China and India, as well as the growing demand for sugar substitutes in these countries. Consumers around the world are opting for healthier, more natural substitutes to conventional sugar to combat diseases like diabetes and obesity. The vast beet production in Russia is likely to record notable growth. Due to the increased demand for syrup in France and Germany, Europe will become one of the main regional markets during the projection period. The Asia Pacific region is deemed to be the fastest-growing regional market due to improved eating habits and the adoption of western culture in developing countries. The advent of new companies and the presence of organic snacks on online platforms in countries like India and China are expected to spur the growth of the glucose syrup market in the area.

KEY MARKET PLAYERS

Key Players in Glucose Syrup Market are Cargill,Inc, Agrana Group, Avebe U.A, Bakers Kitchen, Beneo, DGF Service, Ingredion, Karo Syrup, Dr. Oetker, Grain Processing Corporation, L'Epicerie, Queen of Fine Foods, Roquette Freres, Tate and LYLE.

RECENT HAPPENINGS IN THE MARKET

-

In June 2016, ADM acquired a production plant from Tate & Lyle PLC of Morocco (United Kingdom) that produces glucose and starch. This acquisition allows the company to reach clients by region as well as globally.

-

Tate & Lyle, during October 2017, decided to extend its manufacturing capacity in Boleraz, Slovakia, to increase the present production rate of glucose syrup. This expansion is expected to be completed in 2019.

- In October 2017, Ingredion launched a new line of Mortgage Glucose Syrup (VERSASWEET) in the United States and Canada.

- In March 2018, Tate & Lyle expanded its Shanghai Food Applications Laboratory to meet growing consumer demand for healthy food and beverage products.

MARKET SEGMENTATION

This research report on the global glucose syrup market has been segmented and sub-segmented based on grade, application, & region.

By Grade

- Food

- Pharmaceutical

By Application

- Sweetening Agent

- Wine

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1.What are the main applications of glucose syrup?

Glucose syrup is widely used in the food and beverage industry as a sweetener, thickener, and humectant. It is commonly found in confectionery, baked goods, beverages, dairy products, and processed foods

2.What are the key factors driving the growth of the glucose syrup market?

The growth of the glucose syrup market is driven by factors such as increasing demand for sweetening agents in the food and beverage industry, growing consumption of convenience foods, and the versatility of glucose syrup as an ingredient.

3.What are some of the challenges faced by the glucose syrup market?

Challenges faced by the glucose syrup market include competition from alternative sweeteners, regulatory concerns regarding high-fructose corn syrup (a type of glucose syrup), and fluctuations in raw material prices

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com