Global Lab On a Chip Market Size, Share, Trends & Growth Forecast Report By Product Type, Technology and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Lab on a Chip Market Size

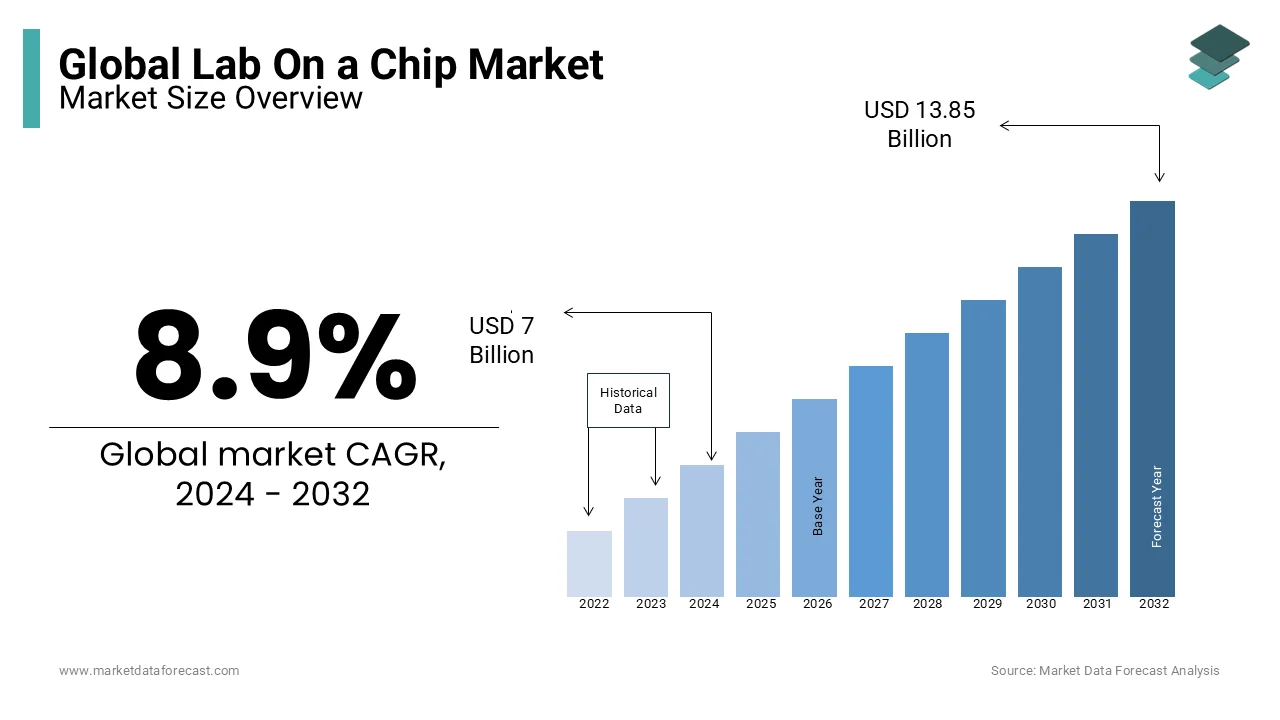

The global lab on a chip market was worth US$ 7 billion in 2024 and is anticipated to reach a valuation of US$ 15.07 billion by 2033 from US$ 7.62 billion in 2025, and it is predicted to register a CAGR of 8.9% during the forecast period 2025-2033.

Lab-on-a-Chip has several laboratory functions in a single integrated chip. Lab-on-a-chip is fabricated through a process called photolithography. This is superior in consuming low fluid and works efficiently with a faster response time. Point-of-care testing devices depend highly on these integrated chips to provide adequate healthcare. This technology is based on a complex biosensor system and uses a small metal layer embedded in a microchip to eliminate the cumbersome and complicated optics used in diagnostic laboratories. Similarly, researchers at other universities are building labs for chip technology. For example, in February 2016, researchers at the University of Kansas developed a new chip laboratory diagnostic device that quickly adjusted the liquid biopsy principle to detect cancer using plasma or blood drops.

Biochips are increasingly used in the fields of biomedical and biotechnology research. Technological advances in the medical field are increasing the adoption rate of biochips in proteomics (such as microarrays). The advantages of protein biochips include low sample consumption and a tendency to miniaturize. For example, protein microarrays can display multiple proteins simultaneously, and these properties translate into the ability to process thousands of samples in parallel. This feature of microarrays is important for proteome-wide analysis. Proteomics is widely used for biomarker and drug discovery. Also, the growing demand for personalized medicine specializing in diseases is driving market growth. Other factors drive the development of the chip lab and microarray (biochip) markets, including increased use of biochips in cancer treatment and diagnosis, the demand for personalized medicine, and rapid advances in biochip technology.

MARKET DRIVERS

Increasing Adoption of Personalized Medicine and Rapid Diagnostics

YOY's growth in the adoption of personalized medicine, increasing research in drug discovery and life sciences, and the need for rapid diagnostics are primarily driving growth in the global Lab on a chip market. R&D investment growth in developing countries is expected to provide significant opportunities for the key players operating in the Lab on a chip market throughout the forecast period. The rise in the incidences of many health disorders and increasing support from the semiconductor industry in launching innovative circuits for the medical sector are further propelling the Lab on a chip market growth. In addition, the growing demand for quality treatment procedures is favoring the market. A growing number of research institutes in the biotechnology field set up growth opportunities for the Lab on a Chip Market. In addition, the rise in genomics and proteomics applications is likely to bolster market growth.

Limitations Due to Alternative Technologies and Technical Knowledge Gaps

The microarray technology has advantages (labor-intensive and economically low), the availability of alternative technologies and conveniences over microarrays, limiting the growth of the chip lab and microarray (biochip) markets, and the limited technical knowledge and availability of alternative technologies are supposed to restrict the Lab on a chip market growth.

MARKET RESTRAINTS

High Cost of Equipment for Installation and Maintenance

The high cost of equipment for installation and maintenance is restraining the market's growth. In addition, stringent rules and regulations have remained challenging for the global Lab on a chip market. The costs and low commercial acceptance due to a shortage of skilled workers are also hindering the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Product Type, Technology, and Region |

|

Various Segments Analysed |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE AnaPorter'sorter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa |

|

Market Leaders Profiled |

Becton, PerkinElmer, Inc., Danaher Corporation, Bio-Rad Laboratories, Thermo Fisher Scientific, F. Hoffmann-La Roche AG, Dickinson and Company, Agilent Technologies, Inc., Abbott Laboratories, Fluidigm Corporation, RainDance Technologies, Inc., and IDEX Corporation. |

SEGMENTAL ANALYSIS

By Product Type Insights

Based on product type, the instruments segment is gaining more attention and is predicted to account for the leading share in the global Lab on a chip market during the forecast period. In addition, the increasing prevalence of point care testing devices is boosting the market's growth.

REGIONAL ANALYSIS

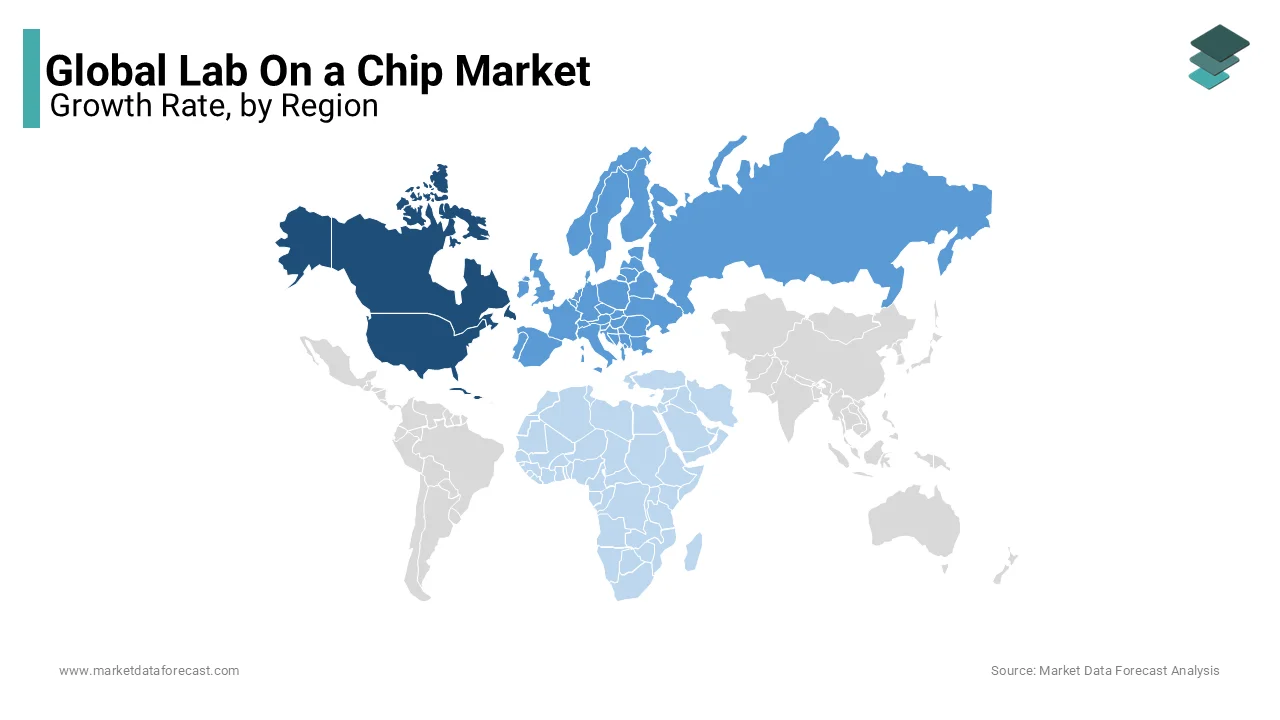

Geographically, North America dominated the worldwide Lab on a chip market in 2024. YOY rise in the incidence of infectious diseases is one of the major factors promoting the Lab on a chip market in this region. For example, according to the Centers for Disease Control and Prevention, the number of TB and salmonella cases in the United States in 2017 was 9,105 and 54,285, respectively. As a result, the lab-on-a-chip market in North America has grown to become the largest regional market in the global market owing to the developed healthcare and biotechnology research infrastructure, as well as the region's inexpensive microarray chips, which encourage diagnostic applications. In addition, the United States has the highest-earning country in North America due to favorable commercial and state financing in R&D.

Due to the presence of a high-quality healthcare system, the United States lab-on-a-chip and microarrays (biochip) market have a substantial market share in North America. In addition, with the escalating pandemic scenario, there is a significant need for quick COVID-19 testing kits, which will likely complement the market's expansion in the United States.

Europe held the second-largest share of the global Lab on a chip market in 2024. With increased government funding in hospitals, Europe is second only to North America.

Due to an increasing population susceptible to a viral illness, Asia Pacific is the fastest-growing area in the worldwide lab-on-a-chip market. According to the Joint United Nations Program on HIV/AIDS (UNAIDS) estimates from 2013, more than 350,000 persons in Asia were infected with HIV, with over 5 million people living with HIV/AIDS, which is projected to drive market expansion in the area.

China is also investing heavily in scientific research to understand people's biological makeup, analytical tools, cutting-edge data gathering, and efficient computing capabilities to facilitate a significant volume of research data in the Asia-Pacific region. The country is also a technological leader, particularly in the lab-on-a-chip-based POC. As a result, the market's dominating growth factor is a growing focus on clinical research, precision medicine, technology advancements, and new medication discovery.

In the coming years, the Middle East and Africa are expected to develop substantially due to the improving healthcare sector, increasing investments, and supportive government policies.

KEY MARKET PLAYERS

Companies that are playing a leading role in the global Lab on a chip market profiled in the report are Becton Dickinson and Company, PerkinElmer, Inc., Danaher Corporation, Bio-Rad Laboratories, Thermo Fisher Scientific, F. Hoffmann-La Roche AG, Agilent Technologies, Inc., Abbott Laboratories, Fluidigm Corporation, RainDance Technologies, Inc. and IDEX Corporation.

Key players employ strategic developments to enhance their market position, including product development, acquisitions, contracts, and collaborations. Also, the analysis considers technological advances in the global Lab on a chip industry. For example, in February 2019, bimillennial, a French-based life sciences company, launched a microflora culture collection service to identify previously uncultivated bacteria. The service is based company'smpany's unique on-chip microbiome technology platform. Similarly, other key players, such as Abbott Laboratories and EMD Millipore, and others like Biomillenia, are expected to dominate the lab on the chip market during the forecast period.

MARKET SEGMENTATION

This research report on the global lab on a chip market has been segmented and sub-segmented based on the product type, technology, and region.

By Product Type

- Instruments

- Reagents & Consumables

- Software

- Others

By Technology

- Microarrays

- Microfluidics

- Tissue Biochip

- Others

By Region

- North America

- The U.S.

- Canada

- Rest of North America

- Europe

- UK

- France

- Spain

- Germany

- Italy

- Rest of EU

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia & New Zealand

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

- Middle East

- Africa

Frequently Asked Questions

At what CAGR, the size of the lab on a chip market is projected to grow during the forecast period?

The size of the global lab on a chip market is projected to grow at a CAGR of 8.9% during the forecast period 2025 to 2033.

Which region accounted for the largest share of the market?

North America region is accounted for the largest share of the global lab on a chip market.

What will be the size of the lab on a chip market by 2033?

The size of the global lab on a chip marke is estimated to reach USD 15.07 billion by 2033.

Who are the key players in the lab on a chip market?

Key market players leading the global lab on a chip market profiled in the report are Becton Dickinson and Company, PerkinElmer, Inc., Danaher Corporation, Bio-Rad Laboratories, Thermo Fisher Scientific, F. Hoffmann-La Roche AG, Agilent Technologies, Inc., Abbott Laboratories, Fluidigm Corporation, RainDance Technologies, Inc. and IDEX Corporation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com