Global Liquid Biopsy Market Size, Share, Trends & Growth Analysis Report - Segmented By Cancer Type (Lung Cancer, Pancreatic Cancer, Leukemia and Visceral Cancers), Sample Type (Circulating Tumour Cells (CTC), Circulating Tumour DNA (ctDNA test), RNA in exosomes and Extra-Cellular Vesicles), Diagnostic Approach (Blood, Urine, Plasma, Saliva and Cerebrospinal Fluid), End Users and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From 2025 to 2033

Global Liquid Biopsy Market Size

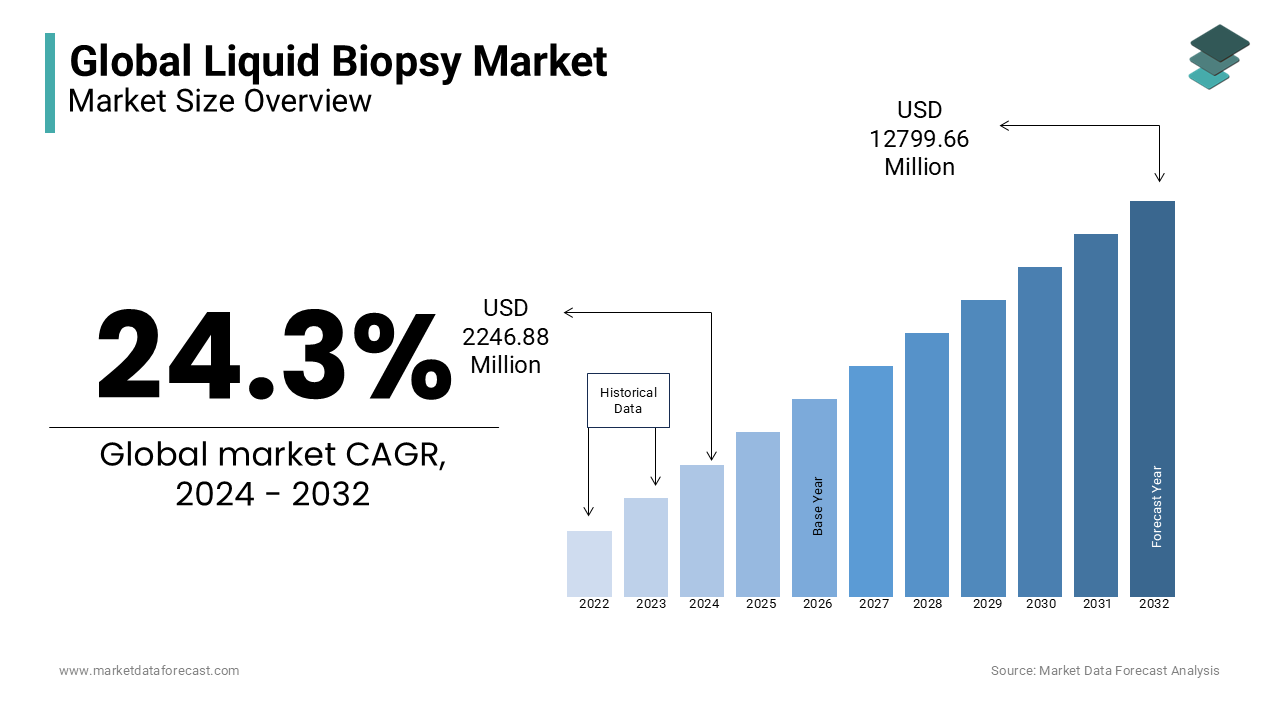

The liquid biopsy market size was valued at USD 2246.88 million in 2024. The global liquid biopsy market is estimated to grow at a CAGR of 24.3% from 2025 to 2033. As a result, the market is predicted to be worth USD 15915.48 million by 2033 from USD 2792.87 million in 2025.

Liquid biopsy is primarily used to detect the presence of diseases such as cancer using samples such as blood or other body fluids. Liquid biopsy is an effective alternative to traditional invasive biopsy procedures. The output from the liquid biopsy tests provides valuable information to healthcare providers to assess the stage of the disease and aids in preparing effective treatment plans. Cell-free DNA tests, circulating tumor cell (CTC) tests, and microRNA tests are some available liquid biopsy tests. Each test has advantages and disadvantages. According to the needs of the patients, the type of test will be chosen by the healthcare provider. The usage of liquid biopsy is expected to grow aggressively in the coming future to address the increasing burden of various diseases such as cancer.

MARKET DRIVERS

The growing cancer population is propelling the liquid biopsy market growth worldwide. The prevalence and incidence of cancer are growing significantly.

This is driving the need for effective diagnostic tools. Liquid biopsy is one of the greatest tests to detect and monitor cancer progression. The results from the liquid biopsy offer enough information to healthcare providers regarding the molecular changes associated with cancer. Unfortunately, the chance of diagnosing cancer grows with increasing age and the adoption of unhealthy lifestyles.

Increasing demand for personalized medicine is expected to boost the growth rate of the liquid biopsy market. The adoption of personalized medicine is growing rapidly. In this, treatment options are made according to the specific needs of the patients by studying their genetic makeup and other factors. Therefore, the results from the liquid biopsy give useful insights regarding the molecular changes of various diseases, including their genetic mutations and other biomarkers. Likewise, the rising demand levels for personalized medicine and increasing awareness among healthcare providers regarding the importance of molecular information for the diagnosis and treatment of various diseases are expected to promote the growth of the liquid biopsy market.

In addition, factors such as increasing preference towards non-invasive minimally invasive surgical procedures from people, an increasing number of healthcare facilities worldwide, and continuous R&D activities in the biotechnology industry are expected to favor the growth rate of the liquid biopsy market. Furthermore, increasing demand for early diagnosis of diseases as there is a permanent cure at the first stage of the diseases, the emergence of the latest technological developments in the medical sector, and growing focus on developing innovative kinds of techniques for diagnosing and treating various diseases are supporting the liquid biopsy market growth. In addition, the rise in concern towards health and increasing awareness among healthcare providers to make the best decisions in treating diseases with an appropriate plan to promote the patient's well-being is boosting the growth rate of the global liquid biopsy market.

MARKET RESTRAINTS

The lack of skilled persons handling the systems and the high costs involved with the installation of liquid biopsy devices are majorly hampering the growth rate of the global liquid biopsy market.

In addition, the increased range of equipment and facilities required to facilitate the laboratories for liquid biopsy is hindering the market. Furthermore, increasing complications in real-time due to sudden failures of the systems and maintenance of the devices also require heavy financial support, which is a burden for small-scale industries and is expected to showcase a negative impact on market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Cancer Type, Diagnostic Approach, Sample Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Janssen Diagnostics, Qiagen, Rarecells SAS, Silicon Biosystems, SRI International, Myriad Genetics, Natera, and Personal Genome Diagnostics, Sysmex InosticsTrovagene, Exosome Diagnostics, Exosome Sciences, and HansaBiomed OU. |

SEGMENTAL ANALYSIS

By Cancer Type Insights

The lung cancer segment held a significant share of the liquid biopsy market in 2024. The domination of the segment is estimated to continue during the forecast period owing to the growing awareness among people over the availability of different treatment procedures for cancer, the growing prevalence of proper diagnostic and treatment procedures, and the increasing geriatric population suffering from lung cancer.

The colorectal cancer segment is anticipated to register a healthy CAGR during the forecast period owing to the growing number of colorectal cancer patients. As per the data published by the American Society of Clinical Oncology (ASCO), approximately 151,030 adults diagnosed with colorectal cancer in 2023 are expected to go higher during the forecast period.

By Diagnostic Approach Insights

More than 8-10 CTCs and ctDNA tests are currently commercialized.

CTCs (Circulating Tumour cells), the first such entities on the liquid biopsy scene, accounted for a significant market share. As a result, the cancer institute is the largest revenue end-user segment and is expected to create substantial opportunities in the global liquid biopsy market over the forecast period.

However, the circulating tumor DNA (ctDNA test) is also expected to show significant revenue growth because DNA is the base genetic material of all cells. Therefore, any problems can be examined and treated by observing the fundamental changes in the DNA structure. Thus with the increasing cases of circulating tumor cells, there is a need to monitor the DNA structures.

By Sample Type Insights

The blood sample segment dominated the liquid biopsy market in 2024, expected to dominate the liquid biopsy market during the forecast period. The segmental growth can be attributed to factors such as the growing number of diagnostic centers worldwide with the latest equipment and increasing preference from people for early diagnosis of the disease where there is a permanent cure for it when it is treated at first levels.

However, the urine segment is expected to show promising growth during the forecast period as it is the most common method used for cancer diagnosis. Urine is readily available to be tested and is a fast and efficient process of diagnosis that does not require complex extraction methods, making it the second most preferred method. Urine is also preferred by patients who are scared of needles or blood extraction. In addition, it is an entirely non-invasive process making it comparatively safer.

By End User Insights

The laboratories segment accounted for the most significant share of the liquid biopsy market in 2024. Focusing on improving the patient's health condition by evaluating quality treatment procedures is one of the notable factors boosting the segment's growth rate.

However, the academic and research segment is expected to grow significantly during the forecast period due to the growing research in the treatment of cancer in educational institutes and the increased research on the same topic. Additionally, the newfound freedom of students towards experimentation and the increasing number of research institutes is helping the segment grow.

REGIONAL ANALYSIS

North America captured the largest share of the worldwide market in 2024, and the region's domination is predicted to continue during the forecast period. The domination of the North American region is attributed to factors such as the growing patient population suffering from chronic diseases, increasing disposable income, the presence of developed countries, and the growing number of product launches for disease diagnosis. The U.S. led the North American market in 2023, followed by Canada.

The Asia-Pacific regional market had the second-largest global market share in 2023. The rise in the geriatric population is spurring the market's growth rate. Additionally, increasing support from private and public organizations is gearing up in the market. India and China are the major countries in the Asia Pacific, contributing their highest market share.

Europe is expected to grow at a CAGR of 21.45% from 2024 to 2029. The rise in the demand to improve the quality of the treatment is expanding the market shares. In addition, increasing focus on lowering the cost of treatment and diagnostics applications in the medical sector magnifies the market demand. Furthermore, increasing training institutes in the pharmaceutical industry are also showing potential growth rates for the market.

Middle East and Africa is anticipated to have a moderate growth rate during the forecast period. The rise in government support by launching reimbursement schemes is surging the demand in the liquid biopsy market.

Latin America is forecasted to grow at a CAGR of 27.6% during the forecast period.

KEY MARKET PLAYERS

Companies playing a notable role in the global liquid biopsy market are Janssen Diagnostics, Qiagen, Rarecells SAS, Silicon Biosystems, SRI International, Myriad Genetics, Natera, and Personal Genome Diagnostics, Sysmex InosticsTrovagene, Exosome Diagnostics, Exosome Sciences, and HansaBiomed OU.

RECENT MARKET HAPPENINGS

- High-performing assays that offer translational insights to support possible cancer therapy approaches are part of PredPredicine'suid biopsy portfolio. Necessary details include the full range of cancer care covered by NGS solutions based on urine, blood, and tissue, from treatment selection to therapy monitoring and minimal residual disease (MRD) monitoring. In addition, PredPredicine'slity to conduct international clinical trials and produce companion diagnostics (CDx) using standardized assays in the USA and ChinaPredicine, Inc., a firm that provides worldwide molecular insights, said today that it would exhibit four posters at the ESMO conference, which will take place in Paris, France, from September 9 to 13, 2022.

- In September 2022, "ANG" E," a "global leader in liquid biopsy, released its unaudited interim financial results for the six months ending June 30, 2022.

- The Parsortix system received FDA De Novo clearance for its intended use with metastatic breast cancer (MBC) patients; the first FDA product clearance to harvest cancer cells from a patient blood sample for later user-validated analysis; first mover advantage for intact cancer cell analysis in the global liquid biopsy market with FDA clearance and CE Mark in place; and the commercial roll-out in progress with a worldwide distributor network are among the operational highlights.

- In September 2022, The PredicineCARETM cfDNA Assay, a Next-Generation Sequencing (NGS) assay for tumor mutation profiling in cfDNA isolated from liquid biopsy samples from cancer patients, received Breakthrough Device designation from the U.S. Food and Drug Administration (FDA), according to a recent announcement from Predicine, Inc., a global molecular insights company dedicated to advancing precision medicine in oncology and infectious diseases.

- The PredicineCARE cfDNA Assay is a specific, CLIA-validated assay that searches for variations in 152+ genes, including known clinically significant single nucleotide variants (SNVs), insertions and deletions (indels), DNA re-arrangements (fusions), and copy number variations (CNVs). The PredicineCARE cfDNA Assay is being created to recognize cancer patients with specific indications who may benefit from treatment with targeted therapy and are biomarker-eligible.

- In March 2017, Adha Test Prostate Cancer Panel AR-V7 was introduced by QIAGEN N.V. (Netherlands). It is used to detect the androgen receptor splice variant seven and promote better treatment for the patient.

- In March 2017, AVENIO circulating tumor DNA (ctDNA) Analysis Kits were introduced by Roche Diagnostics, which plays an essential role in all Next Generation Sequencing (NGS) laboratories.

- In April 2017, Janssen Diagostics LLC. (the U.S.) was acquired by Menarini Silicon Biosystems (Italy), and this is related to the CELL SEARCH Circulating Tumor Cell System. Menarini Silicon Biosystems (Italy) has entered the U.S. diagnostics market with this acquisition.

MARKET SEGMENTATION

This research report on the global liquid biopsy market has been segmented and sub-segmented based on cancer type, diagnostic approach, sample type, end-user, and region.

By Cancer Type

- Lung Cancer

- Pancreatic Cancer

- Leukemia

- Visceral Cancers

By Diagnostic Approach

- Circulating Tumour cells (CTC)

- Circulating Tumour DNA (ctDNA test)

- RNA in exosomes

- Extra-Cellular Vesicles

By Sample Type

- Blood

- Urine

- Plasma

- Saliva

- Cerebrospinal Fluid

By End User

- Reference Laboratories

- Hospital/Physician Laboratories

- Academic and Research Centres

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much is the global liquid biopsy market going to be worth by 2033?

As per our research report, the global liquid biopsy market size is estimated to be worth USD 15915.48 million by 2033.

Does this report include the impact of COVID-19 on the liquid biopsy market?

Yes, we have studied and included the COVID-19 impact on the global liquid biopsy market in this report.

Which region led the liquid biopsy market in 2024?

North America led the liquid biopsy market in 2024.

Who are the leading players in the liquid biopsy market?

Janssen Diagnostics, Qiagen, Rarecells SAS, Silicon Biosystems, SRI International, Myriad Genetics, Natera, Personal Genome Diagnostics, Sysmex InosticsTrovagene, Exosome Diagnostics, Exosome Sciences, and HansaBiomed OU are some of the promising companies in the global liquid biopsy market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com