Middle East and Africa Fintech Market Size, Share, Trends & Growth Forecast Report – Segmented By Technology (API, Artificial Intelligence, Blockchain, and Distributed Computing), Service (Payment, Fund Transfer, Personal Finance, Loans, Insurance, and Wealth Management), Application(Banking, Insurance, and Securities), Deployment Mode(Cloud, and On-Premises) and Country (KSA, UAE, Israel, rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, and Rest of MEA) - Industry Analysis From 2024 to 2033

Middle East and Africa Fintech Market Size

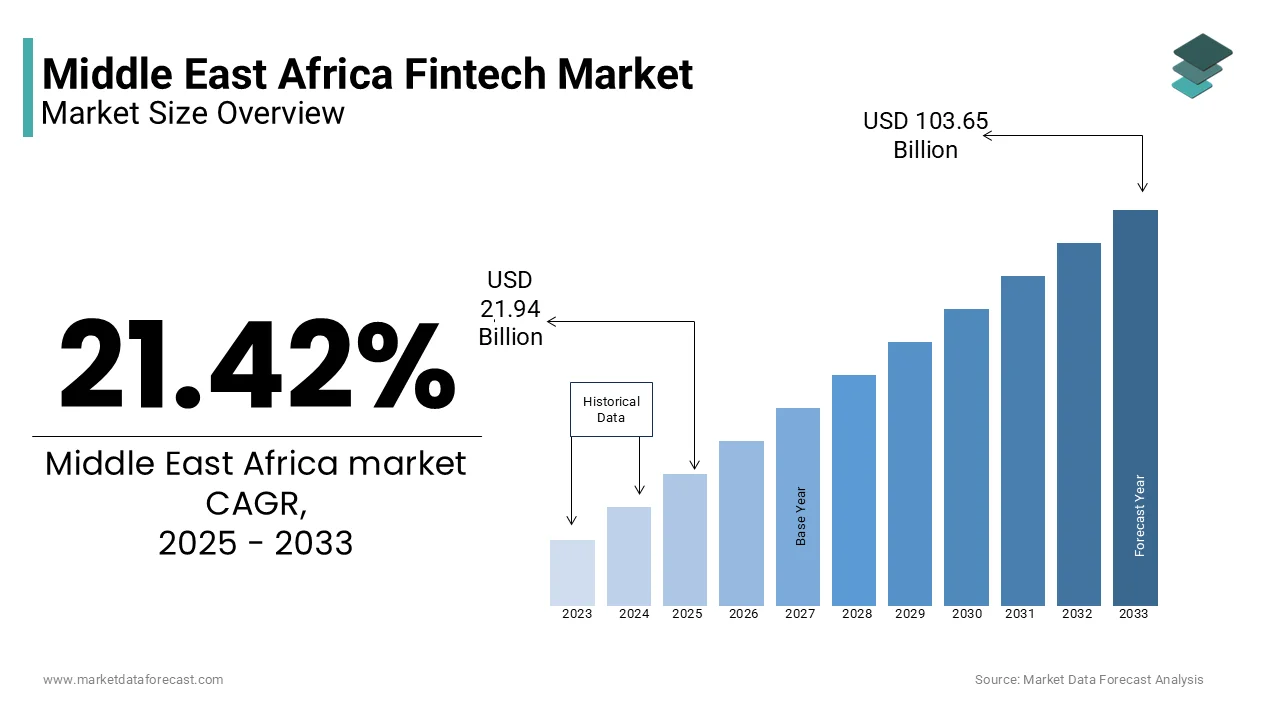

The fintech market in the Middle East and Africa (MEA) was valued at USD 18.07 billion in 2024. The MEA market is expected to hit a CAGR of 21.42% from 2025 to 2033 and the regional market size is predicted to be valued at USD 103.65 billion by 2033 from USD 21.94 billion in 2025.

FinTech did not reach the Gulf region until 2017 when regulators began implementing policies to encourage the growth of the sector. Although the region was slower to adopt FinTech than others around the world, the sector is growing rapidly and, above all, in a sustainable way. The growing penetration of mobile banking in the Middle East and Africa is majorly propelling the growth of the MEA fintech market.

As and when the usage of mobile banking is growing in the Middle East and African region, several Fintech startups have identified the trend and seized the opportunity by offering innovative solutions tailored to local needs, such as mobile payments and banking. On the other hand, the governments of MEA countries have also understood the changing scenario and adapted policies to support the fintech sector.

Presently, the Middle East and Africa fintech market is experiencing a shift in its financial environment. The advancements in unique finance services and swift digital transformation propels this. The Kingdom of Saudi Arabia, Egypt, and the United Arab Emirates play vital roles in expanding the Middle East (ME) market. The customer's tech savviness in the ME region, particularly in the UAE, is a big factor that has caused this market to remain on a growth trajectory. This is fuelling the development of startups as they seek greater value from the rising organizations. Digital banking, Buy-now-Pay-Later (BNPL), instant cross-border payments, and digital payments are all trending domains that attract customer attention.

Africa, on the other hand, is experiencing a revolutionary rise in fintech innovations. Its tech-savvy demographic, penetration of mobile phones, and young population have made it a fertile area for fintech solutions.

MARKET DRIVERS

The increasing investments for fintech startups in the MEA fuel the regional market growth.

According to a study by Redmadrobot, between 2021 and 2023, the fintech startups in the Middle East raised funding of 2 billion dollars through 140 to 160 deals, with the United Arab Emirate holding 43 percent of all fintech financing in the area during the last 3 years.

Investment and interest in financial technology are increasing considerably in several regions across the world, including the UAE. The investments are believed to be higher owing to the combination of the rising corporate interest, the increasing maturity of various fintech subsectors, and the expanding scope. UniFinancial, a Singapore-based group, estimated that by 2028, the funding will increase to 2.8 billion dollars in 2028 from 1.8 billion dollars in 2023. Its powerful state support is also a major strength of the ME landscape, especially the Gulf states. They have big sovereign funds that are actively investing. Hence, a startup culture with government support is propelling the market growth.

The increasing investments by banks and companies in technological solutions boost the MEA market growth.

Several companies in the financial technology sector are increasingly implementing novel technologies like blockchain to increase their security and efficiency. Blockchain is a technology that is comprised of a distributed database accessible to all users on a network, where each user can add a new data record (block) with a time stamp that cannot be changed. Blockchain technology maintains data authentication by limiting changes to older data blocks while allowing users to keep adding new data blocks, thus providing high security and transparency for companies operating in the fintech market. It improves trading accuracy, speeds up the settlement process, and reduces risk.

With their diverse initiatives and policies, Middle Eastern nations strongly advocate for digital revolution in fintech. The shift towards a cashless society in the region is broadly fuelled by specific state initiatives, such as Vision 2030 of Saudi Arabia to attain 70 percent cashless payments by 2025 and the measures by the UAE to link regional payment networks. Additionally, infrastructure-based technology and APIs are reshaping the future of the financial services industry, thus contributing to the growth of the Middle East and Africa fintech market. In addition, FinTech companies offer low-cost customized products due to emerging developments in the technology industry that generate higher customer expectations, driving market growth on a large scale.

MARKET RESTRAINTS

On the other hand, factors such as high rates of unbanked population in some of the Middle Eastern and African countries, complex and evolving regulatory frameworks in some countries, and poor awareness and understanding of fintech services among populations are majorly hindering the adoption of fintech in the Middle East and Africa and hampering the MEA market growth. Inadequate digital infrastructure, including internet connectivity and mobile penetration, risks of cybersecurity, and lack of interoperability between fintech platforms and traditional banking systems are further inhibiting the growth rate of the MEA market.

MARKET OPPORTUNITIES

Artificial intelligence (AI) for improving user experience is gaining traction and is expected to boost significantly the Middle East and Africa markets. Banks can better understand and analyze unique behavior, preferences, and requirements by employing AI for large amounts of customer data. By analyzing social media interactions, browsing behavior, and transaction histories, AI algorithms can generate data and intelligence into every consumer's financial goals, risk profile, and lifestyle preferences.

For instance, the Personal Financial Management tool by Clayfin used diverse AI-powered engagement tools to give intelligent and hyper-customised suggestions to consumers.

AI can also help in covering the unbanked population across ME and Africa with the growing availability of smartphones and the internet at cost-effective rates. The North African nations have shown a strong ability to lead Africa's fintech market, of which Egypt alone possesses 9.6 percent of new startups in this continent. This is due to the trend of mobile wallets and digital payments.

As per the Redmadrebot, 50 percent of the population of the Middle Eastern countries is financially excluded. Also, 4.25 percent of unbanked adults globally are present in the ME.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

21.42% |

|

Segments Covered |

By Technology, Service, Application, Deployment Mode, and Country |

|

Various Analyses Covered |

Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

KSA, UAE, Israel, Rest Of GCC Countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, Rest Of MEA |

|

Market Leaders Profiled |

PayPal Holdings, Inc., Ant Group, Afterpay Limited, Google Pay (Alphabet Inc.), Nexi SpA, Klarna Bank AB, Social Finance, Inc. and Avant, LLC |

SEGMENTAL INSIGHTS

By Technology Insights

Of these, the Artificial Intelligence (AI) segment dominated the market in 2024 with a 38.25% share, and the trend is expected to continue until 2033. AI interfaces and chatbots have primarily redefined customer service, and their activity expansion will enable the AI-oriented fintech market to grow at an impressive rate until 2025. AI chatbots provide 24/7 consumer assistance, managing inquiries, addressing problems, and helping transactions with human-like communication, influencing the segment's market growth. The escalating application of Natural Language Processing (NLP) algorithms improves efficiency and satisfaction through task automation, allowing agents to focus on more complicated engagements.

According to a survey of business leaders 2024, the Middle East and North Africa (MENA) region is projected to be the biggest spender on AI technologies, accounting for one-fourth of the overall expenditure. The application of AI is estimated to contribute up to 13.6 percent to the GDP of the region.

By Service Insights

The Payment segment is rapidly gaining traction and is estimated to grow at a higher CAGR during the forecast period for the Middle East and Africa fintech market. This can be attributed to the escalating adoption and application of digital payments. Customer expectations are transforming as digital engagements are regarded as an integral component of consumer experience. Banks are noticing the shift in these expectations and demands in the payment and banking landscape. Moreover, the MEA region has witnessed a steep decrease in cash applications for in-store payments, backed by the increase in mobile payments. This transition to cashless matches the rise of mobile and digital payments, propelled by fintech, banks, and governments. Ultimately, this is increasing the segment's market share.

According to Mastercard, in 2022, 85 percent of customers in the Middle East and North Africa (MENA) region utilized a minimum of one novel payment solution, with application anticipated to increase further. Penetration of smartphones in the Middle East is at 80 percent to 90 percent, as per Entrust.

By Application Insights

The banking segment is the fastest-growing category in the Middle East and Africa fintech market. The United Arab Emirates commands the region's financial technology revolution. The market progressed in this country because its firm commitment to innovation has attracted several established financial institutions and startups in this field. Apart from this, the MENA area is a rapidly expanding market for banking and finance service providers. In this region, the digital payments category captured the biggest share of the fintech market in MENA. The region is distinctly positioned for further financial breakthroughs due to a technologically friendly population, rising need for financial inclusion, and a modern banking environment that houses new solutions.

By Deployment Mode Insights

The cloud segment is swiftly moving forward in the Middle East and Africa fintech market and is anticipated to experience more developments during the forecast period. The ME counties have stepped up their efforts for the adoption of cloud technologies for fintech. As per a study, the banking and security companies will invest 12 billion dollars into technology during the next ten years owing to the recent introduction of public cloud data centers in the ME.

According to research, about 82 percent of banks utilize the cloud for enhanced protection; however, over 52 percent of their higher management people consider it a threat.

REGIONAL ANALYSIS

The UAE held the leading share of the MEA fintech market in 2024.

The UAE stands out as a key player in the MEA fintech market due to the presence of advanced infrastructure, a supportive favorable regulatory environment, and an increasing number of initiatives by the government of UAE, such as Dubai's FinTech Hive and the Abu Dhabi Global Market. The growing smartphone penetration and increasing number of tech-savvy consumers are further boosting the fintech market growth in the UAE.

According to UniFinancial, the number of financial technology startups in the UAE will become three times 531 in 2033 from 2000 to 2024. The increase in fintech financing is because of the UAE's extensive range of multidisciplinary free zones, which make it convenient to commence a business, and its visa categories for startup owners and investors.

South Africa is expected to play a major role in the Middle East and African fintech market during the forecast period due to the presence of a growing fintech startup ecosystem and robust ranking sector. The region is leading the African industry, intending to be the hub for premier technology. There is great emphasis on online payment platforms like PayGate and YOCO. Besides this, 20 percent of the total new African Fintech startups are present in this region. It generates about 40 percent of all revenue in this market in Africa. Moreover, the fintech companies in South Africa have been working to address challenges such as financial inclusion and offer innovative solutions for payments, lending, and insurance. The South African Reserve Bank is putting efforts into promoting innovation in fintech and bringing consumer protection and financial stability across the nation.

According to BDO, from January 2015 to May 2022, 357 individual South African technology startups received combined funding, almost reaching 1 billion dollars, i.e., 993,684,600 US dollars.

Nigeria is another prominent player in the Middle East and Africa fintech market.

KEY PLAYERS IN THE MARKET

Companies playing a major role in the Middle East and Africa fintech market include PayPal Holdings, Inc., Ant Group, Afterpay Limited, Google Pay (Alphabet Inc.), Nexi SpA, Klarna Bank AB, Social Finance, Inc., and Avant, LLC.

RECENT HAPPENINGS IN THE MARKET

- In September 2024, RAKBANK successfully performed a cross-border Central Bank Digital Currency (CBDC) payment in UAE through the mBridge platform. This makes it the foremost bank in the country to execute a CBDC payment. This transaction facilitated the Digital Dirham's immediate transfer against the digital Chinese Yuan, marking a major achievement in digital banking transformation.

- In September 2024, the Saudi Central Bank (SAMA) and Samsung reported signing a contract to enable the introduction of Samsung Pay in Saudi Arabia over the fourth quarter of 2024. The agreement was inked at the first 24 Fintech conference in Riyadh. The step comes under the current measures to improve the digital payment ecosystem in the country. It goes with the targets of the Financial Sector Development Program (FSDP), a significant project of Saudi Vision 2030.

- In August 2024, Fintech Tuesdays (FTT) and ADGM Academy (ADGMA) Research Centre announced that they will host the UAE Fintech Vision 2024 event. It was scheduled to take place on 30 September 2024.

MARKET SEGMENTATION

This research report on the Middle east africa fintech market is segmented and sub-segmented into the following categories.

By Technology

- API

- Artificial Intelligence

- Blockchain

- Distributed Computing

By Service

- Payment

- Fund Transfer

- Personal Finance

- Loans

- Insurance

- Wealth Management

By Application

- Banking

- Insurance

- Securities

By Deployment

- Cloud

- On-Premises

By Region

-

Saudi Arabia

-

Egypt

-

UAE

-

Tunisia

-

Qatar

-

Morocco

Frequently Asked Questions

What are the key drivers of fintech growth in the MEA region?

Key drivers include increasing smartphone penetration, a large unbanked population, supportive government policies, and rising demand for digital payment solutions.

What are the main challenges faced by fintech companies in the MEA region?

Major challenges include regulatory hurdles, cybersecurity threats, limited access to funding, and the need for greater financial literacy among consumers.

What role do fintech accelerators and incubators play in the MEA region?

Fintech accelerators and incubators play a crucial role in nurturing startups by providing mentorship, access to funding, and networking opportunities to help them scale and succeed.

What future trends are expected in the MEA fintech market?

Future trends include increased collaboration between traditional financial institutions and fintech startups, the rise of AI and machine learning in financial services, and the growth of digital identity solutions to enhance security and user experience.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com