Asia-Pacific Fintech Market Size, Share, Trends, & Growth Forecast Report By Service (Payments, Personal Finance, Loans, Insurance, Fund Transfer, Wealth Management and Others), Application (Banking, Insurance, Trading, Taxation, and Others) and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC), Industry Analysis From 2024 to 2033

Asia-Pacific Fintech Market Size

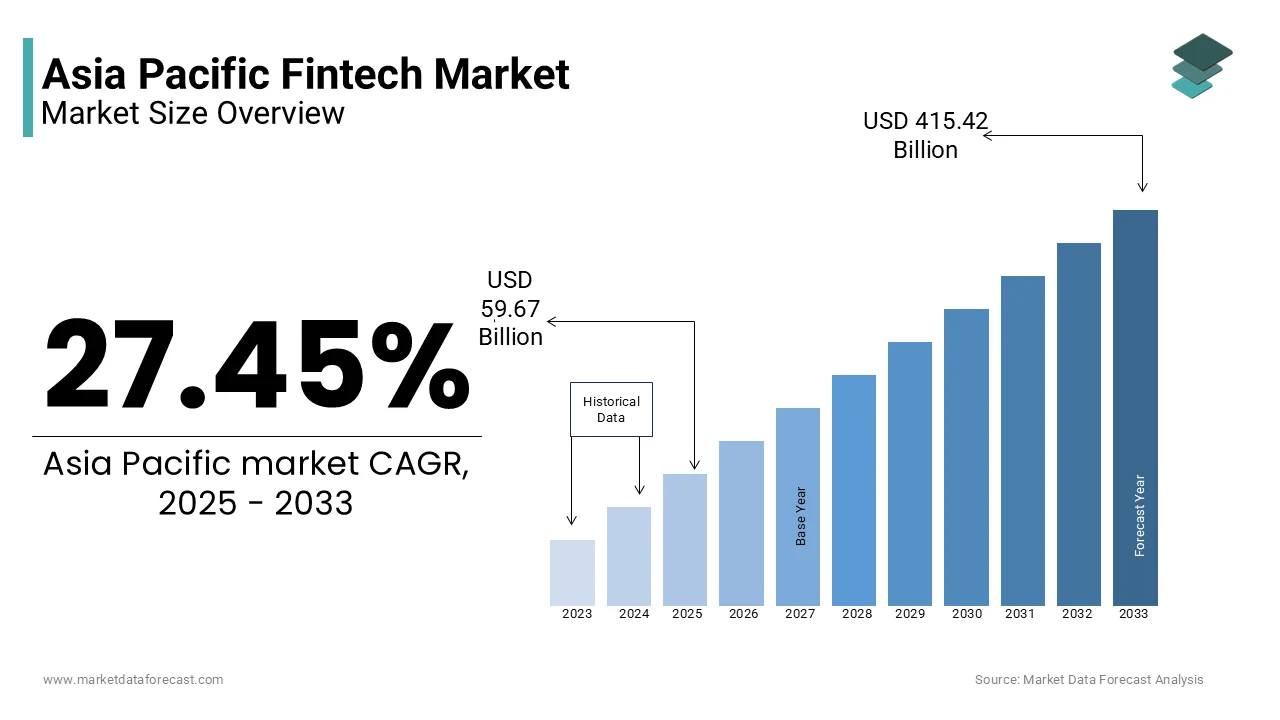

The Asia-Pacific fintech market was worth USD 46.82 billion in 2024. The Asia Pacific market is expected to grow at a whopping CAGR of 27.45% from 2025 to 2033 and be worth USD 415.42 billion by 2033 from USD 59.67 billion in 2025.

The Asia-Pacific region is considered as a fintech powerhouse and is projected to showcase rapid growth in the coming years. Factors that contribute to the growth of the fintech market in the Asia-Pacific region include rapid digitalization, growing internet penetration, and favorable regulatory frameworks. For instance, Asia had the highest population of internet users globally with 2.3 billion users in 2020, as per the data published by learnbonds. Countries such as China, India, Singapore and Australia are hotspots for fintech innovation in the Asia-Pacific region and have been attracting significant investments. The rapid adoption of mobile payment solutions is one of the major trends in the Asia-Pacific fintech market. Mobile payment platforms such as Alipay and WeChat Pay in China have totally changed the way people transact. On the other hand, the peer-to-peer lending platforms in India have been playing a key role in addressing the credit needs of underserved people. For instance, China held the top spot in the adoption of mobile payments worldwide, and more than 500 million people in China use mobile payments.

Asia-Pacific is witnessing significant investments and funding in the fintech sector.

These investments and funds have been favouring fintech companies in developing cutting-edge solutions across various verticals ranging from payments, lending and wealth management to blockchain technology. For instance, according to KPMG, the fintech investments in the Asia-Pacific region grew from USD 14.7 billion in 2020 to USD 27.5 billion in 2021.

MARKET DRIVERS

The rising support and favorable regulations by the governments of Asia-Pacific countries are further supporting the growth rate of the Asia-Pacific fintech market.

Governments in the Asia-Pacific region have been proactive in establishing supportive regulatory frameworks for fintech companies to provide clarity and guidance for fintech startups. For instance, the Reserve Bank of India (RBI) announced the Regulatory Sandbox Framework in 2019 to promote innovation in the fintech sector by allowing startups to test their products and services in a controlled environment. The Monetary Authority of Singapore (MAS) also brought a regulation called the Payment Services Act in 2019 to regulate payment services and digital payment tokens. Many governments in the Asia-Pacific region are favorable to promoting financial inclusion and supporting fintech solutions such as mobile banking, digital wallets and microfinance platforms to expand financial access. In some of the Asia-Pacific countries, governments and regulatory bodies have even been providing funding support for fintech startups through grants and subsidies. For instance, the Indonesian government introduced the National Strategy for Financial Inclusion (SNKI) in 2016 to promote financial access to the underserved population with an aim to achieve 75% financial inclusion by 2019.

Apart from the above, factors such as the growing usage of e-commerce portals, rapid adoption of blockchain technology, the emergence of neobanks and an increasing number of initiatives promoting financial inclusion in the Asia-Pacific region are boosting the fintech market growth in this region.

MARKET RESTRAINTS

On the other hand, factors such as security concerns, insufficient infrastructure and connectivity, cybersecurity risks and data privacy concerns, slow adoption of fintech solutions in rural areas and competition from traditional financial institutions are hindering the growth of the fintech market in the Asia-Pacific region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

27.45% |

|

Segments Covered |

By Technology, Service, Application, Deployment Mode, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Oscar, ZhongAn, Qufeng, Lufax, Avant, Atom Bank, Kabbage, Kreditech, JD Finance, Nubank, SoFi, Square, Klarna and Funding Circle. |

SEGMENTAL INSIGHTS

By Technology Insights

The AI and blockchain segments together held the major share of the fintech market in Asia-Pacific in 2024 and the domination of these segments is expected to continue throughout the forecast period. The usage of AI-powered chatbots and virtual assistants by banks to provide enhanced customer support and real-time support has seen a spike in the recent past in the Asia-Pacific. Blockchain technology is being increasingly used in the payments, remittances, and trade finance across the Asia-Pacific region and this technology is gaining tremendous attraction.

By Service Insights

The payment services segment led the market in 2023. However, the personal finance segment is expected to register promising growth during the forecast period. APAC is one of the fastest-growing regions in terms of digital adoption and this shift is promoting the usage of fintech for payment services as fintech provides convenience, speed and security.

By Application Insights

The banking segment captured 44.7% of the share of the Asia-Pacific fintech market in 2023 and is estimated to be the dominating segment throughout the forecast period. The growing adoption of advanced technologies such as AI, blockchain, IoT and cloud computing by banks to streamline operations, enhance customer experience and offer innovative financial services such as mobile banking, digital wallets, and online lending is primarily driving the expansion of the banking segment in the Asia-Pacific fintech market.

The insurance segment is another major segment and is estimated to witness a notable CAGR during the forecast period.

By Deployment Mode Insights

The cloud segment accounted for 64.8% of the Asia-Pacific market share and is expected to continue its domination throughout the forecast period.

REGIONAL ANALYSIS

Globally, Asia Pacific is predicted to be the fastest-growing region for the worldwide fintech market. There are many opportunities in the rapidly changing Asia-Pacific finance technology environment, and investment in them is increasing rapidly. Open banking and other regulatory initiatives are redefining the financial services market, and external providers can access data from previously owned bank customers. China and India have a much greater penetration of Fintech services. Singapore already has the best mobile payment solutions to promote acceptance on the island. With limited partnerships and the first local mentality, there is a risk that the market will not fully realize its potential.

China led the fintech market in the Asia-Pacific region in 2023. China emerged as one of the leading fintech ecosystems in the global market. Fintech companies in China such as Ant Group and Tencent have revolutionized digital payments, wealth management and lending services through platforms like Alipay and WeChat Pay.

India is playing a key role in the Asia-Pacific fintech market and has experienced rapid growth in the recent past. As published in livemint.com, India secured the third position worldwide with the greatest number of fintech unicorns in 2023, the U.S. and the UK occupied first and second places respectively. The growing efforts from the governments to promote financial inclusion and the rise of digital payment solutions are majorly boosting the Indian fintech market growth. In India, companies such as Paytm, PhonePe and PolicyBazaar have gained prominence in areas such as mobile wallets, digital lending and insurance technology (insurtech). Regulatory initiatives such as the Unified Payments Interface (UPI) have further facilitated seamless digital transactions in India and such initiatives have been contributing significantly to the Indian market growth.

Singapore is anticipated to account for a notable share of the Asia-Pacific market during the forecast period. Singapore is a financial hub in the Asia-Pacific region and positioned itself as a promising player in the Asia-Pacific market through initiatives such as the Monetary Authority of Singapore's (MAS) FinTech Regulatory Sandbox and the establishment of the Singapore FinTech Festival. Singapore is one of the leading fintech hubs in Asia-Pacific and has over 1,000 fintech companies operating in the country. The presence of several fintech startups and the availability of strong infrastructure are supporting the fintech market in Singapore.

KEY PLAYERS IN THE MARKET

The most promising companies in the Asia-Pacific fintech market include Oscar, ZhongAn, Qufeng, Lufax, Avant, Atom Bank, Kabbage, Kreditech, JD Finance, Nubank, SoFi, Square, Klarna and Funding Circle.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, FIS launched the FIS Fintech Hangout Series, an initiative to promote and connect fintech startups, FIS professionals, financial institutions, investors, and participants in the FIS Fintech Accelerator Program. In this series, the company shares best practices and highlights the great work of participating fintech companies.

- In March 2023, Ant Group made a significant announcement. They launched a digital asset trading platform in Singapore named “AntChain Exchange.” This platform, designed for fast and secure transactions, allows users to trade various cryptocurrencies and other digital assets, notably impacting the digital asset trading market.

- In February 2023, PhonePe announced its partnership with Flipkart, India’s leading e-commerce company. This partnership aims to expand PhonePe’s digital payment services to millions of Flipkart customers and improve the shopping and payment experience.

MARKET SEGMENTATION

This research report on the Asia-Pacific fintech market has been segmented and sub-segmented into the following categories.

By Technology

- API

- Artificial Intelligence

- Blockchain

- Distributed Computing

By Service

- Payment

- Fund Transfer

- Personal Finance

- Loans

- Insurance

- Wealth Management

By Application

- Banking

- Insurance

- Securities

By Deployment Mode

- Cloud

- On-premises

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

Which countries in the Asia-Pacific region contribute the most to the fintech market share?

China, India, and Singapore are among the leading contributors to the fintech market share in the Asia-Pacific region, with each country having a dynamic and evolving fintech ecosystem.

What is the CAGR of the fintech market in the Asia-Pacific teio

The Asia-Pacific regional market is expected to grow at a CAGR of 27.45% from 2025 to 2033.

What are the challenges faced by fintech startups in Asia?

Fintech startups in Asia may encounter challenges related to regulatory compliance, cybersecurity, and the need for robust infrastructure. Overcoming these challenges is crucial for sustained growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com