North America Hydroponics Market Size, Share, Trends & Growth Forecast Report, Segmented By Equipment, Type, Crop Type, Input Type, And By Country (U.S, Canada, Mexico and Rest of North America), Industry Analysis From 2025 to 2033

North America Hydroponics Market Size

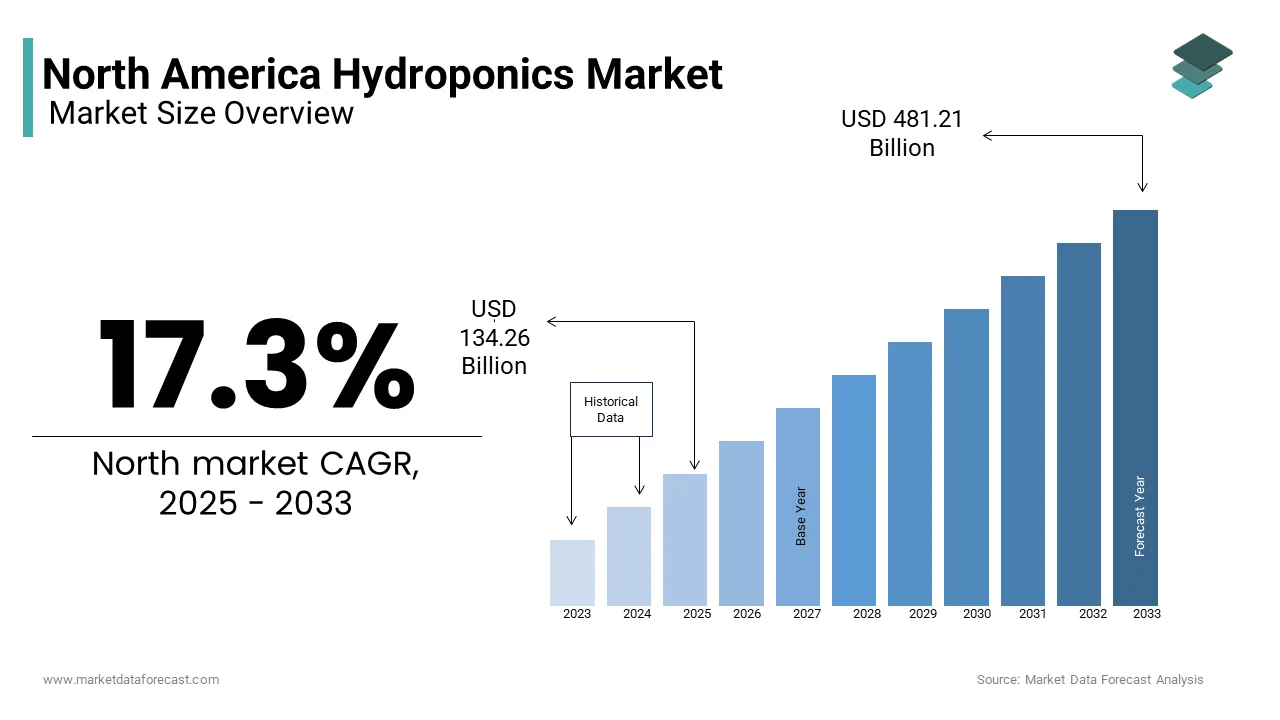

The North American hydroponics market was valued at USD 114.46 billion in 2024 and is anticipated to reach USD 134.26 billion in 2025 from USD 481.21 billion by 2033, growing at a CAGR of 17.3 % during the forecast period from 2025 to 2033.

MARKET DRIVERS

Urbanization and Limited Arable Land

Urbanization is reshaping agriculture across North America, creating a pressing need for innovative farming solutions like hydroponics. According to the United Nations, approximately 82% of North Americans will live in urban areas by 2050, reducing available farmland significantly. Traditional agriculture faces challenges due to soil degradation, which affects around 52% of agricultural land in the U.S., as per the Environmental Protection Agency. Hydroponics addresses these issues by enabling cultivation in non-arable zones, including rooftops and abandoned industrial spaces. Furthermore, hydroponic systems use up to 90% less water than conventional farming, making them ideal for regions facing droughts, such as California.

Consumer Demand for Organic and Locally Grown Produce

The surge in consumer preference for organic and locally sourced produce is another key driver propelling the hydroponics market. Hydroponic farming allows growers to cultivate pesticide-free crops, meeting this demand effectively. BrightFarms, a leading hydroponic firm, supplies over 750 grocery stores with fresh produce grown within a 200-mile radius, reducing carbon footprints associated with transportation. Moreover, hydroponics supports year-round production, addressing seasonal gaps in supply chains. For example, AeroFarms, based in New Jersey, produces over 2 million pounds of leafy greens annually using aeroponic technology, a subset of hydroponics. Consumers’ willingness to pay premium prices for sustainably grown, nutrient-rich vegetables further incentivizes farmers to adopt hydroponic systems, accelerating market growth.

MARKET RESTRAINTS

High Initial Investment Costs

One significant restraint hindering widespread adoption of hydroponics in North America is the substantial initial capital required to set up hydroponic systems. Advanced equipment such as LED grow lights, climate control systems, and automated nutrient delivery mechanisms contributes to these costs. Small-scale farmers often find it challenging to secure financing due to perceived risks associated with new technologies. A study by the University of California, Davis, highlights that only 30% of small-scale hydroponic ventures achieve profitability within the first three years. This financial barrier disproportionately impacts rural areas, where access to investment capital is limited.

Technical Expertise and Knowledge Gap

Another critical restraint is the lack of technical expertise required to manage hydroponic systems efficiently. As stated by the National Institute of Food and Agriculture, operating hydroponic setups demands specialized knowledge in plant biology, nutrient management, and system maintenance, which many traditional farmers lack. Errors in pH balance or nutrient concentration can lead to crop failure, resulting in significant financial losses. For instance, a survey conducted by the Canadian Greenhouse Conference revealed that nearly 40% of new entrants to hydroponic farming reported difficulties in maintaining optimal growing conditions during their initial years. Training programs and educational resources are limited, particularly in rural regions, exacerbating the problem. This knowledge gap not only increases operational risks but also discourages new participants from entering the market.

MARKET OPPORTUNITIES

Technological Advancements Enhancing Efficiency

Emerging technologies present vast opportunities for the North American hydroponics market to enhance efficiency and scalability. Artificial intelligence (AI) and Internet of Things (IoT) integration allow real-time monitoring and automation of hydroponic systems, optimizing resource utilization. According to McKinsey & Company, IoT-enabled smart farming could increase crop yields by up to 25% while reducing water and energy consumption by 20%. Companies like Plenty and Bowery Farming are leveraging AI-driven analytics to fine-tune growing conditions, achieving yields 350 times higher per acre compared to traditional farming. Innovations in LED lighting, which mimic sunlight spectra, have reduced energy costs. These advancements make hydroponics financially viable even for large-scale operations. Furthermore, the development of modular hydroponic kits tailored for home growers expands market reach beyond commercial applications.

Expansion into Non-Traditional Crops

Hydroponics offers an unprecedented opportunity to diversify crop portfolios beyond leafy greens and herbs, traditionally dominant in the market. According to Cornell University’s Controlled Environment Agriculture program, hydroponic systems are now being adapted to grow strawberries, tomatoes, and even root vegetables like carrots and radishes. This diversification opens lucrative revenue streams, especially given the growing demand for exotic and specialty crops. Vertical farming startups like Freight Farms are experimenting with high-value medicinal plants, including turmeric and ginger, responding to the booming nutraceutical industry. Expanding into these non-traditional crops not only attracts niche markets but also strengthens supply chain resilience by offering alternatives to imports.

MARKET CHALLENGES

Energy Dependency and Sustainability Concerns

A significant challenge facing the North American hydroponics market is its heavy reliance on energy-intensive systems, raising sustainability concerns. According to the International Energy Agency, indoor farming facilities consume a significant amount of electricity per kilogram of produce, primarily for lighting and climate control. Rising energy costs exacerbate operational expenses, particularly in regions like New England, where electricity prices are among the highest in the U.S. Besides, reliance on fossil fuels undermines the eco-friendly image of hydroponics. Like, transitioning to renewable energy sources could reduce hydroponic farms' carbon footprint, yet adoption rates remain low due to upfront costs. While solar-powered systems offer a viable alternative, they require substantial investment and space, limiting feasibility for urban farms.

Regulatory Hurdles and Policy Gaps

Navigating regulatory frameworks poses another formidable challenge for the hydroponics industry in North America. As per the U.S. Food and Drug Administration, hydroponic produce must meet stringent safety standards, including rigorous testing for contaminants and adherence to labeling requirements. However, inconsistencies in state-level regulations create confusion for growers. For example, California mandates specific water recycling protocols for hydroponic farms, while other states lack clear guidelines. Furthermore, federal subsidies favor traditional agriculture, leaving hydroponic farmers at a disadvantage. The Congressional Research Service notes that less than 5% of agricultural grants are allocated to innovative farming methods like hydroponics. Such policy gaps hinder market growth by increasing compliance burdens and limiting access to financial incentives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.3 %. |

|

Segments Covered |

By Equipment, Type, Crop Type, Input Type, Aggregate Hydroponics Systems, Liquid Hydroponic Systems, Closed Systems, and Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

The U.S, Brazil, Argentina, Mexico, and Country |

|

Market Leaders Profiled |

Argus Control Systems, Koninklijke Philips NV, Greentech Agro LLC, Logiqs B.V., and Lumigrow, Inc. |

SEGMENTAL ANALYSIS

By Equipment Insights

LED grow lights dominate the North American hydroponics equipment market by capturing 35% of the total market share in 2024. This dominance is attributed to their energy efficiency and ability to mimic natural sunlight, which optimizes plant growth. According to the U.S. Department of Energy, LED lighting systems consume less energy than traditional lighting solutions, making them a cost-effective choice for hydroponic farmers. The increasing adoption of vertical farming further amplifies demand, as these systems require precise lighting to maximize yields in limited spaces. For instance, AeroFarms, a pioneer in vertical farming, utilizes LED grow lights to produce leafy greens with yields 390 times higher per square foot compared to conventional agriculture. In addition, government incentives promoting energy-efficient technologies have accelerated LED adoption. A report by the National Renewable Energy Laboratory highlights that subsidies for energy-efficient agricultural equipment have notably reduced, encouraging small-scale farmers to invest in LED systems.

The control systems segment is projected to be the fastest-growing category in the North America hydroponics equipment market, with a CAGR of 14.7% from 2025 to 2033. This sudden rise is driven by the increasing integration of automation and IoT technologies into hydroponic operations. Companies like Heliospectra leverage AI-driven control systems to monitor and adjust environmental parameters such as temperature, humidity, and nutrient levels in real-time, ensuring optimal growing conditions. The rising complexity of hydroponic setups, particularly in urban farming, has further fueled demand for advanced control systems.

By Type Insights

The aggregate hydroponics segment held the largest share of the North America hydroponics market, i.e,. 65.1% of the total portion in 2024. This influence is caused by its versatility and adaptability to various crops, including high-value produce like tomatoes and cucumbers. As per the Food and Agriculture Organization, aggregate systems, such as gravel culture and perlite-based setups, are preferred due to their durability and reusability, reducing long-term operational costs. These systems also offer superior aeration, promoting healthier root development, which is critical for maximizing yields. The widespread availability of affordable growing media, such as coconut coir and expanded clay pellets, further supports the adoption of aggregate systems.

The segment of liquid hydroponics is the fastest expanding, with an estimated CAGR of 16.2% during the forecast period. This rapid expansion is fueled by advancements in nutrient delivery systems, enabling precise control over plant nutrition. Innovations such as deep-water culture (DWC) and nutrient film technique (NFT) have gained traction due to their ability to scale efficiently in urban environments. Furthermore, the rising popularity of home-based hydroponic kits, which predominantly use liquid systems, contributes to market expansion.

By Crop Type Insights

The lettuce and leafy vegetables segment became the largest one in the North American hydroponics market by commanding a 45% share in 2024. This leading position is propelled by their compatibility with hydroponic systems and the growing consumer demand for fresh, pesticide-free produce. According to the U.S. Department of Agriculture, lettuce accounts for a significant share of all hydroponically grown vegetables in the region, with a large portion of annual production heads. Vertical farming startups like Gotham Greens utilize hydroponics to produce premium-quality greens, supplying major retailers such as Whole Foods and Walmart. The short growth cycle of lettuce, typically 4-6 weeks, aligns perfectly with hydroponic efficiency, enabling multiple harvests annually. Moreover, the increasing focus on urban farming has bolstered demand, as highlighted by the Urban Land Institute, which reports that many metropolitan areas now incorporate vertical farms producing leafy greens.

The strawberries segment is the rapidly advancing crop type in the North American hydroponics market, with a CAGR of 18.3%. This surge is propelled by the rising demand for year-round availability of high-quality berries. A report reveals that hydroponic systems reduce water usage while increasing profitability. These advancements position strawberries as a lucrative opportunity for hydroponic growers.

By Input Type Insights

The nutrients constituted the biggest segment in the North American hydroponics input market by holding a 60.5% share in 2024. This control over the market is because of the critical role of nutrient solutions in ensuring plant health and maximizing yields. According to the International Fertilizer Association, the demand for hydroponic nutrients is projected to grow, supported by the increasing adoption of precision agriculture. Nutrient formulations tailored for specific crops, such as tomatoes and lettuce, have gained popularity, with companies like General Hydroponics offering customized blends. The versatility of liquid nutrients, which account for a notable share of total nutrient sales, enhances their appeal among commercial growers. Furthermore, the rising trend of organic hydroponics has spurred demand for bio-based nutrients, contributing to market expansion.

The growth medium segment is emerging at the fastest pace, with a CAGR of 15.8% during the forecast period. This development is attributed to innovations in sustainable materials like coconut coir and rockwool, which offer superior water retention and aeration properties. Companies like Grodan specialize in rockwool substrates, which are widely used in large-scale hydroponic operations due to their durability and reusability. The increasing focus on reducing plastic waste has further accelerated the adoption of biodegradable growth mediums. A report by the Environmental Protection Agency states that transitioning to sustainable substrates could reduce agricultural plastic waste. Apart from these, the versatility of growth mediums in supporting diverse crops, from leafy greens to berries, positions them as a key driver of market growth.

By Aggregate Hydroponics Systems Insights

The closed hydroponic systems segment dominated the North American market by accounting for a substantial share in 2024. This prevalence is credited to their water efficiency and ability to recycle nutrients, addressing critical environmental concerns. According to the World Resources Institute, closed systems reduce water consumption compared to open systems, making them ideal for arid regions like California and Arizona. Companies like Plenty utilize closed-loop systems to achieve zero water wastage, aligning with sustainability goals. The ability to control nutrient concentrations precisely also enhances crop quality. Furthermore, the rising adoption of vertical farming, where space optimization is crucial, has bolstered demand for closed systems.

The open hydroponic systems category is the fastest-growing, with a CAGR of 12.5%. This expansion is caused by their cost-effectiveness and simplicity, making them accessible to small-scale farmers and hobbyists. Like, open systems require lower initial investment compared to closed systems, enabling broader adoption. Innovations in drip irrigation technology have enhanced their efficiency, reducing water wastage. Apart from these, the increasing focus on rural agricultural development has spurred demand for open systems, as they are easier to implement in remote areas. A report by the Canadian Greenhouse Conference shows that over 40% of new hydroponic ventures in rural regions opt for open systems, underscoring their growth potential.

COUNTRY ANALYSIS

KEY MARKET PLAYERS

Major Players dominating the market are Argus Control Systems, Koninklijke Philips NV, Greentech Agro LLC, Logiqs B.V., and Lumigrow, Inc. These are some of the market players dominating the North American hydroponics market.

Top Players In the Market

Aero Farms is a trailblazer in indoor vertical farming, leveraging aeroponics, a subset of hydroponics, to revolutionize agriculture. Based in New Jersey, the company focuses on sustainable practices by eliminating pesticides and reducing water usage through innovative systems. AeroFarms has made significant contributions to global food security by supplying fresh produce to urban areas while minimizing environmental impact.

Plenty Unlimited Inc.

Plenty is at the forefront of redefining farming with its high-tech indoor farms designed to maximize yield and quality. The company’s emphasis on automation and AI-driven systems allows for precise control over growing conditions, ensuring consistent crop production. Plenty’s focus on sustainability and scalability has enabled it to cater to both local and international markets, making it a key contributor to the global hydroponics industry.

Bright Farms

Bright Farms specializes in hydroponic greenhouse farming, producing leafy greens and herbs for supermarkets across North America. By prioritizing local production, the company minimizes transportation emissions while delivering fresher produce. BrightFarms’ partnerships with major retailers underscore its role in promoting sustainable agriculture.

Top Strategies Used By Key Market Participants

Strategic Partnerships and Collaborations

Key players in the North American hydroponics market are increasingly forming alliances with technology providers and retailers to enhance their operational capabilities. For instance, collaborations with IoT and AI companies enable growers to integrate advanced monitoring systems into their farms. These partnerships help streamline processes such as nutrient delivery and climate control, improving efficiency and scalability.

Expansion of Product Portfolios

Diversification is another critical strategy adopted by leading firms. Companies are expanding their product offerings to include a wider variety of crops, from leafy greens to exotic fruits. This diversification caters to evolving consumer preferences and opens new revenue streams. Additionally, investing in modular hydroponic kits for home growers broadens market reach beyond commercial applications, fostering brand loyalty and long-term growth.

Sustainability Initiatives

Sustainability remains a cornerstone of competitive strategies in the hydroponics sector. Market leaders are adopting eco-friendly practices, such as using renewable energy sources and biodegradable materials, to reduce their carbon footprint. These initiatives resonate with environmentally conscious consumers and regulatory bodies, enhancing brand reputation.

COMPETITION OVERVIEW

The North American hydroponics market is characterized by intense competition, driven by innovation and a growing emphasis on sustainability. Leading players like AeroFarms, Plenty, and BrightFarms dominate the landscape, leveraging cutting-edge technologies to optimize yields and reduce resource consumption. The market also witnesses participation from smaller startups and regional players, contributing to a dynamic ecosystem. Companies are increasingly focusing on differentiation through unique value propositions, such as organic certifications and localized production. Strategic R&D investments enable firms to stay ahead of technological advancements, while partnerships with retailers ensure market penetration.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Aero Farms announced the construction of a new vertical farm in Virginia, aimed at expanding its East Coast presence and meeting rising demand for locally grown produce.

- In June 2023, Plenty Unlimited Inc. partnered with Albertsons Companies to supply hydroponically grown greens to over 2,000 stores nationwide, enhancing its retail distribution network.

- In August 2023, Bright Farms launched a sustainability initiative focused on achieving net-zero emissions across all its greenhouse operations, reinforcing its commitment to eco-friendly practices.

- In October 2023, Gotham Greens opened a state-of-the-art hydroponic facility in Chicago, marking its entry into the Midwest market and increasing its production capacity for leafy greens.

- In December 2023, Freight Farms introduced a new line of modular hydroponic kits designed for home growers, expanding its customer base beyond commercial farmers and tapping into the urban gardening trends.

MARKET SEGMENTATION

This market research report on the North American hydroponics market is segmented and sub-segmented into the following categories.

By Equipment Insights

- HVAC

- LED Grow Light

- Communication Technology

- Irrigation Systems

- Material Handling

- Control Systems

By Type Insights

- Aggregate & Liquid

By Crop Type Insights

- Tomato

- Lettuce & Leafy Vegetables

- Cucumber

- Pepper & Strawberry

By Input Type Insights

- Nutrients

- Growth Medium

By Aggregate Hydroponics Systems Insights

- Closed Systems

- Open Systems

By Liquid Hydroponic Systems Insights

- Nutrient Film Technique (NFT)

- Floating Hydroponics

- Aeroponics

By Closed Systems Insights

- The Water Culture System

- The EBB and Flow System

- Drip Systems

- The Wick System

By Country

- The U.S

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What is driving the growth of the hydroponics market in North America?

Rising demand for locally grown produce, limited arable land, and advancements in controlled environment agriculture are key growth drivers.

Which crops are most commonly grown using hydroponics in North America?

Leafy greens like lettuce, spinach, and herbs, along with tomatoes, cucumbers, and strawberries, are most common.

Who are the major players in the North American hydroponics industry?

Companies like AeroFarms, BrightFarms, Freight Farms, and Gotham Greens lead the market.

What challenges does the hydroponics industry face in North America?

High initial setup costs, technical knowledge requirements, and energy consumption are major challenges.

Is the North American hydroponics market expected to grow in the future?

Yes, it's expected to grow steadily due to increasing urban farming trends and demand for sustainable agriculture solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com