North America Medical Waste Management Market Size, Share, Trends & Growth Forecast Report By Treatment Site (Onsite [Collection, Treatment, Recycling, Others], Offsite [Collection, Treatment, Recycling, Others]), Treatment Type (Incineration, Autoclaving, Chemical Treatment, Others), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Medical Waste Management Market Size

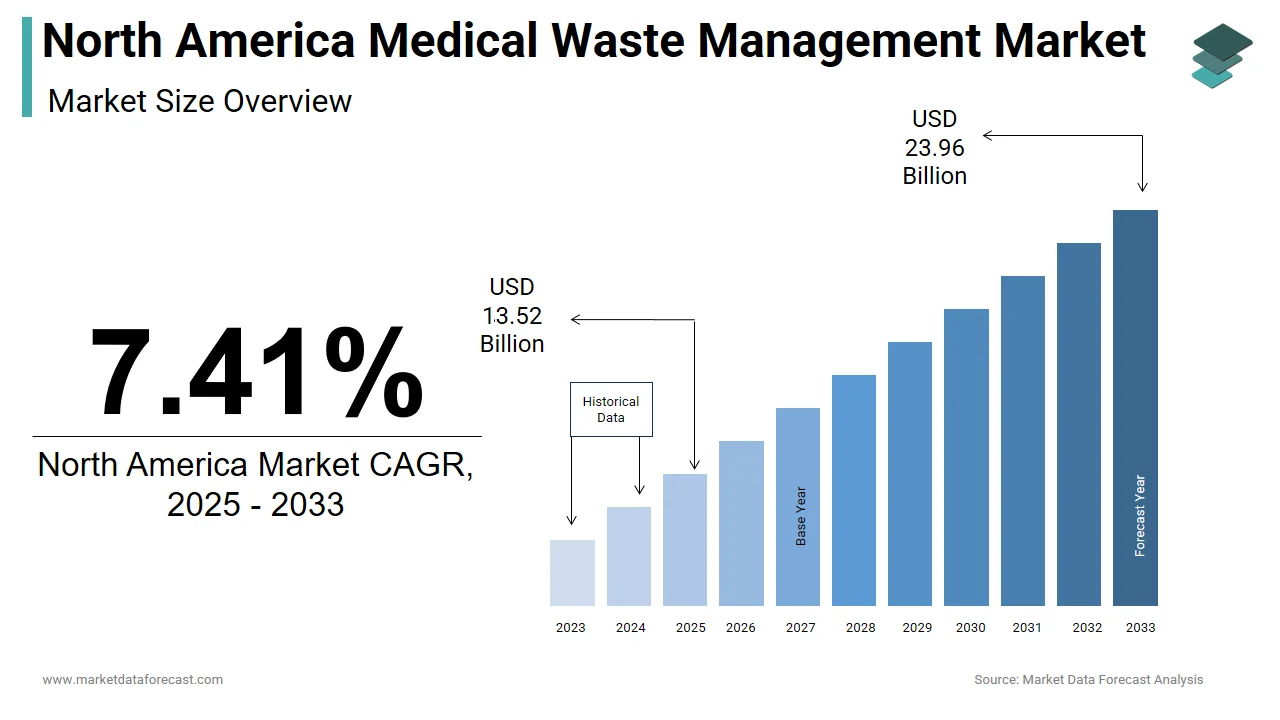

The size of the North America medical waste management market was worth USD 12.59 billion in 2024. The North America market is anticipated to grow at a CAGR of 7.41% from 2025 to 2033 and be worth USD 23.96 billion by 2033 from USD 13.52 billion in 2025.

The North America medical waste management market includes services and technologies designed to handle, treat, transport, and dispose of waste generated by healthcare facilities including hospitals, clinics, laboratories, and research centers. This waste includes infectious, pathological, sharps, pharmaceutical, and chemical materials that pose significant health and environmental risks if not managed properly.

Medical waste is subject to stringent regulatory frameworks such as the Medical Waste Tracking Act in the U.S. and the Canadian Environmental Protection Act in Canada, which mandate safe handling practices and proper documentation throughout the waste lifecycle. In addition, rising public awareness regarding biohazard exposure and contamination has prompted both government and private stakeholders to invest in advanced treatment methods like autoclaving, incineration, and chemical disinfection.

Moreover, the post-pandemic surge in biomedical waste generation, particularly from disposable personal protective equipment (PPE), testing kits, and vaccination programs, has further intensified pressure on waste management systems. These developments have reinforced the importance of efficient and environmentally responsible waste management strategies across the region.

MARKET DRIVERS

Increasing Healthcare Activities and Hospitalization Rates

The growing volume of healthcare activities, including hospital admissions, surgical procedures, and diagnostic testing, is driving the North America medical waste management market.

According to the American Hospital Association, in 2023, U.S. hospitals conducted over 52 million inpatient stays and more than 55 million surgical procedures, which significantly contributes to the generation of regulated medical waste. Each procedure typically produces between 2 to 4 kilograms of medical waste, necessitating robust and compliant disposal mechanisms.

In Canada, the situation mirrors similar trends. As per the Canadian Institute for Health Information, in 2023, over 15 million patient visits were recorded in emergency departments nationwide, alongside a steady increase in outpatient treatments and laboratory diagnostics. These activities generate substantial quantities of infectious and hazardous waste, including used syringes, gloves, gowns, and contaminated swabs, all of which require specialized handling and processing.

In addition, the expansion of ambulatory care centers, long-term care facilities, and home healthcare services has broadened the sources of medical waste beyond traditional hospitals. These factors collectively drive the demand for structured and scalable medical waste management solutions across North America.

Stricter Regulatory Frameworks and Compliance Requirements

A key factor fueling growth in the North America medical waste management market is the enforcement of increasingly stringent regulations governing waste handling and disposal.

In the United States, the Occupational Safety and Health Administration (OSHA) mandates strict guidelines under its Bloodborne Pathogens Standard, ensuring that all healthcare facilities implement comprehensive exposure control plans and use certified waste handlers.

Similarly, in Canada, Environment and Climate Change Canada enforces rigorous standards under the Canadian Environmental Protection Act, which requires all provinces to maintain detailed tracking and reporting systems for medical waste transportation and disposal. As per a 2023 report from Health Canada, provincial governments imposed over $12 million in fines related to improper waste handling, reinforcing the necessity for healthcare providers to engage licensed and compliant waste management service providers.

Furthermore, state and provincial authorities are increasingly adopting digital waste tracking systems to enhance transparency and accountability.

MARKET RESTRAINTS

High Costs Associated with Proper Medical Waste Disposal

The most significant restraints affecting the North America medical waste management market is the high cost associated with compliant and secure disposal methods. These wastes require specialized handling, packaging, transportation, and treatment to ensure safety and regulatory compliance.

For smaller healthcare facilities such as clinics and independent laboratories, these expenses can represent a considerable financial burden. The American Medical Association noted in 2023 that a notable portion of independent physician offices struggled to allocate sufficient budgets for medical waste management, often leading to improper segregation or unauthorized disposal practices. This issue is particularly acute in rural areas where access to certified waste haulers is limited, forcing providers to travel longer distances and incur higher transportation costs.

Moreover, fluctuations in energy prices impact the operational costs of waste treatment facilities, especially those relying on incineration and autoclaving. So, these economic pressures constrain market growth and deter small-scale players from entering the industry, limiting overall expansion potential.

Lack of Awareness and Improper Waste Segregation Practices

Many healthcare facilities in North America continue to struggle with inadequate awareness and poor waste segregation practices, which hinder the efficiency of medical waste management efforts.

In Canada, a 2023 audit by the Ontario Ministry of the Environment found that over 30% of healthcare institutions failed to meet provincial waste segregation standards, with common mistakes including the mixing of general waste with biohazardous material and improper labeling of sharps containers. These lapses not only increase the volume of waste requiring specialized disposal but also expose staff and waste handlers to preventable hazards.

Educational gaps among frontline healthcare workers remain a persistent challenge. As per the Canadian Nurses Association, only 55% of nursing staff received formal training on medical waste handling protocols in 2023, indicating a need for improved institutional education programs.

MARKET OPPORTUNITIES

Adoption of Advanced Waste Treatment Technologies

The increasing adoption of advanced waste treatment technologies presents a major opportunity for growth in the North America medical waste management market. Traditional methods such as incineration are being supplemented or replaced by innovative alternatives like microwave treatment, plasma gasification, and chemical disinfection, which offer greater environmental sustainability and reduced emissions.

One example is the widespread implementation of mobile sterilization units, which allow on-site waste decontamination before transportation, reducing logistical complexities and lowering overall costs.

In the U.S., the Environmental Protection Agency has actively promoted the shift away from incineration due to concerns about dioxin emissions and air pollution. Similarly, in Canada, the British Columbia Centre for Disease Control backs the use of hydrogen peroxide vapor technology for treating infectious waste, citing its effectiveness and minimal ecological footprint.

Expansion of E-Waste and Biomedical Waste Recycling Programs

Another emerging opportunity in the North America medical waste management market is the growing emphasis on recycling and resource recovery from biomedical and electronic healthcare waste. Hospitals and laboratories are increasingly producing e-waste from outdated diagnostic equipment, monitors, and other electronic devices, which contain valuable metals and components that can be reclaimed through specialized recycling processes.

Like, North America contributed notably to global e-waste generation, with a significant portion originating from healthcare institutions. Recognizing this trend, several states and provinces have introduced extended producer responsibility (EPR) policies to encourage the recycling of medical electronics. For example, the California Department of Resources Recycling and Recovery reported that over 150 hospitals in the state participated in certified e-waste recycling programs in 2023, diverting thousands of tons from landfills.

Simultaneously, biomedical waste recycling, particularly for plastics and glass items that do not pose contamination risks, is gaining traction. Companies such as Stericycle and SUEZ have launched dedicated programs to recover and process materials from non-infectious medical waste streams.

This evolving focus on circular economy principles is reshaping how medical waste is perceived,not just as a liability, but as a potential source of reusable materials, opening new avenues for market participants.

MARKET CHALLENGES

Regulatory Fragmentation Across States and Provinces

One of the most pressing challenges facing the North America medical waste management market is the inconsistency in regulatory frameworks across different jurisdictions. While federal agencies such as the Environmental Protection Agency and Health Canada provide overarching guidelines, individual states and provinces implement their own specific rules regarding waste categorization, permitted treatment methods, and record-keeping requirements. To address this issue, industry stakeholders are advocating for greater harmonization of regulations. However, until uniform standards are adopted, regulatory divergence will remain a significant barrier to market consolidation and operational efficiency.

Rising Incidence of Non-Compliant Waste Disposal Practices

Instances of non-compliant medical waste disposal continue to plague the North America medical waste management market. A combination of cost-cutting measures, lack of enforcement, and insufficient monitoring has led to cases of illegal dumping, improper segregation, and unlicensed waste transportation.

A major concern is the rise of informal waste collection networks, particularly in rural and underserved areas, where healthcare facilities may opt for cheaper, unregulated disposal options. As per the Canadian Medical Association Journal, in 2023, approximately 12% of small clinics admitted to using unauthorized third-party haulers to reduce costs, increasing the risk of exposure to harmful pathogens.

These violations not only undermine public health and environmental protection efforts but also create unfair competition for legitimate waste management firms. Strengthening enforcement mechanisms, increasing penalties, and improving transparency in waste tracking systems are essential to mitigating this persistent challenge.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Treatment Site, Treatment Type, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

REMONDIS SE & Co. KG, Republic Services, Inc., Sharp Compliance, Inc., Stericycle, Inc., Suez Environment, Veolia, Waste Management, Inc., Clean Harbors, Inc., BioMedical Waste Solutions, LLC, Daniels Sharpsmart, Inc., and Others. |

SEGMENTAL ANALYSIS

By Treatment Site Insights

The offsite treatment segment commanded the North America medical waste management market, accounting for 68.2% of total market share as of 2024. This dominance is primarily attributed to the high volume of waste generated by large healthcare institutions such as hospitals and research centers that rely on specialized offsite facilities for safe and compliant disposal.

A key factor driving this segment’s growth is the complexity and cost associated with maintaining on-site treatment infrastructure. Like, only a small share of U.S. hospitals had fully operational autoclave or microwave-based sterilization units on their premises due to capital investment requirements and maintenance challenges. As a result, most facilities prefer outsourcing to licensed third-party treatment providers equipped with advanced processing technologies. Moreover, regulatory mandates play a crucial role in reinforcing off-site treatment as the preferred approach.

The onsite treatment segment is currently the fastest-growing within the North America medical waste management market, projected to expand at a CAGR of 9.1%. This rapid growth is driven by increasing adoption among small and mid-sized healthcare facilities seeking greater control over waste handling processes while reducing transportation costs and compliance risks.

A major contributing factor is the advancement in compact and energy-efficient sterilization technologies. These are particularly attractive to rural clinics and urgent care centers that face logistical challenges in accessing regular waste haulers.

Moreover, onsite treatment aligns with growing sustainability goals within the healthcare sector. The American Hospital Association noted that in 2023, more than 100 hospitals integrated point-of-care sterilization into their green initiatives to reduce carbon footprints associated with long-distance waste transport. In parallel, Canadian provinces like British Columbia introduced incentive programs encouraging private clinics to adopt decentralized waste processing solutions, further accelerating the expansion of the onsite treatment segment.

By Treatment Type Insights

The autoclaving segment remained at the forefront of the North America medical waste management market, capturing 42.1% of total revenue in 2024. It remained the most widely adopted non-incineration method due to its effectiveness in sterilizing infectious waste using high-pressure steam without generating harmful emissions.

Spearheading the market, this segment benefits from the increasing preference for environmentally friendly alternatives to incineration.

Like many hospitals phased out traditional incinerators in favor of autoclaves to comply with federal air quality standards aimed at reducing dioxin emissions. Additionally, the World Health Organization has endorsed autoclaving as a safer and more sustainable option for treating sharps and contaminated textiles.

Furthermore, technological advancements have made autoclaves more efficient and accessible. The Healthcare Environmental Resource Center noted that mobile and modular autoclave systems accounted for nearly 30% of new installations, especially in outpatient clinics and laboratories that require flexible waste processing solutions. In Canada, provincial health authorities mandated the use of autoclaving for certain categories of regulated medical waste, reinforcing its widespread adoption across healthcare settings.

Apart from these, the integration of automated monitoring systems allows for real-time tracking of temperature and pressure levels during the sterilization process, enhancing safety and compliance.

The chemical treatment segment is expected to expand at the highest CAGR of 10.4% during the forecast period. This growth is largely attributed to the rising demand for low-energy, non-thermal disinfection methods that can effectively neutralize pathogens without requiring complex infrastructure.

The market is being significantly influenced by the increasing application of chemical disinfectants in small-scale and decentralized healthcare settings. According to the Healthcare Environmental Resource Center, over 350 urgent care centers and dental offices adopted liquid chemical treatment systems to manage biohazardous waste on-site, eliminating the need for costly transportation and external processing.

In addition, advancements in formulation technology have led to the development of eco-friendly and biodegradable disinfectants that align with sustainability goals. Several companies introduced chlorine-free, hydrogen peroxide-based solutions that degrade safely after use, addressing concerns about residual chemical discharge.

In Canada, Health Canada supported the adoption of chemical treatment through revised regulatory frameworks that recognize its suitability for certain waste types. These developments collectively reinforce the strong growth trajectory of the chemical treatment segment in the medical waste management landscape.

COUNTRY-WISE ANALYSIS

The United States accounted for the largest share of the North America medical waste management market, representing 76.4% of regional revenue in 2024. As the global leader in healthcare expenditure, the U.S. generates vast quantities of medical waste annually, necessitating robust and compliant disposal mechanisms across thousands of hospitals, clinics, and research institutions.

A critical force shaping the market is the sheer scale of healthcare activity. According to the American Hospital Association, in 2023, U.S. hospitals high volume inpatient stays and more than 55 million surgical procedures, all of which contributed significantly to regulated medical waste volumes. The Centers for Disease Control and Prevention also reported a rise in outpatient diagnostics and vaccination campaigns, further intensifying waste generation.

Regulatory enforcement plays a critical role in shaping the industry. The Occupational Safety and Health Administration mandates strict adherence to bloodborne pathogens standards, compelling healthcare providers to engage licensed waste handlers. Besides, the Environmental Protection Agency continues to promote non-incineration treatment technologies, influencing a shift toward autoclaving and chemical disinfection.

Technological innovation and private-sector participation further bolster the U.S. market.

Canada ranked just behind the US in market share. The country’s well-developed healthcare system, coupled with stringent environmental policies, supports a structured and highly regulated approach to managing medical waste.

Healthcare activity in Canada contributes significantly to waste generation. Environmental and public health agencies actively enforce medical waste regulations. Health Canada, in collaboration with provincial authorities, mandates detailed tracking and reporting of waste movement. The Ontario Ministry of the Environment noted in 2023 that all Class A medical waste generators must submit quarterly compliance reports, ensuring transparency and accountability.

In addition, Canada has been proactive in adopting alternative treatment technologies. The British Columbia Centre for Disease Control endorsed hydrogen peroxide vapor treatment as a safer alternative to incineration, prompting several hospitals to transition accordingly. Moreover, Environment and Climate Change Canada promotes biomedical recycling initiatives, supporting the recovery of plastics and metals from non-infectious waste streams.

Mexico represents a key contributor to the North America medical waste management market. While smaller in scale, its market is gradually expanding due to increased healthcare spending, urbanization, and growing awareness of biohazard risks.

A key driver of market growth is the expansion of the public and private healthcare sectors. Additionally, government investments in new medical facilities, particularly in underserved regions, have contributed to higher volumes of regulated medical waste.

However, regulatory enforcement remains inconsistent across states. Despite these challenges, private sector involvement is increasing. Companies such as SUEZ and local firms have expanded operations to offer integrated waste handling services, including secure transportation and compliant treatment.

MARKET KEY PLAYERS

Companies playing a dominant role in the North America medical waste management market profiled in this report are REMONDIS SE & Co. KG, Republic Services, Inc., Sharp Compliance, Inc., Stericycle, Inc., Suez environment, Veolia, Waste Management, Inc.,Clean Harbors, Inc., BioMedical Waste Solutions, LLC, Daniels Sharpsmart, Inc., and Others.

TOP LEADING PLAYERS IN THE MARKET

Stericycle, Inc.

Stericycle is a global leader in medical waste management and holds a dominant position in North America. The company provides comprehensive services including collection, transportation, treatment, and disposal of regulated medical waste. Known for its extensive service network and compliance expertise, Stericycle serves thousands of healthcare facilities across the U.S. and Canada. Its commitment to sustainability, regulatory adherence, and innovation has set industry benchmarks. The company also offers consulting and training services to help clients meet federal and state-level waste handling requirements.

Waste Management, Inc.

Waste Management is one of the largest environmental solutions providers in North America and plays a crucial role in the medical waste management sector. While primarily known for municipal waste, the company has expanded into specialized healthcare waste handling through dedicated divisions. Waste Management integrates medical waste processing with broader environmental services, offering secure, compliant, and sustainable disposal solutions. Its strong logistics infrastructure and investment in alternative treatment technologies reinforce its market presence and long-term growth potential.

Clean Harbors, Inc.

Clean Harbors is a leading provider of environmental, hazardous waste, and industrial cleaning services, with a strong foothold in the medical waste management segment. The company operates an extensive network of treatment and disposal facilities across North America, ensuring safe handling of biohazardous materials. Clean Harbors emphasizes innovation by investing in advanced sterilization and recycling technologies. Its acquisition strategy and ability to serve both public and private healthcare sectors have solidified its reputation as a key player in the region’s medical waste management landscape.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Expansion Through Strategic Acquisitions

Major players are actively acquiring regional medical waste management firms to enhance their geographic reach and service capabilities. These acquisitions allow companies to integrate smaller operators into their established networks, improving efficiency and customer retention while strengthening their competitive edge in localized markets.

Investment in Sustainable Treatment Technologies

To align with evolving environmental regulations and corporate sustainability goals, leading firms are investing heavily in non-incineration treatment methods such as autoclaving, chemical disinfection, and microwave sterilization. These technologies offer safer, more eco-friendly alternatives that reduce emissions and support circular economy initiatives.

Digital Integration and Compliance Management Systems

Companies are increasingly adopting digital platforms to streamline waste tracking, documentation, and reporting processes. Advanced software tools provide real-time monitoring of waste movement, regulatory compliance updates, and customized client dashboards, enhancing transparency and operational efficiency for both service providers and healthcare institutions.

COMPETITION OVERVIEW

The competition in the North America medical waste management market is highly consolidated yet dynamic, shaped by the dominance of large multinational corporations and the growing influence of regional players. Industry leaders such as Stericycle, Waste Management, and Clean Harbors maintain a strong presence due to their expansive infrastructure, regulatory expertise, and diversified service offerings. These companies continuously invest in technology upgrades, compliance training, and customer engagement strategies to reinforce their market positions.

At the same time, mid-sized and local firms are leveraging cost-effective operations and niche service models to capture market share, particularly in underserved or rural areas where national providers may lack accessibility. The increasing demand for sustainable and environmentally responsible waste handling has intensified product differentiation efforts, with many companies introducing green-certified disposal options and transparent waste tracking systems.

Regulatory pressures and rising awareness around biohazard safety further shape competitive dynamics, compelling firms to adapt quickly to changing compliance standards and consumer expectations. As healthcare activity expands across the region, competition will likely intensify, driven by technological advancements, strategic expansions, and a growing emphasis on integrated, end-to-end waste management solutions tailored to diverse institutional needs.

RECENT MARKET DEVELOPMENTS

- In January 2024, Stericycle launched a new digital compliance platform designed to provide healthcare clients with real-time tracking of medical waste shipments, improving transparency and simplifying regulatory reporting processes.

- In March 2024, Waste Management announced a strategic partnership with a biotech firm to pilot a program that converts treated medical plastic waste into raw materials for manufacturing, supporting circular economy goals.

- In June 2024, Clean Harbors acquired a regional medical waste processor in the Midwest United States, expanding its footprint and enhancing its capacity to serve small and medium-sized healthcare providers.

- In August 2024, Stericycle introduced a mobile autoclave service targeting rural clinics and urgent care centers, allowing on-site sterilization before final disposal, reducing logistical complexities and costs.

- In October 2024, Waste Management unveiled a new medical waste treatment facility in British Columbia, equipped with automated sorting and non-thermal disinfection technologies to improve efficiency and environmental performance.

MARKET SEGMENTATION

This research report on the North America medical waste management market is segmented and sub-segmented into the following categories.

By Treatment Site

- Onsite

- Collection

- Treatment

- Recycling

- Others

- Offsite

- Collection

- Treatment

- Recycling

- Others

By Treatment Type

- Incineration

- Autoclaving

- Chemical treatment

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. Which countries are included in the North America Medical Waste Management Market?

The market covers the United States, Canada, and Mexico, with the U.S. holding the largest share due to stringent regulations and advanced healthcare infrastructure

2. What are the main types of waste managed in the North America Medical Waste Management Market?

The market handles hazardous and non-hazardous waste, including sharps, anatomical, microbiological, pharmaceutical, and general healthcare waste

3. How do digital platforms and technology impact the North America Medical Waste Management Market?

Digital solutions enable real-time waste tracking, automated compliance reporting, and efficient scheduling, improving transparency and regulatory adherence

4. What are the key trends shaping the North America Medical Waste Management Market?

Trends include rising adoption of digital tracking, focus on sustainability and recycling, and technological innovation in waste treatment and reduction

5. What are the main challenges facing the North America Medical Waste Management Market?

Challenges include high disposal costs, complex regulatory compliance, need for specialized infrastructure, and training for safe handling of medical waste

6. Who are the leading companies in the North America Medical Waste Management Market?

Major players include Stericycle, Suez, Veolia Environnement, BioMedical Waste Solutions, and Daniels Sharpsmart, among others

7. What role do hospitals play in the North America Medical Waste Management Market?

Hospitals are the largest waste generators, requiring comprehensive waste management services for a variety of hazardous and non-hazardous materials

8. What innovations are emerging in the North America Medical Waste Management Market?

Innovations include advanced incineration, automated waste segregation, digital compliance tools, and waste-to-energy conversion technologies

9. What opportunities exist for growth in the North America Medical Waste Management Market?

Opportunities include digital platform integration, sustainable waste solutions, expansion into smaller healthcare and retail sectors, and partnerships for eco-friendly services

10. Who are the primary generators of medical waste in North America?

Hospitals, clinics, laboratories, blood banks, pharmaceutical companies, and research facilities are major sources of medical waste

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com