Global Orthobiologics Market Size, Share, Trends & Growth Forecast Report By Product (Viscosupplementation, Demineralized Bone Matrices, Synthetic Orthobiologics, Bone Morphogenic Protein, Allografts, Plasma-Rich Protein and Bone Marrow Aspirate Concentrate), Application (Osteoarthritis and Degenerative Arthritis, Spinal Fusion, Fracture Recovery, Soft Tissue Injuries and Maxillofacial & Dental Applications), End Users and Region (North America, Europe, APAC, Latin America, Middle East and Africa) - Industry Analysis from 2025 to 2033.

Global Orthobiologics Market Size

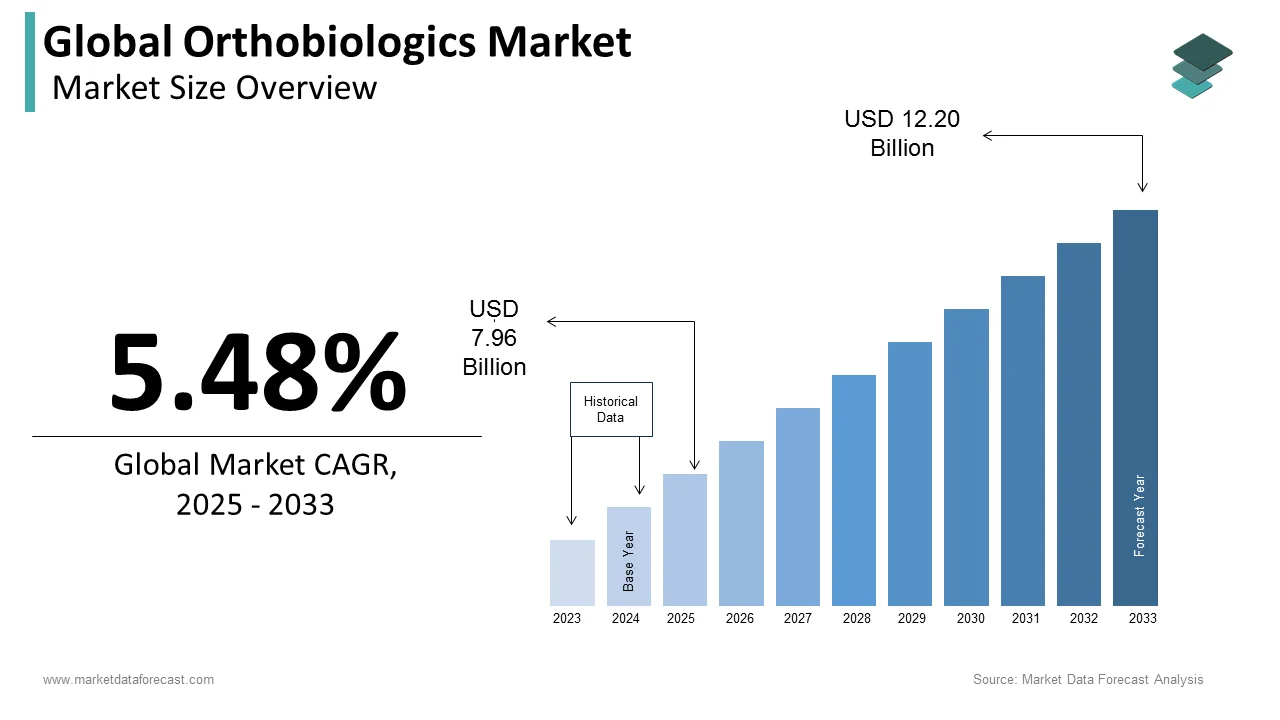

The size of the global orthobiologics market was worth USD 7.55 billion in 2024. The global market is anticipated to grow at a CAGR of 5.48% from 2025 to 2033 and be worth USD 12.20 billion by 2033 from USD 7.96 billion in 2025.

MARKET DRIVERS

Rising mechanical advancements in biomaterials utilized as a part of the generation of orthobiologics are predicted to drive the market during the forecast period.

The global orthobiologics market is further expected to grow in the future years as patient awareness of various orthopedic and chronic conditions increases, as well as the availability of effective and appropriate orthobiologics products. The growing geriatric population provides an abundance of chances for orthobiologics manufacturers. Amputations are commonly caused by age-related disorders such as osteoarthritis, musculoskeletal ailments, spine deformity, etc. Increased accident rates due to urbanization are another important cause that is likely to open up numerous opportunities for orthobiologics makers.

Many multinational corporations are focusing on orthobiologics product advancements. Furthermore, ortho biologics' numerous beneficial qualities have lately been utilized in medical science. The worldwide orthobiologics market is experiencing substantial expansion due to rising demand for cost and time-efficient products. The orthobiologics market is expected to be driven by recent advancements and expanding healthcare explorations over the forecast period.

MARKET RESTRAINTS

However, complex synthesization processes, regulations for manufacturing, and expensive production costs hinder the market a little. Other significant factors restricting the growth of this market are the high costs and inadequate reimbursements for orthobiologics products and procedures. The high pricing of orthobiologics procedures and product is one of the significant challenges to the growth of the global orthobiologics market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Medtronic, DePuy Synthes, Zimmer Biomet, Bioventus, Stryker, Harvest Technologies, Globus, Orthofix International, RTI Surgical, K2M Group, Kuros Biosciences |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the market for orthobiologics was dominated by viscosupplementation in 2024. The significant proportion is related to the widespread availability and extraordinary adoption of these medicines in conditions including osteoarthritis and degenerative hip joint. The advantages of viscosupplementation are thought to cause a high adoption rate. These advantages include improved knee mobility, pain relief, reduced invasiveness, and fewer adverse effects. It is also assumed that this is due to the tremendous demand for minimally invasive surgical treatments and the patient population's high acceptability of these techniques.

By Application Insights

Spinal fusion accounted for a majority share of over 50% in the application segment. Penetration of demineralized bone matrices, bone morphogenetic proteins, autografts, and allografts in spinal fusion surgeries boosts the market's growth.

The benefits of orthobiological products in spinal fusion, such as rapid stimulation of cells to initiate the bone formation and reduction of the stay duration in the hospital, and reducing visits in the hospital, are believed to be responsible for growing larger share in the application segment. In addition, the share attained by orthobiologics is also believed to be a consequence of third-party insurances for fusion enhancement products, thus increasing growth.

By End-User Insights

Based on the end-user, the Hospitals segment is forecasted to have a significant share in the global orthobiologics market from 2024 to 2033. Increasing the adoption of orthobiological products in a wide range of spinal and reconstructive surgeries performed in hospitals is the main factor contributing the most significant shares to this segment. Specialized patient care and easy availability of a wide range of orthobiologics in hospitals are factors for this segment's growth. High patient turnaround, frequent readmissions, and large procedure volumes contributed to the segment growth. In addition, the supportive infrastructure facilitates accurate operative procedures, which further contribute to the development of the segment.

REGIONAL ANALYSIS

Regionally, the North American orthobiologics market dominated the market for orthobiologics market worldwide in 2024, followed by Europe and the Asia Pacific. The share acquired by this region is due to the presence of a large number of key players, which are involved in promoting quality care and undertaking new product development strategies. In addition, reimbursement available for soft tissue healing and fusion enhancement products contributes significantly to the regional share.

The Asia Pacific orthobiologics market is expected to witness a more significant share of the global market during the forecast period due to the growing number of patients, and the presence of developing nations such as China and India are expected to support the market growth in the region. The development of the orthobiologics market in the APAC region is mainly due to the rising healthcare spending and disposable income and physician awareness levels about these products' benefits. As the Asia Pacific countries are developing, there is an opportunity for the key players to invest. In addition to that heightening healthcare infrastructure quality, the orthobiologics market's growth in this region expands tremendously. With that increasing product launches across this region aside, there is a growing competition between the key players, contributing significantly to the leading growth of orthobiologics in the Asia Pacific.

Bioventus, one of the key players in the orthobiologics market, launched DUROLANE, a hyaluronic acid-based injection, to treat joint-fluid osteoarthritis in Taiwan. The product launch led to the company's geographical presence and increased the product penetration of ortho biological products in the Asia Pacific region. The other factors contributing to this market's growth in the area include the rise in several chronic arthritis, osteoarthritis, and orthopedic conditions. These different factors have led to an increase in demand for orthobiologics in the Asia Pacific region.

KEY MARKET PLAYERS

Companies playing a prominent role in the global orthobiologics market include Medtronic, DePuy Synthes, Zimmer Biomet, Bioventus, Stryker, Harvest Technologies, Globus, Orthofix International, RTI Surgical, K2M Group, and Kuros Biosciences., and Others.

RECENT HAPPENINGS MARKET

- In 2021, DePuy Synthes, a franchise of orthopedic and neurosurgery companies which is part of Johnson & Johnson Medical Devices Group, has signed an agreement with Mountain View, California’s Expanding Innovations Inc. for distributing the Expanding Innovations’ X-Pac Expandable Lumbar Cage System in the U.S. DePuy Synthes is saying that with the help of this product they can offer comprehensive procedural solution within the lumbar degenerative and minimally invasive spine segments.

- In 2021, Orthofix Medical Inc., a global medical device company that provides reconstructive and regenerative orthopedic & spine solutions to physicians, announced the U.S. and European full market launch FITBONE® intramedullary lengthening system for limb lengthening and deformity correction of the femur and tibia bones.

- In 2021, Medtronic PLC, an American domiciled medical device company that generates the majority of its sales and profits from the U.S. healthcare system but is headquartered in the Republic of Ireland for tax purposes, has completed its seventh acquisition by a friendly tender of Medicrea International for their strategic expansion into AI, machine learning and predictive analytics.

MARKET SEGMENTATION

This research report on the global orthobiologics market has been segmented and sub-segmented based on product, application, ens-user, and region.

By Product

- Viscosupplementation

- Demineralized Bone Matrices

- Synthetic Orthobiologics

- Bone Morphogenic Protein

- Allografts

- Plasma-Rich Protein

- Bone Marrow Aspirate Concentrate

By Application

- Osteoarthritis and Degenerative Arthritis

- Spinal Fusion

- Fracture Recovery

- Soft Tissue Injuries

- Maxillofacial & Dental Applications

By End-User

- Hospitals

- Orthopedic Clinics

- Ambulatory Care Centres

- Research and Academic Institutes

- Dental Clinics & Facilities

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

How much is the global orthobiologics market going to be worth by 2033?

The size of the global orthobiologics market size is forecasted to be valued at USD 12.20 Billion by 2033.

Which region is growing the fastest in the global orthobiologics market?

The Asia-Pacific region is predicted to witness the fastest CAGR among all the regions in the global orthobiologics market from 2025 to 2033.

Which segment by product occupied the leading role in the orthobiologics market?

During the forecast period, the viscosupplementation segment by product led the orthobiologics market in 2024.

Who are the major players in the global orthobiologics market?

Medtronic, DePuy Synthes, Zimmer Biomet, Bioventus, Stryker, Harvest Technologies, Globus, Orthofix International, RTI Surgical, K2M Group, and Kuros Biosciences are some of the promising players in the orthobiologics market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]