Global Prebiotic Ingredients Market Size, Share, Trends, & Growth Forecast Report - Segmented By Ingredients (Yeast And Bacteria), Type (Oligosaccharides, Inulin, And Polydextrose), Application (Food & Beverages, Dietary Supplements, And Animal Feed), Source (Roots, Grains, And Vegetables), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Prebiotic Ingredients Market Size

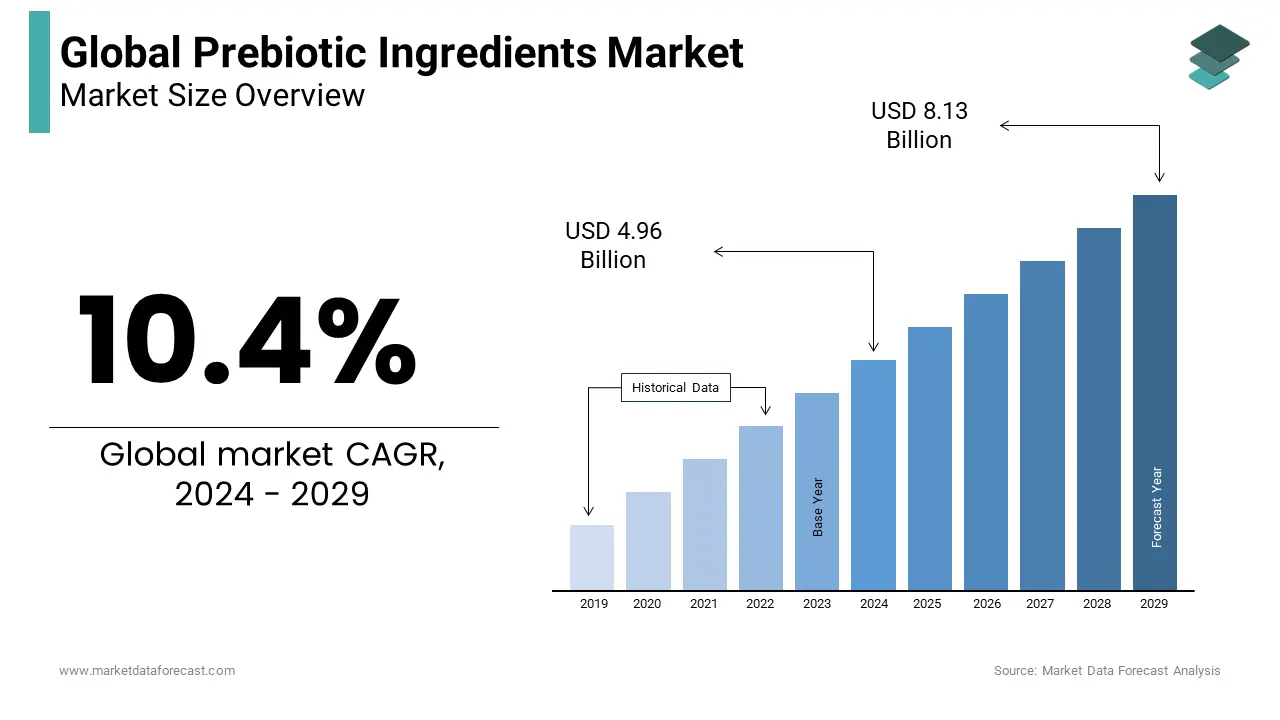

The global prebiotic ingredients market size was expected to be worth USD 4.96 Billion in 2024 and is anticipated to be worth USD 12.09 billion by 2033 from USD 5.48 billion In 2025, growing at a CAGR of 10.40% during the forecast period.

Prebiotics are carbohydrates that are not digested by enzymes and digestive acids, which enhance the growth or activity of beneficial bacteria in the human intestine. They help improve intestinal barrier function, strengthen the immune system, reduce stomach inflammation, increase overall digestive health, minimize the risk of diarrhea, increase calcium absorption, improve bone density, and reduce risk factors of cardiovascular disease. Mannan-oligosaccharides (MOS), inulin, fructose-oligosaccharides (FOS), oligosaccharides, galacto-oligosaccharides (GOS), and polydextrose are various types of prebiotic components beneficial to human and animal health. Prebiotic ingredients treat and prevent a variety of health problems, including antibiotic-related diarrhea, inflammatory bowel disease, visible bowel syndrome, allergic conditions such as allergic rhinitis (hay fever), atopic dermatitis (eczema), colic in babies, and necrotizing enteritis. Low birth weight refers to the terms prebiotics and dietary fiber, which are used instead for eating mechanisms that are not digested by the gastrointestinal tract. Carbohydrates like dietary fiber are possible prebiotics. Prebiotic ingredients affect stomach bacteria by increasing the number of useful anaerobic bacteria and reducing the population of potential pathogenic microorganisms.

MARKET DRIVERS

The growing consumer perception of the health benefits of prebiotics is primarily propelling the growth of the prebiotic ingredients market.

With the growing demand for healthy foods containing prebiotic ingredients, the market for prebiotic ingredients is expected to grow, mainly in the United States and European countries. In keeping with the trend, processed foods are widely consumed, keeping the gut healthy that friendly bacteria need. The bakery and confectionery sector consumes the most emulsifiers, while the meat industry is emerging as a growing segment of the market. Prebiotic ingredients are key ingredients that promote the growth of beneficial bacteria.

The growth of the global market is further driven by the growing consumer awareness of the health benefits of consuming prebiotics increases. These prebiotic ingredients are widely used in digestive health products and provide many benefits related to immunity, weight management, and digestion. Prebiotics can be used to prevent oral health, bacterial vaginosis, and diseases related to the urinary tract. It can also be used to prevent diseases such as respiratory infections, necrotizing enteritis, and intestinal disease. In addition, information on preventive care is available on the Internet, helping to raise awareness. A variety of factors, such as rising disposable income, rising living standards, an aging population, and changing attitudes towards health care, are increasing awareness of preventive care. The risk of developing these diseases is particularly high in the elderly population. Prebiotics have proven to be a safe and readily available measure to prevent the onset of these diseases.

Increased use of prebiotics in poultry feed to improve digestion, performance, and the immune system to enhance the overall productivity of animals and the versatility of prebiotic components. It can be easily integrated into a wide range of foods and beverages. This trend is expected to continue to drive the global prebiotic ingredients market during the forecast period. The demand for these ingredients is mainly due to the increased consumption of the dietary supplement. Prebiotic ingredients are used in food to prevent digestive problems and other health problems. They are beneficial bacteria that are widely used to treat digestive problems, nervous system disorders, and mental illness. Health problems are the result of harmful and busy lifestyles, such as long working hours, mental stress, poor eating habits, excessive food intake, excessive alcohol consumption, and smoking. Prebiotic ingredients are often used in the food industry, such as dairy, confectionery, beverages, processed food, and many other sub-industries. This habit of consumers expecting the growth of the global prebiotic ingredients market. These benefits increase awareness among consumers and drive market growth. Increased intake of prebiotics and fiber-rich functional foods in the food and beverage industry is associated with benefits such as better digestion, less response to stress, better hormonal balance, and a reduction in cardiovascular disease. People are aware of the problems related to health and well-being, and health awareness has become a trend in the region, with the largest number of consumers and food manufacturers that can create huge market opportunities for prebiotic ingredients.

MARKET RESTRAINTS

Despite growing margins in the global prebiotic ingredients market, the high cost required for research on the applicability and safety of prebiotics has limited the market.

American market policy has strict rules. However, structural or functional applications are allowed. Manufacturers and distributors face challenges during production and distribution due to strict laws and regulations. The growing demand for prebiotics may allow more players to enter the market, but the high R&D cost of prebiotic ingredients is likely to limit the scalability of the global prebiotic ingredients market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.4% |

|

Segments Covered |

By Ingredients, Application, Type, Source & Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nestle, Yakult Honsha Co., Ltd, Chr. Hansen Holding A/S, Danone S.A, Arla Foods, Danisco A/S and Lallemand Inc |

SEGMENTAL ANALYSIS

Global Prebiotic Ingredients Market Analysis By Ingredients

The bacteria segment has driven the market and is expected to maintain its privileged position during the forecast period. Bacteria are widely used in applications such as probiotic foods and beverages and dietary supplements to provide health benefits for their guests. Widespread awareness of the bacteria has helped segment market demand in recent years, and this trend is expected to continue throughout the forecast period.

Global Prebiotic Ingredients Market Analysis By Application

The prebiotic food and beverage segment led the market in 2020. The increasing consumption of probiotic products such as yogurt is driving a growing demand for food and beverage applications. Additionally, major industry players are looking to enter into long-term supply agreements to inject proprietary strains into food products at food and beverage companies, especially in regions such as Central and South America.

Global Prebiotic Ingredients Market Analysis By Type

The polydextrose segment is expected to develop with a considerable growth rate in the coming years.

REGIONAL ANALYSIS

Europe recorded the largest share at 35.5% in the global prebiotic ingredients market in 2018, and the region is expected to remain dominant during the forecast period. The presence of leading companies, high awareness related to the use of prebiotics, and easy availability have supported the demand in this area and are foreseen to continue through the outlook period. Germany ranks first in the food service sector in Europe and is one of the main consumers in the market for additives and ingredients, including emulsifiers, in the region. The country's bakery and confectionery sector consumes the majority of emulsifiers, while the meat industry is emerging as a growth segment of the market that is expected to lead the market in the future. The Asia Pacific is expected to become the second-largest market after Europe by 2025. The growing preference for functional foods and rising living standards are expected to benefit the local market in the foreseen years.

KEY MARKET PLAYERS

Nestle, Yakult Honsha Co., Ltd, Chr. Hansen Holding A/S, Danone S.A, Arla Foods, Danisco A/S, and Lallemand Inc. are some of the notable companies in the global prebiotic ingredients market.

RECENT HAPPENINGS IN THE MARKET

- Friesland Campina acquired shares in Best Cheese Corporation, a US manufacturer and supplier of specialty cheeses, in December 2018.

- In October 2016, Cargill announced in the Philippines that it would expand its animal nutrition capabilities to manufacture premixed feed solutions. This has enabled Cargill to meet the growing demand from its domestic customers.

DETAILED SEGMENTATION OF THE GLOBAL PREBIOTIC MARKET INCLUDED IN THIS REPORT

This research report on the global prebiotic market has been segmented and sub-segmented based on ingredients, application, type, source, and region.

By Ingredients

- Yeast

- Bacteria

By Application

- Food & Beverages

- Dietary Supplements

- Animal Feed

By Type

- Oligosaccharides

- Inulin

- Polydextrose

By Source

- Roots

- Grains

- Vegetables

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

1. What are the key factors influencing the choice of prebiotic ingredients by food manufacturers?

Factors such as stability during food processing, taste, texture, and the ability to withstand varying pH levels in the digestive system influence food manufacturers' selection of prebiotic ingredients.

2. How can consumers incorporate more prebiotic ingredients into their diet?

Consumers can include garlic, onions, bananas, asparagus, and chicory root. Additionally, prebiotic supplements are available for those looking to boost their prebiotic intake.

3. What are the health benefits associated with consuming products containing prebiotic ingredients?

Regular consumption of prebiotic ingredients is linked to improved digestive health, enhanced nutrient absorption, and potential immune system support. They may also play a role in managing conditions such as irritable bowel syndrome (IBS).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com