Global Resistant Starch Market Size, Share, Trends & Growth Forecast Report - Segmented by Source (Fruits and Nuts, Grains, and Vegetables), Sources Of Variation, Application, Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis 2025 to 2033

Global Resistant Starch Market Size

The Global Resistant starch market size was valued at USD 10.06 billion in 2024 and the global market size is predicted to reach USD 10.68 billion in 2025 and USD 17.25 billion by 2033, growing at a CAGR of 6.18% during the forecast period.

Resistant starch is a natural fiber that is not absorbed or broken down, converted to fatty acids by intestinal bacteria. The resistant starch is not fully absorbed from the small intestine but is transferred to the large intestine to be fermented by bacteria and create short-chain fatty acids, which are believed to benefit the body in various ways. The resistant starch helps the human body by reducing fat and cholesterol in the blood and by limiting the production of new fat cells, facilitates digestion and insulin sensitivity, keeps the appetite stable helps the body's rehydration process, and improves immunity. Resistant starch is also useful in preventing diseases such as diabetes, cancer, and heart disease, and in enhancing the immune system. The resistant starch includes foods rich in fiber, such as legumes and grains, but it also contains food additives and foods rich in carbohydrates.

MARKET DRIVERS

The driving factors of the global Resistant Starch market are the growing incidence of health problems, increasing population, and rising disposable income. Trends like the rising popularity of cereal bars in common consumers and sportspersons, the introduction of new innovative products, and growth in the awareness of diseases are propelling the demand for resistant starch. Resistant starch assists the body in preventing colon cancer, diagnosing gut pain, and assisting in numerous other disease treatments which is driving its growth in the market.

Starch is a sophisticated type of carbohydrate, which releases glucose during digestion and acts as an energy source for the body. Resistant starch is an indigestible fraction of starch, which causes bacterial fermentation and health benefits due to its low glycemic index and low carbohydrate content.

The increased need for low carbohydrates, gluten, and dietary fiber in baked goods in the Asia Pacific will drive the consumption of resistant starch during the forecast period. In the food industry, starches are mainly used as thickeners, texturizers, and stabilizers in products such as bread, cookies, ice cream, custard, pasta, noodles, etc. slow-digesting starch with resistant starch, which acts as a dietary fiber. It is attracting growing interest from scientists, industry, and consumers due to its use as a dietary fiber and various health benefits, which is expected to stimulate product requirements during the outlook period.

MARKET RESTRAINTS

The resistant starch has a low glycemic index, which makes it a suitable substance to protect people against strokes, hypertension, coronary heart disease, obesity and, in particular, type 2 diabetes. Type 2 diabetes is a concern in everything in the world. According to the International Diabetes Federation (IDF), in 2017, approximately 45.5 million adults ages 20 to 29 had diabetes in the North America and Caribbean region. The figure is supposed to increase by more than a third by 2030. Public health nutrition messages focus on increased fiber intake and further emphasize that the use of resistant starch can lead to better public health outcomes. This, in turn, will facilitate the use of the Resistant Starch market during the outlook period. However, lack of awareness in the developing countries is assumed as the restraining factor for Resistant Starch Market during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2032 |

|

CAGR |

6.18% |

|

Segments Covered |

By Source, Source of variation, type And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Fruits Limited,Ingredion Incorporated, Stawi Foods, Arcadia Biosciences, Tate & Lyle Plc, Penford Corporation, Cargill Foods, MGP Ingredients, Natl. Starch and Chemical Co, Opta Food Ingredients, Inc. |

SEGMENTAL ANALYSIS

By Source Insights

The global resistant starch (RS) market is segmented according to the source from which the product is derived, which includes cereals, vegetables, and others. Cereals are small, hard, dry seeds that are harvested for human consumption. Rice, wheat, and legumes have a higher content of amylose, which is processed to improve the quality of resistant starch. With the increase in cereal production in Asia-Pacific, RS consumption is expected to grow significantly at an impressive rate during the forecast period. Cereals represented more than 45% of all the sources used in the production of RS.

By Source of Variation Insights

In terms of source of variation, Biotechnology, Natural Genetic Variation, Mutations, Environmental Source

By Application Insights

In terms of Application, the resistant starch market is divided into dairy products, baked goods, sweet confectionery, and ready meals. Of these, baked goods will see significant growth due to the increasing demand for natural, healthy, and gluten-free baked goods around the world.

By Type Insights

RSs are divided into Type 1, Type 2, Type 3, Type 4, and Type 5. Of these, Type 3 is widely used in baked goods and will see a steeper 6.4% CAGR incline overtime period. RS type 3 is a retrograde non-granular starch formed by cooling cooked starchy foods such as potatoes, retrograde high amyl cornstarch, corn flakes, and bread crust. It is a highly commercialized type of RS available for consumption that has the highest proportion of applications in the baking industry. With the increasing demand from the bakery industry, product requirements are expected to increase accordingly during the forecast period.

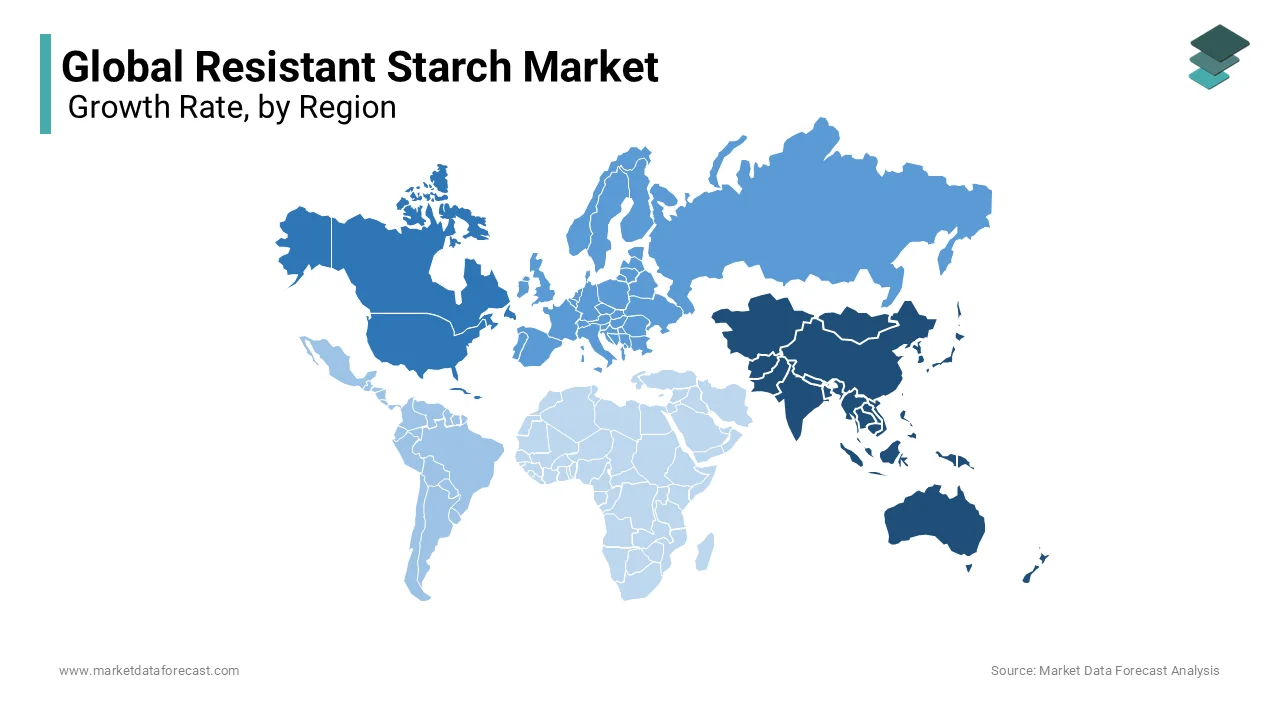

REGIONAL ANALYSIS

The Asia Pacific region accounts for a dominant share of the international marketplace. The global Resistant Starch market has been divided by geography into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa. Of these, The Asia-Pacific region is also home to the most abundant grains and fruits, a necessary factor in increasing Resistant Starch's manufacturing capacity. Increasing the spending capacity of the middle-class population to buy healthy foods high in dietary fiber and gluten-free will complement the consumption of products by 2025. For example, the Chinese food industry booming due to the increased use of dishes prepared. With the rising call for healthy, ready-to-eat foods in North American and European countries, resistant starch is considered an ideal substitute for conventional starch.

KEY MARKET PLAYERS

Major Key Players in the Global Resistant Starch Market are Fruits Limited, Ingredion Incorporated, Stawi Foods, Arcadia Biosciences, Tate & Lyle Plc, Penford Corporation, Cargill Foods, MGP Ingredients, Natl. Starch and Chemical Co, Opta Food Ingredients, Inc.

RECENT HAPPENINGS IN THE MARKET

-

In January 2020, with a focus on sports nutrition and weight management, Chicago-based Lodaat Pharma launched potato prebiotic-resistant starch. The ingredient has been specially developed to increase the production of butyrate in the large intestine. The company targets food and beverage brands with its ingredient PotatoDaat, which contains 78% weight-resistant starch.

-

Archer Daniels Midland Company is proud to announce a long-term partnership with General Starch Limited (GSL), a leading producer of tapioca starch located in Thailand. ADM will have exclusive rights to distribute GSL-modified tapioca starch products in most European countries, as well as in the Middle East and Africa.

-

In December 2019, Archer Daniels Midland Company will expand its starch portfolio through a partnership with IMCD in Canada, which is a leading distributor of specialty chemicals and food ingredients, which will take effect immediately. ADM texture solutions offered products like tapioca starch, corn starch, and tapioca maltodextrin to buyers in the Canadian market, in addition to a range of other ADM solutions.

-

In March 2019, Ingredion Incorporated, one of the world's leading providers of ingredient solutions for various industries, announced that it had acquired the business of Western Polymer, a privately held company in the United States, whose headquarters is located in Moses Lake, Washington. Western Polymer produces modified and native potato starches for food and industrial applications and also sells modified tapioca starch for industrial applications.

-

Megazyme has recently introduced its new test method for resistant starch. Resistant starch (RS) is the part of a carbohydrate that is not broken down by human enzymes in the small intestine. It enters the large intestine where it is partially or fermented. RS is generally considered one of the components that make up the total dietary fiber.

MARKET SEGMENTATION

This research report on the global resistant starch market has been segmented and sub-segmented based on Type, Source, Source of variation, Application & region.

By Source

-

Fruits

-

Nuts

-

Grains

-

Vegetables

By Sources Of Variation

-

Biotechnology

-

Natural Genetic Variation

-

Mutations

-

Environmental Source

By Application

- Beverages

-

Meat

-

Processed Food

-

Confectionary

-

Bakery Products

-

Breakfast Cereal

-

Snack

-

Dairy Products

By Type

-

Type 1

-

Type 2

-

Type 3

-

Type 4

-

Type 5

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East, and Africa

Frequently Asked Questions

1.What is Resistant Starch?

Resistant starch is a type of starch that is not fully digested in the small intestine and behaves more like dietary fiber. It passes through to the large intestine where it can provide various health benefits.

2.What factors are driving the growth of the resistant starch market?

The growth of the resistant starch market is driven by increasing consumer awareness of its health benefits, such as improved digestive health, blood sugar control, and weight management. Additionally, the demand for clean label and natural ingredients in food products is boosting the use of resistant starch as a functional ingredient.

3.Which application segment is expected to dominate the resistant starch market?

The food & beverages application segment is expected to dominate the resistant starch market. Resistant starch is increasingly being used in a variety of food products, including bread, pasta, cereals, snacks, and beverages, to enhance their nutritional profile and texture.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]