Global Seed Processing Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report – Segmented By Type (Seed Treatment, Seed Coating Material), Crop Type (Cereals & Grains, Oilseeds & Pulses, Vegetables, Flowers & Ornamentals), Equipment (Cleaners, Gravity Separators, Seed Treatment, Dryers, Graders, De-Stoners, and Other) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) – Industry Analysis From 2025 to 2033

Global Seed Processing Market Size

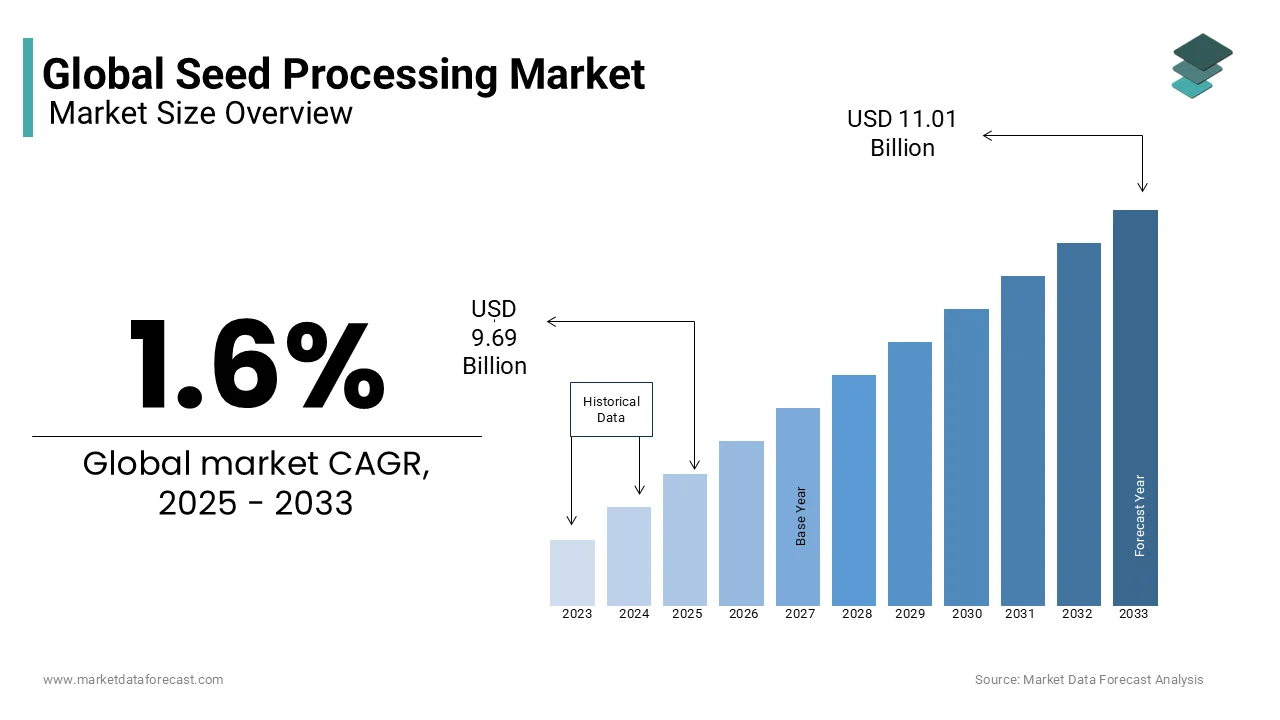

The global seed processing market was expected to be valued at USD 9.54 billion in 2024 and is anticipated to reach USD 9.69 billion in 2025 from USD 11.01 billion by 2033, growing at a CAGR of 1.6% during the forecast period from 2025 to 2033.

Seed processing includes harvesting and processing post harvested seeds to get superior quality seeds with minimal adulteration safe for both farming and consumption purposes. Increasing demand for hybrid seeds due to the rising middle-class population will drive the seed processing market during the forecast period.

Market Drivers

The rising adoption of commercialized seeds owing to the protection offered by germinating seeds and seedlings against soil and seed-borne insects is the primary factor propelling the global seed processing market. The emergence of a cost-effective crop protection solution, enhanced product quality, and improved yield of crops are other factors driving the market growth.

Growing disposable income of the people, increasing demand for high-quality crops, raising awareness among farmers about the benefits of utilizing treated seeds, and increasing demand for agricultural activities may further drive the growth of the seed processing market worldwide. The surge in global population has increased the demand for food production, which is supposed to boost sales in the seed processing market in the coming years.

Market Restraints

The introduction of government regulations to affect the market growth will likely hamper the seed processing market's development in the outlook period. The imposition of rules on crops to restrain the market growth will act as a challenge for seed processing business.

Impact of COVID-19 on the Seed Processing Market

The coronavirus pandemic can affect the production, certification, and distribution remarkably, and cost of seeds, which play a crucial role in developing resilient agricultural sectors and food systems in the least developed countries.

Although most spring and autumn seeds had already arrived in their final country of the target before COVID-19 travel restrictions were put in place, for both developed and emerging countries, it is uncertain whether seeds currently being sowed for the next growing seasons will arrive in time.

Lack of availability and increased cost of transport because of the reduced number of commercial flights; fewer means available for production, transportation, and documentation processes; and a contraction in the market for plants and seeds are creating problems in terms of the production of seed for international trade, as well as access to high-quality seed of modern varieties for domestic agriculture.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.6% |

|

Segments Covered |

By Type, Crop Type, Equipment, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bayer (Germany), BASF (Germany), Cimbria (Denmark), Alvan Blanch Development Company Ltd. (UK), Nufarm (Australia), Lanxess (Germany), Clariant (Switzerland), Incotec (Netherlands), PETKUS Technologie GmbH (Germany), Corteva (US), Syngenta (Switzerland), Sensient Technologies (US), Lewis M. Carter Manufacturing, LLC (US), and WESTRUP A/S (Denmark). |

SEGMENTAL ANALYSIS

Global Seed Processing Market Based On Type

The seed treatment fragment held the dominant portion of the global seed processing market in 2019. In the Asia Pacific nations, particularly in India, farmers are slowly turning towards the advanced seeds of various crops instead of seeds from earlier crops. The increase in demand for hybrid seeds due to the increasing middle-class population, growth in disposable income, and the expansion in the food processing sector are projected to drive the emerging countries across regions. Seed treatment products usually comprise insecticides, bactericides, and fungicides. It offers enhanced crop cultivation at a comparatively low cost compared to spraying, making it one of the preferred treatments for seeds. Therefore, the seed treatment segment is estimated to record significant growth in developing economies in the future.

Global Seed Processing Market Based On Crop Type

The cereals & grains segment accounted for a significant portion of the global market in 2019. Cereals & grains form the staple food products in several countries. It comprises wheat, rice, corn, sorghum, oats, and barley. Of these cereals & grains, rice is consumed as a staple food in many emerging countries. It is primarily consumed in Asia, Africa, Latin America, and the Caribbean. Corn is consumed on a larger scale in the US, with the country being the largest corn producer globally. The rising awareness of the benefits of seed processing, like improved seed germination and security against pathogens, is supposed to accelerate the growth of the cereals & grains segment in this market in the coming years.

Global Seed Processing Market Based On Equipment

The seed processing market is majorly divided into cleaners, gravity separators, seed treatment, de-stoners, dryers, graders, and others (color sorter and dust equipment machines).

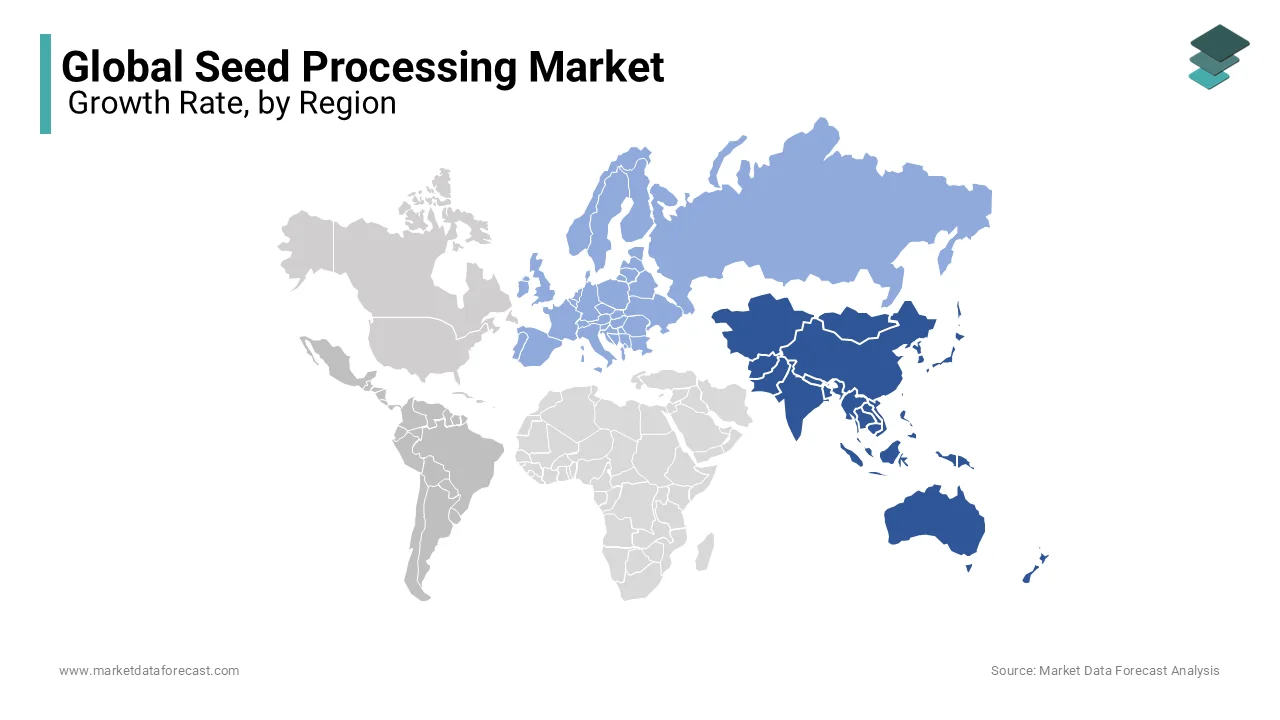

REGIONAL ANALYSIS

The Asia Pacific seed processing market is estimated to be the fastest-growing region during the forecast timeframe. Countries like China and Australia comprised the largest markets in the Asia-Pacific region. China is estimated to offer lucrative opportunities for seed processing companies and is the second-largest market for planting seeds, after the US, according to the USDA. It is among the biggest producers of crops, such as soybean and wheat. Australia is backed by the prominent seed treatment company, Nufarm. Furthermore, India is projected to be another critical revenue generator due to the rise in awareness among farmers about seed treatment products. Therefore, Asia Pacific stands as a high-growth market for the seed processing market.

Farmers in developed and mature markets like the US, Germany, and other European countries, primarily concentrate on the quality of seeds while making purchase decisions, which has increased demand for processed seeds. Therefore, the expansion in the import and export of seeds in developed and developing countries is projected to drive processed seeds' demand. As per the FAO, in 2017, the US observed a notable growth in the import and export of seeds. European countries, such as the Netherlands, Germany, and France, have also observed a substantial increase in seed import and export. Therefore, the growing commercial seed trade is projected to play a vital role in the seed processing market.

KEY MARKET PLAYERS

Some of the prominent players operating in the global seed processing market are Bayer (Germany), BASF (Germany), Cimbria (Denmark), Alvan Blanch Development Company Ltd. (UK), Nufarm (Australia), Lanxess (Germany), Clariant (Switzerland), Incotec (Netherlands), PETKUS Technologie GmbH (Germany), Corteva (US), Syngenta (Switzerland), Sensient Technologies (US), Lewis M. Carter Manufacturing, LLC (US), and WESTRUP A/S (Denmark).

RECENT HAPPENINGS IN THIS MARKET

October 2019 – A fungicide seed treatment, ILevo, was launched by BASF to help the Australian canola farmers to reduce the spread of the blackleg disease.

September 2018 – A new USD 200 million seed processing plant was opened by Bayer in Ukraine, which helped the company serve Europe's most growing crop protection market.

In February 2016, the State-owned Chinese Company China National Chemical Corporation acquired Syngenta International AG for USD 43 billion to secure a sustainable food supply for its growing population.

MARKET SEGMENTATION

This research report on the global seed processing market is segmented and sub-segmented into the following categories.

Based on Type

- Seed Treatment

- Seed Coating Material

Based on Crop Type

- Cereals & Grains

- Oilseed & Pluses

- Vegetables

- Flowers & Ornamental

Based on Equipment

- Cleaners

- Gravity Separators

- Seed Treatment

- Dryers

- Graders

- De-stoners

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com