Global Single-Use Bioprocessing Market Size, Share, Trends & Growth Forecast Report – Segmented By Product (Simple & Peripheral Elements, Apparatus & Plants, Work Equipment), Workflow, End-use and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From 2025 to 2033

Global Single-use Bioprocessing Market Size

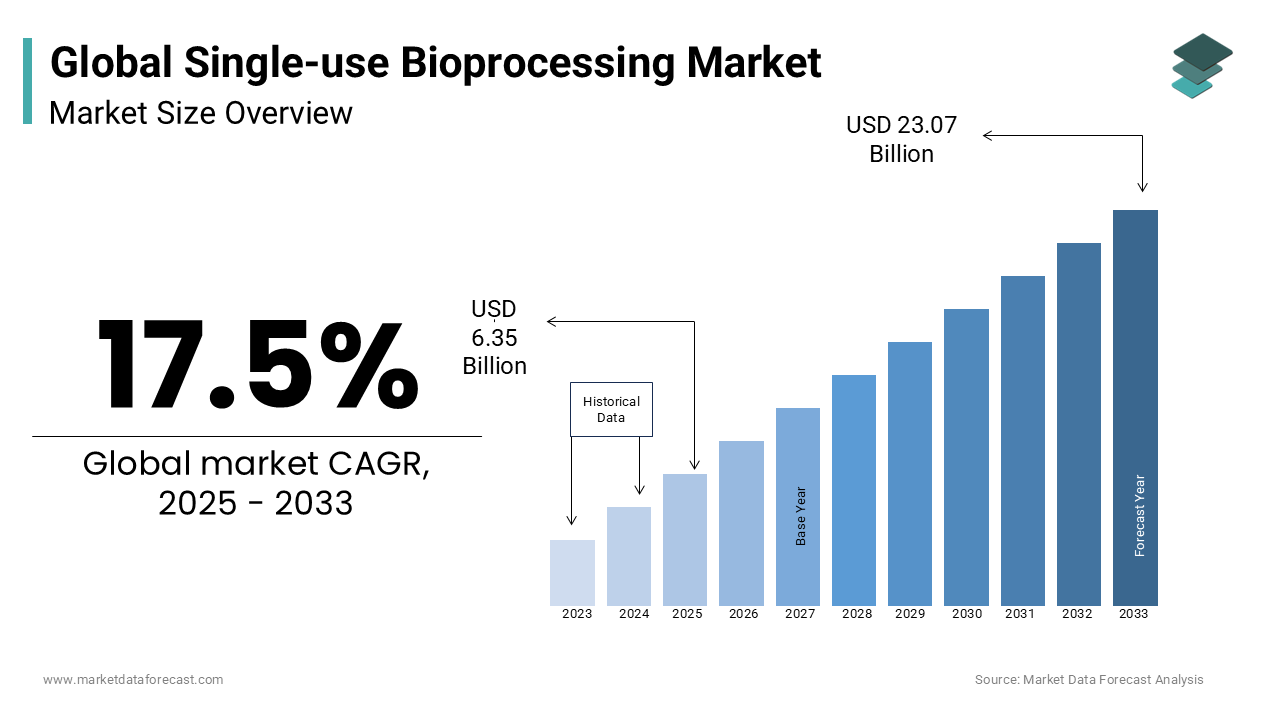

The single-use bioprocessing market size was valued at USD 5.40 billion in 2024. The global single-use bioprocessing market is estimated to be worth USD 23.07 billion by 2033 and USD 6.35 billion in 2025, growing at a CAGR of 17.5% from 2025 to 2033.

Single-use bioprocessing refers to the utilization of disposable technologies and systems in biopharmaceutical manufacturing by replacing traditional reusable stainless-steel equipment. These single-use systems (SUS) encompass a wide array of products such as bioreactors, filtration assemblies, tubing, connectors, and storage bags, all designed for one-time use. This approach has gained significant traction due to its ability to enhance operational efficiency, reduce contamination risks, and lower capital expenditure. The technology is particularly advantageous in applications requiring flexibility, scalability, and rapid turnaround times, such as vaccine production, cell and gene therapies, and personalized medicine.

The adoption of single-use bioprocessing has been driven by the increasing demand for biologics, which accounted for over 50% of the total pharmaceutical market revenue in recent years, according to a report by the Pharmaceutical Research and Manufacturers of America. Additionally, regulatory bodies like the FDA have emphasized the importance of reducing cross-contamination risks in bioprocessing, further propelling SUS adoption. A study published in the journal BioPharm International have revealed that the companies leveraging single-use systems can achieve up to a 30% reduction in water consumption and energy usage compared to conventional methods. Furthermore, the global push toward sustainability aligns with the reduced environmental footprint of these systems, as per the Bioprocess Systems Alliance. The single-use bioprocessing stands as a cornerstone of modern manufacturing strategies by addressing critical challenges while fostering innovation and compliance in an increasingly dynamic healthcare landscape.

MARKET DRIVERS

Increasing Demand for Biologics and Personalized Medicine

The growing demand for biologics, including monoclonal antibodies, vaccines, and cell and gene therapies, is a significant driver of the single-use bioprocessing market. According to the U.S. Food and Drug Administration (FDA), biologics accounted for over 30% of new drug approvals in recent years due to their prominence in modern healthcare. These therapies often require small-batch, flexible manufacturing processes that single-use systems are uniquely equipped to handle. The National Institutes of Health (NIH) reports that personalized medicine, which relies heavily on biologics, could influence up to 70% of all clinical decisions by 2030. Single-use technologies facilitate rapid changeovers and reduce contamination risks, making them ideal for such applications. Moreover, a Centers for Medicare & Medicaid Services (CMS) study estimates that biologics will represent 50% of the top 100 drug sales globally by 2025.

Stringent Regulatory Standards and Focus on Contamination Control

Stringent regulatory standards aimed at ensuring product safety and reducing contamination risks are another major driver of single-use bioprocessing adoption. The World Health Organization (WHO) emphasizes that cross-contamination in biopharmaceutical manufacturing can lead to significant public health risks, necessitating advanced solutions like disposable systems. A report from the European Medicines Agency (EMA) study have shown that single-use systems can reduce contamination incidents by up to 40% compared to traditional stainless-steel equipment. Additionally, the FDA’s guidance on current Good Manufacturing Practices (cGMP) advocates for technologies that minimize human intervention, a hallmark of single-use systems. According to the Occupational Safety and Health Administration (OSHA), these systems contribute to safer working environments by reducing exposure to hazardous substances. The single-use bioprocessing has emerged as a key enabler of compliance and operational excellence in the biopharmaceutical industry with global regulatory bodies increasingly prioritizing contamination control.

MARKET RESTRAINTS

Environmental Concerns and Waste Management Challenges

The environmental impact of single-use bioprocessing systems for the generation of plastic waste, poses a significant restraint to market growth. According to the Environmental Protection Agency (EPA), the healthcare sector is responsible for approximately 10% of greenhouse gas emissions in the United States, with disposable plastics being a major contributor. Single-use systems, often made from non-recyclable polymers, exacerbate this issue, as per the National Institute of Environmental Health Sciences (NIEHS). A study conducted by the United Nations Environment Programme (UNEP) estimates that the global pharmaceutical industry generates over 500,000 tons of plastic waste annually, much of which comes from single-use bioprocessing components. While these systems reduce water and energy consumption, their end-of-life disposal remains a challenge.

High Costs Associated with Implementation and Validation

The high costs associated with the implementation and validation of single-use bioprocessing systems act as a significant restraint for small and medium-sized enterprises. According to the International Trade Administration (ITA), the initial investment required for transitioning from stainless-steel systems to single-use technologies can exceed $1 million per facility, depending on scale and complexity. According to the U.S. Department of Commerce, validation processes, including leachable and extractable testing, can increase operational costs by up to 20%. According to the World Health Organization (WHO), while single-use systems reduce long-term operational expenses, the upfront financial burden can deter adoption in emerging markets. Furthermore, the complexity of integrating these systems into existing manufacturing setups often necessitates extensive staff training by adding to the overall expenditure. These cost barriers remain a critical challenge for widespread adoption despite the technology's advantages.

MARKET OPPORTUNITIES

Expansion of Contract Development and Manufacturing Organizations (CDMOs)

The rapid growth of contract development and manufacturing organizations (CDMOs) presents a significant opportunity for the single-use bioprocessing market. The growth is driven by increasing demand for outsourced biopharmaceutical production. According to the Food and Drug Administration (FDA), CDMOs are increasingly adopting single-use systems to meet diverse client needs, as these systems offer flexibility and faster turnaround times. A report by the European Federation of Pharmaceutical Industries and Associations (EFPIA) have revealed that over 60% of biologics manufacturing projects outsourced to CDMOs utilize single-use technologies.

Advancements in Material Science and Recycling Technologies

Innovations in material science and recycling technologies present another promising opportunity for the single-use bioprocessing market. According to the National Institute of Standards and Technology (NIST), advancements in polymer chemistry have led to the development of more durable and sustainable materials, addressing concerns about plastic waste. As per the Environmental Protection Agency (EPA), new recycling initiatives, such as closed-loop systems for single-use components, could reduce plastic waste by up to 30% in pharmaceutical manufacturing. A study by the United Nations Industrial Development Organization (UNIDO) reported that integrating recyclable materials into single-use systems could lower lifecycle environmental impacts by 25%. As per the Bioprocess Systems Alliance, improved material compatibility and reduced extractables enhance system safety and regulatory compliance. These technological breakthroughs not only address sustainability challenges but also expand the applicability of single-use systems across diverse bioprocessing applications.

MARKET CHALLENGES

Supply Chain Vulnerabilities and Raw Material Dependence

The single-use bioprocessing market faces significant challenges due to supply chain vulnerabilities and dependence on raw materials, which are often sourced from limited suppliers. According to the U.S. Department of Health and Human Services (HHS), over 80% of critical raw materials for single-use systems, such as specialized polymers, are imported from a small number of countries, creating potential bottlenecks. The Food and Drug Administration (FDA) has identified supply chain disruptions as a growing concern, with global shortages of key components impacting production timelines in 2022. According to the International Trade Administration (ITA), these disruptions can increase manufacturing costs by up to 15%, particularly during geopolitical tensions or pandemics.

Standardization and Compatibility Issues Across Systems

A lack of standardization and compatibility across single-use systems poses another major challenge, hindering seamless integration into existing workflows. According to the National Institute for Innovation in Manufacturing Biopharmaceuticals (NIIMBL), incompatible connectors, tubing sizes, and port designs lead to operational inefficiencies, with nearly 25% of facilities reporting delays due to mismatched components. According to the European Medicines Agency (EMA), this lack of uniformity increases validation complexities and raises the risk of contamination during system transitions. Additionally, a study by the Bioprocess Systems Alliance reveals that manufacturers spend approximately 30% more time on system customization to ensure compatibility. The International Organization for Standardization (ISO) has called for industry-wide standards, yet progress remains slow by leaving manufacturers grappling with fragmented solutions that impede scalability and innovation in bioprocessing operations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, WorkFlow, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Thermo Fisher Scientific, Danaher Corporation, GE Healthcare (General Electric Company), Sartorius Stedim Biotech S.A, Merck Millipore (Merck Group. |

SEGMENTAL ANALYSIS

By Product Insights

The simple & peripheral Elements segment dominated the single-use bioprocessing market with 45.3% of share in 2024. This segment includes tubing, filters, connectors, and bags, which are essential for contamination-free operations. According to the National Institutes of Health, these components reduce cross-contamination risks by up to 40% by making them indispensable in biologics manufacturing. Their widespread adoption is driven by cost-effectiveness and ease of integration into existing systems. The rising support for small batch production for vaccines and personalized therapies is ensuring flexibility and scalability in bioprocessing workflows.

The Apparatus & Plants segment is anticipated to register a CAGR of 18.5% during the forecast period. This growth is fueled by increasing demand for single-use bioreactors and mixing systems, which are critical for scaling up biologics production. According to the Food and Drug Administration, bioreactors reduce turnaround times by up to 30% by enabling rapid responses to emerging therapeutic needs. As per European Federation of Pharmaceutical Industries and Associations, over 60% of new biopharmaceutical facilities now incorporate single-use apparatus due to their lower capital investment and reduced validation requirements.

The single-use bioreactors segment is expected to record considerable growth during the forecast period. The disposable bioreactors have disposable bags instead of culture vessels, which allows the processors to avoid the risk of contamination; this factor enhances the adoption of disposable technology, leading to the segment growth rate.

By Workflow Insights

The upstream bioprocessing segment was the largest and held 55.4% of the global single use bioprocessing market share in 2024. This segment includes critical operations such as cell culture and media preparation, which are foundational to biopharmaceutical production. According to the U.S. Food and Drug Administration, upstream processes benefit significantly from single-use systems due to their ability to reduce contamination risks and enhance flexibility. This segment's prominence is driven by its pivotal role in ensuring product quality and yield by making it indispensable for scalable and efficient bioprocessing.

The downstream bioprocessing segment is accounted in exhibiting a CAGR of 14.2% during the forecast period. This rapid growth is fueled by increasing demand for purification technologies like chromatography and filtration, essential for isolating high-purity biologics. As per World Health Organization, downstream operations face higher contamination risks, driving adoption of single-use systems that minimize cross-contamination. According to the National Institutes of Health, advancements in membrane technologies have improved downstream efficiency by 20%.

By End-Use Insights

The biopharmaceutical manufacturers segment dominated the single-use bioprocessing market by holding significant market share in 2024 owing to the rising demand for biologics, which account for over 30% of new drug approvals annually, according to the FDA (Food and Drug Administration). The scalability and flexibility of single-use systems align perfectly with the needs of large-scale biopharmaceutical production. According to the National Institutes of Health, biologics are expected to represent 50% of global pharmaceutical sales by 2025.

The academic and clinical research institutes segment is likely to experience a CAGR of 14.5% in the foreseen years. This growth is fueled by increasing investments in life sciences research, with global spending reaching $2.2 trillion in 2023, according to UNESCO. According to the World Health Organization, institutes leverage single-use systems for early-stage research and development in cell and gene therapies, where contamination control is critical. According to the Biomedical Advanced Research and Development Authority, grants and funding for personalized medicine research have surged by 25% annually. These institutes play a pivotal role in advancing innovative therapies by making their rapid adoption of single-use technologies vital for future breakthroughs.

REGIONAL ANALYSIS

North America led the single-use bioprocessing market by holding 40.2% of the global share in 2024. This dominance is driven by the region's robust biopharmaceutical industry, which accounts for over 45% of global biologics production, according to the Biotechnology Innovation Organization (BIO). The FDA’s emphasis on reducing contamination risks and adopting advanced technologies further propels demand. Additionally, significant investments in personalized medicine and cell and gene therapies, with the NIH allocating $45 billion annually to biomedical research.

Asia-Pacific is projected to witness a CAGR of 15.2% during the forecast period. This growth is fueled by increasing biopharmaceutical manufacturing hubs in countries like China and India, where the Indian Department of Pharmaceuticals reports a 20% annual rise in biologics production capacity. According to the World Health Organization, Asia-Pacific nations are investing heavily in vaccine development, accounting for over 30% of global vaccine output. Furthermore, government initiatives, such as China’s "Healthy China 2030" plan, aim to boost biotech R&D spending by 10% annually. The region’s focus on cost-effective manufacturing and rising healthcare needs positions it as a critical driver of future market expansion by ensuring sustainable growth and innovation.

Europe is expected to maintain steady growth due to stringent EU regulations promoting contamination-free systems, with the European Medicines Agency projecting a 10% annual increase in biologics approvals. Latin America shows moderate growth, supported by expanding healthcare infrastructure, with the Pan American Health Organization estimating a 7% rise in biopharmaceutical investments by 2026. The Middle East and Africa are likely to witness gradual adoption, driven by increasing healthcare access and partnerships with global firms, as noted by the African Union’s Pharmaceutical Manufacturing Plan, which targets a 25% increase in local drug production by 2030. These regions collectively contribute to diversifying the global market landscape.

Top 3 Players in the market

Sartorius AG

Sartorius AG is a global leader in the single-use bioprocessing market, commanding a significant share due to its comprehensive portfolio of innovative solutions. The company specializes in single-use bioreactors, filtration systems, and fluid management technologies, which are integral to modern biopharmaceutical manufacturing. Its strong focus on R&D has enabled the development of advanced products like the BIOSTAT® STR bioreactor series, which supports scalable production for vaccines and biologics. Sartorius’s collaboration with key industry players and its commitment to sustainability by the German Federal Ministry for Economic Affairs. The company’s contributions ensure efficient, contamination-free processes, making it indispensable for biopharmaceutical manufacturers worldwide.

Danaher Corporation

Danaher Corporation is another dominant player, leveraging its subsidiary Cytiva (formerly GE Healthcare Life Sciences) to drive innovation in single-use bioprocessing. Cytiva’s Xcellerex™ and FlexFactory™ platforms are widely adopted for their flexibility and efficiency in producing biologics and cell therapies. The company’s investments in digital bioprocessing technologies, such as data analytics and process monitoring tools, align with the FDA’s push for Industry 4.0 in pharmaceuticals. Additionally, Danaher’s strategic acquisitions and partnerships, as noted by the International Trade Administration, enhance its market presence. Its robust product offerings and technological advancements make it a cornerstone of the single-use bioprocessing ecosystem.

Thermo Fisher Scientific, Inc.

Thermo Fisher Scientific is a key contributor to the global single-use bioprocessing market, renowned for its diverse range of products, including single-use bags, filtration systems, and bioprocessing containers. Thermo Fisher’s Gibco™ and HyClone™ brands are trusted globally for their high-quality media and bioproduction solutions, supporting applications from vaccine development to gene therapy. According to the National Institutes of Health, Thermo Fisher’s focus on customization and scalability addresses the evolving needs of biopharmaceutical manufacturers. Furthermore, its commitment to sustainability, evidenced by initiatives to reduce plastic waste in bioprocessing that aligns with global environmental goals. Thermo Fisher’s extensive distribution network and customer-centric approach ensure its continued influence in the market.

Top strategies used by the key market participants

Strategic Acquisitions and Partnerships

Key players in the single-use bioprocessing market have heavily relied on acquisitions and partnerships to expand their product portfolios and geographic reach. For instance, Danaher Corporation’s acquisition of Cytiva (formerly GE Healthcare Life Sciences) significantly bolstered its capabilities in single-use technologies, enabling it to offer end-to-end solutions for biopharmaceutical manufacturing. Similarly, Thermo Fisher Scientific has pursued strategic collaborations with biotech firms to co-develop innovative solutions tailored to specific therapeutic applications. According to the U.S. Department of Commerce, such mergers and alliances accounted for over 30% of market growth strategies in 2022. These moves allow companies to integrate complementary technologies, enhance scalability, and address unmet customer needs, thereby strengthening their competitive edge.

Investment in R&D and Technological Innovation

Investment in research and development is another critical strategy employed by market leaders to maintain their dominance. Sartorius AG, for example, allocates approximately 12% of its annual revenue to R&D, as reported by the German Federal Ministry for Economic Affairs. This focus has led to groundbreaking innovations like the BIOSTAT® RM TX bioreactor, designed for cell and gene therapy applications. Similarly, Merck KGaA has developed advanced single-use assemblies with improved extractable profiles, addressing regulatory concerns leveraged by the European Medicines Agency. The Bioprocess Systems Alliance notes that R&D spending across the industry grew by 15% in 2022, underscoring the importance of innovation in staying ahead. By continuously enhancing product performance and compliance, these companies ensure they meet evolving industry standards and customer expectations.

Expansion into Emerging Markets

To capitalize on untapped opportunities, key players are expanding their presence in emerging markets such as Asia-Pacific, Latin America, and the Middle East. For instance, Corning Incorporated has established manufacturing facilities in India and China to cater to the growing demand for biologics and vaccines in these regions. According to the Asian Development Bank, such expansions have enabled companies to achieve a 20% increase in regional sales annually. Additionally, Avantor, Inc. has partnered with local distributors in Africa to enhance accessibility to single-use systems, aligning with the African Union’s goal of boosting pharmaceutical production. These efforts not only diversify revenue streams but also position companies as global leaders capable of addressing regional healthcare challenges.

Sustainability Initiatives and Circular Economy Models

Sustainability has become a focal point for strengthening market position, with companies adopting eco-friendly practices to address environmental concerns. Thermo Fisher Scientific and Sartorius AG have launched recycling programs for single-use plastics, aiming to reduce waste by up to 40%, as per the Environmental Protection Agency. Furthermore, Meissner Filtration Products, Inc. has introduced biodegradable materials for single-use components, aligning with global sustainability goals. The World Economic Forum emphasizes that such initiatives enhance brand reputation and meet the increasing demand for greener solutions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Some of the prominent companies leading single-use bioprocessing market profiled in this report are Thermo Fisher Scientific, Danaher Corporation, GE Healthcare (General Electric Company), Sartorius Stedim Biotech S.A, Merck Millipore (Merck Group), 3M Company, Eppendorf AG, Finesse Solutions, Inc., Applikon Biotechnology B.V., and Cesco Bioengineering Co., Ltd.

The single-use bioprocessing market is characterized by intense competition, driven by the increasing demand for biologics, vaccines, and personalized medicine. Key players such as Sartorius AG, Danaher Corporation, and Thermo Fisher Scientific dominate the market through their extensive product portfolios, technological innovations, and strategic initiatives. According to the Bioprocess Systems Alliance, these companies collectively account for over 60% of the global market share, leveraging their expertise in single-use bioreactors, filtration systems, and fluid management technologies. The competitive landscape is further intensified by mid-sized firms like Merck KGaA and Avantor, Inc., which focus on niche applications such as cell and gene therapies, thereby challenging larger incumbents.

To maintain their edge, companies are adopting aggressive strategies, including mergers, acquisitions, and partnerships. For instance, Danaher’s acquisition of Cytiva has strengthened its position in end-to-end bioprocessing solutions. Additionally, investments in R&D remain a cornerstone of competition, with firms striving to enhance product performance and address regulatory requirements. As per the U.S. Department of Commerce, R&D spending in the sector grew by 15% in 2022, reflecting the emphasis on innovation. Emerging markets in Asia-Pacific and Latin America present new battlegrounds, with companies expanding manufacturing facilities and distribution networks to tap into rising healthcare demands.

RECENT MARKET DEVELOPMENTS

- In February 2025, Thermo Fisher Scientific acquired Solventum's purification and filtration business for approximately $4.1 billion. This acquisition allows Thermo Fisher to enter the filtration category in bioprocessing, complementing its existing bioprocessing segment and enhancing its tools and services for drug development.

- In May 2023, Danaher Corporation completed the merger of its subsidiaries, Pall Life Sciences and Cytiva, to form a new Biotechnology Group. This consolidation aimed to create a global innovation and solutions leader in biotechnology, enhancing Danaher's capabilities in the bioprocessing sector.

- In 2020, Sartorius AG acquired selected assets from Danaher Corporation, including products for the research and development of cell therapies. This acquisition expanded Sartorius's portfolio in the bioprocessing market, particularly in single-use technologies.

- In 2021, Sartorius AG strengthened its position by acquiring the German cell culture media manufacturer Xell AG. This acquisition enhanced Sartorius's capabilities in providing specialized media for cell and gene therapies, which are crucial components in single-use bioprocessing.

- In August 2023, Danaher Corporation announced a definitive agreement to acquire Abcam for approximately $5.7 billion. This acquisition aimed to enhance Danaher's life sciences offerings, including its bioprocessing capabilities.

- In 2021, Thermo Fisher Scientific acquired PPD, a pharmaceutical testing company, for more than $15 billion. This acquisition expanded Thermo Fisher's services in drug development and bioprocessing.

- In October 2024, Danaher Corporation reported strong demand in its diagnostics and bioprocessing businesses, with its life sciences unit achieving $1.78 billion in sales. This growth reflects Danaher's strengthened position in the bioprocessing market.

- In 2019, Sartorius AG acquired the Israel-based cell culture media developer and manufacturer Biological Industries. This acquisition expanded Sartorius's offerings in cell culture media, essential for single-use bioprocessing applications.

- In April 2024, Danaher Corporation merged Precision Nanosystems into Cytiva, enhancing its capabilities in nanomedicine and bioprocessing technologies.

- In 2017, Sartorius AG acquired Essen BioScience, a company specializing in cell-based assays and instrumentation, for $320 million. This acquisition bolstered Sartorius's position in the bioprocessing market by enhancing its cell analysis capabilities.

MARKET SEGMENTATION

This research report has segmented and sub-segmented the global single-use bioprocessing market based on product, application and region.

By Product

- Simple & Peripheral Elements

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Bioreactors

- Work Equipment

- Cell Culture System

- Syringes

- Others

By Workflow

-

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the value of the global single-use bioprocessing market in 2024?

The global single-use bioprocessing market size was worth USD 5.40 billion in 2024.

Which region had the largest share of the global single-use bioprocessing market in 2024?

Geographically, the North American region accounted for the largest share of the global single-use bioprocessing market in 2024.

Which segment by product led the single-use bioprocessing market in 2024?

Based on product, the media bags and containers segment had the most significant share of the global single-use bioprocessing market in 2024.

What are some of the key participants in the global single-use bioprocessing market?

Thermo Fisher Scientific, Danaher Corporation, GE Healthcare (General Electric Company), Sartorius Stedim Biotech S.A, Merck Millipore (Merck Group), 3M Company, Eppendorf AG, Finesse Solutions, Inc., Applikon Biotechnology B.V., and Cesco Bioengineering Co., Ltd. are some of the promising players in the single-use bioprocessing market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com