Global Smart Home Security Market Size, Share, Trends & Growth Forecast Report By Systems (Fire Protection, Video Surveillance, Access Control, Entrance Control and Intruder Alarm), Services (Security System Integration, Remote Monitoring, Fire Protection, Video Surveillance and Access Control) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Smart Home Security Market Size

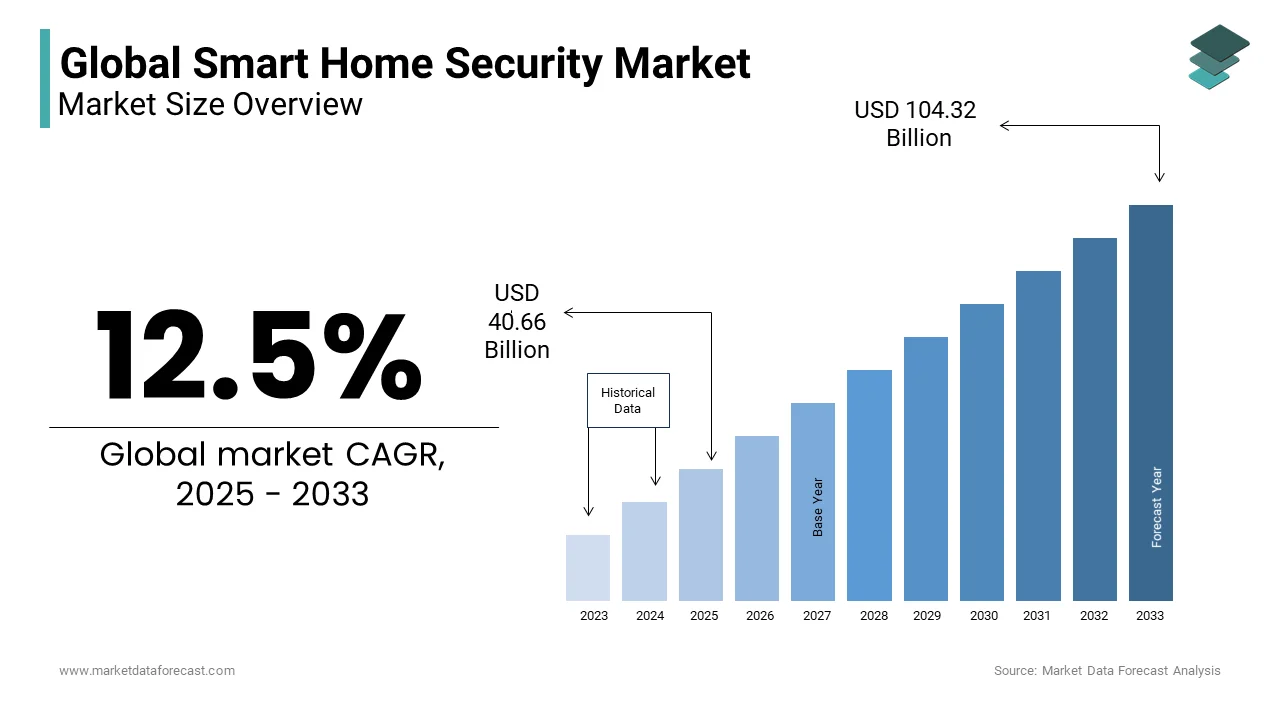

The size of the global smart home security market was valued at USD 36.14 Billion in 2024. The global market is projected to grow at a CAGR of 12.5% from 2024 to 2033 and be worth USD 104.32 billion by 2033 from USD 40.66 billion in 2025.

The smart home security market is gaining more traction in recent times. It got the first boost after COVID-19 and the second accelerator by multiple regional wars which drastically increased the frequency of all sorts of cyberattacks. Automated and intelligent home devices and security systems are also affected by these attacks. So, the demand for advanced technologies combined with other smart home gadgets and gives a low or zero failure rate or probability. In terms of region, the market in the United States is more mature than that in Europe. Though the industry penetration is low in the EU as compared to the US, the number of houses integrated with smart systems has considerably risen. This helped the regional industry to position itself in a position nearly equivalent to that of the North American market. For better understanding, as per a study conducted in 2024, there was an increase of 21 percent annually, and by the end of 2022, overall, 2067 million smart home systems were in application in the European Union. This trend presents a huge potential opportunity for domestic and international players to drive their market share. However, the malfunction rate is also high, with more than 26 million devices, systems, or whole-home systems. Hence, the frequency of such incidences is decreasing the growth rate of the smart home security market. Additionally, matter-based smart home security is also driving the market growth. Its objective is to ensure IoT systems and devices remain protected and encrypted to safeguard against privacy attacks.

MARKET DRIVERS

Growing Crime Rates

YoY rise in crime rates around the world is resulting in the increasing adoption of smart home security systems and driving market growth. Consumers are placing a higher emphasis on safety and security measures, particularly in residential areas, as crime rates rise. Smart home technologies such as smart alarms, smart cameras and smart lockers are preferred by households because they are more safe and secure. As a result, the application of the Internet of Things, miniaturized sensors and actuators, and energy-efficient wireless communication technologies have evolved. Moreover, both product quality and automation system consistency have increased because of the IoT. Also, the home security system, upon integration with the cloud, enables remote monitoring of residence or other infrastructure using mobile devices or other handheld devices via the internet as interfaces. According to 2024 research, six out of ten American citizens say bringing down the crime rate should be the prime focus of the US government. Interestingly, FBI data on crime is based on the information shared by several states, federal, city, county, and other public departments, but agencies never participate 100 percent annually. About 83 percent of participating authorities made their data available to the FBI. Apart from this, theft or larceny is the most frequently committed property crime and aggravated assault in terms of violent crimes tops the list in the United States in 2022. Overall, 1954.4 property crimes per 100,000 people were reported, while the count of violent crimes is 380 per 100,000 individuals in 2022. Hence, all these trends and factors are fuelling the smart home security market.

Technological Advancements in Smart Home Security

Recent advancements in smart sensing and actuation devices coupled with essential communication technologies such as Bluetooth Low Energy (BLE), ZigBee and ANT have made IoT integration in home security systems easier. Wireless connectivity to a variety of security options, such as access control and fire and gas detection systems, provides consumers with flexibility, simplicity, and assurance. The integration of artificial intelligence, sophisticated sensors and other advanced technologies is expected to boost the smart home security market. The incorporation or blend of AI, machine learning, and the Internet of Things has significantly made these smart systems more reliant and efficient. The pace at which the technologies are developing will surely drive forward the transformation of smart home security solutions. Nowadays, people have the facility to use and interact with systems like Alexa, which is made possible by natural language processing with the support of AI. As we progress, artificial intelligence is projected to indulge deeply in routine tasks in our lives. Besides this, cars are already integrated with AI for collision resistance, traffic navigation, facial recognition, and others. All of these use machine learning. Moreover, using AI to minimize the threat vector in cyberattacks is the prime focus of the smart home security companies in the market. It is also essential for consumers to stay updated and aware of the growing methods of online risks to their house security devices.

MARKET RESTRAINTS

The high cost of home security system installation and maintenance is hampering the smart home security market growth. Customers are growing more aware of the benefits of home security systems, but they are still hesitant to spend because security system prices remain out of reach for many. The high cost of hardware and ownership, as well as the costs of advice and installation, have stifled the adoption of home security systems. The total cost of ownership includes maintenance, monitoring subscription fees, part replacement prices, and installation charges.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.5% |

|

Segments Covered |

By Systems, Services, and Regions. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Honeywell International Inc (US), Amazon Inc (US), ABB Ltd (Switzerland), LG (South Korea), Apple (US), Samsung (South Korea), Sony Corp (Japan), Siemens AG (Germany), ADT Inc (US), Johnson Controls International (Northern Ireland), Hangzhou Hikvision Digital Tech Co Ltd (China) and Adobe Systems Inc (US) |

SEGMENTAL ANALYSIS

By Systems Insights

The video surveillance segment had the greatest share of the global market in 2024 and the lead of the segment is predicted to continue throughout the forecast period. Through real-time event recognition, post-event analysis, and statistical data extraction, video analytics improves the performance of video surveillance systems while reducing human costs and boosting the effectiveness of surveillance system operations. Video analytics algorithms can be used to evaluate recorded video, which is a difficult and time-consuming operation for a human operator, especially when there is a large amount of video data to eliminate. A relevant video clip of an incident in a recorded video can be obtained through a quick analysis of the footage.

By Services Insights

During the forecast period, the demand for home security system integration services will dominate the services segment. Major factors driving the growth of the market for security integration services include increasing digitization and optimization of operational costs for security infrastructure, as well as increasing reliance on third-party service providers for the smooth and continuous operation of all security products as well as for security assurance.

REGIONAL ANALYSIS

North America is anticipated to hold a significant part of the market. According to the National Council for Home Safety and Security, 47% of millennials in the United States own smart gadgets, and 70% of those who currently have one are considering acquiring another. Because security is a key concern in the home, there is expected to be a high demand for security equipment.

During the forecast period, Europe is expected to develop at a CAGR of 16.1%. In recent years, the region's market has seen widespread adoption, particularly in nations like Germany, the United Kingdom, the Netherlands, and France. The real estate business is predicted to rise as demand for smart and connected homes grows, as well as home automation systems, which are an important aspect of smart homes.

The rapid development of smart cities across Asia-Pacific countries is propelling the region's smart home security market. Smart home security systems are widely used in India, Australia and New Zealand, South Korea, and Japan. China is the world's leading manufacturer as a result of a conglomeration of leading companies in the city of Shenzhen.

During the forecast period, the LAMEA is projected to grow at the slowest CAGR. The United Arab Emirates is currently the region's largest consumer of smart home security systems, and this trend is expected to continue through the forecast period.

KEY MARKET PARTICIPANTS

Honeywell International Inc. (US), Amazon Inc. (US), ABB Ltd. (Switzerland), LG (South Korea), Apple (US), Samsung (South Korea), Sony Corp (Japan), Siemens AG (Germany), ADT Inc. (US), Johnson Controls International (Northern Ireland), Hangzhou Hikvision Digital Tech Co Ltd (China), and Adobe Systems Inc. (US) are a few of the noteworthy companies in the global smart home security market.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Resideo Technologies launched the AI-based First Alert VX5 indoor camera at the exhibition ISC West 2024. This product is the newest addition to their First Alert Series, which consists of a video doorbell and an FA outdoor camera. Moreover, it comes with artificial intelligence event detection which is a special self-acting stealth mode and flexible installation option to satisfy the demands of the professional security vendors.

- In March 2024, the “Diamond” level performance was given to Samsung’s Bespoke Jet Bot Combo AI and Family Hub Refrigerators. This verification is granted for its IoT security by UL Solutions and is only given when products pass the examination to stop illegal access activities, identify malicious software modification, and depersonalize personal data.

- In February 2024, Honeywell Security and Network Webcams announced the partnership. Network Webcams became a value-added partner for the United Kingdom market, offering Honeywell video surveillance products. In addition, they first introduced the Honeywell 35-Series security cameras beside the compatible Honeywell network video recorders (NVRs).

- In January 2024, Johnson Controls launched the Illustra Standard Gen 3 camera in India with more than 75 percent domestic elements. This is one of the latest security cameras, which are mainly designed and produced in the country under the Make in India scheme.

MARKET SEGMENTATION

This research report on the global smart home security market has been segmented and sub-segmented based on systems, services, and regions.

By Systems

- Fire Protection

- Video Surveillance

- Access Control

- Entrance Control

- Intruder Alarm

By Services

- Security System Integration

- Remote Monitoring

- Fire Protection

- Video Surveillance

- Access Control

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the projected growth of the Smart Home Security Market?

The global smart home security market was valued at USD 32.12 billion in 2023 to reach a valuation of USD 104.32 billion by 2033 with a CAGR of 12.5% from 2024 to 2033.

What are the primary drivers of the Smart Home Security Market?

Rising crime rates worldwide, increasing emphasis on safety, advancements in IoT technology, and integration with the cloud are driving the Smart Home Security Market.

How has COVID-19 impacted the Smart Home Security Market?

COVID-19 has adversely affected the market, with a 5-10% decrease in global sales expected due to supply chain disruptions and decreased demand, especially in major markets like the US and China.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com