Global Waste Sorting Robots Market Size, Share, Trends & Growth Forecast Report – Segmented By Waste Type (Organic, Plastics, Metal, Waste, Chemical, Wood, Electronic, and Others), Industry (Recycling, Plastics, Metal & Minerals, Wood, Food and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2024 to 2032)

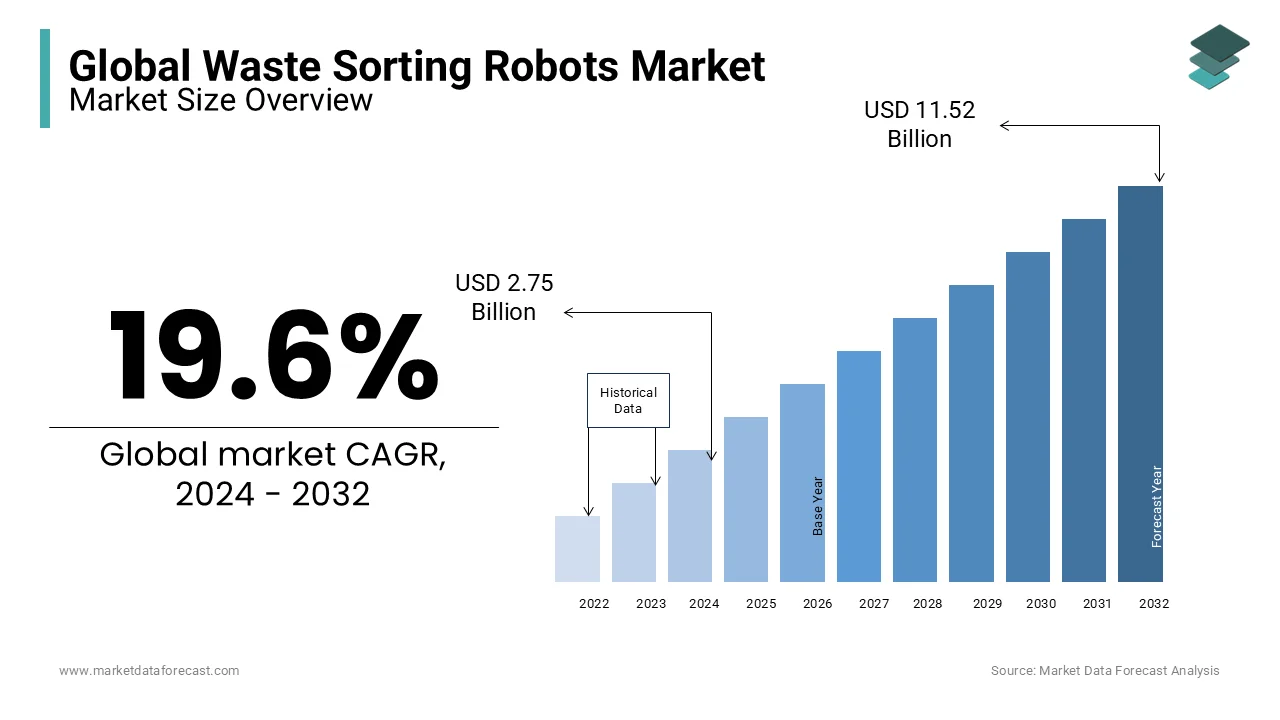

Global Waste Sorting Robots Market Size (2024 to 2032):

The size of the global waste sorting robots market was valued at USD 2.3 billion in 2023. The global market size is further expected to expand at a CAGR of 19.6% from 2024 to 2032 and be worth USD 11.52 billion by 2032 from USD 2.75 billion in 2024.

Waste management has become a societal issue, endangering the environment's safety and long-term viability. If garbage is not handled appropriately, it is either burned or kept in various locations, causing harm to the environment and individuals. The previous waste separation approach not only puts the human workforce's health in danger but also pollutes the air, water, and land. As a result, rubbish recycling and reuse have become increasingly important. Traditional waste sorting methods have been replaced by waste sorting robots, which are automated machinery. These robots are artificial intelligence units that are employed in the waste and recycling industries. The waste is separated by a robotic arm that uses a sensor array to detect, pick, and place it separately. Robotics plays a key part in the effective implementation of waste management techniques by speeding up the process and lowering costs. A two-arm robot can sort 4,000 picks every hour, demonstrating its superiority to human labor.

Current Scenario of the Waste Sorting Robots Market

The necessity of automation of robot-based recycling processes is rising due to the biological hazards involved in conventional methods and the regular workforce shortages. For instance, mechanizing the categorization of a wide variety of wastes. So, many organizations or firms are looking for or have started the application of robots for recycling trash. The current practice for the treatment of huge quantities of mixed and unclassified industrial garbage, which are brought together at a particular location, is executed manually and separated into different conveyor lanes and boxes. It is not feasible to process the whole industrial waste in one facility or plant where it is aggregated and therefore, automated solutions are required in recycling factories and not in the same industrial facility. As of now, it is relatively simple to mechanize the low degree of mixing waste which has only a few classifications. Whereas a dedicated single automatic system or machine cannot process the extremely tangled and merged garbage. Hence, both robots and specifically committed machines must be included in one to form a combined solution that needs a low amount of manual labor.

MARKET DRIVERS

The rapid adoption of automation technologies in waste management processes worldwide is primarily driving the growth of the waste sorting robots market.

The need for faster waste management processes to handle the garbage produced, which is increasing at a double-digit rate, is a major driving force for the market expansion of waste sorting robots. The robots' picking speed varies between 3,000 and 6,000 picks per hour, and they work 24 hours a day, 7 days a week, with a 98 percent accuracy rate. In addition, the growing popularity of smart waste management solutions is boosting the market growth rate. These solutions are integrated with the Internet of Things (IoT) for live monitoring, identification and analysis of data which will assist in improving waste collection and encourage upcoming innovation.

As per the Environmental Protection Agency (EPA), about 75 per cent of the garbage stream is recyclable, however, in reality, 30 per cent of reprocessable matter is recycled. Also, interestingly, more than 2 billion tons of garbage annually is generated by the people and the amount is so huge that it results in waterways and landfills globally. And, the conventional waste management solutions are not capable enough to handle such large amounts of trash which is why this garbage is not leaving soon. Hence, this phenomenon or pattern is propelling the necessity for waste-sorting robots.

Furthermore, the pandemic caused a shortage of manpower, due to which the recycling centers struggled to reprocess the waste and meet the end demands. This paved the way for artificial intelligence-based robots to grow and help mitigate this problem. For the successful execution of tasks it will need human intelligence like speech recognition, computer vision, visual perception, decision making and language translation. Additionally, the growing capacity of robotics and artificial intelligence is also fuelling the growth of the waste sorting robots market. It is highly important in mapping an eco-friendly course for garbage disposal. The incorporation of AI and robotics will completely transform the industry including the very substance of waste disposal and reprocessing. Also, it provides incomparable intelligence into the structure and prospective recyclability of waste matters.

MARKET RESTRAINTS

The high cost and maintenance of waste sorting robots are major barriers for small businesses and is hampering the global market growth.

This accounts for a significant portion of the overall number of businesses engaged in waste sorting activities. The upfront costs include procurement expenses, integration charges for existing infrastructure and workforce training expenditures. All this needs a considerable sum of money making it tough for small and medium enterprises to absorb such technology. Another factor hindering the expansion of the waste sorting robots market is the need for regular maintenance to achieve the desired results. A major portion of overall costs is covered by the specialized components, multiple sensors, and software upgrades or any rectification. All of these take a hefty amount due to the complexity attached to it. Also, extensive and rough garbage or squandered processing causes faster depreciation and deterioration. Besides this, the fees or charges of experts or professionals for technical evaluation, identification and solution to any key problem are high. Furthermore, according to a survey, there are three prime issues in sorting automation, which are the end-effector, sensor, and planner. First, several garbage items with deformation and dirt require a powerful and sturdy grasp and manipulation. Second, to identify the type, form and posture of current objects to be manipulated with dirty and wet surfaces. Third, to produce practically sound and efficient sequences, grips and paths or courses. Thus, the limitations of traditional systems are restricting the growth of the waste sorting robots market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

19.6% |

|

Segments Covered |

By Application, Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AMP Robotics (US), Sadako Technologies (Spain), Waste Robotics (Canada), Bollegraaf Recycling Machinery (Netherlands), HOMAG Group (Germany), TOMRA (Norway), Greyparrot (UK), Specim Spectral (Finland), ecoBali (Indonesia) and EuReciclo (Brazil) |

SEGMENTAL ANALYSIS

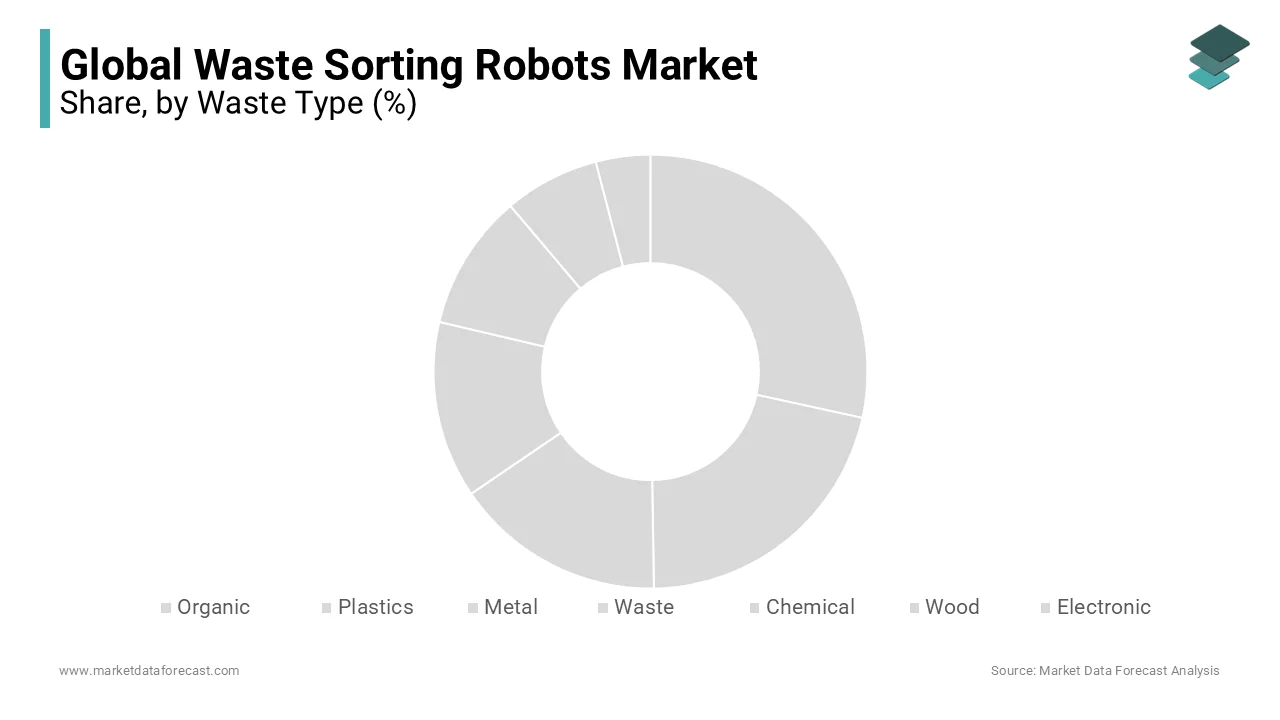

Global Waste Sorting Robots Market Analysis By Waste Type

The plastic segment accounted for 30.6% of the global market share in 2023 and was the biggest segment of all. The amount of waste produced by various households, business locations, and companies grows in tandem with the world's population. Increased recycling rates and the diversion of precious resources away from landfills can be aided by advanced technologies.

Global Waste Sorting Robots Market Analysis By Industry

The recycling industry segment had the largest market share, accounting for 52.1% of the global waste sorting robots market. The recycling industry's market share has expanded because of increasing compliance with several government laws involving waste management and recycling, as well as increased opportunities for large actors in the recycling sector. Plastics, which are manufactured by recycling old plastics and other materials, are used in a variety of industries, and the plastics industry segment has been growing at a 12.5% annual pace.

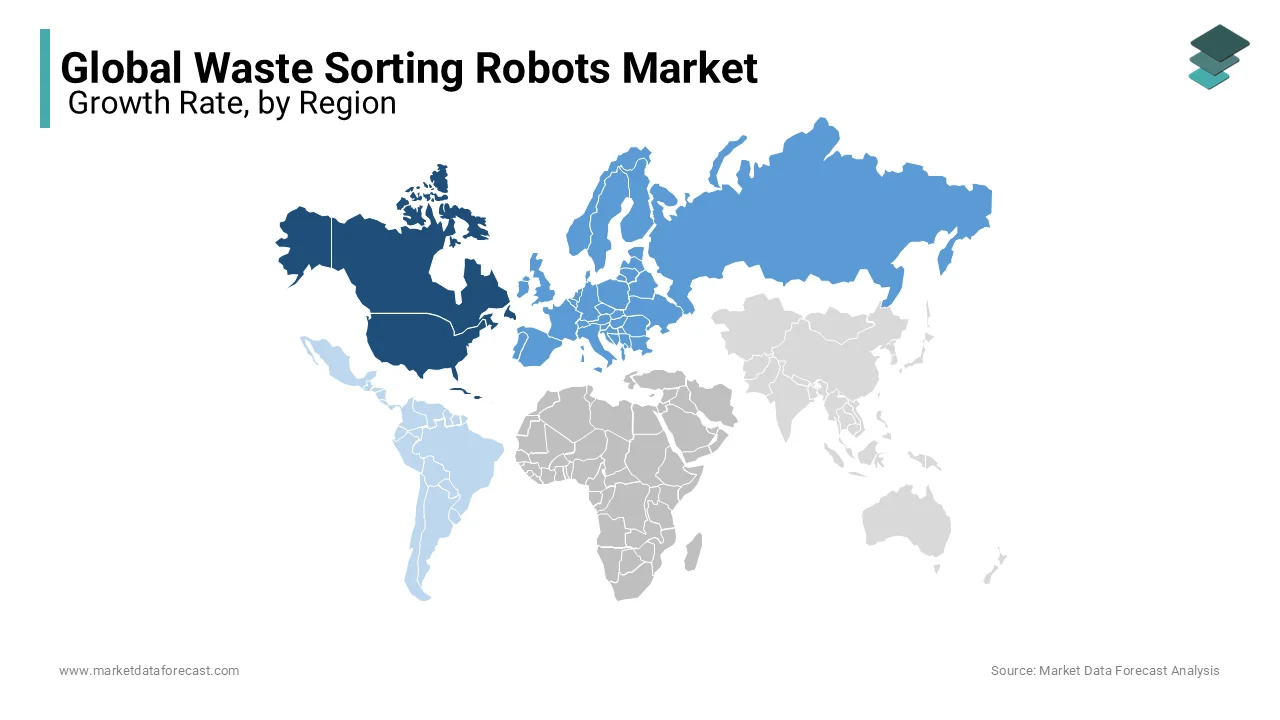

REGIONAL ANALYSIS

North America is the largest and fastest-growing market because of its increased use of ecologically damaging products. After combining data from key robot vendors, Resource Recycling indicates that roughly 80 robots are either operational or have been purchased in the United States and Canada. They're sorting recyclables, garbage, plastics, shredded electronics, and construction and demolition waste from people's homes and businesses. The region is expected to hold more than 42% of the global market share during the forecast period.

Europe is a prominent regional segment for waste-sorting robots and is anticipated to account for a considerable share of the worldwide market during the forecast period. The growth of the European market is majorly driven by government initiatives and extensive investment in automation. The European market is estimated to grow at a CAGR of 11% during the forecast period.

In APAC, China is the leading manufacturer of waste sorting robots. China recycles a large portion of the world's garbage. However, in April 2019, China implemented harsher contamination restrictions, stating that anything containing more than 0.5 percent impure will be buried. This necessitates the introduction of robots into garbage sorting facilities. Countries like Japan, Singapore and Australia-NZ are ahead in implementing waste sorting robots but India and other South-East Asian countries are still in the planning phases of deployment.

In the LAMEA region, the Middle East is the leading market because of heavy investments in automation. Contrarily, the African and South American markets are behind in planning and implementation.

KEY PLAYERS IN THE GLOBAL WASTE SORTING ROBOTS MARKET

Companies playing a major role in the global waste sorting robots market include AMP Robotics (US), Sadako Technologies (Spain), Waste Robotics (Canada), Bollegraaf Recycling Machinery (Netherlands), HOMAG Group (Germany), TOMRA (Norway), Greyparrot (UK), Specim Spectral (Finland), ecoBali (Indonesia) and EuReciclo (Brazil). ZenRobots is the pioneer and also the current market leader in manufacturing waste sorting robots.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, ZenRobotics presented the Heavy Picker 4.0 and the Fast Picker 4.0. Both are the fourth generation of waste sorting robots with new capabilities.Heavy Picker 4.0 is a multifunction robot for heavier goods whereas the Fast Picker 4.0 is a high speed bot perfect for lightweight matter. It features an updated and advanced artificial intelligence to enhance and maximize the efficiency of material sorting activities.

- In May 2024, SES AI Corp. entered into a partnership with Worcester Polytechnic Institute (WPI) for the development of cutting-edge technology for recycling lithium-metal batteries. Moreover, SES AI will finance a new research project at WPI.

DETAILED SEGMENTATION OF THE GLOBAL WASTE SORTING ROBOTS MARKET INCLUDED IN THIS REPORT

This research report on the global waste sorting robots market has been segmented and sub-segmented based on the waste type, industry and region.

By Waste Type

- Organic

- Plastics

- Metal

- Waste

- Chemical

- Wood

- Electronic

- Others

By Industry

- Recycling

- Plastics

- Metal & Minerals

- Wood

- Food

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size and growth projection for the waste sorting robots industry?

The global waste sorting robots market, valued at $2.3 billion in 2023, is forecasted to reach $11.52 billion by 2032, with a robust CAGR of 19.6% during the period from 2023 to 2032.

How do waste sorting robots contribute to improving waste management processes?

Waste sorting robots utilize artificial intelligence and robotic arms equipped with sensor arrays to detect, pick, and separate waste efficiently. With a picking speed ranging from 3,000 to 6,000 picks per hour and operating 24/7 with a 98% accuracy rate, these robots significantly accelerate the waste sorting process, thereby enhancing productivity and reducing costs compared to traditional methods.

What are the key factors driving and hindering the adoption of waste sorting robots in the market?

The primary driver for the adoption of waste sorting robots is the urgent need for faster waste management processes to handle the increasing volume of waste generated worldwide. However, the high initial cost and maintenance expenses associated with waste sorting robots pose a significant barrier, particularly for small businesses, which comprise a considerable portion of the waste sorting industry.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]