Global Yogurts Market Size, Share, Trends, & Growth Forecast Report - Segmented By Product Type (Icelandic Yogurt, Australian Yogurt, Traditional Yogurt, Greek Yogurt, Kids Yogurt, Non-Dairy Yogurt And Other Yogurts), Packaged Containers (Yogurt Tubs, Yogurt Cups, Yogurt Pouches And Yogurt Bottles), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis (2025 To 2033)

Global Yogurts Market Size

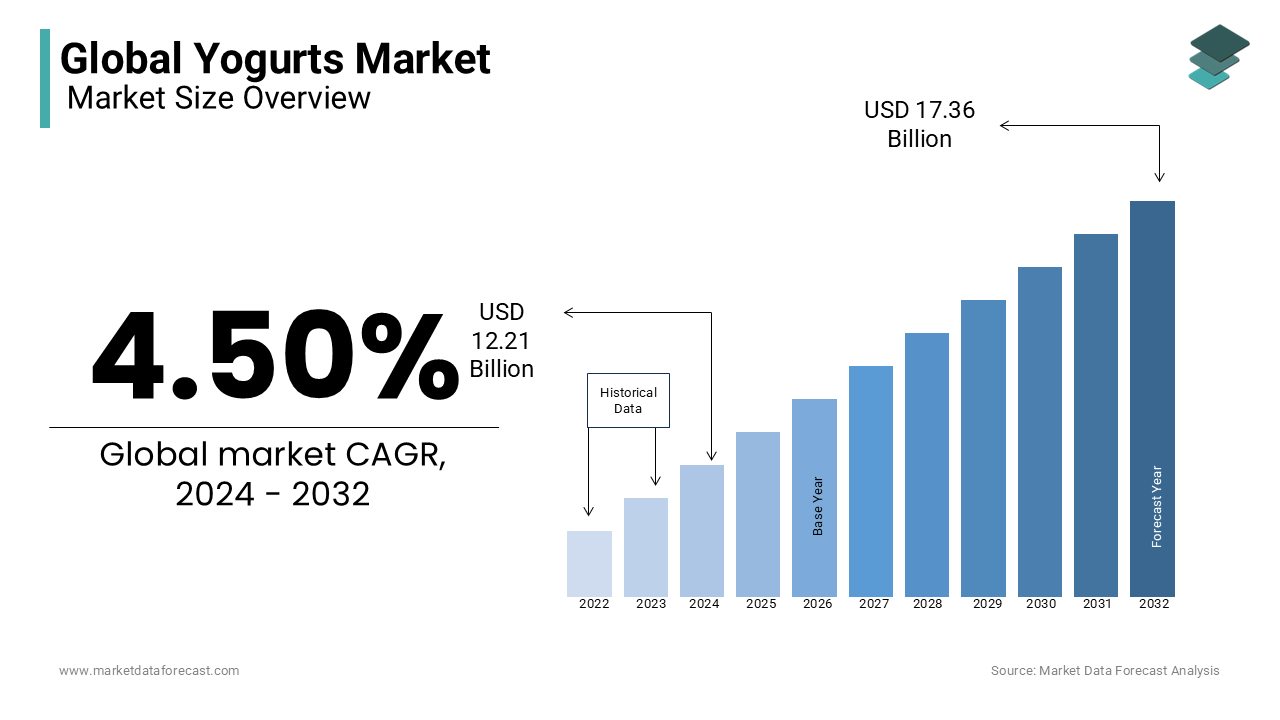

The size of the global yogurts market is expected to be worth USD 12.21 billion in 2024 and is anticipated to be worth USD 18.15 billion by 2033 from USD 12.76 billion In 2025, growing at a CAGR of 4.50% during the forecast period.The use of large amounts of yogurt in various cooking recipes and consuming it as a dessert contributes to the growth of the global yogurt market.

Yogurt is a flavored food that is made by the homogenization and fermentation of pasteurized milk. It is consumed in a variety of forms, such as drinks, snacks, meal replacements, desserts, protein-rich sports drinks, and other forms. The health benefits associated with consuming yogurt include healthy digestion, reduced risk of type 2 diabetes, colon cancer prevention, prevention and treatment of osteoporosis, improved fat and weight loss, improved immune system, high blood pressure high blood pressure, and poor cholesterol. It is a rich source of protein, calcium, vitamins B6 and B12, riboflavin, potassium and magnesium. Because of its high nutritional value, yogurt provides several medicinal benefits. It helps improve immunity, reduces the risk of type 2 diabetes, strengthens bones and teeth, prevents digestion problems, and reduces high blood pressure and bad cholesterol. In recent years, manufacturers have introduced various types of yogurt with probiotics, shakes, cream, and lace pulp. The desire of consumers to increase Internet penetration and the ease of purchasing products is expected to be the driving force behind online shopping in the yogurt market in the near future.

CURRENT SCENARIO OF THE GLOBAL YOGURT MARKET

The increase in demand for probiotic-rich yogurts is due to the rising cognizance of digestive and metabolic advantages and high-protein choices such as Greek yogurt highlights the industry’s alliance with health trends. In addition, the consumption of lactose-free and plant-based substitutes with coconut, soy, and almond-induced products has surged and is progressing as a prevalent option among people wanting dairy-free food. Also, customers are more interested in different flavors as some eat them daily. So, flavor development continues to be part of the company’s product expansion strategy for retaining its existing consumers and adding new ones with unique and exotic taste combinations. Besides this, eco-friendly practices are also transforming the market with the growing emphasis on sustainable packing solutions. This trend is highly popular in European and North American nations. As a result, yogurt producers are employing biodegradable and recyclable packing materials to meet the customer's demand for ecological responsibility. However, in the middle of these patterns, the United States yogurt market is dealing with problems like intense competition and cost pressures. On the other, the prices of yogurt are falling in China. This is because of the large customer of elderly and children. As per a study, the major cost reduction is seen in Tianyou yogurt with a price fall between 14 percent to 22 percent off the listed cost. Hence, it can be said that the market will further expand across the regions in the coming years.

MARKET DRIVERS

Yogurt is increasingly preferred by health-conscious consumers due to its low fat and sugar content.

Makers in this business are providing fortified products that contain vitamins, minerals, and fiber. Leading dairy industry companies are expanding their businesses and expanding their market operations globally. Regular yogurt is readily available in the retail space on the online and offline retail channels at affordable prices. Yogurt consumption can ideally meet the top three consumer product needs for health, mobility and convenience. As a practical alternative to yogurt cups and spoons, yogurt drinks are available in a closing carton pack or with a convenient straw, making them an ideal snack, alternative breakfast, or healthy snack halfway. The increase in digestive disorders promotes the call for probiotic foods in different consumer groups across the world. Yogurt in drink form in multiple flavors is the preferred mostly among various probiotic foods. The market for probiotic food products has emerged as American consumers gradually move to products geared toward digestive health. The global yogurt market is also propelled by the health advantages related to the increasing awareness of people about yogurt intake and weight loss. Other factors supporting market growth are the expansion of retail markets in various regions and lower lactose content in lactose-intolerant patients who do not eat dairy products.

The rise in the call for yogurt in several emerging nations because of the mounting disposable incomes and growth in health awareness is predicted to create extensive growth potential for the extension of the global yogurt market. Many suppliers of national and international raw materials reduce their bargaining power at a low cost. The risk of forwarding integration of suppliers in the market is high, which increases the negotiating power of the supplier. Given the factors, the per capita spending ability is rising and is deemed to remain tight over the calculated period. In addition to the vitamin-fortified, agitated, creamy-pulp-fortified probiotic forms, the availability of nutritious, protein-rich yogurt is expected to fuel the yogurt market during the estimated time. It is also expected to lead the growth of the yogurt market as people are expected to learn about the benefits of yogurt, such as yogurt with good bacteria or probiotics, which strengthens the immune system, provides calcium, and helps fight constipation and diarrhea. The growth of a youth population base with a focus on health, an increasing trend in dual household income, an increase in disposable income and an increase in the demand for organic products are a few of the critical factors promoting the yogurt market globally. The convenient and innovative packaging format offers manufacturers a wide range of growth opportunities. As a result, we are launching products such as self-supply defoamer balls, compressible tubes, and containers with choking caps to minimize spills and minimize potential safety risks.

MARKET RESTRAINTS

Regulatory issues regarding nutritional claims, labeling, and food safety standards are restricting the growth of the yogurt market.

The food and beverages industry is encountering multiple problems which include complying with the rising complicated set of rules and regulations worldwide, maintaining the transparency and visibility of the supply chain, and meeting local or vernacular demands such as language. Apart from this, companies are also encountering hurdles in fulfilling the legal requirements of traceability, compliance, efficacy, and labeling accuracy. For instance, the e Food Safety Modernization Act (FSMA) of the United States necessitates that companies deploy preventative measures, record examinations and safety data for each batch of goods produced, track their entire logistics chain and also furnish information requested by government and law establishments within 24 hours. Also, one of the major constraints is the data collection for traceability, the food safety law demands that milk be collected from a cow and a sample must be kept in a chilled soak and examined regularly after 72 hours to protect the milk’s health and pathogen-free.

Artificial additives and ingredients added to yogurt and treating harmful hormones in dairy cows can limit the consumption of yogurt by people. This is another factor limiting the expansion of the market share. As per the National Center for Biotechnology Information, recent epidemiological research shows a concrete and direct link between milk and dairy items with high consumption and rate of prostate and testicular cancers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.50% |

|

Segments Covered |

By Product Type, Packaged Containers, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis. Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Danone Groupe SA, Ultima Foods Inc., Chobani Inc., Sodiaal S.A, NESTLÉ SA, General Mills, Kraft Foods Group, Inc., and Yakult Honsha Co. |

SEGMENT ANALYSIS

Global Yogurts Market Analysis By Product Type

The traditional yogurt segment is dominating with a considerable market share and is projected to thrive forward during the forecast period. The health benefits it offers like probiotic nutrients, help in stomach inflammation, etc are majorly pushing the segment’s growth rate. According to a survey, yogurt and related drinks are an essential part of Indian meals and about 84 per cent of customers are consuming it regularly. It also shows that close to 47 percent of people are in favour of eating more different packed yogurt items if they provide extra health advantages. Apart from this, plant-based yogurt will be referred to as one of the fastest-expanding snacks around the world. But, it is more common in America and Europe than in China. The majority of eaters like to eat this in IML yogurt cups. Also, they favor plant-based cups and 71-caliber cups with a lid. Interestingly, several foods are affordable in the United States in comparison to the rich nations of the European Union. However, foodstuff is somewhere costlier in the US than in the less expensive countries of the EU. Except for Slovenia, both the US and the EU have elevated food rates than the wealthier EU nations in the East. Therefore, it’s a major factor influencing the demand for the traditional yogurt market.

Global Yogurts Market Analysis By Packaged Containers

The surge in consumption of yogurt pouches will remain ahead of those offered under this category of the market. This can be credited to a significant rise in the popularity and sale of squeezable yogurt products. Moreover, this makes it easy for kids to hold and go for school recess or eat as an appetizer without the need for clean-up. Customers purchase these pouches for snack time during short breaks and their compact size is perfectly suited for camping or traveling. So, these are extremely handy and become convenient for children to have something nice while going. Moreover, companies are adopting environment-friendly solutions in the pouch packaging sector. For example, a recyclable Spout Pouch for yogurt. Some also use several layers to make a viable option that offers all the advantages of being ecologically friendly. In addition, the use of mono-material re-processable pouches is produced from a separate plastic type either Mono PP or Mono PE. This helps in easy recycling against multilayers of synthetic material that utilizes different sorts of polymers and other matters.

REGIONAL ANALYSIS

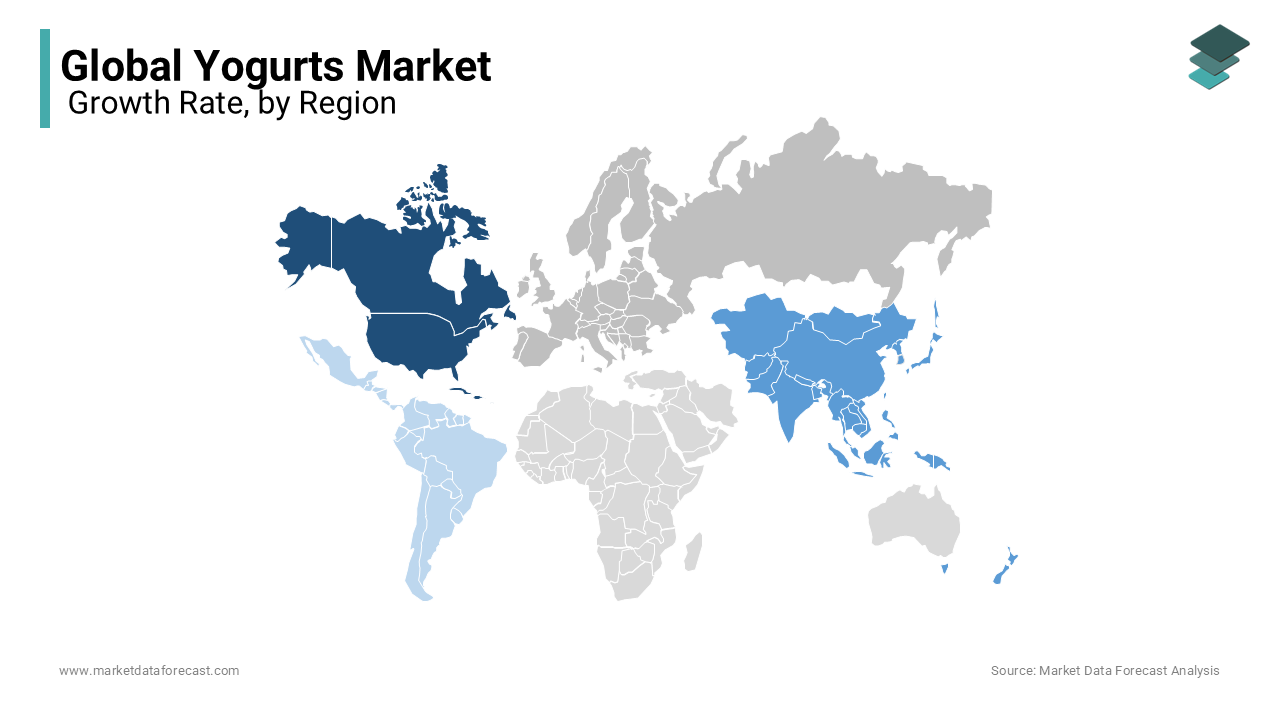

On the basis of geographical presence, North America is touted to be a notable contributor to the yogurt market followed by Europe. Also, the region is supposed to register as a mature market with a stable growth rate in the following years. In addition to providing low-fat products, the introduction of new flavor flavors can promote the growth of the yogurt market in the region. In developing nations in the Asia-Pacific area, China is determined to rule the local market, followed by India. Moreover, Japan is deemed to have recorded significant growth over the evaluated period. In particular, the rise in intake of flavored yogurt in nations like China and Japan is assessed to fuel the yogurt business in the Asia Pacific locale during the conjecture period. As yogurt is considered a snack and dessert, Europe has the largest share, followed by Eastern Europe, Latin America, and others.

KEY PLAYERS IN THE GLOBAL YOGURTS MARKET

Major Key Players in the Global Yogurts Market are Danone Groupe SA, Ultima Foods Inc., Chobani Inc., Sodiaal S.A, NESTLÉ SA, General Mills, Kraft Foods Group, Inc., and Yakult Honsha Co.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Danone lately introduced creative packing for its REMISX yogurt product range. It presents the latest design that steps into consumer insights. Apart from this, the company has also filed a new patent for a recyclable cup shape to fit comfortably in the palm.

- ·In March 2024, the U.S. Food and Drug Administration (FDA) reported through the letter of enforcement discretion that it qualifies the health claims concerning the consumption of yogurt and lower risk of type 2 diabetes. It also stated that the claims should not mislead people and that other elements for utilization of claims are satisfied.

- In January 2024, Nature’s Fynd made a major milestone by developing the world’s first groundbreaking dairy-free, fungi-based yogurt. It is introducing this unique item of yogurt across the country at Whole Foods Market stores. Also, they are the first ones to use Fy, a sustainable fungi protein. This process provides a new substitute for both conventional and current plant-based Yogurts.

- In December 2023, the experts at the University of Virginia School of Medicine found that Lactobacillus helps the body handle stress, potentially providing a new way to defeat mental health conditions such as depression and anxiety. This research separates Lactobacillus from the wider microbiota and focuses on the significance of digestive bacteria in impacting mood disorders via immune system regulation.

DETAILED SEGMENTATION OF THE GLOBAL YOGURTS MARKET INCLUDED IN THIS REPORT

This research report on the global yogurts market has been segmented and sub-segmented based on product type, packaged containers, and region.

By Product Type

- Icelandic Yogurt

- Australian Yogurt

- Traditional Yogurt

- Greek Yogurt

- Kids Yogurt

- Non-Dairy Yogurt

- Other Yogurts

By Packaged Containers

- Yogurt Tubs

- Yogurt Cups

- Yogurt Pouches

- Yogurt Bottles

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What factors are driving the growth of the global yogurt market?

Factors driving the growth of the yogurt market include increasing consumer awareness about the health benefits of yogurt, rising demand for convenient and nutritious snacks, and the introduction of innovative yogurt flavors and formulations.

2. What are the key challenges faced by the yogurt market?

Key challenges faced by the yogurt market include competition from alternative dairy products (such as plant-based yogurts), fluctuations in milk prices, and concerns about added sugars and artificial ingredients.

3. What are the recent trends in the yogurt market?

Recent trends in the yogurt market include the launch of innovative yogurt products with functional ingredients (such as probiotics, protein, and superfoods), increased demand for lactose-free and low-fat options, and the expansion of yogurt-based beverages and smoothies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com