Global Artificial Intelligence (AI) Hardware Market Size, Share, Trends, & Growth Forecast Report by Type (Processors, Memory and Network), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Artificial Intelligence (AI) Hardware Market Size

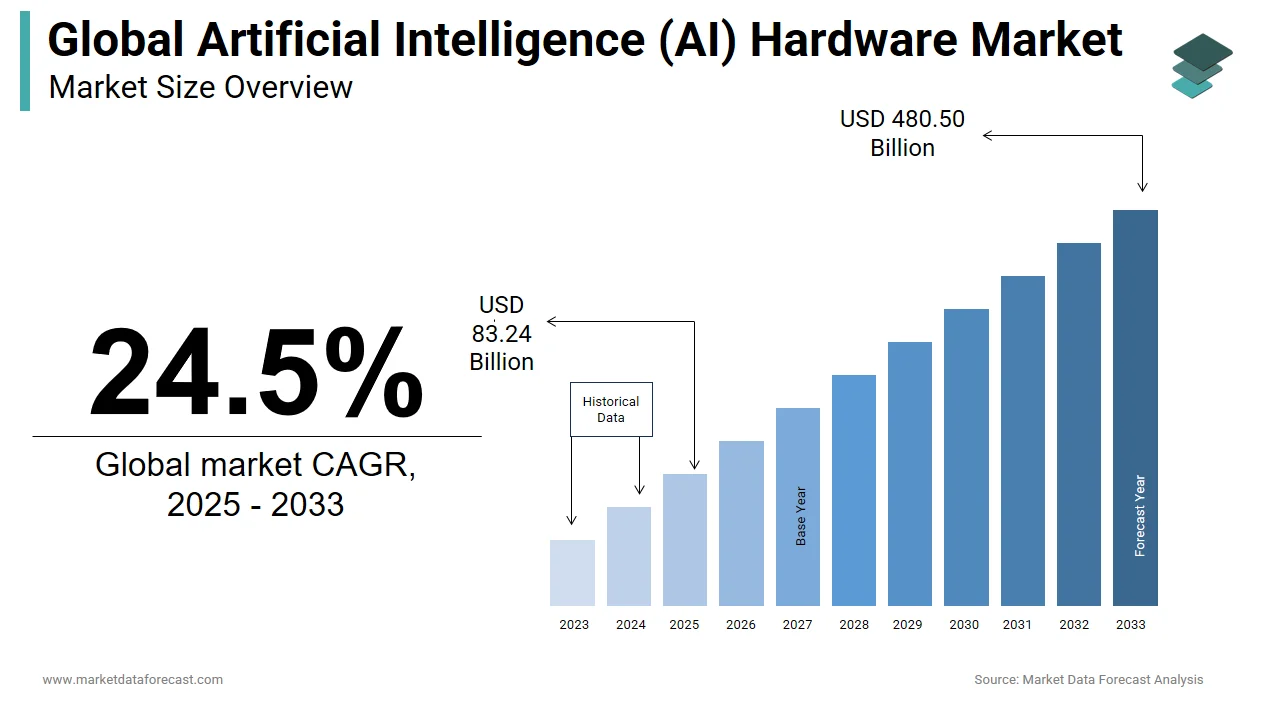

The artificial intelligence (AI) hardware market was worth USD 66.86 billion in 2024. The global market is predicted to reach USD 83.24 billion in 2025 and USD 480.50 billion by 2033, growing at a CAGR of 24.5% during the projection period.

AI Hardware stems from the need to create perfect hardware to accelerate artificial intelligence applications. The physical infrastructure comprises three main parts: computing, storage, and networking. In recent years, the computer has made the most significant progress. The other two areas, storage and networking, which are not as advanced, have yet to see significant innovations in AI applications. The continued increase in Internet users and the advent of Industry 4.0 has intensified the artificial intelligence (AI) hardware market. The growth of big data, the advancement of computer applications and software, and significant improvements in the business aspects of artificial intelligence are driving the industry's growth. Technological advancements due to the increasing adoption of AI and robotics in end-use industries such as IT, automotive, healthcare, and manufacturing will drive demand for the forecast period. The recent advancements in the smartphone industry and the rising application of semiconductors have supported the call for AI hardware market. Also, machine learning and deep learning will be crucial for developing the global artificial intelligence (AI) hardware market.

The demand for AI hardware in the defense sector is driving the market. The Air Force needs unconventional computer architectures for pattern recognition, event reasoning, decision-making, adaptive learning, and autonomous tasks in fuel-efficient manned and unmanned aircraft. According to the researchers, the central area of interest is neuromorphic computing or brain-inspired computing, which involves more advanced processors than traditional Von Neumann architectures. This type of design could lead to unconventional circuits based on emerging nanotechnologies, such as memristors and nano-photonics.

MARKET DRIVERS

The main drivers expected to drive the Global AI hardware market are the demand for an increasingly large and complex dataset, the adoption of AI to improve consumer services and reduce operating costs, the rising number of AI applications, enhanced computing power, and affordable hardware costs.

The continued increase in the number of Internet users around the world is expected to strengthen the overall IoT market further due to the growth of Internet-enabled smart devices such as Radio Frequency Identification (RFID) devices, card readers, barcodes, and mobile computers. With AI technology still in the early stages of your product lifecycle, your workforce with deep knowledge of this technology is limited. Therefore, the impact of this limiting factor is likely to remain high during the early years of the forecast period. The lack of standards and protocols further hinders the growth of the global AI hardware market. New metrics and standards must be developed to implement safe, usable, reliable, and interoperable artificial intelligence technologies that make decisions based on data-driven models, such as machine learning. This can be done by working with stakeholders to develop AI assessment methodologies, best practices, and standard test/work protocols.

The automotive industry is experiencing a decade of rapid change. As vehicles become more connected, new powertrains, such as electric motors, reach the general public, and vehicle autonomy increases. Many automakers have already responded by announcing pilot projects in autonomous driving, which may require artificial intelligence hardware.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

24.5% |

|

Segments Covered |

By Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nvidia (United States), Intel (United States), Xilink (United States), Samsung Electronics (South Korea), Micron Technology (United States), Qualcomm Technologies (United States), IBM (United States), Google (United States), Microsoft (United States), Amazon Web Services (United States), and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The processor segment is estimated to experience the highest CAGR for the forecast period. The factors can be attributed to the increased speed, which enables fast data transmission. High parallel processing capabilities and improved computing power have driven acceptance into the processor segment.

REGIONAL ANALYSIS

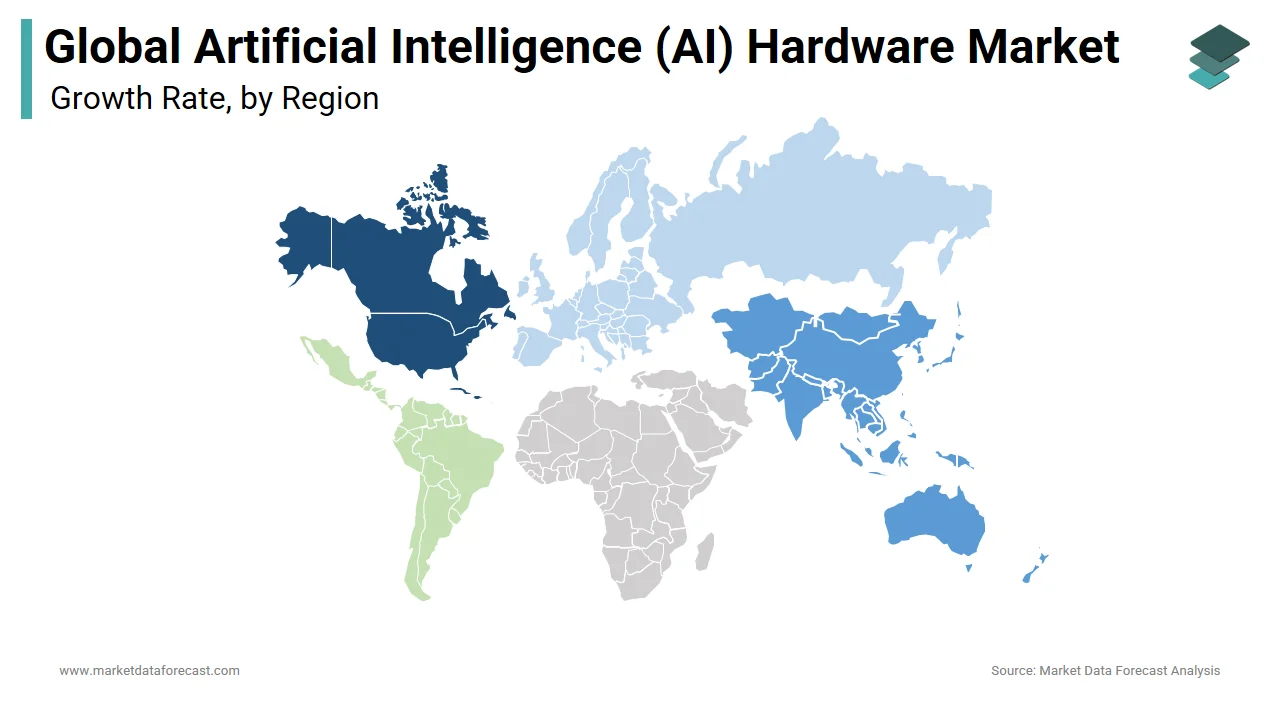

North America will likely experience the highest growth rate during the outlook period. The growing adoption of cloud services in developed countries such as the United States and Canada, along with a strong technical adoption base and the availability of government funds, will drive the market in this area.

KEY MARKET PARTICIPANTS

The major companies operating in the global artificial intelligence (AI) hardware market include Nvidia (United States), Intel (United States), Xilink (United States), Samsung Electronics (South Korea), Micron Technology (United States), Qualcomm Technologies (United States), IBM (United States), Google (United States), and Microsoft (United States).

RECENT MARKET HAPPENINGS

-

In December 2017, NVIDIA introduced TITAN V, the world's most powerful PC GPU, powered by the world's most advanced GPU architecture, NVIDIA Volta. TITAN V excels in computer processing for scientific simulation. Its 21.1 billion transistors deliver 110 teraflops of raw power, nine times more than its predecessor, and are extremely energy efficient.

-

In December 2017, IBM presented its next-generation Power Systems servers with its new POWER9 processor. Explicitly designed for compute-intensive artificial intelligence workloads, the new POWER9 systems can improve training times for deep learning executives by nearly 4x, enabling organizations to build more precise applications faster.

-

In December 2017, Qualcomm Technologies introduced the new Qualcomm Snapdragon 845 mobile platform. Snapdragon 845 uses cutting-edge computing experience Qualcomm Technologies to create a platform for alluring multimedia experiences, which comprises extended reality (XR), on-device AI, and lightning-fast connectivity.

-

In October 2017, Intel is expected to deliver the industry's first silicon for neural network processing, the Intel Nervana Neural Network Processor (NNP), before the end of 2017. Intel collaborated with Facebook to bring technical knowledge from Facebook to develop this new AI material. Intel Nervana NNP promises to revolutionize AI computing in all industries. With Intel Nervana technology, end-user companies can develop entirely new classes of artificial intelligence applications that maximize the amount of data processed and enable customers to find better information, thereby transforming their businesses.

MARKET SEGMENTATION

This research report on the global artificial intelligence AI hardware market has been segmented and sub-segmented based on the type and region.

By Type

- Processors

- Memory

- Network

By Region

- North Americ

- Europ

- Asia Pacific

- Middle East and Africc

Frequently Asked Questions

What types of AI hardware components are experiencing the highest demand globally?

Graphics Processing Units (GPUs) are in high demand for AI applications, with a significant market share, as they excel in parallel processing tasks essential for machine learning and deep learning algorithms.

How is the AI hardware market impacted by advancements in quantum computing?

Quantum computing is poised to revolutionize the AI hardware market by significantly enhancing processing speeds, enabling more complex computations, and unlocking new possibilities in AI applications, though it's still in early stages of adoption.

How are AI hardware vendors addressing concerns related to energy efficiency and sustainability?

AI hardware vendors are increasingly focusing on developing energy-efficient solutions, incorporating technologies like neuromorphic computing and exploring novel materials to mitigate the environmental impact of AI hardware systems.

How is the AI hardware market responding to the increasing demand for specialized hardware for specific AI applications, such as natural language processing or computer vision?

The AI hardware market is witnessing a trend towards the development of specialized hardware tailored for specific AI workloads, such as TPUs for deep learning and AI accelerators optimized for natural language processing and computer vision applications.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com