Global Auditing Services Market Size, Share, Trends, & Growth Forecast Report By Type (Internal Audit and External Audit), Service (Operational Audits, Financial Audits, Advisory & Consulting and Investigation Audit), End-Use (BFSI, Government, Manufacturing, Healthcare, Retail & Consumer, IT & Communications), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Auditing Services Market Size

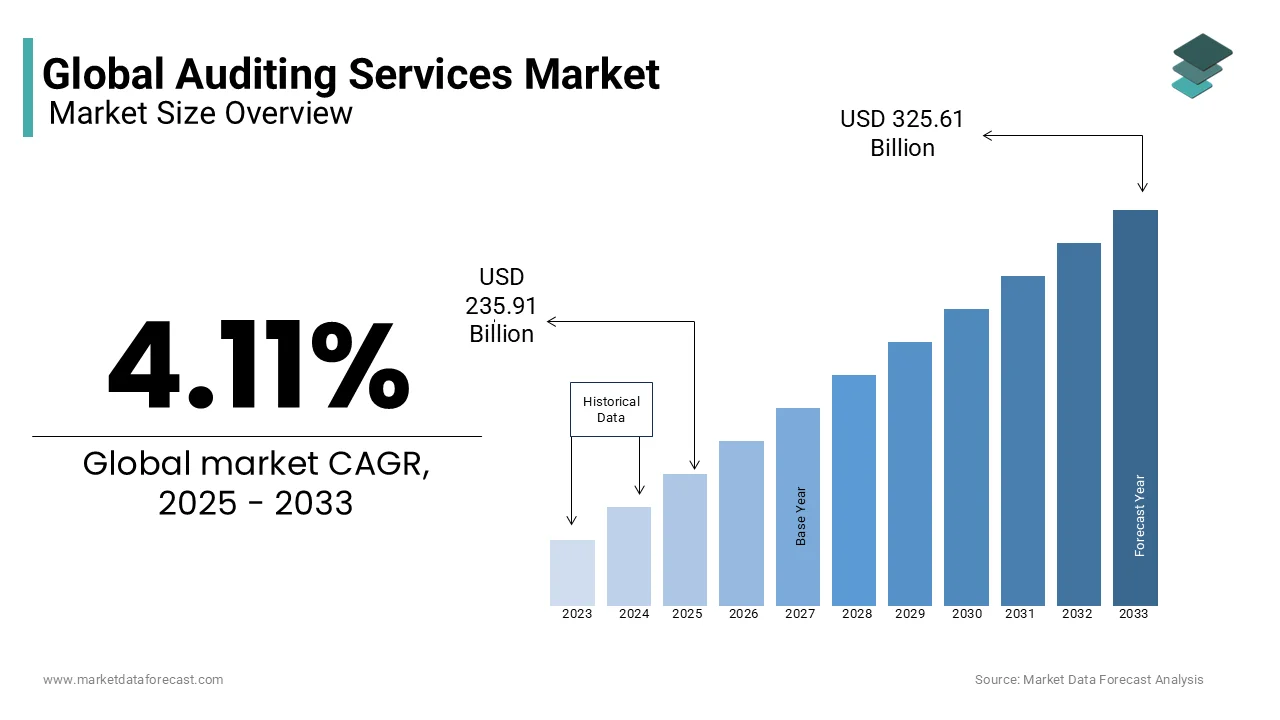

The global auditing services market was worth USD 226.6 billion in 2024. The global market is estimated to be worth USD 325.61 billion by 2033 from USD 235.91 billion in 2025, growing at a CAGR of 4.11% during the foreseen period 2025 to 2033.

Auditing is described as the assessment of the accuracy and dependability of financial and non-financial data, as well as the systems and processes that record and summarise such data. Audit firms provide integrated, strategic, and enlarged audit reports to address concerns and opportunities that affect a company's long-term worth. Auditing services are independent reporting procedures that objectively evaluate a company's financial records and other financial activities to satisfy regulators, investors, directors, and managers that the financial statements are accurate. Shared service delivery models may enable audit firms to collaborate with companies specializing in digital technologies such as big data, analytics, machine learning, mobile computing, and business intelligence. Data analytics services are poised to emerge as new sources of revenue generation that can supplement auditing firms' core business.

In recent times, the auditing services market witnessed a burst of acquisitions and mergers. Mid-range such as Baker Tilly and Grant Thornton have sold controlling holdings to private equity, and other prominent players in the market are engaged in extending their footprints. Like, earlier in 2024, CBIZ picked up stakes in Brown & Kloster LLC, and CompuData and Erickson, and on the other hand, Marcum bought Croskey Lanni PC and others. It's evident that companies and organisations are working diligently to enhance their offerings and compete with the Big Four, comprising PwC, KPMG, EY, and Deloitte. In addition, today's market players are offering a wide range of services from accounting and tax to specialized services such as executive search and technology solutions to gain a competitive edge over their counterparts. When examining the overall landscape, the accounting profession is experiencing a substantial evolution. Market consolidation, regulatory burdens, and technological breakthroughs are propelling shifts throughout the market. Additionally, investments in digital transformation and innovations are heart of the market’s future, with a particular focus on high-growth areas like virtual risk and ESG advisory services.

Over the forecast period, the global auditing services market is expected to rise due to increasingly authoritarian government rules surrounding financial disclosure and reporting. In addition, one significant trend in the auditing services market has been market consolidation. As a result, many auditing firms have been purchased by major accounting firms to expand their service lines or strengthen their existing auditing services.

MARKET DRIVERS

Increasing Corporate Spending on Financial Audits and Recording

The growing corporate spending on financial audits and recording encourages new entrants to choose auditing services is one of the major factors propelling the auditing services market expansion. Furthermore, rising demand for auditing services across various industries, such as healthcare, IT & telecommunications, BFSI, and others, to manage businesses' workflow is likely to fuel the expansion of the auditing services market throughout the forecast period. Technological advancements in audit services to assist auditors in gaining actionable insights by leveraging financial numbers and graphs from organizations are supporting the growth of the auditing services market.

Demand for Financial Transparency

Rising demand for financial transparency propels the market growth. Given the situation of the global economy and the volatile financial market worldwide, there is an escalating demand for financial transparency. The changing technological landscape and the application of new business models have increased irregularities in digital finance.

According to Consumer International, about 43 per cent of customer bodies found the absence of transparency as a major issue in digital finance. As per their 6 months campaign regarding Transparent Digital Finance for Consumers, outcomes reveal that transparency goes beyond simply fulfilling regulatory obligations.

MARKET RESTRAINTS

Lack of Awareness about Financial Auditing

Limited awareness about financial auditing services among people is a significant issue projected to limit the global market's growth over the forecast period. Furthermore, another factor launched to impede the development of the auditing services market over the forecast period is an increase in people's inclination for automation or artificial intelligence (AI) across various industries.

MARKET OPPORTUNITIES

AI-Powered Innovations

The adoption of AI-powered innovations is expected to shape the future of the auditing services market. The specific manners in which auditors are currently utilising AI continue to be largely undiscovered. It is predicted that AI will be employed in real-time auditing to perform 24/7, examining vast amounts of data for trends and anomalies, finding unusual transactions, evaluating the stability of a company and forecasting its future viability.

According to the survey of the Center for Audit Quality, 1/3rd of public entities are utilizing artificial intelligence in their financial reporting. However, it is believed to elevate in the coming years.

As per another survey published in Thomson Reuters, 8 per cent of tax companies were found to be using Generative AI technology, with 13 per cent of establishments preparing to employ this technology soon.

In 2023, artificial intelligence has become a fundamental component of workflows for accounting and tax professional’s processes by optimizing activities, improving precision, and allowing experts to concentrate on higher-value jobs.

MARKET CHALLENGES

Reluctance to use Artificial Intelligence

The expansion of the auditing services market is impeded by the reluctance to use artificial intelligence. It is set to reshape the market in future, but currently, its adoption is difficult due to several factors including the absence of infrastructure and training, highly costly technology, difficulty in usage, etc.

According to the Journal of Accountancy, major reasons stated by companies for not integrating AI technology into their organization and audits are the lack of training and infrastructure (23 per cent of survey participants), technology is extremely expensive (17 per cent), not useful technology (17 per cent), incompetent to access usable customer data (13 per cent), and insufficient client controls for data integrity (4 per cent)

Risk of employing AI in auditing is another factor impeding the market growth. Basically, there is still a dependence on the accurate data being entered at the outset. Similarly, AI cannot determine if an answer or solution has been implemented appropriately. Besides being faster than humans, the risk equally persists due to the absence of transparency in reaching results or outcomes.

As per the findings of a survey by the KPMG, about 65 per cent i.e. 2/3rd of firms are turning to their external auditors for assistance with AI-related threats and problems, particularly through extensive evaluations of their AI control frameworks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.11% |

|

Segments Covered |

By Type, Service, End Use, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ProtivitiRSM US, Grant Thornton International Ltd., Moore Stephens International Limited, Mazars, Nexia International Limited, Ernst & Young, Deloitte, KPMG, PwC and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The external audit segment is expected to grow at a 4.5% compound annual growth rate (CAGR) to reach US$56.7 billion by the conclusion of the analysis period. For the following five years, growth in the Internal Audit Services market has been revised to 4.8% CAGR. The global Auditing Services market is now dominated by this category, accounting for 18.1% of the total. In addition, due to increasing companies' preference for successfully managing fraud risks, defending company interests, and promoting business performance, the internal segment is predicted to grow faster over the projection period.

According to the annual market share analysis of auditor engagements by Ideagen Audit Analytics, as of May 2023, a total of 258 firms were engaged in performing audits for 6,950 companies registered with the Securities and Exchange Commission (SEC). This depicted the upward trend which was witnessed in 2022. There was a 4.5 per cent rise in population. Moreover, 2023 marks the straight 4th year on the trot noticing a growth in SEC registrants.

By Service Insights

The market is bifurcated into Operational Audits, Financial Audits, Advisory and Consulting, and Investigation Audit. The financial statement audit segment had a market share of more than 60.0 per cent. This is because of strict laws governing financial audits and reporting, businesses are predicted to grow at the fastest rate over the forecast period.

As per the study by the Business Standard, as of the end of September 2024, over 3 million audit reports, comprising around 2.95 million reports of tax audits, have been duly filed or effectively submitted for Assessment Year 2023-24 on the e-filling portal of the Income Tax Department in India.

Further, the segment’s market size is expected to grow due to the use of AI for document review. Companies apply AI to summarize major points from receipts, invoices, and contracts; and can rapidly determine irregularities which need further examination. This ability not only quickens the review process but also improves the precision and dependability of compliance checks and financial audits. Additionally, the injection of AI algorithms has granted auditors a unique capability to determine complicated patterns and subtle irregularities inside large datasets.

By End-Use Insights

The market has been segmented into BFSI, government, manufacturing, healthcare, retail & consumer, IT & communications. The BFSI category accounted for roughly 21.0 per cent of total revenue. During the projected period, the segment is expected to grow at the fastest rate.

REGIONAL ANALYSIS

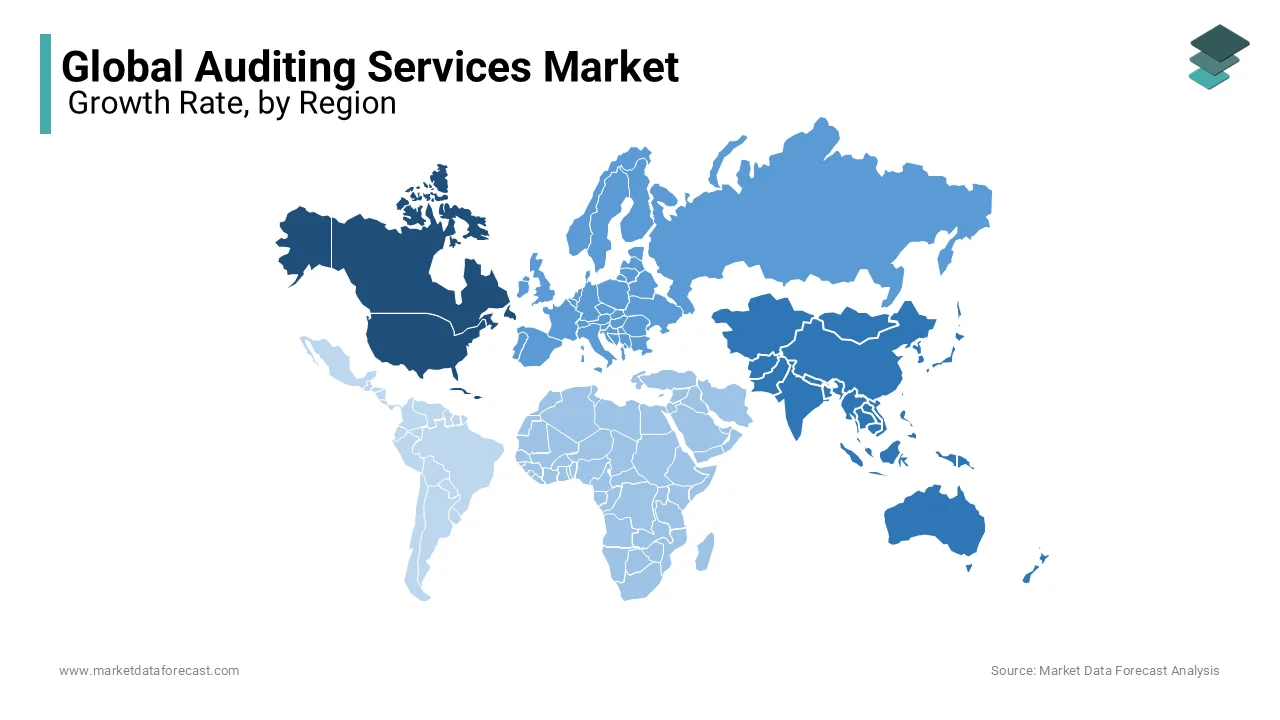

North America is predicted to dominate the auditing services market worldwide in terms of revenue during the forecast period. This is because of the regulatory environment, the presence of many multinational corporations, and the rising adoption of efficient internal auditing and reporting practices by companies in various regions. Moreover, the market in the United States is expected to expand considerably in the coming years. The country currently controls 28.85 per cent of the global market. Canada is expected to grow at a 3.3 per cent annual rate between 2025 to 2033.

A study published in Richard Chambers, around 48 per cent of study participants in North America, and about 51 per cent globally stated their internal audit function included a team of five or fewer people. In a wider context, 73 per cent are from the North America and 71 per cent in total answered their team or department had 10 or fewer personnel.

Asia Pacific is rapidly expanding in the Auditing services market and holds a substantial share. China and India are likely to lead the regional market growth. China is expected to reach a market size of USD 50.3 billion in 2027, with a CAGR of 6.7 per cent from 2016 to 2026, and Japan at 2.4%. In India, 70% of all statutory auditors operate with one of the Big 4, indicating that smaller auditors need help breaking into the upper end of the audit market. The Asia-Pacific market is expected to reach USD 38.5 billion by 2026, led by countries like Australia, India, and South Korea. Germany is expected to increase at a 3 per cent compound annual growth rate (CAGR), while the rest of Europe's market will reach USD 50.3 billion by 2026. During the analysis period, Latin America will grow at a CAGR of 3.2 per cent.

KEY PLAYERS IN THE MARKET

Companies playing a notable role in the global auditing services market include ProtivitiRSM US, Grant Thornton International Ltd., Moore Stephens International Limited, Mazars, Nexia International Limited, Ernst & Young, Deloitte, KPMG, and PwC.

The four largest accounting companies in the World, based on revenue, are referred to as the "Big Four." Deloitte, Ernst & Young (EY), PricewaterhouseCoopers (PwC), and Klynveld Peat Marwick Goerdeler (KPMG) are the names of the Big Four. The Big Four also provide tax, strategy, and management consulting, valuation, market research, assurance, legal advising services, and auditing services.

RECENT HAPPENINGS IN THE MARKET

- In November 2024, BDO reported a drop in their payout to its partners, giving an average of 609,000 euros per partner. This comes after an ambitious hiring program and substantial investment in its strategy for growth. Even though partner's earnings were reduced by 6 per cent from the last year, the company’s financial growth remains strong and operating profits increased by 5 per cent to 198 million Euros, propelled by a significant 24 per cent surge in auditing services.

- In July 2024, CBIZ Inc. announced that it will purchase Marcum LLP in a definitive deal of 2.3 billion dollars, which depicts the new reorganization in the audit industry. This deal is predicted to conclude by the end of the year and will position the CBIZ as the 7th biggest accounting company in the United States and can bring in a total annual revenue of 2.8 billion dollars.

- In May 2024¸ partners at the KPMG United Kingdom and KPMG Switzerland with astounding voted to unite, making a new 4.4 billion dollars entity (3.44 billion euros) which will position itself as the 2nd biggest firm within the umbrella of the KPMG market. This will set up a new limited liability partnership (LLP) combining the equity partners of both firms. Moreover, this merger can into effect on 1st October 2024. By joining their complementary technologies and strengths, the new firm strives to improve service offerings throughout the advisory, tax and legal, and audit sectors. With a wider geographical reach, the entity will also augment its proficiency, benefiting both international and national clients.

MARKET SEGMENTATION

This research report on the global auditing services market has been segmented and sub-segmented based on type, service, end-use, and region.

By Type

- Internal audit

- External audit

By Service

- Operational Audits

- Financial Audits

- Advisory and Consulting

- Investigation Audit

By End-Use

- BFSI

- Government

- Manufacturing

- Healthcare

- Retail & consumer

- It & communications

By Region

- North America

- Europe

- Asia-pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global auditing services market?

The global auditing services market size is estimated to be worth USD 235.91 billion in 2025.

Which regions contribute significantly to the global auditing services market share?

Major contributors to the global auditing services market share include North America, Europe, Asia-Pacific, and emerging markets in Latin America and the Middle East.

How has the COVID-19 pandemic impacted the global auditing services market?

The COVID-19 pandemic has led to increased scrutiny of financial reporting, remote auditing practices, and a greater focus on risk management, influencing the dynamics of the global auditing services market.

Who are the key players in the auditing services market?

ProtivitiRSM US, Grant Thornton International Ltd., Moore Stephens International Limited, Mazars, Nexia International Limited, Ernst & Young, Deloitte, KPMG and PwC are the leading companies in the global auditing services market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com