Global Autoimmune Diagnostics Market Size, Share, Trends & Growth Analysis Report – Segmented By Test Type ( Autoantibody Tests, Antinuclear Antibody Tests, Complete Blood Count (CBC),C-reactive protein (CRP) ), Disease Type, End-User & Region - Industry Forecast (2025 to 2033)

Global Autoimmune Diagnostics Market Size

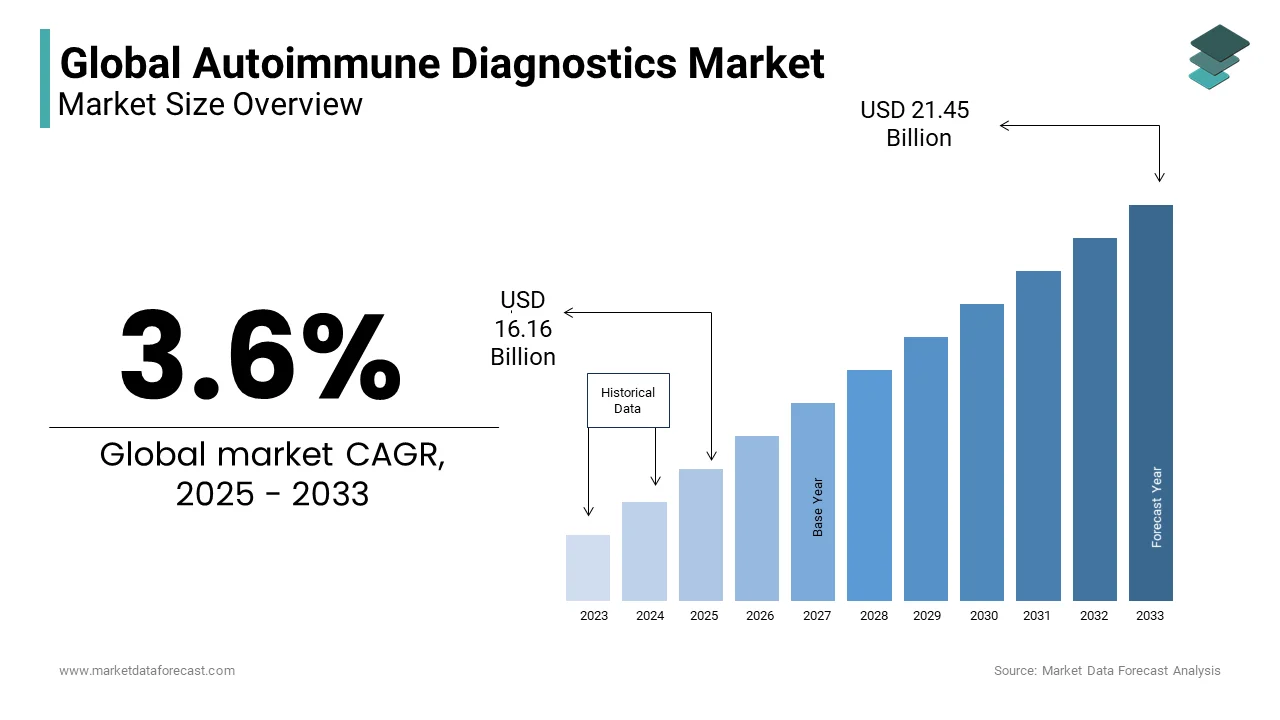

In 2024,the global autoimmune diagnostics market was valued at USD 15.60 billion and it is expected to reach USD 21.45 billion by 2033 from USD 16.16 billion in 2025, growing at a CAGR of 3.6% during the forecast period.

Autoimmune disease is a disorder where the patient’s immune system attacks its body tissues, leading to body organs damage. Nearly 80 types of autoimmune diseases have been known so far.

MARKET DRIVERS

The high incidences of autoimmune diseases and growing awareness about autoimmune diseases further contribute to the growth of the global autoimmune diagnostics market.

The global autoimmune diagnostics market is forecasted to grow tremendously during the forecast period. It is receiving a significant boost from a rise in the prevalence of autoimmune disorders like people with type 1 diabetes in newborn babies with copulation of demand for rapid diagnostics.

In addition, growing R&D activities on autoimmune diseases are favoring the growth of the autoimmune disorders market. Across the world, many research and diagnostics industries are undertaking new initiatives with a complication with government organizations by owning a rise in the prevalence of autoimmune disorders. They will have a consequence on healthcare expenditure, as per the National Institutes of Health (NIH) data published that these disorders are in the top ranking, which leads to an increment in mortality rates among women. The factors mentioned above are the primary and significant drivers of the autoimmune diagnostics market.

MARKET RESTRAINTS

Factors such as the high frequency of false-positive results and high turnaround time for diagnostic test results are anticipated to hamper the market's growth rate. In addition, rising healthcare expenditures, poor awareness among people regarding autoimmune diseases, and diagnostic measures further inhibit the growth of the autoimmune diagnostics market. Moreover, fewer income companies and the rise of economy countries address some issues for the autoimmune diagnostics market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.6% |

|

Segments Covered |

By End User, Test Type, Disease Type & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bio-Rad, Siemens Healthcare, Abbott Laboratories, Crescendo Bioscience, Roche Diagnostics, SQI Diagnostics, AESKU Diagnostics, INOVA Diagnostics Inc., BioMerieux SA, Beckman Coulter Inc., Hemagen Diagnostics, Quest Diagnostics, Eli Lilly, and GlaxoSmithKline Plc. |

SEGMENTAL ANALYSIS

By End User Insights

Based on the end-user, the hospital end-user segment is projected to play a leading role in the global autoimmune diagnostics market growth. Hospitals use advanced technologies to organize multiple tests simultaneously with robust and appropriate results. The surging autoimmune disease consultations

Research centers and diagnostic labs worldwide are likely to encourage measures in coordinating with the government sectors due to growing incidences of autoimmune disorders and expansion of investments in the healthcare field. These factors represent the segment's growth worldwide. In addition, many research and diagnostic centers commit to organizing public awareness activities to educate singles regarding autoimmune diseases and possible treatment options and diagnoses. Therefore, the mentioned factors influence the segment positively.

By Test Type Insights

The autoantibody tests segment is predicted to dominate the global market based on the test type during the forecast period. An autoantibody is the largest among all the elements of the autoimmune diagnostics market.

By Disease Type Insights

Based on the disease type, the localized autoimmune disease diagnostics segment was the market leader in 2023 and is predicted to witness healthy growth during the forecast period. The segment is majorly driven by the heavy procedural volumes and relevantly high compared to systemic autoimmune disease diagnostics. According to the American Autoimmune Related Diseases Association, approximately 50 million people suffer from related autoimmune disorders.

The systematic autoimmune disease diagnostics market is expected to grow at the fastest CAGR during the forecast period. Due to the burgeoning prevalence of rheumatoid arthritis, the rheumatoid arthritis segment, surging consciousness of the disease, and government support, aid in market development. For example, Amgen exhibited a safety trial for diagnostics in treating Systematic Lupus Erythematous.

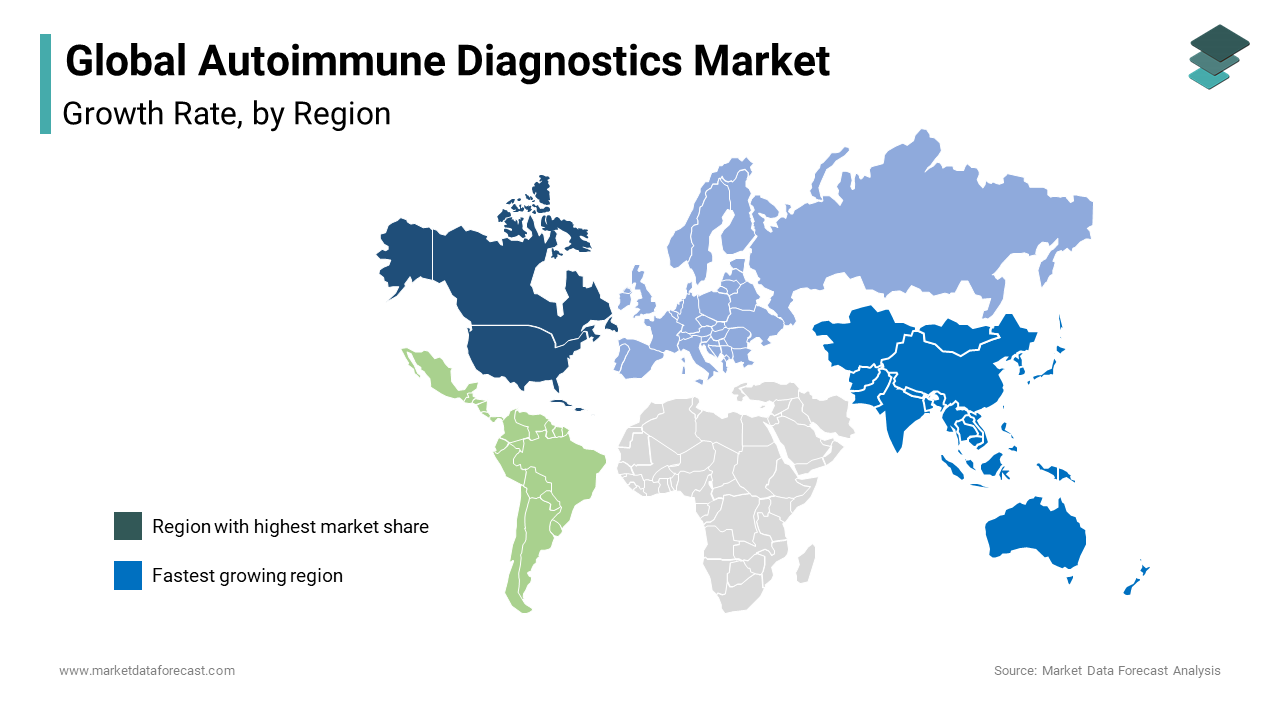

REGIONAL ANALYSIS

Geographically, the North American region is estimated to rule the global autoimmune diagnostics market during the forecast period, followed by Europe and Asia Pacific. The Asia-pacific market is expected to account for the fastest growth rate during the forecast period. The North American region accounted for 39.2% of the worldwide market in 2023. The presence of favorable initiatives and regulations by AARDA majorly drives the growth of the North American region. Moreover, North American has a high prevalence of diseases.

During the forecast period, the Asia-Pacific region is one of the most lucrative regional markets worldwide and is anticipated to showcase the fastest CAGR. The advancements primarily drive the progress of the APAC region in the healthcare infrastructure and increase patient awareness levels.

The European region had a substantial share of the worldwide market in 2023 and is forecasted to witness a promising CAGR in the coming years. Factors such as growing economies and increasing R&D activities around autoimmune diagnostics are favoring the regional market growth. In addition, the rising need for a better and more accurate diagnosis for systematic localized diseases positively impacts the autoimmune diagnostic market.

KEY MARKET PLAYERS

Notable participants leading the global autoimmune diagnostics market profiled in the report are Bio-Rad, Siemens Healthcare, Abbott Laboratories, Crescendo Bioscience, Roche Diagnostics SQI Diagnostics, AESKU Diagnostics, INOVA Diagnostics Inc., BioMerieux SA, Beckman Coulter Inc., Hemagen Diagnostics, Quest Diagnostics, Eli Lilly and GlaxoSmithKline Plc.

RECENT HAPPENINGS IN THIS MARKET

-

In 2019, Cambridge Life Sciences limited launched ZEUS IFA test systems in the US.

-

In 2019, US FDA EUROIMMUN Anti-Tissue Transglutaminase ELISA approval was received by PerkinElmer, Inc. It will help the confirmation of clinicians for celiac disease diagnosis.

- In 2019, an agreement was made between Exagen Inc. with GSK earlier extended for a year. This extension will help the key players to drive awareness about challenges facing lupus diagnosis and management.

MARKET SEGMENTATION

This research report on the global autoimmune diagnostics market has been segmented and sub-segmented based on the test type, disease type, and region.

By End User

- Hospitals

- Research Centers

- Diagnostic Laboratories

By Test Type

- Autoantibody Tests

- Antinuclear Antibody Tests

- Complete Blood Count (CBC)

- C-reactive protein (CRP)

- Comprehensive Metabolic panel

- Urinalysis

- Erythrocyte Sedimentation Rate (ESR)

- Others

By Disease Type

- Localized Autoimmune Disease Diagnostics

- Graves' Disease

- Hashimoto's Thyroiditis

- Multiple Sclerosis

- Type 1 Diabetes

- Psoriasis

- Others

- Systemic Autoimmune Disease Diagnostics

- Rheumatoid Arthritis (Ra)

- Ankylosing Spondylitis

- Systemic Lupus Erythematosus (SLE)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the autoimmune diagnostics market?

The growing prevalence of autoimmune diseases, growing awareness and understanding of autoimmune diseases, and the development of novel diagnostic technologies are majorly driving the growth of the autoimmune diagnostics market.

Who are some of the key players in the autoimmune diagnostics market?

The global autoimmune diagnostics market was worth USD 15.06 billion in 2024.

What regions are expected to witness significant growth in the autoimmune diagnostics market?

North America and Europe are expected to witness significant growth in the market, owing to the increasing prevalence of autoimmune diseases and the presence of well-established healthcare infrastructure.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com