Global Carrageenan Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Kappa, Lota And Lambda), Application (Food Industry Dairy, Meat, Beverages And Pet Food), Pharmaceutical Industry And Cosmetics Industry), Grade (Refined Carrageenan And Semi-Refined Carrageenan), Seaweed Source (Gigartina, Chondrus, Iridaea And Eucheuma), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Carrageenan Market Size

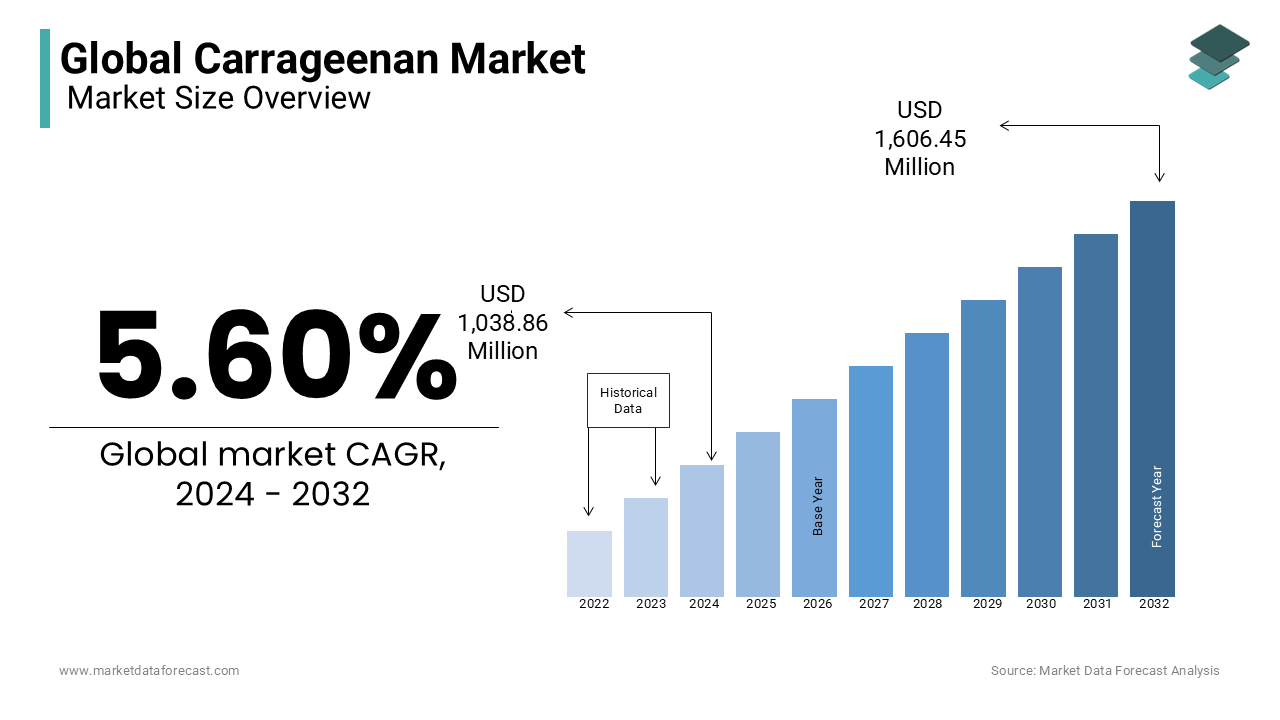

The global carrageenan market size was calculated to be USD 1.03 billion in 2024 and is anticipated to be worth USD 1.69 billion by 2033 from USD 1.09 billion In 2025, growing at a CAGR of 5.60% during the forecast period.

Carrageenan is an additive and natural component of red algae or Irish moss used to emulsify, concentrate, and preserve food and beverages. Carrageenan is a water-soluble fiber that makes low-fat and low-fat options taste better than sugar, making certain foods more nutritious. In addition, carrageenan helps stabilize food and drinks by preventing them from separating. For example, chocolate is deposited at the bottom of chocolate milk without carrageenan. Yogurt, meat products, and walnut milk are the main applications in which carrageenan is used as an ingredient. Additionally, soy milk, hemp milk, deli meats, chocolate milk, cottage cheese, non-dairy desserts, vegan cheese, coconut milk, etc., are the main sources of carrageenan in the market. Also, discontinuing infant formula, minimizing food waste by avoiding spoilage, and making yogurt and ice cream creamier are some of the benefits of carrageenan ingredients. Carrageenan is commonly found in undigested and decomposed forms. Some studies suggest that carrageenan intake may promote or trigger inflammation, swelling, food allergies, colon cancer, glucose intolerance, and irritable bowel syndrome, which can lead to diseases such as tendinitis, arthritis, and chronic cholecystitis. Carrageenan, although indigestible, is used prominently in the emulsification of food products. The increasing demand for processed food ingredients and organic ingredients is increasing the carrageenan market.

MARKET DRIVERS

The growing demand for organic ingredients and increasing usage of carrageenan for various reasons are driving the growth of the global carrageenan market.

The properties of carrageenan such as texturing, thicknesses, stabilizers and gelling agents are contributing to the growth of the global market. A significant amount of carrageenan is used in nutritional supplements, processed meats, kinds of toothpaste, dairy products, skin preparations, laxatives, and pesticides to further develop the global market during the estimated time. Another important factor in the growth of the market is the many functional and health benefits of carrageenan-based products. It acts as a stabilizing, thick texturizing, and gelling agent. The carrageenan market is multiplying with the rise in its application as a raw material in the production of bakery products, water-based foods, meat, and pet foods.

Carrageenan is also used as an emulsifier in the production of dairy products. In addition, carrageenan is also used in meat and poultry, as well as in bakery and confectionery products. Mono and diglycerides of carrageenan, lecithin, and fatty acids are considered the best alternatives to artificial additives derived from natural sources such as sunflower, palm, or soybean oil. So, the surge in the demand for natural food additives will support the development of the market during the projection period. Additionally, many food and beverage manufacturers prepare vegan products using carrageenan instead of gelatin in the dessert production process. One of the prominent aspects boosting the global carrageenan market is the augmented call for processed foods. As awareness of ingredients in processed foods increases, so does the demand for organic ingredients. Another very important factor for the growth of the carrageenan market is the multi-functionality of the product. It is thicker and acts as a stabilizing, texturizing, and gelling agent. This replaces many other products used in processed foods.

MARKET RESTRAINTS

The availability of several alternative products that can replace carrageenan is expected to limit the growth of the global carrageenan market.

Various health effects associated with carrageenans, such as bloating, glucose intolerance, and inflammation, can lead to incredible use and are estimated to hinder the growth of the market during the estimated time frame. Some government agencies, such as the National Organic Standards Board, recently decided to remove carrageenan from the approval list, and foods containing carrageenan are no longer marked as organic in the USA. This may affect the consumption of carrageenan and is expected to hinder the growth of the global carrageenan market in the near future.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.60% |

|

Segments Covered |

By Type, Application, Grade, Seaweed Source & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis. Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Shemberg Marketing Corporation, AEP Colloids, Ingredients Solutions Inc., Gelymar SA, Soriano SA, Marcel Trading Corporation, Danisco A/S, Scalzo Food Industries, Altrafine Gums, TIC Gums Incorporation, Gum Technology Corporation, DuPont (U.S.), Cargill (U.S.), Kerry Group (Ireland), CP Kelco (U.S.), Ashland Inc (U.S.), Ingredion (U.S.), TIC Gums (U.S.), and Tate & Lyle (U.K.) |

SEGMENTAL ANALYSIS

Global Carrageenan Market Analysis By Type

Kappa carrageenan is one of the most common types of food and beverage use. It is a natural polymer that is extracted from the red marine macroalgae. In general, it acts as a stabilizer or thickening agent that can be applied either in water or milk. The rising prominence of organic food products is escalating the growth rate of this segment. The Lota segment is thriving to hit the highest CAGR by the end of the forecast period. The rising importance of using this product in cosmetics and pharmaceuticals is attributed to leveraging the growth rate of the market. This type is getting a huge positive response for use in pharmaceuticals to manufacture prominent drugs of high quality that have very few side effects. The lambda segment is set to have prominent growth opportunities in the coming years.

Global Carrageenan Market Analysis By Application

The food industry is esteemed to have the fastest growth rate throughout the forecast period. The increasing global population and rising consumer preferences for different flavors and innovative food products are likely to cause a surge in the growth rate of the market. The rising demand for the launch of high-quality and effective food or beverages using natural ingredients is substantially elevating the growth rate of the market. Increasing investments in the food and beverages industry by the government accordingly to reduce the concern of food insecurity in various countries is certainly to bolster the growth rate of the market. The pharmaceutical industry segment is attributed to leveraging the growth rate of the market. Carrageenan is more specific in reducing cancer diseases. It shows anti-cancer properties and also acts as an immunomodulatory activity, which will reduce the growth of cancer cells. The rising use of carrageenan for medicinal purposes is merely to elevate the growth rate of the market.

Global Carrageenan Market Analysis By Grade

The refined carrageenan segment is leading with the dominant share of the market, whereas the semi-refined carrageenan segment is accomplished to hit the highest CAGR by the end of 2029. Increasing support from government organizations by approving the partial use of carrageenan in food and drugs is expected to showcase the growth rate of the market.

Global Carrageenan Market Analysis By Seaweed Source

The Gigartina segment is leading with the largest share of the carrageenan market. In recent times, it has been one of the most effective molecular probes that is used to detect SARS-CoV-2. Carrageenan extracted from the Gigartina molecular probe played an important role in detecting this disease. Also, it is one of the rich natural sources of carrageenan, which is the most utilized seaweed in Chile. The Chrondus segment is likely to have the fastest growth opportunities in the coming years.

REGIONAL ANALYSIS

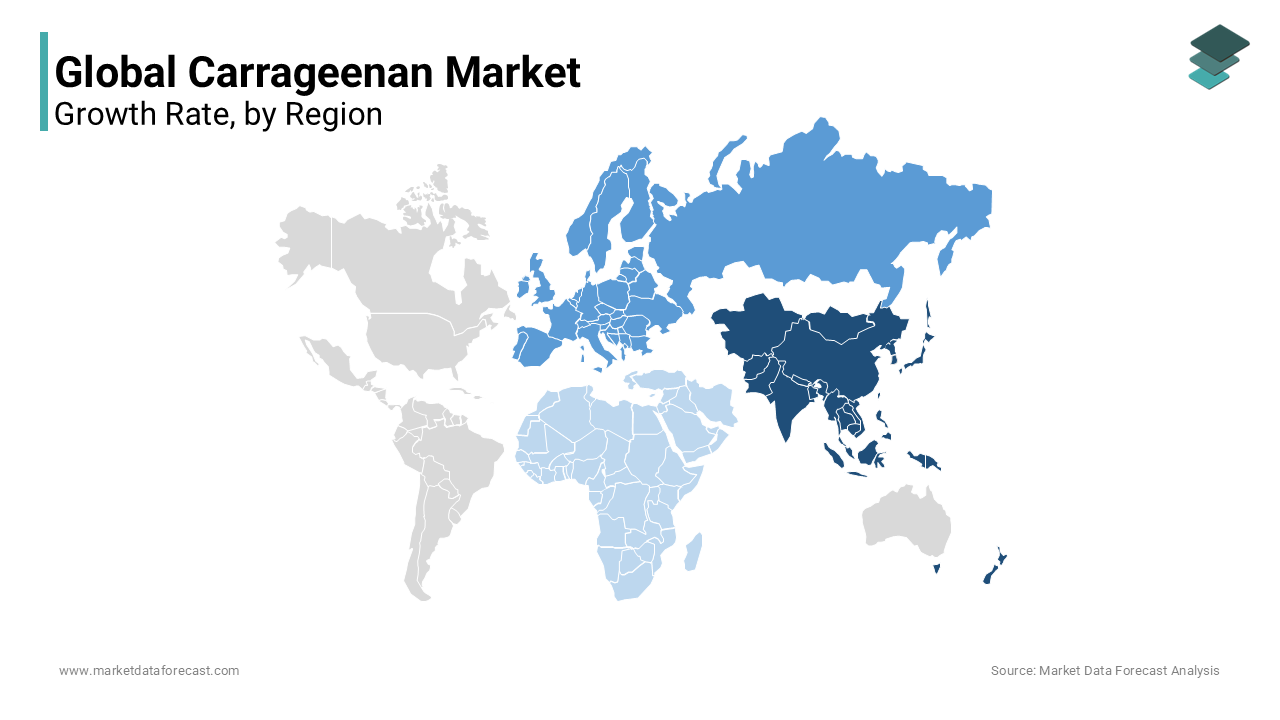

Asia Pacific is expected to occupy most of the industry as the number of applications increases. The European Union and Latin America are also among the prominent producers of carrageenan across the world. Of these regions, Europe is estimated to remain dominant during the outlook period in terms of value and volume. The growth of the carrageenan market in European countries is supposed to be driven by several factors. One of the prominent elements supplementing the growth of this market is the intake of processed foods by European consumers. The changes in consumer lifestyle have pushed them towards processed foods, accelerating the carrageenan market growth over the determined period. Of the countries in Europe, Germany, and the United Kingdom, in 2019, a total of 45% of the market share in the regional carrageenan market, but Asia Pacific is foreseen to expand at the most substantial growth over the prognosis period. The making of carrageenan is exceptionally high in the southeastern nations of the APAC. The Philippines has a significant market share in the region in terms of production. The United States is one of the main exporters of carrageenan, with the world average that drives the North American market. Carrageenan markets in the Middle East, Africa, and Latin America are likely to experience a significant increase in carrageenan consumption as food intake and low-fat food intake increase to avoid sugar-related problems.

KEY PLAYERS IN THE GLOBAL CARRAGEENAN MARKET

Major Key Players in the Global Carrageenan Market are Shemberg Marketing Corporation, AEP Colloids, Ingredients Solutions Inc., Gelymar SA, Soriano SA, Marcel Trading Corporation, Danisco A/S, Scalzo Food Industries, Altrafine Gums, TIC Gums Incorporation, Gum Technology Corporation, DuPont (U.S.), Cargill (U.S.), Kerry Group (Ireland), CP Kelco (U.S.), Ashland Inc (U.S.), Ingredion (U.S.), TIC Gums (U.S.), and Tate & Lyle (U.K.)

RECENT HAPPENINGS IN THE MARKET

- CP Kelco U.S., Inc., in November 2019, declared the introduction of NUTRAVA citrus fiber. It is produced in the form of citrus peel to help provide water-holding capacity, emulsion stabilization, viscosity, and suspension.

- Cargill declared the extension of its Seabrid portfolio in July 2018, with the advent of the latestSatiagel Carrageenan Extract. It is specifically designed to provide texturing solutions for creamy dairy desserts.

- In May 2018, Marcel announced the acquisition of CP Kelco's Cebu carrageenan plant. Through this, the company will deal with four carrageenan plants.

DETAILED SEGMENTATION OF GLOBAL CARRAGEENAN MARKET INCLUDED IN THIS REPORT

This research report on the global carrageenan market has been segmented and sub-segmented based on type, application, Grade, seaweed source, & region.

By Type

- Kappa

- Lota

- Lambda

By Application

- Food Industry

- Pharmaceutical Industry

- Cosmetic Industry

By Grade

- Refined Carrageenan

- Semi-Refined Carrageenan

By Seaweed Source

- Gigartina

- Chondrus

- Iridaea

- Eucheuma

By Region

- North America

- Europe

- APAC

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What are the factors driving the growth of the Carrageenan market?

Factors driving the growth of the Carrageenan market include its natural and plant-based origin, increasing demand for convenience foods, rising awareness about clean label ingredients, and its functional properties like gelling and stabilizing.

2. What are the challenges faced by the Carrageenan market?

Challenges faced by the Carrageenan market include fluctuating prices due to raw material availability, competition from alternative hydrocolloids, and ongoing research regarding its role in food formulations amidst evolving consumer preferences and regulatory landscapes.

3. What are the key applications of Carrageenan?

Carrageenan is widely used in dairy products (such as ice cream, yogurt, and cheese), meat products, processed foods, beverages (including plant-based milk alternatives), pet foods, and pharmaceuticals.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com