Global Commercial Seaweed Market Size, Share, Trends, And Growth Forecasts Report - Segmented By product (Red Seaweed, Green Seaweed And Brown Seaweed), form (Wet and Dry), End use (Food, Animal Feed, Personal Care & Pharmaceuticals, Biofuels and others), And Region (North America, Latin America, Asia Pacific, Europe, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Commercial Seaweed Market Size

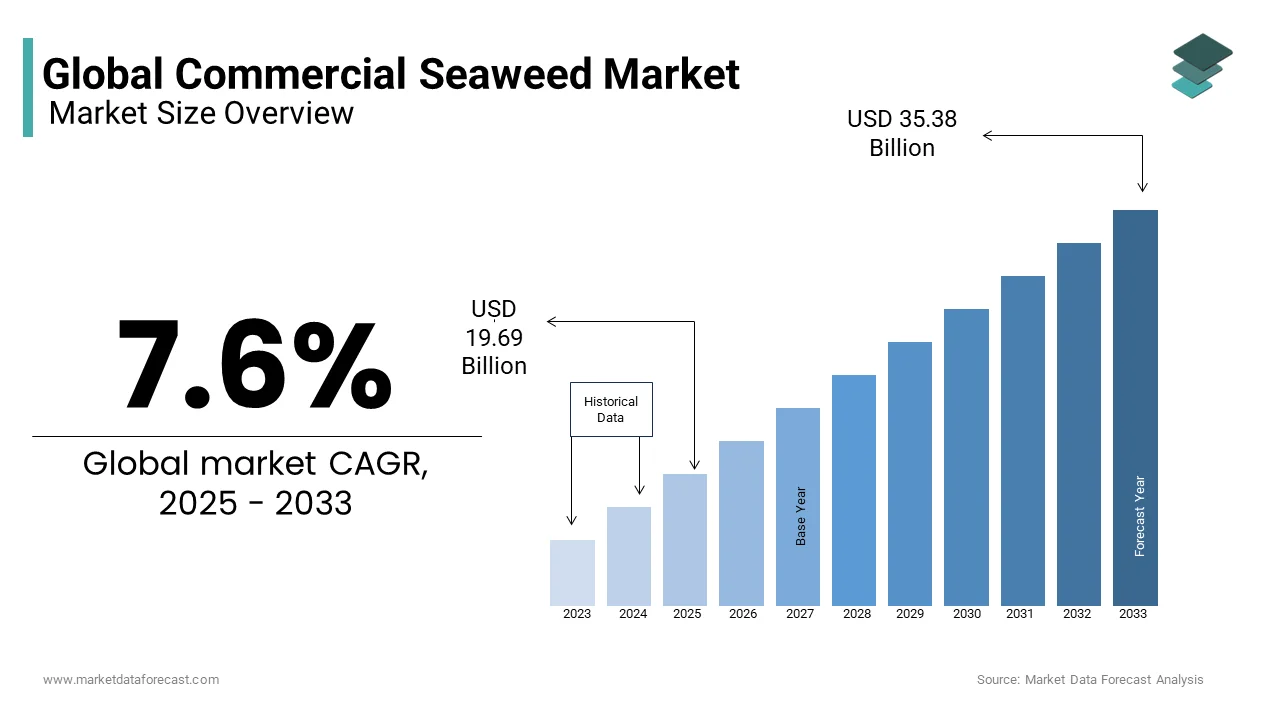

The global commercial seaweed market was valued at USD 18.3 billion in 2024 and is anticipated to reach USD 19.69 billion in 2025 from USD 35.38 billion by 2033, growing at a CAGR of 7.6% during the forecast period from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL COMMERCIAL SEAWEED MARKET

The consumption of seaweeds was facilitated a long time ago in the fourth century in Japan and sixth century in China.

The commercial seaweed market will be initiated by increasing calls from the food business. These days, they are becoming more popular among customers due to advantages like nutrition-rich content, supporting the ability to thyroid function, and an excellent source of vitamins, antioxidants & minerals. Furthermore, they help in weight loss and decrease the risk of heart disease and diabetes. The present global population is around 7.5 billion and is estimated to cross 9 billion at the end of 2050, which will further propel the demand for food production.

The United Nations has been forecasting a lot of interest in escalating seaweed production as it promotes global food security.

Carrageenan farming has an economic potential with less capital investment, decent farming techniques, and a short production cycle. A biologist at Wageningen University has shown findings on decreasing the acidification of the oceans by promoting sea lettuce growth. As per recent studies, lettuce can reduce the acidity in water as it grows, and the biologist team also discovered that a marine garden covering over 180,000 square kilometers could offer enough protein for the global population.

MARKET DRIVERS

The growing demand for hydrocolloids in the food industry due to their comprehensive utilization as food additives is the primary factor contributing to the global commercial seaweed market growth. The rising awareness among the people regarding seaweed's health benefits as it is a rich source of amino acids, peptides, lipids, vitamins, peptides, and polysaccharides is fueling the global market growth. Products such as alginate, agar, and carrageenan are the most common seaweed-based derivates with broad applications in the food industry, such as gelling, stabilizing, emulsifier, and thickening agents propelling market growth opportunities. The increased consumption of plant-based products due to the rising number of vegan people worldwide is another factor augmenting the global commercial seaweed market growth. The escalation in the trend of veganism in various end-user industries is enhancing the adoption of plant-based products, creating opportunities for the seaweed market. Seaweed is in high demand in the personal care industry due to its beneficial properties, such as antiaging and antioxidants, accelerating market revenue.

Due to its natural activities and wide applications of seaweed, various industries such as agriculture and the pharmaceutical industries are opening market expansion opportunities. Seaweed has had active applications in cancer prevention, enhancing growth opportunities in the pharmaceutical industry and leading to market expansion in the coming years. The growing investments in the R&D activities by the major market players to increase the benefits of the seaweed will augment the market growth over the forecast period. Seaweed is extensively used as a biofertilizer for crops, enhancing crop yield and effectiveness and increasing farmers' adoption.

MARKET RESTRAINTS

The high costs associated with seaweed production are the primary factor hampering the market growth. The increased rate of water pollution from the past years due to the release of industrial waste, chemicals, and toxins is restricting seaweed production, leading to limited market growth. The cultivation and harvesting of seaweeds pose various challenges due to the need to harvest from the ocean beds, which is raising production costs and leading to an overall increase in the final product, which hinders the market growth rate. The presence of stringent regulations for the utilization of seaweed in medicinal products and in the food industry, which are complex and have high-time consumption procedures, is challenging to manufacturers. The continuous fluctuations in seaweed prices due to the availability of quality raw materials are expected to limit the market expansion. The cases of few side effects, such as high consumption of seaweeds, lead to hyperthyroidism, which may limit the consumption among people with thyroid issues and impede market growth. The presence of environmental concerns for cultivating seaweed and the limited awareness among the people, especially among the underdeveloped and emerging nations, may restrain the market revenue.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.6% |

|

Segments Covered |

By Product, Form, End Use and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

CP Kelco, Yan Cheng Hairui Food Co., Ltd., Mara Seaweed, Biostadt India Limited, Algea AS, Qingdao Seawin Biotech Group Co., Ltd., FMC BioPolymer AS, Indigrow Ltd., Chase Organics GB Ltd., Arcadian Seaplants Ltd., Pacific Harvest, Aquatic Chemicals and Marcel Carrageenan and Others. |

SEGMENT ANALYSIS

Global Commercial Seaweed Market By Product

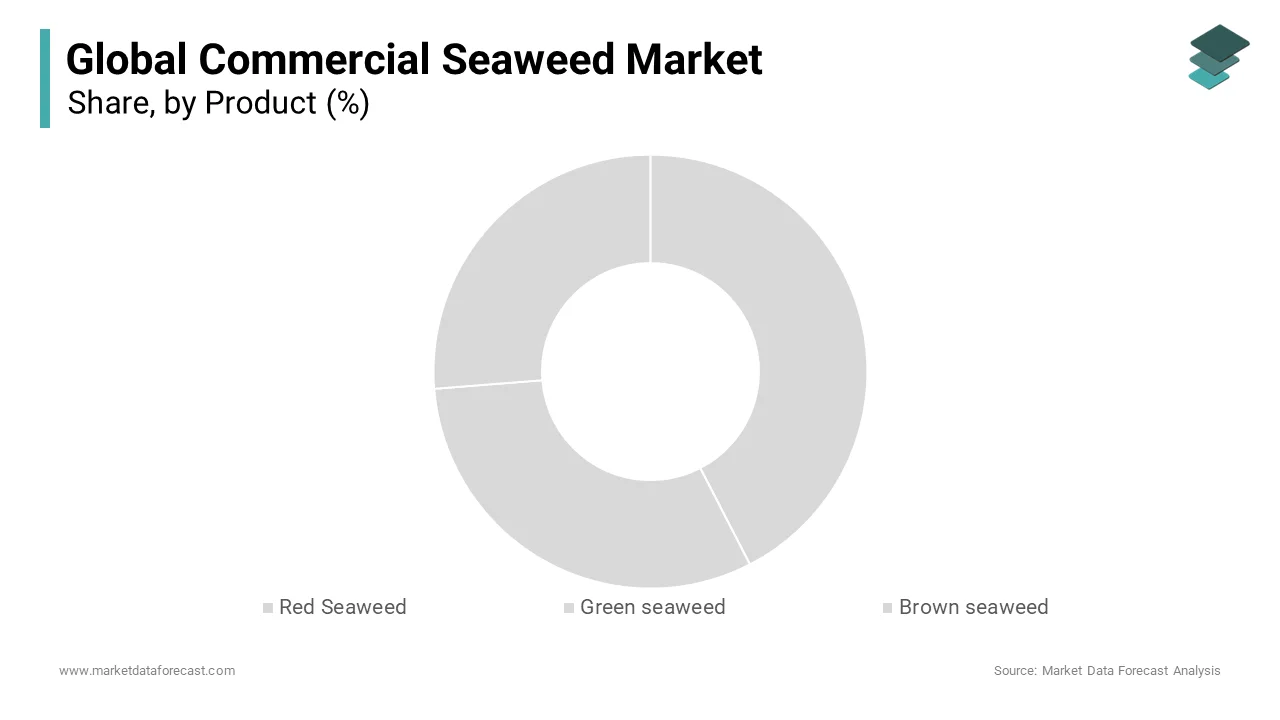

The red seaweed segment dominated the global commercial seaweed market with a prominent share of around 43% in 2024 and is expected to dominate during the forecast period. The red seaweed is derived from Seaweeds such as Gelidium and Gracilaria, which are red or purplish. Red seaweed had broad applications in various industries, such as food, medicines, and cosmetics, propelling the segment's growth. Red seaweed consists of high amounts of proteins and vitamins, making it an excellent source for people seeking protein intake. The primary purpose of red seaweed is to produce carrageenan, which is widely used in food processing. This is a significant factor contributing to the market growth in the segment.

The green seaweed segment is estimated to have a rapid growth rate during the forecast period owing to its high beta-carotene content. Beta-carotene is extensively used to prevent cancer, and the growing demand for green seaweed supplements boosts the growth rate.

Red seaweed is predicted to rise at a CAGR of over 7% during the foreseen time. These seaweeds are small in length, ranging from few centimeters to about a meter and are mainly employed as a food and sources of hydrocolloids like agar and carrageenan.

Global Commercial Seaweed Market By Form

The dry segment held the most significant share in the commercial seaweed market and is projected to witness a prominent growth rate during the forecast period. Seaweed powders are in high demand among the food and cosmetic industries, fueling revenue growth for the segment. Growing applications of seaweed powder in people's health are a great alternative to artificial fragrances, dyes, and preservatives, which augments the segment growth rate. The cosmetic applications of seaweed are expanding due to its antiaging, moisturizing, and antioxidant properties, which will enhance growth opportunities in the coming years.

The wet segment is estimated to have considerable growth during the forecast period. The rising use of wet seaweed in beverages to add flavors and fragrances boosts growth opportunities.

Wet seaweed sector recorded around USD 9.5 billion in 2018. Countries like China, South Korea, Chile, Norway, Japan, Madagascar and other southeast Asian countries are mainly consuming the wet seaweeds in the form of salads, curd soups, seasoned snacks and also with rice dishes. The demand for dry products is also estimated to expand steadily in the coming years.

Global Commercial Seaweed Market By End Use

The food and beverages segment accounted for the notable growth and is expected to maintain the highest CAGR during the forecast period. The increased applications of seaweed in the food industry, such as protein alternatives, and the growing demand for food additives are escalating the market growth opportunities in the segment. The seaweeds are widely harvested and cultivated to extract polysaccharides such as alginate, agar, and carrageenan, which are in high demand in the food industry, leading to the expansion of the segment revenue.

The personal care and pharma segment is estimated to have the fastest growth during the forecast period due to the comprehensive utilization of seaweeds in cosmetics. The enlarging demand for antioxidant and antiaging components in cosmetics is fueling the segment's growth. The wide application of green seaweeds in cancer treatment and prevention methods is escalating the demand for seaweeds in the pharmaceutical industry, contributing to the segment expansion.

Animal feed captured around 4% volume share in 2018 and shows a positive outlook in future years. The product is employed as an additive in animal feed, particularly in the coastal regions. It contains a massive amount of essential vitamins and different minerals like potassium, phosphorous, calcium, sodium, magnesium, chlorine & sulphur, which plays a vital role in the healthy development of the animal.

REGIONAL ANALYSIS

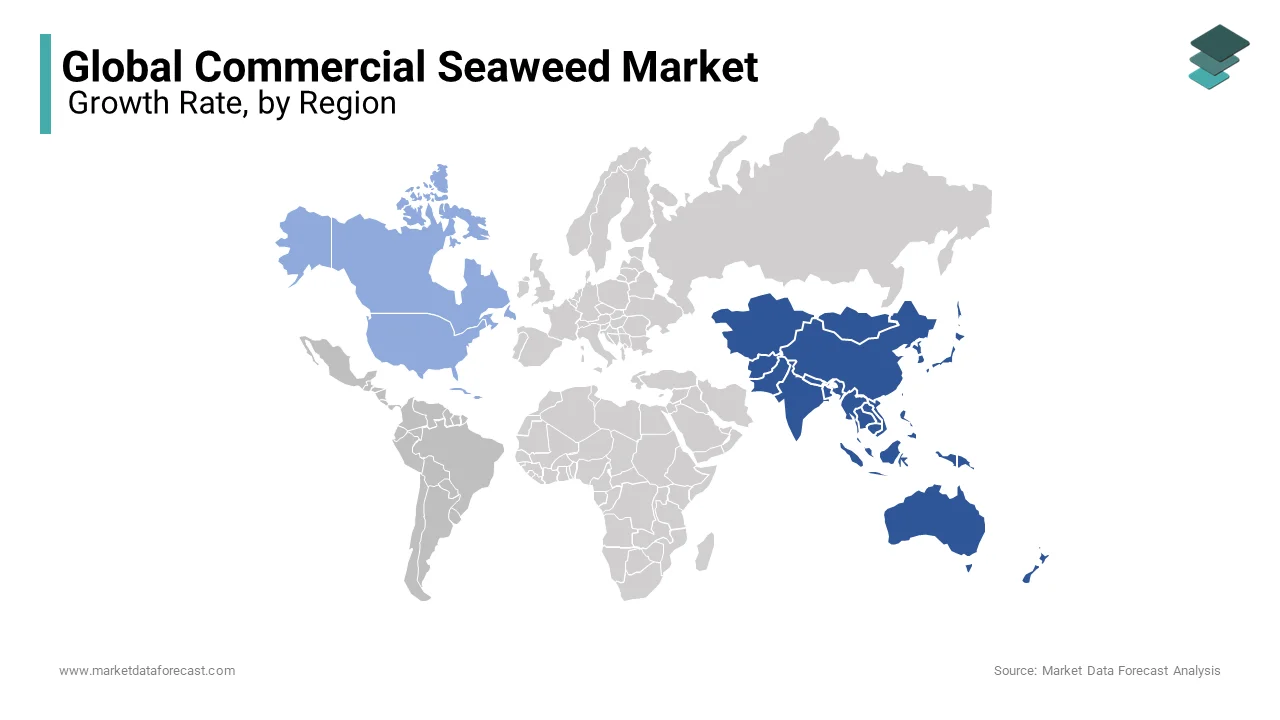

The Asia Pacific region dominates the global commercial seaweed market revenue with a notable share of 87.34% in 2023 and is projected to maintain the domination in the coming years. Regional countries such as China, Japan, and South Korea are the major contributors to market revenue growth. Seaweed is the most common seafood consumed in most Asian countries due to its medicinal benefits, which are driving the regional market growth rate. The increased demand for plant-based protein food across the region and the broad traditional consumption practices due to the historical medicinal practices in the regional countries.

The North American region is expected to record considerable growth during the forecast period owing to a surge in plant-based products in the United States. The growing awareness among the people regarding the health benefits of seaweed and the presence of well-established R&D centers that are boosting the activities to enlarge the medicinal properties of seaweed are a few factors contributing to the regional market growth rate. The strong food and beverage industry in the region, along with the presence of significant market players, is boosting regional market growth opportunities.

The European region is estimated to have a steady growth rate in the coming years due to the rising demand for vegan food. The growing trend of veganism escalates the demand for plant-based products and their health benefits, fueling the regional market growth. The enlarging cosmetics industry across the regional countries is enhancing the demand for natural and plant-based products such as seaweeds, which is augmenting the region's growth rate.

The Latin American, Middle Eastern, and African regions are projected to witness moderate growth in the coming years due to expanding awareness of the benefits of seaweed in the food and beverages, cosmetics, and medicinal industry.

KEY MARKET PLAYERS

Some of the major producers in the global commercial seaweed market are Seasol International, CP Kelco, Yan Cheng Hairui Food Co., Ltd., Mara Seaweed, Biostadt India Limited, Algea AS, Qingdao Seawin Biotech Group Co., Ltd., FMC BioPolymer AS, Indigrow Ltd., Chase Organics GB Ltd., Arcadian Seaplants Ltd., Pacific Harvest, Aquatic Chemicals and Marcel Carrageenan. These companies are trying to gain competitive benefits with the employment of different strategies like the growth of production capacity, mergers & acquisitions, and collaboration with distribution centers.

RECENT HAPPENINGS IN THIS MARKET

- In 2024, Sway, a California-based bioplastic industry, announced the development of edge-cutting technology, which is expected to produce commercial seaweed-based bioplastics. Sway's Thermoplastic Seaweed resin is aa bio-based, microplastic-free, and home-compostable product derived from the ocean crop.

- In March 2024, Sea6 Energy, a leading seaweed company, announced the launch of the world's first large-scale mechanized tropical seaweed farm off the coast of Lombok, Indonesia.

- In March 2023, Loliware, a seaweed company, introduced a new seaweed resin that replaced plastics at the International Materials Conference.

- In 2023, Algaia announced the expansion of its R&D sector and was estimated to introduce highly equipped machinery that supports the building of new workshops to produce new seaweed extracts.

- Mara Seaweed introduces new blends in Morrisons Supermarkets in the UK. After several months of hard work, Mara's seaweed blends, Shony and Furikake, are in a key UK supermarket for the first time. Mara's products are now present in 403 Morrisons stores nationwide.

- Seawin Biotech Group Introduced the United States Business Division. As China's biggest manufacturer of fertilizers made from seaweed, Seawin Biotech Group is the business leader in China, with a 17-year history of offering high-quality products. The company has recently established a business division in the United States to expand its operations further.

MARKET SEGMENTATION

This research report on the global commercial seaweed market is segmented and sub-segmented based on Product, Form, End-Use, and Region.

By Product

- Red Seaweed

- Green seaweed

- Brown seaweed

By Form

- Wet

- Dry

By End Use

- Food

- Animal feed

- Personal care & pharma

- Biofuels

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global commercial seaweed market?

The current market size of the global commercial seaweed market was valued at USD 35.38 billion in 2025

What market drivers are driving the global commercial seaweed market?

The growing demand for hydrocolloids in the food industry due to their comprehensive utilization as food additives is the primary factor contributing to the global commercial seaweed market growth.

Based on product which segment is most dominated in global commercial seaweed market?

The red seaweed segment dominated the global commercial seaweed market with a prominent share of around 43% in 2024 and is expected to dominate during the forecast period.Seasol International, CP Kelco, Yan Cheng Hairui Food Co., Ltd., Mara Seaweed, Biostadt India Limited, Algea AS, Qingdao Seawin Biotech Group Co., Ltd., FMC BioPolymer AS, Indigrow Ltd., Chase Organics GB Ltd., Arcadian Seaplants Ltd., Pacific Harvest, Aquatic Chemicals and Marcel Carrageenan.

Who are the market players that are dominating the global

Seasol International, CP Kelco, Yan Cheng Hairui Food Co., Ltd., Mara Seaweed, Biostadt India Limited, Algea AS, Qingdao Seawin Biotech Group Co., Ltd., FMC BioPolymer AS, Indigrow Ltd., Chase Organics GB Ltd., Arcadian Seaplants Ltd., Pacific Harvest, Aquatic Chemicals and Marcel Carrageenan.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com