Global Cheese Market Size, Share, Trends & Growth Forecast Report By Source (Goat Milk Cheese, Cow Milk Cheese), Process (Mozzarella Cheese, Cheddar Cheese), Product (Fresh & Processed Cheese, Cheese Spreads, Flavoured And Specialty Cheese), And Region(North America, Europe, Asia Pacific, Latin America, Middle East And Africa And Rest Of The Region) – Industry Analysis From 2025 to 2033

Global Cheese Market Size

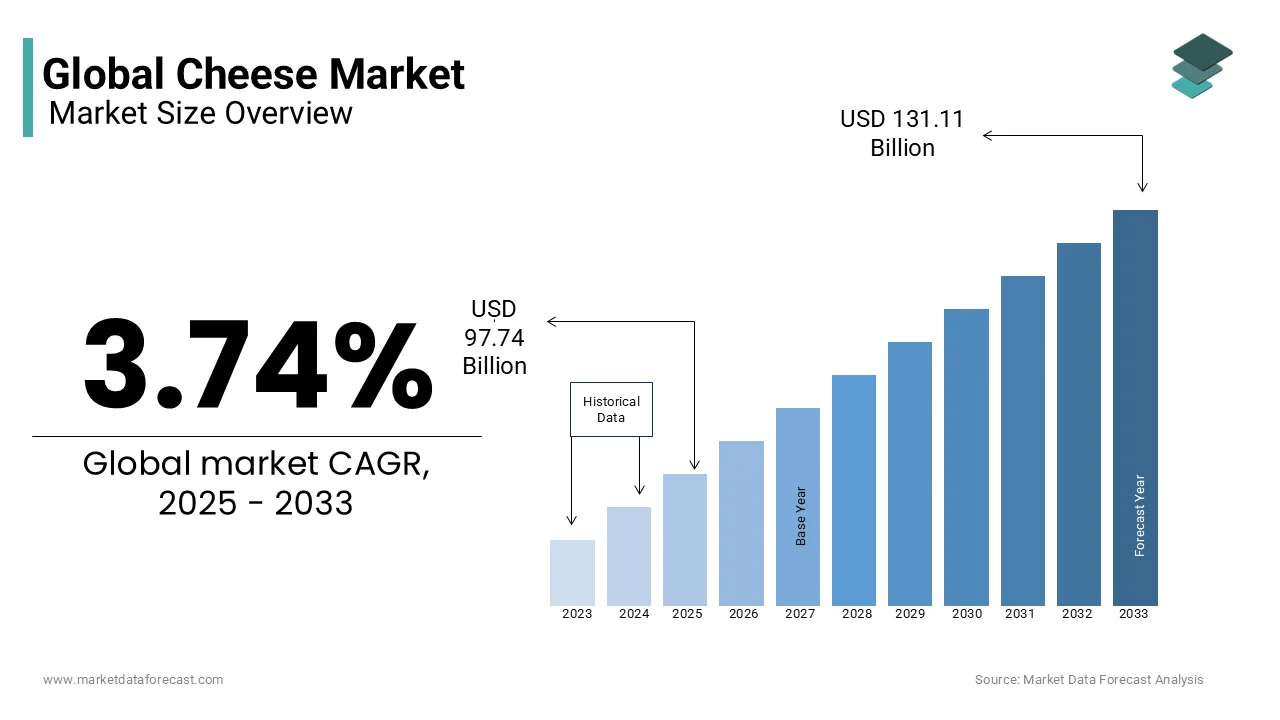

The global cheese market size was valued at USD 94.22 billion in 2024. The global market size is expected to reach USD 131.11 billion in 2033 from USD 97.74 billion in 2025. The market's promising CAGR for the predicted period is 3.74%.

Cheese has been a native of southern Italy and has become a part of various pizzas and pasta dishes. Consumption of cheese has various health advantages as it is a rich source of minerals, proteins, and vitamins. In addition to various benefits, there are various health problems associated with its consumption, such as heart attacks. Cheese has been in the history of our world for almost 7,000 years and can be obtained from raw or pasteurized milk. Classified as the main source of protein and healthy fats, it is now an integral part of specialized diets, such as the ketosis diet. Cheese production goes through several imperative stages, such as curd, coagulation with proteins such as casein and whey, fermentation, maturation and others.

Current Scenario of the Global Cheese Market

In the last few years, the consumption of imported cheeses has increased. The cheese market continues to expand quickly.

- As per the TradeImex, in 2023, Germany was the largest importer and exporter of cheese with 11.18 billion dollars and 12.95 billion dollars, respectively.

Customer’s desire for flavours worldwide will probably continue to escalate in 2025 and after. Also, the flavour is a major factor propelling the demand for imported cheese. It entices customers to look for unique flavours and texture profiles that could have potentially been skipped. Moreover, from breakfast in the morning to snacks at late night, cheese continues to be a widely loved choice with infinite varieties to suit every occasion and palate. Furthermore, the companies in the market are sourcing sustainable raw materials, with an emphasis on domestic manufacturing and minimum food waste. Some are also using cold-press technology to maintain longer shelf life and freshness. This goes with consumer trends supporting preservative-free and organic products.

MARKET DRIVERS

The rapid expansion of fast food chains worldwide is majorly propelling the growth of the global cheese market.

- In October 2024, Subway press released that it crossed the commitment of 10 thousand international restaurants in a three-year time span. The stores are a consequence of over 20 contracts for master franchises. These commitments account for 40 per cent of new launches scheduled for 2024. 7 agreements have been signed in 2024 so far, consisting of entry into Mongolia and Paraguay, and further penetration in Central America, Latin America, and Europe.

Fast-food chains such as McDonald's and Domino’s Pizza have successfully created a pizza and burger culture around the world. Both products are topped with cheese and are also sold at subsidized prices, attracting consumers to the dishes. The most crucial trend in the progression of the cheese market reached the Asian market, which was non-existent for quite some time. China, for example, has been booming with a high demand for cheese since fast-food chains took over the Chinese taste buds. Chinese producers are now struggling to meet the demand for snowballs and are vigorously exporting cheese.

- According to KrAsia, McDonald's aims to enhance its presence in China with 10000 stores by 2028 from 6000. Its revenue for the fourth quarter ended on 31 December 2023 was 6.4 billion dollars with an 8 per cent rise on Year-on-year basis.

As the world moves towards an exponential increase in urbanization, it can be established that households with disposable incomes multiply. This leads to frequent visits to supermarkets and the increasing use of exotic products. With a recent wave of fitness that has already engulfed the world's top countries, people are turning to home cooking using ingredients like cheese that are marketed as a healthy source of protein and fat. Cheese is a staple of the ketosis diet that has gained popularity and spreads the benefits of cheese consumption.

The rising popularity of veganism and increasing consumption of vegan cheese are further contributing to the expansion of the global cheese market.

- A study conducted by Finder.com and published by Plant Based News revealed that veganism is the most aggressive movement in the United Kingdom. The vegan population in the UK skyrocketed in 2023, research shows, with over 1.1 million individuals enjoying a completely animal-free way of living than in 2022. Moreover, It indicates that as of January 2024, approximately 2.5 million vegan people are there in the country, on a par with 4.7 per cent of its total population.

Veganism, which should be the first food trend in 2018, encourages people to innovate and develop alternative and healthier products that taste similar to cheese but do not have any adverse effects on the environment. The cheese market has caught up with the latest trend, as vegan cheese is selling hard worldwide. Veganism has resulted in a condition of herbal diets that easily incorporate vegan cheese. The demand for this product is motivated by its craft appeal and its biological nature. The cheese has a short shelf life, so it is advisable to consume it more quickly. The increasing demand and production of cheese, along with its short shelf life, have led to a perpetual waste of cheese. Expansive flavors arriving in our supermarkets, consumers prefer exotic flavors to traditional cheeses. This leads to a steady drop in sales and consumption of traditional cheeses. About 1.3 billion pounds of American cheese like Cheddar is in American warehouses that could be missed. This challenge can only be overcome if companies drive innovation in the cheese market and modify the quality of their products according to consumer needs.

MARKET RESTRAINTS

Stringent regulations associated with the production and distribution of cheese and cheese products is a significant restraint to the global cheese market. Factors such as health concerns related to high-fat content in cheese, growing competition from plant-based cheese alternatives, the perishability of cheese, which can result in potential wastage, the increasing shift from consumers towards dairy-free diets, limited innovation, and product diversification in traditional cheese offerings are further impeding the growth of the cheese market.

MARKET OPPORTUNITIES

The cheese market is slated to thrive further in the coming years due to the growing inclination towards neutral products and sustainable options. Researchers suggest that shifting to plant-based cheese can decrease the related climate effects by 50 per cent. Moreover, vegetarian ones are also appropriate for cheese enthusiasts who are lactose intolerant. Also, they are a delicious and nutritious option. In addition, the vegan option has different types available. They are produced totally with plant products like nuts, seeds, soy, and vegetables, and can be in a broad range of flavours and textures and make considerably less greenhouse gas than their dairy equivalents. Additionally, health and wellness trends present potential opportunities for market expansion.

- In January 2024, the launching Cow introduced a plant-based spreadable cheese alternative. The company’s plant-sourced in Garlic & Herb is available at Whole Foods across the US.

MARKET CHALLENGES

Environmental impacts of cheese production technologies are a major challenge for the expansion of the market. Certain advanced modern production technologies could have a higher ecological footprint because of waste generation and power generation, increasing worries regarding sustainability. From the different levels of the cheese product system, the production of milk on the farming estate is the most influential in the life cycle, with a focus on animal feed, enteric emissions, and land use. At the industrial level, the use of cleaning, energy, water items, and effluent generation are extremely harmful ecological aspects. The effects can vary significantly depending on the variety of cheese. For instance, the fresh ones consume large amounts of water which has a propensity to lead to lower impact and cured ones, dried form, greatly impactful per unit of item. Therefore, it is one of the key challenges hindering the growth rate of the cheese market.

- According to a 2023 study published in 2023, the life cycle assessment (LSA) greenhouse gas discharge of one kilogram of hard cheese is around 8.5 kgCO2e

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.74% |

|

Segments Covered |

By Source, Process, Product, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Patchwork Traditional Rods, Pyman Pates, Lovefood, Braehead Foods Ltd., Kinsale Bay Foods, Danhull Prepared Foods, Tesco, Waitrose & Partners |

SEGMENTAL ANALYSIS

By Source Insights

The cow milk segment held the major share of the global cheese market in 2023 based on source and the lead of the segment is estimated to continue during the forecast period. Cow milk is further divided into whole milk and skimmed milk. Cow milk dominated this segment as skimmed milk is more used to produce cheese. Cow milk was valued for the largest revenue of USD 1310.5 million in 2016. This is due to the presence of protein and fat in cow milk gives flavor and texture to the cheese. And cow's milk is pasteurized by heating at a normal temperature and then rapidly cooling it. Hot milk is harmful to bacteria.

By Process Insights

The natural cheese segment is estimated to account for the leading share of the global market during the forecast period. Natural cheese is further categorized into hard cheese and soft cheese while processed cheese is divided into spreadable cheese and block cheese.

- According to a study, the natural cheese-shredded experienced a strong growth with a significant increase in revenue of 3 per cent year-on-year (YoY) to 6.95 billion dollars and unit sales climbing to 1.9 billion dollars i.e. 2 per cent rise.

On the other hand, processed spreadable cheese is expected to dominate this segment during the outlook period.

By Product Insights

The mozzarella segment had the major share of the worldwide market in 2023. Mozzarella cheese is dominating this segment because the increasing demand for food rich in protein and calcium has raised the demand for mozzarella cheese. After mozzarella cheese, feta cheese shows the largest growth in this segment as it is exported internationally. In Greece, feta consumers are involved in the food industry, supermarket chains, and smaller retailers and wholesalers.

- As per the Vesper, in Europe, as of August 2024, the cost of Mozzarella has touched 4080 euros per metric ton. Its demand continues to be robust, especially in the fourth quarter, at a time when there were doubts regarding its availability which began to increase its prices.

REGIONAL ANALYSIS

Europe contributed as the largest cheese market, posting a compound annual rate of around 2%, due to strong demand in France, Finland, Denmark, Germany, and other countries. Cheese flows in European tradition and is added to almost every dish in most homes. As per a recent consumer study, about 81 per cent of British people eat cheese weekly, with around 17 per cent consuming it daily. As the winter season approaches in 2024, 74 per cent of participants stated an inclination towards warm comfort foods, with more than half (i.e. 55 per cent) suggesting that hot cheese gives them joy.

However, the regional market is going through a phase of lower milk production, especially in the second half of 2024, which is customarily less than the first half. This decrease, along with lower-than-expected inventory levels, is propelling upwards the cost across the board. Moreover, the cultivators are encountering higher milk prices, which are anticipated to remain increasing as supply continues to be stiff.

Asia-Pacific is the fastest-rising region. The Indian cheese market is foreseen to post notable growth as one of the most significant pizza markets, sourcing from mozzarella cheese. Due to the increasing consumption of cheese in India, several global companies such as Kraft Cheese and Fromageries Bel and Arla Cheese have begun to conquer the Indian market. In addition, the APAC market is driven by China which is one of the significant consumers in the world.

- According to the United States Department of Agriculture (USDA), cheese production in China is estimated to cross 28 thousand metric tons in 2024, which is a 12 per cent yearly rise and a substantial 460 per cent surge in the last ten years.

North America holds a major share of the global cheese market and is believed to witness significant growth during the forecast period. Both the United States and Canada are key players in the region’s market.

- A report by the Observatory of Economic Complexity (OEC) found that the United States imported cheese of over 1.57 billion dollars in 2021, positioning it as the seventh biggest importer of cheese worldwide.

Followed by LAMEA, owing to advanced cheese consumption in numerous developing economies. The Mexican cheese market was valued at $ 1,856 million in 2016 and is anticipated to reach $ 2,216 million by 2023, registering a CAGR of 2.5% during the forecast period.

KEY PLAYERS IN THE GLOBAL CHEESE MARKET

Mother Dairy, Almarai, Bega Cheese, Cady Cheese Factory, Amul, Parag Milk Foods, Hook's Cheese Company, Bel Group, Brunkow Cheese Factory and Bletsoe Cheese are some of the major players in the global cheese market.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, Holy Moly introduced a new range of dippable cheese. It is the foremost hot dips present in the United Kingdom. This prompt launch matches with rising customer inclination for warm comfort foods because of the upcoming winter season. Margherita cheese, Alpine Fondue and Nacho Chilli Cheese are the three flavours launched under the ‘Cheesy Hot Serves range’. The Cheesy Hot Serves are now accessible at prominent retailers including Ocado, Asda and Sainsbury, costing 2.75 pounds for a 150g serving.

- Tofurky has launched a vegan cheese brand. This new brand included three flavors of vegan cheese such as mozzarella, cheddar, and fiesta, with flavors like plain, garden, and strawberry.

- Arla Foods announced that it acquired a kraft-branded cheese business in the Middle East and Africa from Mondelez International.

MARKET SEGMENTATION

This research report on the global cheese market has been segmented and sub-segmented based on source, type, product, distribution channels and region.

By Source

- Cow Milk

- Goat Milk

- Sheep Milk

- Buffalo Milk

By Process

- Natural Cheese

- Processed Cheese

By Product

- Feta

- Parmesan

- Mozzarella

- Cheddar

- Roquefort

By Distribution Channels

- Supermarkets

- Food Specialty Stores

- Convenience Stores

- Hypermarkets

- Online

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Frequently Asked Questions

1.Which regions are leading in the cheese market?

Europe is currently dominating the cheese market, owing to its rich cheese-making tradition, diverse cheese varieties, and strong consumer demand. However, other regions such as North America, Asia-Pacific, and Latin America are also experiencing significant growth due to increasing cheese consumption and expanding dairy industries.

2.What are the popular types of cheese in the market?

The cheese market offers a wide range of popular cheese varieties, including cheddar, mozzarella, Parmesan, Swiss, brie, feta, blue cheese, and many more. Each type of cheese has its unique flavor, texture, and culinary uses, catering to diverse consumer preferences and culinary traditions.

3.What are the challenges facing the cheese market?

Challenges in the cheese market include fluctuating milk prices, supply chain disruptions, regulatory requirements, and competition from alternative dairy products and cheese substitutes. Additionally, concerns about lactose intolerance, cholesterol levels, and environmental sustainability are factors that may impact consumer perceptions and purchasing decisions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com