Global Craniomaxillofacial Implants Market Size, Share, Trends & Growth Analysis Report – Segmented By Type (Mid Face, Plates, Screws, Mandibular Orthognathic Implants, Neuro, Mesh, Bone Graft and Dural Repair), Material Of Construction (Titanium and Polymer), Application, Property & Region – Industry Forecast From (2025 to 2033)

Global Craniomaxillofacial Implants Market Size

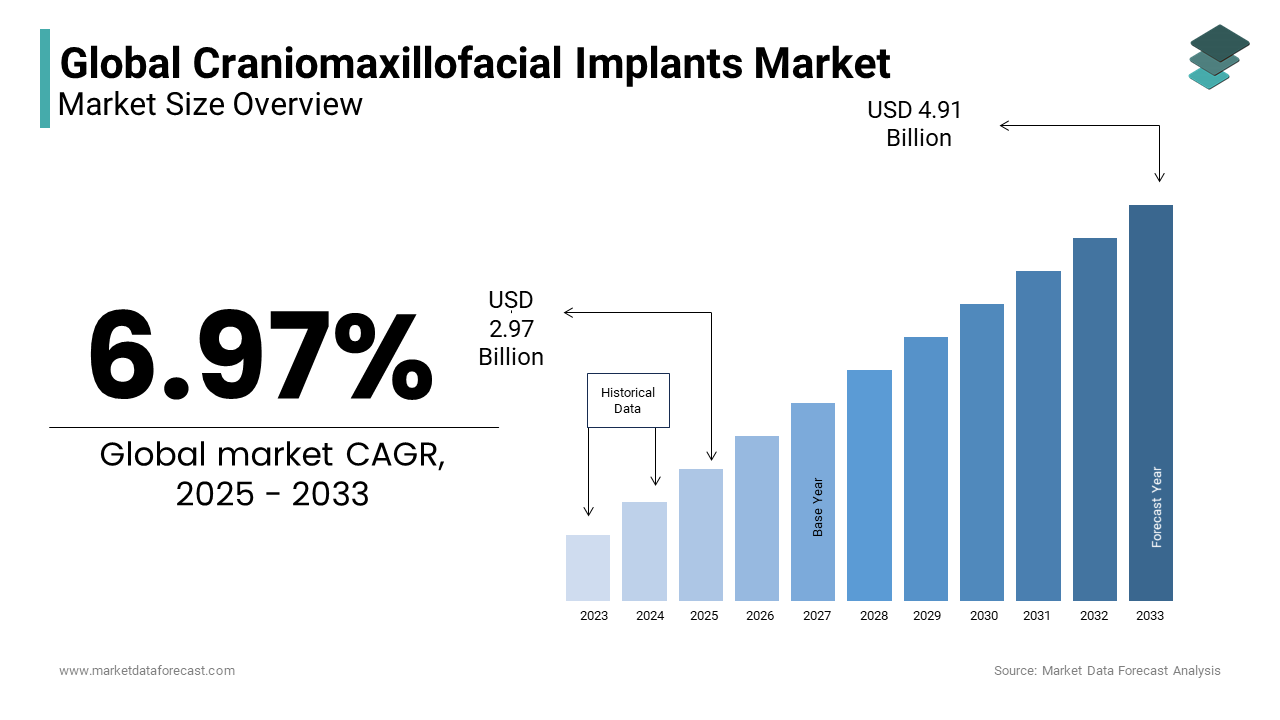

In 2024,the global craniomaxillofacial implants market was valued at USD 2.68 billion and it is expected to reach USD 4.91 billion by 2033 from USD 2.97 billion in 2025, growing at a CAGR of 6.97 % during the forecast period.

MARKET DRIVERS

The growing incidence of facial trauma injuries is one of the key factors boosting the growth of the craniomaxillofacial implants market.

Road accidents, sports injuries, and violence are some of the major causes that can lead to facial trauma injuries. These injuries are believed to be resulting severe damage in the craniomaxillofacial region including the skull, face, and jaws, and can do potential damage in the form of disfigurement, functional impairment, and even death in severe cases. Craniomaxillofacial implants are an effective and preferred way to repair and reconstruct these injuries. Craniomaxillofacial implants such as plates, screws, and meshes are used during facial reconstruction surgeries to stabilize fractures, restore facial symmetry, and improve function. Facial trauma injuries are becoming very common among people and the population suffering from these injuries is growing substantially with each year passing, which is boosting the demand for craniomaxillofacial implants and accelerating the market’s growth rate. As per the statistics published by the World Health Organization (WHO), an estimated 1.35 million people per year dies from road accidents and many more people are injured or disabled. On the other hand, sports-related injuries and violence result in facial trauma injuries. As per the data published by the American Association of Oral and Maxillofacial Surgeons (AAOMS), an estimated 50% of facial injuries are due to sports and 30% are from violence.

The growing prevalence of facial deformities is further fuelling the growth rate of the craniomaxillofacial implants market.

Trauma, congenital defects, tumors, infections, and aging are some of the issues that can result in facial deformities. Due to facial deformities, people suffer in a variety of ways ranging from appearance issues to speech, breathing, and eating. The growing number of accidents happening worldwide, and the increasing incidence of injuries due to various reasons that affect the face and skull are majorly contributing to the rising prevalence of facial deformities. As per the data published by the Journal of Oral and Maxillofacial Surgery, 1 in every 550 newborns is suffering from craniofacial anomalies in the United States. According to the study conducted by the Journal of Cranio-Maxillofacial Surgery, the incidence of maxillofacial fractures rose by 24% between 2001 to 2008 in the United States. Craniomaxillofacial implants can potentially help reconstruct and repair the defects in the skull, face, and jaws. The number of people suffering from facial deformities has grown substantially over the last few years, and the same trend is predicted to continue in the coming years, which is expected to boost the demand for craniomaxillofacial implants and fuel the market’s growth rate.

The growing aging population worldwide is boosting the growth of the craniomaxillofacial implants market.

With growing age, people are more susceptible to falls and accidents that can create fractures in the skull, face, and jaw. In addition, the incidence of osteoporosis is high among aged people and this can weaken the bones of the skull and jaw and is more likely to cause fractures. In such cases, craniomaxillofacial implants are used to repair the damaged area. Furthermore, aged people are likely to get diagnosed with chronic diseases such as CVDs and diabetes. These patients sometimes have to undergo surgeries on the head and neck to remove tumors. In such situations, craniomaxillofacial implants are used to reconstruct the affected area. The number of craniomaxillofacial procedures is growing significantly with each year passing, which is expected to boost the demand for craniomaxillofacial implants and drive market growth. For instance, an estimated 55,385 craniomaxillofacial procedures were performed in the United States in 2023, as per the data published by the American Society of Plastic Surgeons and this trend is expected to continue in the coming years and contribute to market growth.

Technological developments are contributing to the growth of the craniomaxillofacial implants market growth.

In recent years, researchers and healthcare providers have used 3D printing technology to manufacture customized craniomaxillofacial implants that fit the patient's specific anatomy, reducing the risk of complications and improving outcomes. Increasing demand for customized implants is favoring the market growth. The adoption of customized craniomaxillofacial implants market has increased significantly in recent years due to their benefits such as better fit and functionality, improved patient outcomes, and reduced surgery time. In addition, factors such as increasing disposable income in developing countries and rising awareness about facial aesthetics and reconstructive surgeries, and the presence of favorable reimbursement policies in developed countries are showcasing a favorable impact on the growth of the craniomaxillofacial implants market. The growing adoption of dental tourism, rising adoption of minimally invasive surgeries, increasing demand for bioresorbable implants, growing emphasis on R&D activities by manufacturers, a growing number of orthopedic and trauma surgeries, and rising demand for facial implants for cosmetic purposes are further fuelling the growth of the craniomaxillofacial implants market.

MARKET RESTRAINTS

The high cost of craniomaxillofacial implants is one of the key factors hampering the market growth.

Due to these high costs, the adoption of these implants is limited in developing and underdeveloped countries. Unfavorable reimbursement policies for craniomaxillofacial implants in some countries are diluting the overall growth rate of the market. The presence of alternative treatments such as orthodontics, facial fillers, or non-surgical treatments is another significant obstacle to the craniomaxillofacial implants market growth. The scarcity of skilled professionals who can perform craniomaxillofacial surgeries is impacting the market growth negatively. The stringent regulatory environment for craniomaxillofacial implants is making it complex for new products to enter the market and impeding market growth. The safety concerns associated with the usage of craniomaxillofacial implants, such as the risk of infection, rejection, or implant failure, further inhibit the market’s growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.97 % |

|

Segments Covered |

By Type, Material of construction, Application, Property, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Stryker, KLS Martin, Depuy Synthes, Zimmer Biomet, Medtronic, Integra Lifesciences |

SEGMENTAL ANALYSIS

By Type Insights

The mid-face segment had the major share of the global craniomaxillofacial implants market in 2023 and the domination of the segment is likely to continue during the forecast period. The growth of the segment is majorly driven by the growing prevalence of mid-face fractures and the rising adoption of minimally invasive surgeries. The recent technological advancements have helped the development of new and advanced mid-face implants with better biocompatibility, durability, and strength and the trend is predicted to continue in the coming years and fuel the growth of the segment.

During the forecast period, the plates segment is predicted to capture a considerable share of the global market and grow at a healthy CAGR. An increasing number of people suffering from maxillofacial injuries, and rising demand for reconstructive surgeries are majorly boosting segmental growth. In addition, increasing focus on the R&D by the market participants to develop new and advanced plates with better biocompatibility, durability, and strength is favoring the growth rate of the segment.

By Material of Construction Insights

The polymers segment is predicted to rise at the fastest CAGR during the forecast period in the global craniomaxillofacial implants market. The growing usage of biodegradable polymers in the manufacturing of craniomaxillofacial implants, as these can be used as temporary implants for facial fractures or reconstructive surgeries, majorly driving segmental growth. Polymer implants are less likely to cause infections than traditional metal implants, which is another major attribute fuelling the adoption of polymers and boosting the growth rate of the segment. Craniomaxillofacial implants made with polymers are less expensive than metal implants, which is further accelerating segmental growth.

By Application Insights

The external fixators segment accounted for the largest share of the global market in 2023 and the segmental growth is predicted to grow at a promising CAGR during the forecast period. The ease of use and effectiveness of external fixators in stabilizing fractured bones and facilitating the healing process is majorly driving the growth of the segment. External fixators are cheaper than internal fixators and easy to use during craniomaxillofacial surgeries unlike internal fixators and this has fuelled the adoption of external fixators and contributed to the growth rate of the segment.

By Property Insights

The re-absorbable fixators segment is expected to witness the fastest CAGR during the forecast period. The advantages of re-absorbable fixators such as a faster healing time and the elimination of the need for a follow-up operation to remove the fixator are primarily driving the segmental growth. The growing usage of re-absorbable fixators in cosmetic surgeries is boosting the growth rate of the segment. The adoption of cosmetic surgeries has been growing rapidly over the last several years and accelerating the demand for re-absorbable fixators. Recent technological advancements have helped the development of more advanced and effective re-absorbable fixators. Due to this, the demand for these fixators has grown further as these are believed to deliver better outcomes and shorter recovery times compared to non-absorbable fixators. The growing number of people suffering from trauma cases involving the craniomaxillofacial region is another notable factor supporting segmental growth. The growth of the re-absorbable fixators is further driven by cost-effectiveness.

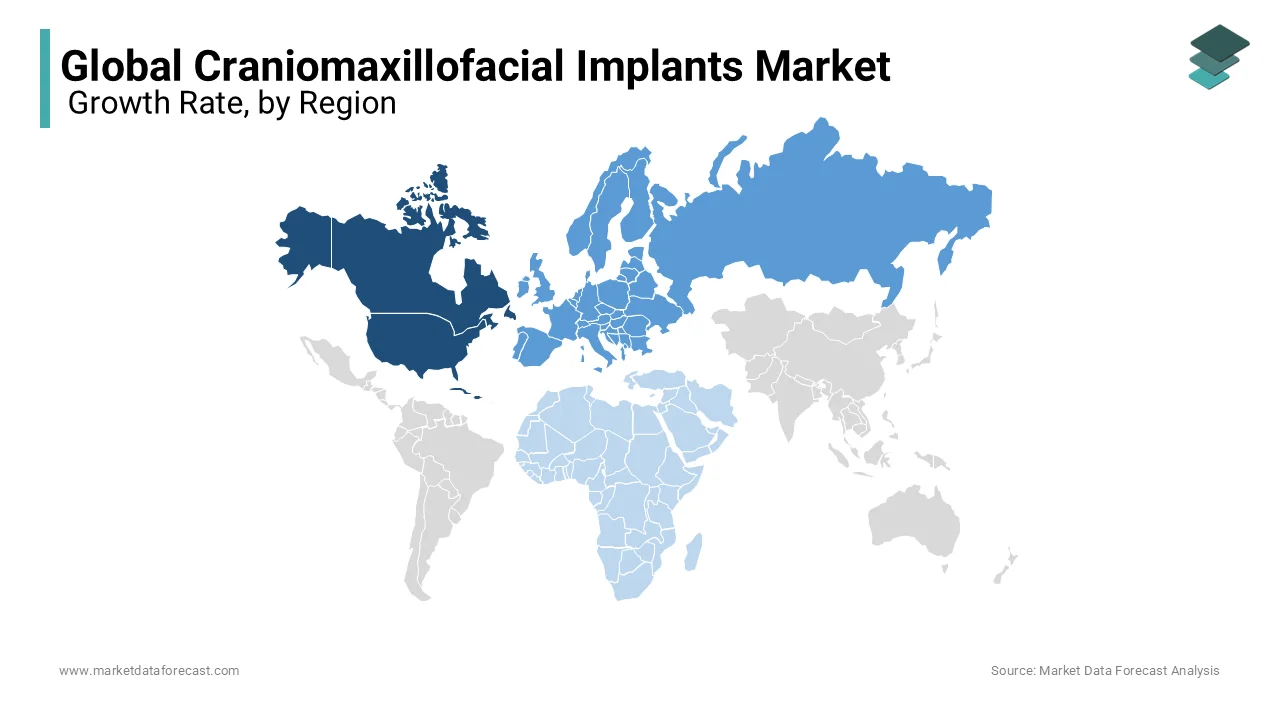

REGIONAL ANALYSIS

The North American region accounted for the largest share of the global market in 2023 The North American regional market is also predicted to grow at a promising CAGR during the forecast period. The growth of the North American market is attributed to the increasing prevalence of facial fractures and injuries, the rising number of accidents happening in North American countries and the presence of major market participants. As per the data published by the American Society of Plastic Surgeons, an estimated 224,000 facial fracture repairs were performed in the United States in 2019. The rising adoption of minimally invasive surgeries is boosting the growth of the North American market. The growing prevalence of sports injuries, increasing participation in sports activities and rising demand for customized implants and technologically well-advanced products are propelling the growth of the North American market. Furthermore, the rising adoption of robotic surgery techniques for craniomaxillofacial procedures and growing awareness about the benefits of craniomaxillofacial implants and reconstructive surgeries are contributing to the growth of the North American market growth.

Europe is another regional market for craniomaxillofacial implants and is predicted to hold a substantial share of the worldwide market during the forecast period. The growing patient population suffering from facial deformities and disorders, the growing geriatric population, the rising adoption of technologically advanced products and increasing investments in R&D of craniomaxillofacial implants by the market participants are fuelling the growth of the European market. In addition, favorable reimbursement policies for craniomaxillofacial procedures, the increasing popularity of dental tourism and cosmetic surgeries in countries like Germany, France, and Italy are boosting the market growth in Europe, Furthermore, increasing healthcare expenditure in the European region and rising focus on enhancing healthcare infrastructure, the presence of leading manufacturers and research institutes in Europe are further favoring the market growth in Europe. The UK, Germany and France are expected to control the leading share of the European market during the forecast period.

The APAC market is predicted to witness the fastest CAGR during the forecast period. The growing adoption of medical tourism and increasing availability of affordable medical treatments in countries like India, Thailand, and Malaysia are majorly driving the craniomaxillofacial implants market in the Asia-Pacific region. The growing number of road accidents happening across the APAC region every year and increasing incidence of industrial injuries, growing healthcare expenditure, increasing number of government initiatives to improve healthcare infrastructure, and rising demand for customized implants and patient-specific treatments are further favoring the growth rate of the APAC market. India, China, Japan and South Korea are predicted to capture the leading share of the APAC market during the forecast period.

The Latin American region is projected to grow at a healthy CAGR in the coming years owing to factors such as growing demand for minimally invasive procedures, the presence of a large patient pool, the growing number of plastic surgeries and aesthetic procedures and the rising prevalence of facial deformities and disorders, such as cleft lip and palate. The growing incidence of age-related facial fractures and injuries is another notable factor contributing to the growth of the craniomaxillofacial implants market in Latin America. During the forecast period, Brazil and Mexico held the major share of the Latin American market.

The MEA market is estimated to grow at a moderate CAGR during the forecast period. Factors such as rising demand for cosmetic surgeries from MEA countries such as Dubai and South Arabia, a growing number of initiatives from the governments of MEA countries to develop he healthcare infrastructure, and increasing adoption of advanced surgical techniques and patient-specific treatments are accelerating the growth of the craniomaxillofacial implants market in MEA.

KEY MARKET PLAYERS

Some of the notable companies participating in the global craniomaxillofacial implants market profiled in this report are Stryker, KLS Martin, Depuy Synthes, Zimmer Biomet, Medtronic, Integra Lifesciences, OsteoMed, Medartis AG, Matrix Surgical, and Calavera.

RECENT HAPPENINGS IN THIS MARKET

- In May 2019, the FDA granted Kelyniam Global Inc. premarketing clearance, allowing it to make unique modifications to its PEEK craniomaxillofacial implant products.

- Renishaw's craniomaxillofacial implants, developed using additive manufacturing techniques, were featured at the British Association of Oral and Maxillofacial Surgeons (BAOMS) Annual Scientific Meeting in June 2018.

MARKET SEGMENTATION

This market research report on the global craniomaxillofacial implants market has been segmented and sub-segmented based on the type, material of construction, application, property, and region.

By Type

- Mid Face

- Plates

- Screws

- Mandibular Orthognathic Implants

- Neuro

- Mesh

- Bone Graft

- Dural Repair

By Material of Construction

- Titanium

- Polymer

By Application

- Internal Fixators

- External Fixators

By Property

- Non-Absorbable Fixators

- Re-absorbable Fixators

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

Which region had the largest craniomaxillofacial implants market share worldwide in 2025?

North America captured the major share of the global market in 2025.

What some of the promising companies in the craniomaxillofacial implants market?

Stryker, KLS Martin, Depuy Synthes, Zimmer Biomet, Medtronic, Integra Lifesciences, OsteoMed, Medartis AG, Matrix Surgical, and Calavera are a few of the notable companies in the craniomaxillofacial implants market.

What was the size of the craniomaxillofacial implants market worldwide in 2025?

2023 is considered as the base year for this report.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com