Europe Electric Vehicle Market Size, Share, Trends & Growth Forecast Report, Segmented By Vehicle Type, Vehicle Class, Type and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Electric Vehicle (EV) Market Size

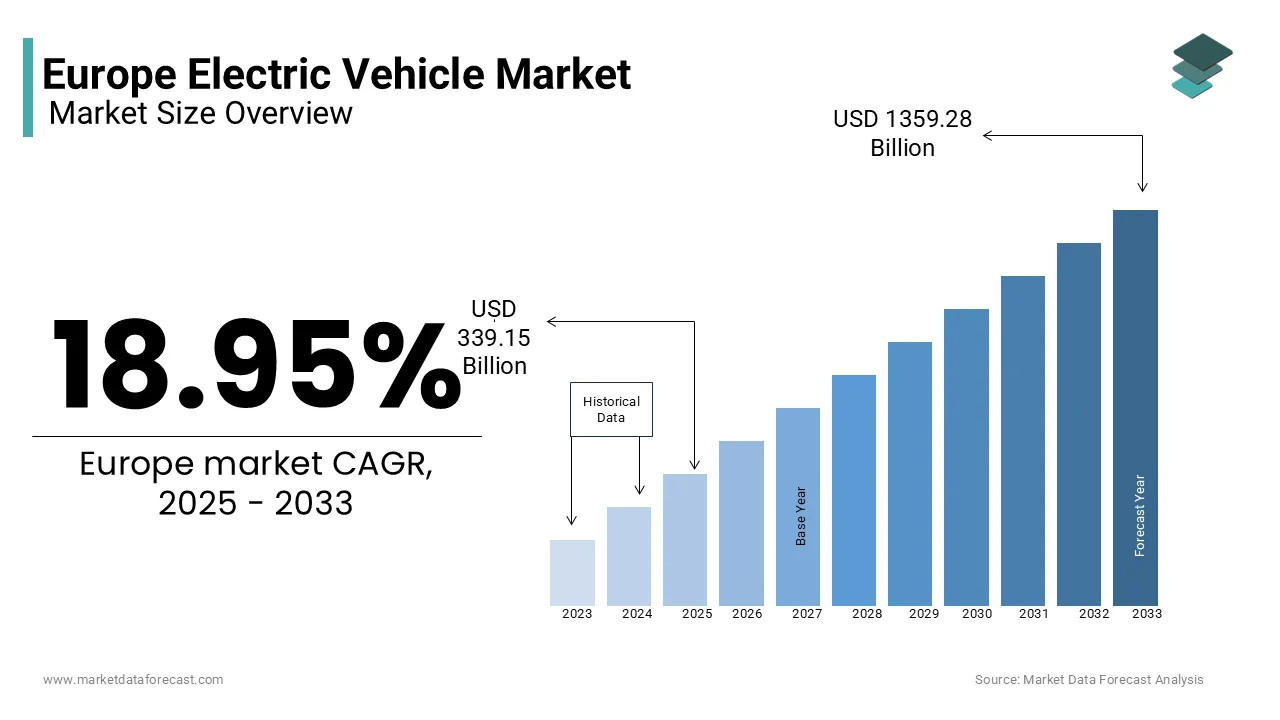

The Europe electric vehicle (EV) market was valued at USD 285 billion in 2024 and is anticipated to reach USD 339.15 billion in 2025 from USD 1359.28 billion by 2033, growing at a CAGR of 18.95% during the forecast period from 2025 to 2033.

The Europe electric vehicle (EV) market has been witnessing exponential growth over the last few years due to the stringent environmental regulations and rising consumer awareness about sustainable mobility. According to the European Automobile Manufacturers' Association, EV registrations surged by 40% in 2023, with over 2 million units sold across the region. Battery electric vehicles (BEVs) dominate the landscape, accounting for approximately 60% of all EV sales, as per data from the International Energy Agency. Germany leads the charge, contributing over 30% of total EV sales, followed closely by France and the UK. The growing network of charging stations, with over 500,000 public chargers installed, has further bolstered adoption rates. Sweden and Norway are at the forefront of this transition, with governments offering substantial incentives such as tax exemptions and subsidies. A study published by the European Environmental Agency highlights that EVs reduce greenhouse gas emissions by 50% compared to conventional vehicles, reinforcing their appeal among environmentally conscious consumers.

MARKET DRIVERS

Stringent Emission Regulations in Europe

Stringent emission regulations imposed by the European Union are majorly driving the European electric vehicle market growth. According to the European Commission, automakers face fines of €95 per gram of CO2 emitted above the limit, compelling manufacturers to accelerate the production of low-emission vehicles. By 2030, new vehicles must emit 55% less CO2 compared to 2021 levels, as mandated by the EU Green Deal. This regulatory push has resulted in a 50% increase in EV production capacity across Europe, as noted by the European Automobile Manufacturers' Association. Countries like Germany and France have embraced these policies, investing heavily in EV manufacturing hubs. Additionally, local governments offer incentives such as tax rebates and reduced road taxes, further encouraging adoption. These measures collectively position regulatory frameworks as a transformative force in driving EV adoption.

Expanding Charging Infrastructure

The rapid expansion of charging infrastructure is further fuelling the expansion of the European electric vehicle market. According to the European Alternative Fuels Observatory, over 500,000 public charging points were operational in 2023, marking a 30% annual increase. This growth is particularly pronounced in urban areas, where fast-charging stations reduce refueling times to under 30 minutes, appealing to time-conscious consumers. Germany leads in charger deployment, with over 100,000 units installed nationwide. A study published by the European Investment Bank highlights that regions with dense charging networks witness a 40% higher EV adoption rate, underscoring its critical role in market expansion. Additionally, private investments from companies like Shell and BP have accelerated infrastructure development, ensuring broader accessibility and sustained growth.

MARKET RESTRAINTS

High Initial Costs of EVs

The high initial costs of electric vehicles are one of the key factors hindering the growth of the European electric vehicle market. According to the European Consumer Organisation, the average price of a new EV exceeds €40,000, making it unaffordable for middle-income households. Even with government subsidies, out-of-pocket expenses deter many potential buyers, particularly in Eastern Europe, where disposable incomes are lower. This financial burden is further compounded by the rising costs of lithium-ion batteries, which account for 40% of an EV’s total cost, as noted by the European Battery Alliance. In countries like Italy and Spain, where subsidies are limited, adoption rates lag behind Western Europe. Additionally, the lack of affordable financing options exacerbates affordability issues, hindering broader market penetration despite growing demand for sustainable mobility solutions.

Limited Driving Range and Battery Anxiety

Limited driving range and battery anxiety is also impeding the growth of the European electric vehicle market. According to the European Automobile Manufacturers' Association, over 30% of potential buyers cite range anxiety as a primary concern, particularly for long-distance travel. While advancements in battery technology have extended ranges to over 300 kilometers, this remains insufficient for users requiring frequent intercity commutes. Additionally, inconsistent charging speeds and incompatible connectors across countries complicate cross-border travel. A study published by the European Transport Safety Council highlights that regions with sparse charging networks experience a 25% lower EV adoption rate, reflecting consumer apprehensions. These restraints hinder market growth and limit the broader adoption of electric vehicles despite ongoing technological advancements.

MARKET OPPORTUNITIES

Growing Adoption of Shared Mobility Solutions

The increasing adoption of shared mobility solutions is one of the major opportunities for the European electric vehicles market. According to the European Shared Mobility Coalition, car-sharing services utilizing EVs have grown by 25% annually since 2020, driven by urbanization and the need for cost-effective transportation. Cities like Paris and Amsterdam have embraced this trend, with startups deploying fleets of electric vehicles tailored to short-term rentals. A study published by the European Urban Mobility Observatory highlights that shared EVs reduce individual ownership costs by 40%, appealing to younger demographics seeking flexible mobility options. Additionally, partnerships between automakers and ride-hailing platforms ensure seamless integration, enhancing user convenience. These innovations position shared mobility as a transformative force in the market, ensuring sustained growth and innovation.

Advancements in Battery Technology

Advancements in battery technology is another promising opportunity for the European EV market. According to the European Battery Alliance, next-generation solid-state batteries are projected to increase energy density by 50%, reducing charging times and extending driving ranges. Germany and Sweden have positioned themselves as leaders in this space, with research institutions collaborating with manufacturers to develop scalable solutions. A study published by the European Innovation Council highlights that advanced batteries reduce production costs by 30%, making EVs more affordable for mass adoption. Additionally, the integration of renewable energy sources into battery production ensures sustainability, aligning with EU environmental goals.

MARKET CHALLENGES

Insufficient Charging Infrastructure and Regional Disparities

The lack of adequate charging infrastructure that varies significantly across regions is one of the major challenges to the growth of the European EV market. According to the European Automobile Manufacturers' Association, there are approximately 330,000 public charging points in the EU as of 2023, but this falls far short of the estimated 3 million needed by 2030 to meet the EU’s Green Deal targets. Western Europe, particularly countries like Germany and the Netherlands, has made significant strides, with over 50% of the region’s charging stations concentrated in these areas. However, Eastern Europe lags behind, with countries like Romania and Bulgaria having fewer than 1,000 charging points each, creating a fragmented experience for EV users. Urban-rural disparities further exacerbate the issue; while cities like Paris and Berlin boast dense networks of fast chargers, rural areas often lack even basic infrastructure. A study by Transport & Environment highlights that nearly 40% of potential EV buyers cite "range anxiety" due to insufficient charging options as a barrier to adoption. Moreover, the slow rollout of ultra-fast chargers, which account for only 15% of all stations, limits long-distance travel. The uneven distribution not only stifles market growth but also undermines efforts to achieve equitable electrification across the continent.

High Upfront Costs and Economic Inequality

The high upfront cost of electric vehicles that remains prohibitive for many consumers despite falling battery prices is a. As per BloombergNEF, the average price of an EV in Europe is €45,000, compared to €28,000 for a conventional internal combustion engine vehicle. While subsidies and tax incentives exist, they are inconsistent across countries. For instance, Germany offers up to €9,000 in incentives, whereas Poland provides minimal support, leaving lower-income populations at a disadvantage. Economic inequality further compounds the issue; Eurostat data reveals that households in Southern and Eastern Europe spend a higher percentage of their income on transportation, making EVs less accessible. Additionally, the total cost of ownership, including insurance and maintenance, can deter first-time buyers. Although EVs are cheaper to operate in the long run, many consumers struggle to overcome the initial financial barrier. A survey by Deloitte found that 52% of Europeans consider affordability a key factor when purchasing a vehicle. Without addressing these economic disparities and ensuring broader access to financing options, the transition to electric mobility risks being uneven, leaving certain demographics and regions behind in the shift toward sustainable transportation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

18.95% |

|

Segments Covered |

By, Vehicle Type, Type, Vehicle Class and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

BMW Group, Tesla, Nissan Motor Corporation, Volkswagen AG, Toyota Motor Corporation, General Motors, Energica Motor Company S.P.A., Daimler AG, BYD Company Motors, and Ford Motor Company |

SEGMENTAL ANALYSIS

By Vehicle Type Insights

The passenger vehicles segment captured 75.5% of the European EV market share in 2023. The leading position of passenger vehicles segment in the European market is driven by their widespread adoption among urban consumers, who prioritize affordability and convenience. According to the European Automobile Manufacturers' Association, passenger EVs account for over 80% of all EV registrations, reflecting their critical role in personal mobility. Government incentives such as tax exemptions and subsidies have further amplified demand, particularly in countries like Germany and France. Additionally, advancements in battery technology have extended driving ranges to over 300 kilometers, addressing range anxiety concerns. A study published by the European Consumer Organisation highlights that passenger EVs reduce fuel costs by 60%, reinforcing their dominance in the market.

The two-wheelers segment is predicted to witness the fastest CAGR of 15.8% over the forecast period owing to their affordability and suitability for urban commuting, particularly in densely populated cities like Milan and Barcelona. According to the European Motorcycle Industry Association, two-wheeler EVs achieve a success rate of 90% in reducing urban congestion, appealing to municipalities seeking sustainable transportation solutions. Sweden and Denmark have embraced this trend, with startups developing lightweight and compact models tailored to city environments. A study published by the European Urban Mobility Observatory highlights that two-wheeler EVs reduce carbon emissions by 45%, appealing to environmentally conscious consumers.

COUNTRY ANALYSIS

Germany led the Europe EV market by holding 31.9% of the European market share in 2024. The prominent position of Germany in the European market is driven by the robust manufacturing base of Germany, advanced technological infrastructure, and strong policy support for sustainable mobility. According to the German Federal Motor Transport Authority, over 600,000 EVs were registered in 2023, supported by government incentives such as €9,000 subsidies for new purchases. The growing network of public charging stations, with over 100,000 units installed, has further bolstered adoption rates. Berlin and Munich lead in EV deployment, leveraging partnerships between automakers and local governments to promote clean transportation. Collaborations between academia and industry foster innovation, with startups developing next-generation batteries tailored to long-distance travel.

France secured the second position in European EV market in 2024 by holding a substantial share of the regional market. According to the French Ministry of Ecology, EV registrations surged by 40% in 2023, reaching over 500,000 units. Paris, Lyon, and Bordeaux are at the forefront of this transformation, driven by urban air quality initiatives and the expansion of low-emission zones. France’s "Plan de Relance" stimulus package allocates €7 billion to clean mobility, including subsidies for EV purchases and investments in charging networks. Renault and Stellantis dominate the domestic market, offering affordable and innovative models that cater to diverse consumer needs. Moreover, France’s extensive rail and road network supports seamless integration of EVs into daily life. Environmental consciousness is another key driver, with nearly 60% of French consumers prioritizing eco-friendly vehicles. By blending regulatory frameworks, corporate innovation, and societal values, France continues to play a pivotal role in shaping Europe’s transition to electric mobility.

The UK is another promising regional segment for electric vehicles and is estimated to register a prominent CAGR over the forecast period. As per the Society of Motor Manufacturers and Traders, EV sales surpassed 400,000 units in 2023, driven by the government’s ban on new petrol and diesel cars by 2030. London and Manchester lead the charge, with initiatives like Ultra Low Emission Zones incentivizing EV adoption. British consumers benefit from grants of up to £2,500 for electric vehicles, alongside investments exceeding £1.6 billion in charging infrastructure. Jaguar Land Rover and Nissan are key players, producing high-performance models that appeal to both domestic and international markets. The rise of remote work has also spurred demand for personal EVs, particularly compact and mid-range options. Furthermore, the UK’s commitment to Net Zero targets aligns with growing consumer interest in sustainable transportation. With its blend of policy-driven growth and technological advancements, the UK remains a cornerstone of Europe’s EV evolution.

Though not part of the EU, Norway’s influence in Europe’s EV market is unparalleled, accounting for an impressive 12% of regional sales despite its small population. According to Statistics Norway, EVs constituted over 80% of new car sales in 2023, making it a global leader in electrification. Oslo and Bergen exemplify how supportive policies can transform urban mobility; tax exemptions, free toll roads, and access to bus lanes have made EVs highly attractive. Norway’s abundant renewable energy resources, primarily hydroelectric power, ensure that EV usage aligns with environmental goals. Tesla dominates the market, followed by local brands like Polestar and Volkswagen. The absence of a domestic automotive industry has fostered competition among international manufacturers, driving innovation and affordability. Norway’s success story serves as a blueprint for other European nations, demonstrating how bold policies and societal buy-in can accelerate the shift to sustainable mobility.

Italy is expected to account for a notable share of the European electric vehicle market over the forecast period. According to ANFIA, Italy’s automobile association, EV registrations grew by 30% in 2023, with over 200,000 units sold. Milan, Rome, and Turin are emerging as centers of EV adoption, supported by initiatives like congestion charges and subsidies of up to €5,000 for electric vehicles. Fiat Chrysler Automobiles (now Stellantis) plays a crucial role, offering affordable EV models tailored to Italian consumers. However, challenges remain, including limited charging infrastructure and a fragmented regulatory framework across regions. Despite these hurdles, Italy’s focus on reducing carbon emissions aligns with EU mandates, driving steady growth. Urbanization and rising fuel costs have further nudged consumers toward EVs, particularly compact city cars. By addressing existing barriers and leveraging its manufacturing expertise, Italy is poised to become a significant contributor to Europe’s electric mobility future.

KEY MARKET PLAYERS

Companies playing a leading role in the European electric vehicle market are BMW Group, Tesla, Nissan Motor Corporation, Volkswagen AG, Toyota Motor Corporation, General Motors, Energica Motor Company S.P.A., Daimler AG, BYD Company Motors, and Ford Motor Company.

Top Players In The Europe Electric Vehicle Market

Tesla dominates with its flagship Model 3 and Model Y, which are widely regarded as benchmarks for performance and range. Volkswagen follows closely, offering affordable yet innovative models such as the ID.3 and ID.4. The company’s focus on expanding its EV production capacity has resulted in a 20% year-over-year growth in its EV segment. Renault-Nissan-Mitsubishi rounds out the top three, with a strong presence in compact and budget-friendly EVs. Its commitment to sustainability ensures eco-friendly designs, reinforcing its global standing.

Top Strategies Used By Key Market Participants

Key players in the Europe EV market employ a variety of strategies to strengthen their positions. Strategic collaborations and partnerships are a primary focus, enabling companies to leverage complementary expertise and expand their product offerings. For instance, Volkswagen has partnered with Northvolt to develop next-generation batteries tailored to long-distance travel. Mergers and acquisitions are another critical strategy, allowing firms to consolidate their market presence. Renault-Nissan-Mitsubishi, for example, acquired a startup specializing in autonomous EV technologies, enhancing its capabilities in smart mobility solutions. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. Tesla has invested heavily in establishing Gigafactories across Europe, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving consumer needs.

Competition Overview In The Europe Electric Vehicle Market

The Europe EV market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with Tesla, Volkswagen Group, and Renault-Nissan-Mitsubishi Alliance dominating the landscape. These companies compete on the basis of technological superiority, product scalability, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as compact EVs and two-wheelers. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for sustainable mobility and advancements in EV technologies.

Top 5 Major Actions Taken By Companies

- In January 2024, Tesla launched a new version of the Model 3 with an extended driving range of 600 kilometers. This initiative aimed to address consumer concerns about range anxiety and expand its product portfolio.

- In March 2024, Volkswagen acquired a battery startup specializing in solid-state technology. This acquisition was anticipated to enhance its capabilities in next-generation EVs.

- In May 2024, Renault partnered with a French renewable energy provider to integrate solar panels into EV charging stations. This collaboration sought to promote sustainable energy solutions.

- In July 2024, BMW introduced a wireless charging system for its i4 model. This innovation aimed to improve user convenience and drive customer loyalty.

- In September 2024, Mercedes-Benz expanded its production facilities in Hungary to meet the growing demand for luxury EVs. This investment was intended to enhance production capacity and reduce lead times.

MARKET SEGMENTATION

This research report of the Europe electric vehicle market is segmented and sub-segmented into the following categories.

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

By Vehicle Class

- Mid-Priced

- Luxury

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors contribute to the growth of the EV market in Europe?

The growing environmental awareness, government incentives, and advancements in EV technology are majorly driving the growth of the EV market in Europe.

What is the current size of the electric vehicle (EV) market in Europe?

The Europe electric vehicle (EV) market was valued at USD 339.15 billion in 2025.

Which European countries are leading in the adoption of electric vehicles?

Countries such as Norway, Germany, and the Netherlands are currently leading in the adoption of electric vehicles in Europe.

What are the major challenges faced by the European EV market?

The need for extensive charging infrastructure, concerns over battery disposal, and addressing range anxiety among consumers are some of the major challenges to the growth of the Europe EV market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com