Europe Food Safety Testing Market Research Report By Contaminant (Microbial, GMOs, Metal Contaminants, Pesticide and Residues, Toxins, Food Allergen, and Others), Food Type (Poultry, Meat, Seafood, Dairy Products, Processed Foods, Fruits & Vegetables, Others), & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Analysis On Size, Share, Trends & Growth Forecast (2025 To 2033)

Europe Food Safety Testing Market Size

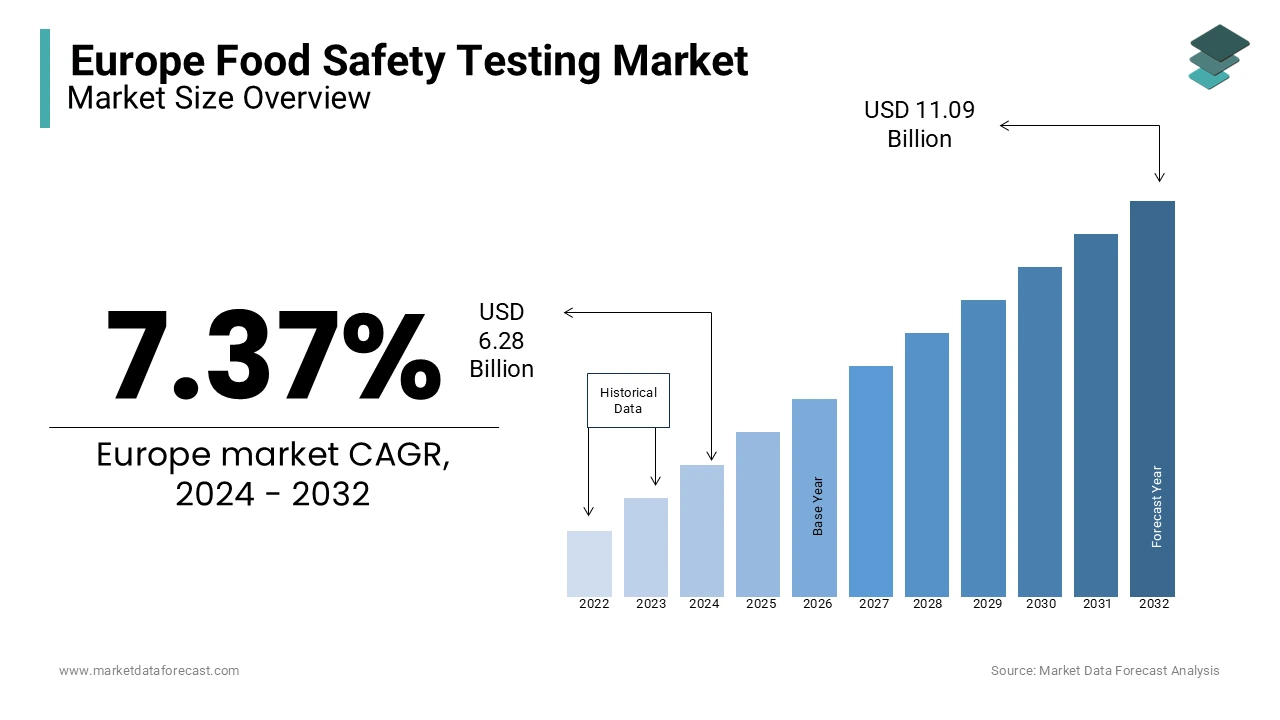

The size of the European food safety testing market was valued at USD 6.28 billion in 2024. The European market is further estimated to grow at a CAGR of 7.37% from 2025 to 2033 and be worth USD 11.90 billion by 2033 from USD 6.74 billion in 2025.

The Europe food safety testing market’s growth is driven by stringent regulatory frameworks, rising consumer awareness about food safety, and increasing instances of foodborne illnesses. For instance, as per Eurostat, over 40% of food recalls in Europe are attributed to microbial contamination with the need for rigorous testing protocols. Additionally, government initiatives promoting transparency in food labeling have accelerated the adoption of advanced testing technologies. However, challenges such as high testing costs and limited awareness among small-scale producers persist is impacting market dynamics.

MARKET DRIVERS

Stringent Regulatory Frameworks

A key driver of the Europe food safety testing market is the implementation of stringent regulatory frameworks. According to the EFSA, over 90% of EU member states now mandate mandatory testing for contaminants like pesticides, heavy metals, and allergens before food products can enter the market. The General Food Law Regulation requires traceability and safety assessments is driving demand for comprehensive testing solutions. For example, as per the German Federal Institute for Risk Assessment, over 60% of food manufacturers in Germany conduct regular safety tests to comply with EU regulations. These mandates not only ensure consumer safety but also enhance market transparency that is propelling market’s growth.

Rising Consumer Awareness and Demand for Safe Food

Increasing consumer awareness about food safety represents another major driver. According to the European Consumer Organisation, over 70% of consumers now prioritize purchasing food products with verified safety certifications. This trend is particularly pronounced in urban areas, where health-conscious buyers drive demand for organic and pesticide-free foods. Additionally, foodborne illness outbreaks have heightened scrutiny. As per the UK Food Standards Agency, incidents of E. coli and Salmonella contamination have increased by 15% since 2020 by creating a robust demand for microbial testing solutions. These factors collectively position food safety testing as an indispensable tool in ensuring public health.

MARKET RESTRAINTS

High Testing Costs

A significant restraint facing the Europe food safety testing market is the high cost of advanced testing technologies. According to the European Federation of Food, Agriculture, and Tourism Trade Unions, the average cost of microbial testing exceeds €500 per sample is making it unaffordable for small-scale producers. A survey by the European Food Safety Laboratory Association revealed that nearly 25% of SMEs consider cost a primary barrier to implementing regular safety tests. These affordability issues create disparities in testing accessibility in rural regions.

Limited Awareness Among Small-Scale Producers

Limited awareness among small-scale producers poses another restraint. According to the European Commission, over 50% of small-scale farmers lack knowledge about mandatory testing requirements, leading to non-compliance and potential food safety risks. This issue is exacerbated in underdeveloped regions, where educational resources are scarce. Additionally, misconceptions about the complexity of testing procedures deter many producers from adopting advanced solutions. As per a study by the French National Institute for Agricultural Research, only 30% of small-scale farms conduct regular safety tests with the need for targeted educational campaigns.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets in Eastern and Southern Europe present significant opportunities for the food safety testing market. According to the European Investment Bank, investments in food safety infrastructure in these regions are projected to grow by 12% annually through 2030. Countries like Poland and Turkey are witnessing rapid industrialization and improved regulatory compliance by creating a conducive environment for testing adoption. For instance, Turkey’s Ministry of Agriculture reported a 20% increase in food safety testing facilities since 2021, driven by government-led initiatives to decentralize food safety monitoring.

Growing Adoption of Rapid Testing Technologies

The growing adoption of rapid testing technologies presents another major opportunity. According to the European Biotechnology Industry Organization, over 60% of food manufacturers are investing in portable testing kits and biosensors to reduce turnaround times. For example, as per the Spanish Ministry of Health, rapid microbial testing has reduced detection times by 50% is enhancing operational efficiency. Advancements in AI-driven analytics and IoT integration have further amplified adoption is positioning rapid testing as a transformative force in the market.

MARKET CHALLENGES

Competition from Alternative Testing Methods

Competition from alternative testing methods, such as traditional laboratory-based assays, poses a significant challenge. According to the European Laboratory Association, conventional methods account for over 40% of the market due to their established reliability and lower costs. This competition is particularly intense in price-sensitive regions like Eastern Europe, where affordability outweighs speed. Additionally, inconsistencies in the accuracy of rapid testing technologies threaten to erode market share. According to a study by the Italian Ministry of Health, rapid tests often require secondary confirmations is creating a formidable rival for advanced solutions.

Stringent Compliance Costs

Stringent compliance costs represent another challenge. The food manufacturers must adhere to rigorous safety standards, which increase operational expenses by 15%, as per the German Federal Ministry for Economic Affairs. Smaller players face difficulties in meeting these requirements is leading to market consolidation. As per a survey by the European Food Safety Laboratory Association, nearly 30% of small-scale labs have exited the market due to compliance-related challenges with the need for supportive policies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.37% |

|

Segments Covered |

By Contaminant, Food Type, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

SGS, Eurofins, Intertek, ALS Limited, Bureau Veritas, Mérieux, TUV SÜD, Microbac Laboratories, AsureQuality, and Romer Labs |

SEGMENTAL ANALYSIS

By Contaminant Insights

The microbial contaminants segment was the largest in the Europe food safety market with a share of 40.3% in 2024 with the high prevalence of foodborne illnesses caused by pathogens like E. coli, Salmonella, and Listeria. For instance, according to the UK Food Standards Agency, microbial contamination accounts for over 60% of food recalls in Europe is creating a robust demand for testing solutions. Key factors driving this segment include advancements in rapid detection technologies. Additionally, government mandates for microbial testing have increased adoption rates by ensuring sustained growth.

The pesticide and residue testing segment is lucratively growing with a CAGR of 8.2% from 2025 to 2033. This growth is fueled by rising consumer demand for organic and pesticide-free foods. According to the French Ministry of Agriculture, pesticide testing sales have increased by 30% annually since 2020. Advancements in chromatography and mass spectrometry technologies have driven adoption. Partnerships between manufacturers and research institutions further amplify growth with this segment as a key driver of market expansion.

By Food Type Insights

The meat and poultry segment was accounted in occupying 35.4% of the Europe food safety testing market share in 2024 owing to the high consumption rates of these products across Europe, coupled with stringent safety regulations. For instance, as per the German Federal Institute for Risk Assessment, over 70% of meat products undergo mandatory microbial and toxin testing before entering the market. Key factors driving this segment include rising consumer awareness about foodborne illnesses and the increasing prevalence of contamination incidents. Additionally, advancements in rapid testing technologies have improved detection accuracy. Government mandates for traceability and transparency have increased adoption rates by ensuring sustained growth.

The processed food segment is anticipated to exhibit a CAGR of 9.5% during the forecast period. This growth is fueled by the rising demand for convenience foods and the increasing complexity of processed food formulations, which require rigorous safety testing. According to the Spanish Ministry of Agriculture, processed food testing sales have increased by 40% annually since 2021. Advancements in allergen detection technologies have driven adoption. Partnerships between manufacturers and regulatory bodies further amplify growth is positioning processed food as a transformative force in the market.

REGIONAL ANALYSIS

Germany held 26.7% of the Europe food safety testing market share in 2024 owing to the country’s robust regulatory framework and high demand for safe food products. Germany’s emphasis on transparency aligns with EU mandates is driving adoption of advanced testing solutions. For instance, as per Eurostat, over 60% of food manufacturers in Germany conduct regular safety tests to comply with EU regulations. Additionally, government incentives for innovation in testing technologies have increased accessibility.

Turkey is likely to grow with a CAGR of 10.2% during the forecast period. This growth is fueled by rapid industrialization, increasing consumer spending, and rising exports of food products. Additionally, government-led initiatives promoting food safety compliance have accelerated adoption by positioning Turkey as a key growth driver in the region.

Countries like France, Italy, and Spain are expected to witness steady growth due to their strong food processing industries and export-oriented economies. Eastern European nations like Poland and Romania face challenges such as limited infrastructure but show potential due to ongoing reforms. The Czech Ministry of Agriculture predicts a 15% increase in food safety testing investments by 2025. Meanwhile, Nordic countries benefit from stringent environmental regulations by ensuring equitable access to sustainable solutions.

LEADING PLAYERS IN THE EUROPE FOOD SAFETY TESTING MARKET

SGS S.A.

SGS S.A. is a leading player in the Europe food safety testing market, contributing significantly to innovations in microbial and residue testing solutions. The company specializes in providing comprehensive testing services tailored for meat, dairy, and processed foods. Its focus on integrating AI-driven analytics aligns with Europe’s demand for rapid and accurate testing solutions by enabling it to maintain a competitive edge.

Intertek Group PLC

Intertek Group PLC is another key contributor, renowned for its expertise in pesticide and allergen testing. Intertek’s strategic emphasis on expanding its service portfolio with portable testing kits has driven growth. Its presence in Europe is strengthened by partnerships with local food producers, ensuring widespread adoption of its services.

Eurofins Scientific

Eurofins Scientific plays a pivotal role in advancing food safety testing technologies, particularly in GMO and toxin detection. Its commitment to innovation and collaboration positions it as a major player in the market in high-growth regions like Germany and France.

TOP STRATEGIES USED BY KEY PLAYERS IN EUROPE FOOD SAFETY TESTING MARKET

Key players in the Europe food safety testing market employ strategies such as technological innovation, geographic expansion, and strategic collaborations to strengthen their positions. Technological innovation is central, with companies investing in AI-driven analytics and IoT integration to enhance testing accuracy. Geographic expansion is another focus, with firms targeting emerging markets like Turkey and Eastern Europe to tap into untapped potential. Strategic collaborations with regulatory bodies also play a crucial role. Eurofins partners with EU agencies to develop standardized testing protocols, increasing adoption rates. These strategies collectively drive market growth and ensure sustained competitiveness.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Europe food safety testing market include SGS, Eurofins, Intertek, ALS Limited, Bureau Veritas, Mérieux, TUV SÜD, Microbac Laboratories, AsureQuality, and Romer Labs

The Europe food safety testing market is highly competitive, characterized by the presence of global leaders and regional players vying for market share. Major companies like SGS, Intertek, and Eurofins dominate the landscape through continuous innovation and strategic collaborations.

Intense competition drives technological advancements, with firms focusing on developing cost-effective and scalable solutions. Regional players differentiate themselves by catering to niche segments, such as organic or specialty foods. Regulatory compliance and adherence to quality standards further intensify competition, ensuring that only the most reliable services gain traction. As demand grows, players increasingly invest in expanding their geographic footprint and forming alliances with end-users by fostering a dynamic and evolving competitive environment.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, SGS launched a new line of AI-driven testing kits in Germany by reducing detection times by 40% while maintaining accuracy.

- In June 2023, Intertek partnered with Italian food producers to develop custom allergen testing solutions by enhancing brand differentiation and market penetration.

- In September 2023, Eurofins acquired a leading testing facility in Turkey is strengthening its position in the fast-growing Middle Eastern market.

- In November 2023, Bureau Veritas introduced a cloud-based platform in Switzerland is streamlining the traceability of food safety data for manufacturers.

- In February 2024, ALS Limited collaborated with tech firms in France to develop portable biosensors by positioning itself as a leader in rapid testing solutions.

MARKET SEGMENTATION

This research report on the European food safety testing market is segmented and sub-segmented into the following categories.

By Contaminant

- Microbial

- GMOs

- Metal Contaminants

- Pesticide and Residues

- Toxins

- Food Allergen

By Food Type

- Meat and Poultry

- Dairy Product

- Processed Food

- Beverages

- Fruits and Vegetables

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com