Europe Home Healthcare Market Size, Share, Trends & Growth Forecast Report By Product Type (Testing, Screening, & Monitoring Products, Therapeutic Products, Mobility Care Products), Type, Services Type, Software and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Home Healthcare Market Size

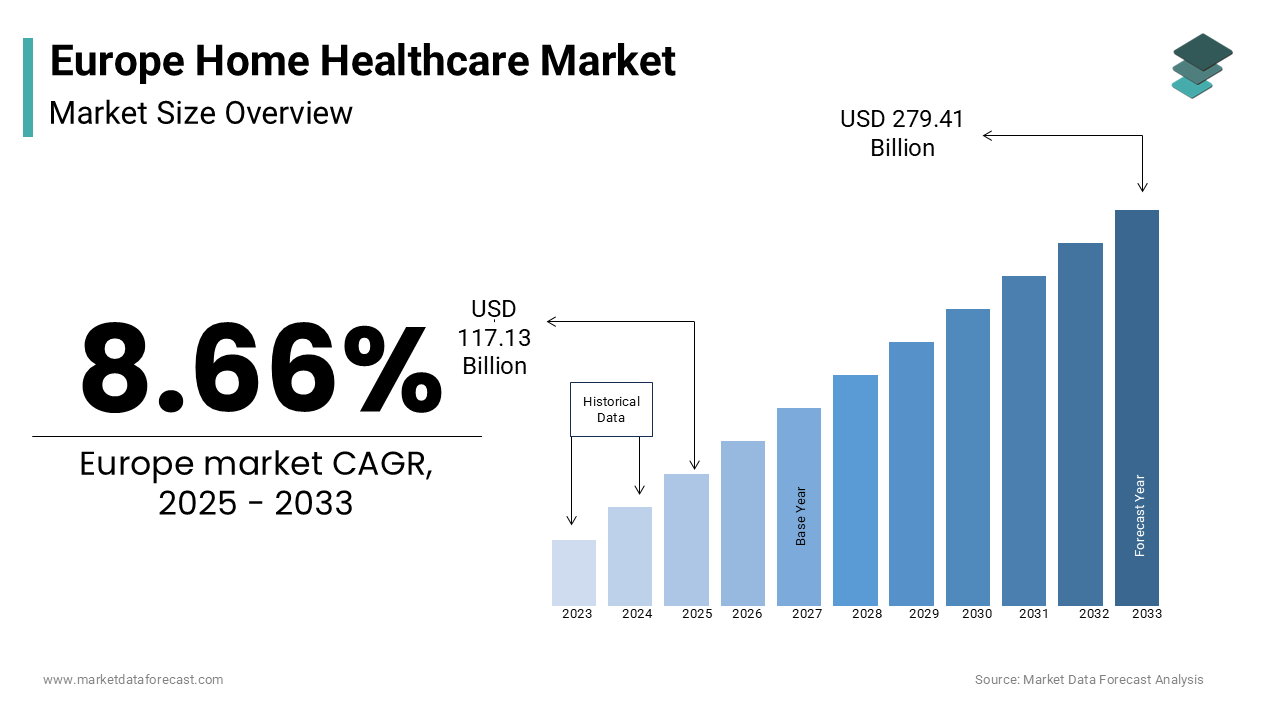

The home healthcare market in Europe size was valued at USD 105.07 billion in 2024. The size of the market is estimated to value USD 279.41 billion by 2033 from USD 117.13 billion in 2025, growing at a CAGR of 8.66% during the forecast period.

Home healthcare refers to medical and non-medical services provided to patients in their homes. These services include skilled nursing, physical therapy, chronic disease management, personal care, and the provision of medical equipment. The aging population of Europe is a key factor propelling the demand for home healthcare services in this region. According to Eurostat, more than 21% of the EU population was aged 65 or older in 2022 and projections indicating continued growth in this demographic segment. The rising prevalence of chronic diseases such as diabetes and cardiovascular conditions are further fuelling the need for personalized and home-based care substantially. Additionally, national healthcare systems across Europe are investing in home healthcare solutions to alleviate pressure on hospitals and long-term care facilities. For instance, Germany and France have implemented policies to integrate home healthcare into their public health frameworks to promote its adoption as a viable alternative to institutionalized care.

MARKET DRIVERS

Growing Aging Population in Europe

The increasing proportion of elderly individuals across Europe is a significant driver of the European home healthcare market. According to Eurostat, more than 21% of the EU population was aged 65 or older in 2022, and this percentage is expected to rise to 30% by 2050. Older adults are more prone to chronic illnesses such as cardiovascular diseases, diabetes, and arthritis and require consistent and cost-effective care. Home healthcare offers a viable solution to manage these conditions while minimizing hospital visits and institutional care. Countries such as Germany and Italy have the highest aging populations in Europe and are leading adopters of home healthcare services to meet these growing demands.

Rising Prevalence of Chronic Diseases in Europe

The prevalence of chronic illnesses is another major driver of home healthcare demand in Europe. According to the World Health Organization, non-communicable diseases, including diabetes and respiratory conditions, account for nearly 87% of all deaths in Europe. Chronic diseases often involve long-term care, rehabilitation, and regular monitoring, which makes home healthcare a preferred choice for both patients and healthcare systems. In addition, as per the reports of the European Respiratory Society, chronic respiratory diseases affect over 10% of the population in the EU, which further emphasizes the need for in-home medical services to reduce the burden on traditional healthcare facilities.

MARKET RESTRAINTS

High Costs of Advanced Home Healthcare Services

While home healthcare is often viewed as cost-effective compared to institutional care, the initial setup and delivery of advanced services can be prohibitively expensive. According to a report by the European Commission, healthcare spending in the EU accounted for 9.9% of GDP in 2021 and a significant portion allocated to chronic disease management and elderly care. However, personalized in-home services, including the use of sophisticated medical devices and telehealth solutions may incur costs that exceed the budgets of middle-income households. This financial barrier limits accessibility, particularly in regions with limited government subsidies for home healthcare initiatives.

Shortage of Skilled Healthcare Professionals

A critical shortage of qualified healthcare workers presents another significant restraint. According to the European Health Union, the EU faces a shortage of approximately one million healthcare professionals and gaps most evident in nursing and home-based caregiving roles. This workforce deficit results from factors such as aging professionals nearing retirement and insufficient recruitment to meet growing demand. For instance, as per the data of the German Federal Employment Agency, Germany, which is a leader in home healthcare adoption, is currently struggling to fill nearly 40,000 nursing vacancies annually. This shortage impacts service quality and availability, hindering the market’s potential to expand.

MARKET OPPORTUNITIES

Integration of Digital Health Technologies

The adoption of digital health solutions such as telemedicine, remote monitoring devices, and AI-driven diagnostic tools presents a significant growth opportunity. According to the Digital Economy and Society Index of the European Commission, 84% of EU households had internet access in 2021, which enabled the proliferation of telehealth services. Remote patient monitoring devices, such as wearable sensors for chronic disease management are gaining traction due to their convenience and effectiveness. For example, as per a European Respiratory Society report, remote monitoring reduced hospital readmissions for chronic respiratory disease patients by 20% in 2020. This shows the transformative potential of digital health in home care settings.

Governmental Support and Policy Initiatives

The growing focus of European governments on promoting home healthcare solutions is another vital opportunity. The European Commission emphasizes the need for integrated care models under initiatives such as Horizon Europe and allocates significant funding to support healthcare innovation. For instance, as per the German Federal Ministry of Health, the long-term care insurance system of Germany reimburses home healthcare costs, and this benefits over 4 million citizens annually. Similarly, the healthcare reforms of France prioritize aging in place through enhanced in-home care support. These policy-driven investments enhance access and affordability and foster the market’s expansion across the region while addressing the healthcare needs of aging and chronically ill populations.

MARKET CHALLENGES

Uneven Access to Services Across Regions

Disparities in healthcare infrastructure and funding among European countries create uneven access to home healthcare services. According to the European Commission, per capita healthcare expenditure varies significantly, and countries like Germany spend €5,800 annually compared to less than €1,500 in Eastern European nations. This financial gap limits the availability and quality of home healthcare services in underfunded regions and leaves many patients underserved. Additionally, rural areas across the EU, home to about 25% of the population face logistical challenges in accessing home-based care due to limited healthcare networks and transportation difficulties, further exacerbating inequities in service delivery.

Lack of Standardized Regulations Across the EU

The absence of harmonized regulations for home healthcare services poses a critical challenge. Each EU member state has its policies and reimbursement systems and create inconsistencies in service provision. For instance, according to European Health, the fragmented nature of healthcare regulations leads to disparities in care quality, patient safety standards, and professional training requirements. This regulatory complexity increases operational hurdles for providers seeking to expand across multiple countries, restricting regional market growth. As per the reports of the World Health Organization, regulatory fragmentation can delay the adoption of innovative home healthcare solutions, impacting the timely delivery of quality care across Europe.

SEGMENTAL ANALYSIS

By Product Insights

The therapeutic products segment held the largest European home healthcare market revenue share in 2023. The rising incidence of chronic ailments such as respiratory disorders, kidney diseases, and others increased the demand for therapeutic equipment at home healthcare. Therapeutic equipment for diagnosing, preventing, treating, or modifying any physiological process enhances market growth.

By Type Insights

The home telehealth software segment acquired a significant market revenue share in 2023 as the software acts as a control portal. Home telehealth supports live patient interaction through video, audio, and messaging. The software segment controls these live interactions with the patient, which has greatly impacted the market growth.

By Services Type Insights

The skilled nursing care services segment led the market in Europe in 2023 and is expected to continue to dominate the market throughout the forecast period. Most patient conditions demand skilled nurses as regular medications are necessary, which induced market growth in the skilled nursing care services segment. Skilled nurses are helpful in all other ways, as nurses can handle emergencies.

By Software Insights

The hospice solutions segment held the largest share of the European market revenue in 2023 as they provide emotional, physical, and social support. This segment is expected to dominate the market over the forecast period due to its functionalities, making it easy to manage the clinic. This system includes appointments, doctor schedules, prescriptions, and others.

REGIONAL ANALYSIS

Germany led the home healthcare market in Europe in 2023. The domination of Germany in the European market is majorly due to its robust healthcare infrastructure and comprehensive long-term care insurance system. According to the reports of the German Federal Ministry of Health, more than 4 million people receive benefits under its long-term care insurance program, which includes extensive support for home healthcare services. As per Eurostat, Germany's focus on aging-in-place solutions is driven by its demographic structure and the fact that over 21% of its population will be aged 65 or older in 2022. The availability of skilled caregivers and advanced medical technologies further enhances Germany's leadership position and meets the growing demand for personalized and home-based care.

France holds a prominent position in the European home healthcare market. The growth of the home healthcare market in France is primarily attributed to its strong policy framework and universal healthcare system. The healthcare reforms of the French government prioritize home-based care for aging and chronically ill populations. According to Santé Publique France, nearly 15% of its population aged 75 and above relies on home healthcare services. The emphasis of France on integrated care models and public funding for in-home medical equipment accelerates the adoption of these services. Additionally, the commitment of France to address rural healthcare disparities bolsters its market standing and makes home healthcare accessible across diverse regions.

The United Kingdom ranks as one of the top performers in the European home healthcare market owing to its National Health Service (NHS) initiatives. The NHS Long Term Plan allocates significant resources toward home healthcare and focuses on chronic disease management and elderly care. As per the data of the UK Office for National Statistics, 18.6% of its population was aged 65 or older in 2022, which shows the greater need for in-home care solutions. Innovative telehealth programs, such as remote patient monitoring for chronic conditions, have further strengthened the position of the UK in the European home healthcare market.

KEY MARKET PARTICIPANTS

Notable companies dominating in the European Home Healthcare Market profiled in the report are Almost Family Inc., Amedisys Inc., General Electric Company (GE), Kinnser Software Inc., Linde Group, Omron Corporation, Roche Holding AG, Philips Healthcare, Mckesson Corporation, LHC Group Inc., Kindred Healthcare, Fresenius Se & Co Kgaa, Abbott Laboratories, and Apria Healthcare Group.

MARKET SEGMENTATION

This research report on the European home healthcare market has been segmented and sub-segmented into the following categories.

By Product Type

- Testing, Screening, & Monitoring Products

- Therapeutic Products

- Mobility Care Products

By Type

- Home Telehealth Monitoring Devices

- Home Telehealth Services

- Home Telehealth Software

By Services Type

- Rehabilitation Therapy Services

- Infusion Therapy Services

- Unskilled Care Services

- Respiratory Therapy Services

- Pregnancy Care Services

- Skilled Nursing Care Services

- Hospice

- Palliative Care Services

By Software

- Agency Software

- Clinical Management Systems

- Hospice Solutions

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Which countries contribute significantly to the home healthcare market in Southern Europe?

Spain and Italy are among the key contributors to the home healthcare market in Southern Europe, accounting for a substantial market share.

What are the primary drivers of home healthcare market growth in Europe?

The growing aging population, increasing prevalence of chronic diseases and a rising preference for in-home care are key factors driving the home healthcare market in Europe.

In what ways is the COVID-19 pandemic influencing the growth trajectory of the home healthcare market in Europe?

The COVID-19 pandemic has accelerated the adoption of home healthcare services in Europe.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com