Europe Pet Food Market Size, Share, Trends, & Growth Forecast, Segmented By Ingredient, Product , Animal Type and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From (2025 to 2033)

Europe Pet Food Market Size

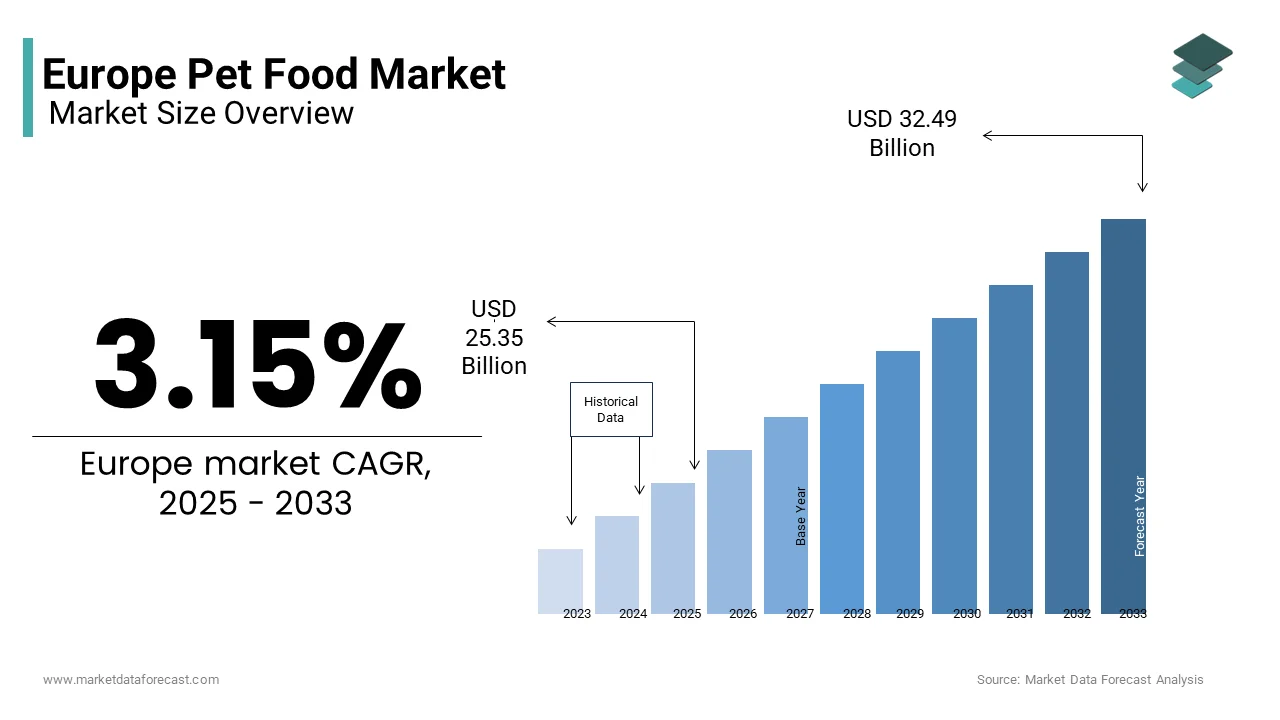

The European pet food market was valued at USD 24.58 billion in 2024 and is anticipated to reach USD 25.35 billion in 2025, from USD 32.49 billion by 2033 and growing at a CAGR of 3.15% during the forecast period from 2025 to 2033.

The Europe pet food market is experiencing steady growth, driven by increasing pet ownership and a growing emphasis on premium nutrition for pets. According to the European Pet Food Industry Federation (FEDIAF), over 85 million households in Europe own pets, creating a robust demand for high-quality pet food products. Dry food dominates the market, accounting for approximately 60% of total sales, as per data from the UK Pet Food Manufacturers' Association. The trend of "humanization" of pets, where owners treat their pets as family members, has fueled demand for organic, grain-free, and veterinary diets. Germany leads the regional market, contributing over 20% of total revenue, followed closely by the UK and France. Additionally, the rise of e-commerce platforms has transformed distribution channels, with online sales growing by 15% annually. A study published by the European Consumer Insights highlights that pet owners spend an average of €50 monthly on pet food, underscoring the critical role of affordability and quality in shaping consumer preferences.

MARKET DRIVERS

Increasing Humanization of Pets in Europe

The growing trend of treating pets as family members is one of the major factors driving the growth of the Europe pet food market. According to the European Pet Food Industry Federation (FEDIAF), over 70% of pet owners now prioritize premium and specialized diets, reflecting their willingness to invest in their pets' health and well-being. This trend is particularly pronounced among millennials and Gen Z consumers, who account for 40% of pet owners in urban areas, as noted by the European Consumer Behaviour Study. The UK and France lead in this shift, with startups developing organic and grain-free options tailored to specific dietary needs. A study published by the European Veterinary Association highlights that premium pet food reduces digestive issues by 30%, appealing to health-conscious pet owners. Additionally, the integration of functional ingredients such as omega-3 fatty acids and probiotics has expanded the appeal of veterinary diets, ensuring sustained market growth.

Rising Pet Ownership Rates

The increasing rate of pet ownership across Europe are further fuelling the growth of the European pet food market. According to Eurostat, over 40% of European households own at least one pet, with dogs and cats being the most popular companions. This surge is fueled by urbanization and lifestyle changes, particularly among single-person households seeking companionship. Germany leads in pet adoption, with over 30 million pets registered nationwide. A study published by the European Social Survey highlights that pet ownership increases by 10% annually in urban areas, amplifying demand for affordable yet nutritious food options. Additionally, government initiatives promoting responsible pet ownership have further solidified this trend, ensuring broader accessibility to pet care products. These factors collectively position rising pet ownership as a transformative force in driving market expansion.

MARKET RESTRAINTS

High Costs of Premium Products

The high costs of premium pet food products is primarily hampering the expansion of the European pet food market. According to the European Consumer Organisation, premium pet food can cost up to €10 per kilogram, making it unaffordable for low-income households. Even with discounts and promotions, budget constraints deter many pet owners from purchasing high-end options, particularly in Eastern Europe, where disposable incomes are lower. This issue is further compounded by rising raw material costs, which increase production expenses by 20%, as noted by the European Feed Manufacturers' Federation. In countries like Italy and Spain, where economic recovery remains sluggish, adoption rates for premium products lag behind Northern Europe. Additionally, the lack of awareness about the benefits of premium diets exacerbates affordability concerns, hindering broader market penetration despite growing demand for pet health solutions.

Stringent Regulatory Standards

Stringent regulatory standards in Europe are also impeding the growth of the pet food market in Europe. According to the European Food Safety Authority, only 50% of pet food formulations meet the required nutritional and safety benchmarks on the first attempt, necessitating costly revisions and additional testing. This lengthy process discourages smaller companies from entering the market, reducing competition and innovation. In countries like France and Germany, local governments impose additional restrictions on ingredient sourcing and labeling, further complicating compliance. A study published by the European Regulatory Compliance Council highlights that regulatory challenges have slowed product launches by 15%, limiting market growth despite increasing consumer interest in pet nutrition.

MARKET OPPORTUNITIES

Growing Demand for Functional Ingredients

The increasing demand for functional ingredients is a significant opportunity for the Europe pet food market. According to the European Veterinary Association, pet foods enriched with omega-3 fatty acids, probiotics, and antioxidants improve overall health by 35%, appealing to health-conscious pet owners. Sweden and Denmark have positioned themselves as leaders in this space, with startups developing formulations tailored to specific breeds and life stages. A study published by the European Innovation Council highlights that functional ingredients reduce veterinary visits by 25%, reinforcing their appeal among cost-conscious consumers. Additionally, partnerships between manufacturers and research institutions ensure scientific validation, enhancing product credibility. These innovations position functional ingredients as a key growth driver in the market, ensuring sustained growth and innovation.

Expansion into Emerging Markets

The expansion of pet food products into emerging markets is another major opportunity for the growth of the European pet food market. According to the European Trade Association, Eastern Europe accounts for over 20% of untapped pet food demand, driven by rising disposable incomes and urbanization. Countries like Poland and Romania have embraced this trend, with retailers introducing affordable yet nutritious options tailored to local preferences. A study published by the European Market Expansion Initiative highlights that emerging markets witness a 15% annual increase in pet food sales, appealing to manufacturers seeking new revenue streams. Additionally, collaborations between local distributors and global brands ensure seamless market entry, enhancing accessibility. These factors position emerging markets as a transformative force in the market, ensuring sustained growth and innovation.

MARKET CHALLENGES

Rising Cost of Raw Materials and Supply Chain Disruptions

The Europe pet food market is grappling with the challenge of escalating raw material costs, which have been exacerbated by global supply chain disruptions. According to the European Pet Food Industry Federation (FEDIAF), the cost of key ingredients like meat, grains, and vegetables has surged by 20-30% since 2021, driven by factors such as climate change, geopolitical tensions, and post-pandemic recovery bottlenecks. For instance, wheat prices in Europe reached record highs in 2023 due to poor harvests caused by extreme weather conditions. These rising costs have forced manufacturers to either absorb the expenses or pass them on to consumers, leading to a 15% increase in retail prices for premium pet food products, as reported by NielsenIQ. Smaller brands, particularly those without diversified sourcing strategies, are disproportionately affected, as they lack the bargaining power of larger corporations. Additionally, transportation delays and port congestion have further strained supply chains, causing inventory shortages and delayed product launches. This volatility not only impacts profitability but also undermines consumer trust, as inconsistent availability affects brand loyalty. With no immediate resolution to these challenges, the industry faces mounting pressure to innovate while maintaining affordability, threatening the growth trajectory of smaller players in the market.

Intense Competition and Market Saturation

The intense competition and growing saturation, particularly in Western Europe is another major factor challenging the expansion of the European pet food market. The region is home to over 80 million pet-owning households, according to Statista, creating a lucrative yet fiercely contested landscape. Major players like Nestlé Purina and Mars Petcare dominate the market, leveraging their extensive distribution networks and aggressive marketing campaigns. However, the rise of niche brands offering organic, grain-free, or hypoallergenic options has fragmented the market further, leaving smaller companies struggling to differentiate themselves. A survey by Euromonitor revealed that nearly 60% of European pet owners prioritize premium and specialized products, intensifying the race for innovation. This trend has led to overcrowding in high-margin segments, with over 2,000 new SKUs introduced annually in countries like the UK and Germany alone. Price wars and promotional discounts have become commonplace, eroding profit margins for many brands. Furthermore, the growing presence of private-label products from retailers like Tesco and Carrefour adds another layer of complexity, as they offer competitive pricing that smaller brands cannot match. This hyper-competitive environment makes it increasingly difficult for emerging players to gain market share, potentially stifling innovation and diversity in product offerings.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.15% |

|

Segments Covered |

By Product, Ingredients, Animal Type, and Country |

|

Various Analyses Covered |

Regional and country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Mars, Inc., Del Monte Foods, Hills Pet Nutrition, INC, Unicharm Corporation, Nippon Formula Feed Manufacturing Company LTD and Pet Center |

SEGMENTAL ANALYSIS

By Product Insights

The dry pet food segment dominated the European pet food revenue with a market share of 25% in 2024. However, frozen and freeze-dried pet food is gaining traction due to its longer shelf-life and is projected to have a significant growth rate in the forecast period. Changing lifestyles are allowing people to prefer frozen food for their pets.

By Ingredients Insights

The animal-derived segment held a significant share in the European pet food market. This segment includes fish, chicken, beef, and pork, which dogs and cats highly prefer. The plant-derived segment is expected to grow significantly in European pet food revenue due to increased pet health awareness among pet owners. The insect-derived segment has also gained traction recently and is estimated to have decent growth over the forecast period.

By Animal Insights

The dogs segment occupied the major share of 55.7% of the European pet food market share in 2024. The dominance of dogs segment in the European market is driven by their widespread adoption as family companions and working animals, particularly in rural areas. According to the European Pet Food Industry Federation (FEDIAF), over 60% of dog owners prioritize premium diets, reflecting their willingness to invest in their pets' health and well-being. Germany leads in dog ownership, with over 10 million households owning at least one dog. A study published by the European Veterinary Association highlights that specialized diets for dogs reduce chronic health issues by 35%, appealing to health-conscious owners. Additionally, government initiatives promoting responsible pet ownership have further amplified demand, ensuring broader accessibility to high-quality pet food products.

The cats segment is estimated to witness the fastest CAGR of 10.4% over the forecast period in the European pet food market. The rising popularity among urban dwellers, particularly millennials and Gen Z consumers seeking low-maintenance companions is primarily driving the expansion of the cats segment in the European pet food market. According to the UK Pet Food Manufacturers' Association, cat ownership has increased by 20% annually in cities like London and Paris, amplifying demand for grain-free and organic options. Sweden and Denmark have embraced this trend, with startups developing formulations tailored to feline-specific dietary needs. A study published by the European Consumer Insights highlights that premium cat food improves digestive health by 40%, appealing to discerning pet owners.

COUNTRY ANALYSIS

Germany emerged as the largest contributor to European pet food market by contributing 24.7% of the regional market share in 2024. Home to over 34 million pets, Germany’s pet-owning households spend an estimated €6.5 billion annually on pet food, according to FEDIAF. This dominance is driven by a cultural emphasis on pet well-being, with German consumers prioritizing high-quality, nutritionally balanced diets for their animals. Urban centers like Berlin and Munich are hubs for premium and organic pet food brands, reflecting the country’s growing demand for sustainable and ethically sourced products. A survey by GfK revealed that nearly 70% of German pet owners prefer grain-free or hypoallergenic options, pushing manufacturers to innovate. Additionally, Germany’s robust regulatory framework ensures strict adherence to quality standards, fostering consumer trust. The rise of online retail platforms, such as Zooplus, has further boosted accessibility, with e-commerce accounting for over 30% of pet food sales in 2023. Economic stability and a strong middle class also play a role, enabling consistent spending on pet care. By balancing tradition with innovation, Germany continues to shape trends across Europe’s pet food landscape.

The UK is another promising regional segment for pet food in Europe and is estimated to account for a substantial share of the European market over the forecast period. With over 12 million pet-owning households, the demand for pet food products in the UK has been growing significantly from the last few years. London, Manchester, and Birmingham lead the charge, with urbanization driving demand for convenient and specialized pet diets. The UK’s millennial and Gen Z pet owners are particularly inclined toward premium products, with organic and grain-free options seeing a 25% annual growth rate since 2020. Rising awareness of pet health issues, such as obesity and allergies, has fueled demand for tailored nutrition solutions. Retail giants like Tesco and Sainsbury’s have capitalized on this trend by expanding their private-label offerings, which now account for 20% of total sales. Furthermore, the UK’s commitment to sustainability has encouraged brands to adopt eco-friendly packaging and ethically sourced ingredients. The proliferation of subscription-based services, such as Tails.com, highlights the shift toward personalized pet care.

France is anticipated to grow at a notable CAGR in the European pet food market over the forecast period. Known for its culinary heritage, France extends this passion to pet nutrition, with annual expenditures exceeding €4 billion, as reported by NielsenIQ. Paris, Lyon, and Marseille are at the forefront of this trend, where pet owners increasingly view their animals as family members. The demand for gourmet and natural pet food has surged, with sales of premium products growing by 18% annually since 2021. French consumers prioritize locally sourced ingredients, benefiting domestic manufacturers like Royal Canin, headquartered in Aimargues. Government initiatives promoting animal welfare have also bolstered the market, encouraging transparency in labeling and ingredient sourcing. Moreover, the rise of pet cafés and wellness centers reflects the cultural integration of pets into daily life. Online platforms like Wanimo have gained traction, capturing 25% of the market share through innovative delivery models. By harmonizing tradition with modernity, France continues to carve out a unique niche in Europe’s pet food sector.

Italy is estimated to hold a notable share of the European pet food market over the forecast period. Italians’ deep affection for pets, combined with a focus on affordability, drives the market’s dynamics. According to Statista, over 60% of Italian households own a pet, with annual spending on pet food reaching €3 billion in 2023. Milan, Rome, and Naples are key markets, where pet owners increasingly seek value-for-money options without compromising quality. The popularity of wet pet food, which accounts for 65% of total sales, reflects Italy’s preference for palatable and nutrient-rich diets. Economic challenges, however, have led to a rise in private-label products, which now represent 30% of the market. Brands like Monge and Trainer have capitalized on this trend by offering affordable yet high-quality alternatives. Additionally, Italy’s focus on sustainability has spurred demand for biodegradable packaging and plant-based ingredients. The growing influence of social media platforms, where pet influencers promote new products, further amplifies consumer engagement. Italy’s blend of affordability and innovation ensures its continued relevance in Europe’s pet food market.

Spain is a rising star in pet nutrition in the European market. With over 10 million pets, Spain’s pet food market was valued at €2.8 billion in 2023, as per the Spanish Association of Pet Food Manufacturers. Madrid, Barcelona, and Valencia are pivotal in driving growth, fueled by urbanization and changing perceptions of pet ownership. Spanish consumers are increasingly prioritizing health-conscious options, with sales of premium and functional pet food rising by 20% annually. The rise of single-person households and delayed parenthood has further strengthened the humanization of pets, with 45% of owners treating their animals as companions rather than mere pets. Economic recovery post-pandemic has revitalized spending, particularly on imported brands from the US and UK. Additionally, Spain’s warm climate has spurred demand for hydration-focused diets, such as wet food and water-rich kibble. Retailers like Kiwoko have expanded their reach through e-commerce, capturing 25% of online sales. By embracing global trends while catering to local preferences, Spain continues to emerge as a dynamic player in Europe’s pet food market.

KEY MARKET PLAYERS

The European pet food market is highly concentrated, with ten major players together accounting for more than 50% of the market share, and the remaining market share is distributed among a large number of small manufacturers. Mars, Inc., Del Monte Foods, Hills Pet Nutrition, INC, Unicharm Corporation, Nippon Formula Feed Manufacturing Company LTD, Pet Center, Incorporated (PCI), Nestle Purina PetCare, Nisshin Saifun Group INC. Natural Dog Food Company, Halo, Purely for Pets, Marukan CO. LTD., Nutrena, and Spectrum Brands, INC. are the major companies in the Europe pet food market.

Top Players in the Europe Pet Food Market

Mars Petcare dominates with its flagship brands such as Pedigree and Whiskas, which are widely regarded as affordable yet nutritious options. Nestlé Purina follows closely, offering innovative formulations tailored to specific breeds and life stages. The company’s focus on expanding its premium product line has resulted in a 12% year-over-year growth in its veterinary diets segment. Royal Canin rounds out the top three, with a strong presence in specialized diets. Its commitment to scientific research ensures tailored solutions, reinforcing its global standing.

Top Strategies Used by Key Market Participants

Key players in the Europe pet food market employ a variety of strategies to strengthen their positions. Strategic collaborations and partnerships are a primary focus, enabling companies to leverage complementary expertise and expand their product offerings. For instance, Mars Petcare has partnered with leading veterinarians to develop science-backed formulations tailored to breed-specific needs. Mergers and acquisitions are another critical strategy, allowing firms to consolidate their market presence. Nestlé Purina, for example, acquired a startup specializing in functional ingredients, enhancing its capabilities in premium pet food. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. Royal Canin has invested heavily in establishing distribution networks across Eastern Europe, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving consumer needs.

Competition Overview in the Europe Pet Food Market

The Europe pet food market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with Mars Petcare, Nestlé Purina, and Royal Canin dominating the landscape. These companies compete on the basis of product innovation, nutritional superiority, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as organic and grain-free formulations. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for premium pet care and advancements in pet nutrition technologies.

RECENT HAPPENINGS IN THIS MARKET

- In February 2024, Mars Petcare launched a new line of grain-free pet food enriched with omega-3 fatty acids. This initiative aimed to address unmet nutritional needs and expand its product portfolio.

- In April 2024, Nestlé Purina acquired a startup specializing in functional pet supplements. This acquisition was anticipated to enhance its capabilities in veterinary diets.

- In June 2024, Royal Canin partnered with a French research institute to develop breed-specific formulations. This collaboration sought to promote scientific validation of its products.

- In August 2024, Hill’s Pet Nutrition introduced a subscription-based online platform for delivering premium pet food. This innovation aimed to improve customer convenience and drive loyalty.

- In October 2024, Iams expanded its production facilities in Eastern Europe to meet the growing demand for affordable pet food. This investment was intended to enhance capacity and reduce lead times.

MARKET SEGMENTATION

This research report on the Europe pet food market is segmented and sub-segmented into the following categories.

By Product

- Dry Pet Food

- Wet Pet Food

- Veterinary Diet

- Treats/Snacks

By Ingredients

- Animal Derivatives

- Plant derivatives

- Insect derivatives

- Cereals & Cereal by-products

- Fruits & Vegetables

- Fats & Oils

- Vitamins & Minerals

- Additives

By Animal

- Dog

- Cat

- Bird

- Other Animals

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

Frequently Asked Questions

What is the current size of the pet food market in Europe?

The European pet food market was valued at USD 25.35 billion in 2025.

Which countries in Europe are the key players in the pet food market?

Germany, the United Kingdom, France, Italy, and Spain are capturing the major share of the Europe pet food market.

What is the impact of the COVID-19 pandemic on the European pet food market?

The impact of the pandemic is severe on pets, as many people thought the spread of the virus increased with the animals during the pandemic. Some people gave up on their pets, and many people considered giving up on their pets to escape from the spread of COVID-19.

What are the key market players involved in European pet food market?

Mars, Inc., Del Monte Foods, Hills Pet Nutrition, INC, Unicharm Corporation, Nippon Formula Feed Manufacturing Company LTD, Pet Center, Incorporated (PCI), Nestle Purina PetCare, Nisshin Saifun Group INC. Natural Dog Food Company, Halo, Purely for Pets, Marukan CO. LTD., Nutrena, and Spectrum Brands, INC. are the major companies in the market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com