Global Game Streaming Market Size, Share, Trends, & Growth Forecast Report By Offering (Platform, Hardware and Services), Solution (Web-Based and App-Based), Revenue Model (Subscription and Advertisement) & Region - Industry Forecast From 2025 to 2033

Global Game Streaming Market Size

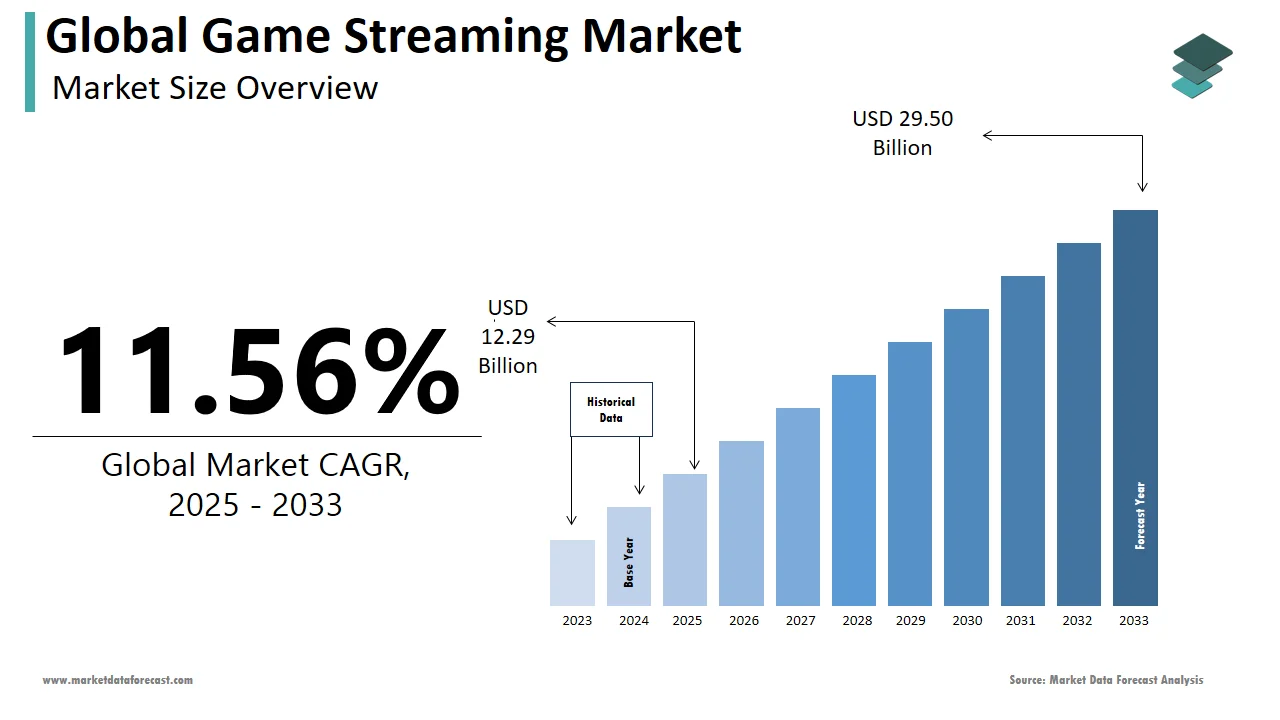

The global game streaming market was worth USD 11.02 billion in 2024. The global market is expected to register a CAGR of 11.56% from 2025 to 2033 and be worth USD 29.50 billion by 2033, up from USD 12.29 billion in 2025.

According to the World Economic Forum, sports viewers spent 17.9 million hours watching their game heroes on various channels, such as the YouTube games channel or Twitch, in the first quarter of 2018. The online marketplace eSport is still in its initial stages, and with the growing audience and increasing popularity, it is expected that it will offer great potential to capitalize on the game streaming market in the future. Additionally, mobile game streaming is a recent phenomenon expected to thrive exponentially in the market. For instance, there were approximately 479,000 active mobile streamers in Streamlabs as of June 2019, which increased from 150,000 in June 2018 globally. The rising penetration of smartphones and mobile transmissions is foreseen to accelerate the business of game streaming in the foreseen years.

MARKET DRIVERS

The growing adoption of the subscription service model to stream games from people is propelling the growth of the global game streaming market.

Large companies rely on a fixed income from monthly subscriptions rather than other income models. In addition, the subscription model provides a lot of data for game developers, such as weapon options, game options, and most most-used game modes. Games like Counterstrike and Dota 2 put more emphasis on the data generated in the game. The most important platforms for live game streaming are Twitch and YouTube. According to a new market report, Twitch viewers streamed 2.72 billion live hours in the second quarter, or 72.2% of all live viewing hours, up from 735.54+ million. Hours on YouTube Live or 19.5% in the second quarter of 2019. Additionally, Twitch's strongest monetization tool is its subscription feature, which is similar to Netflix's. Given the benefits associated with the subscription model, in 2018, YouTube also opened its referral model in exchange for benefits. Exclusive as ad-free streaming, chat features, special gestures, badges, and access to private and archived broadcasts. This growth is also underpinned by the growing digital payment user base. For example, in September 2018, Mastercard entered a multi-year partnership with Riot Games. This agreement made Mastercard the exclusive global payment services partner for global electronic sports gaming events. Additionally, Mastercard has also worked with banking partners to offer unique League of Legends co-branded products in select markets.

The rapid adoption of mobile phones owing to the increasing popularity of social media platforms and other digital media for branding and marketing is further driving the global game streaming market growth.

Subscription models have witnessed huge demand because of the availability of huge video content and original content by OTT providers such as Netflix and Prime. Increased mobile subscriptions and the adoption of connected devices, especially smartphones, are expected to contribute to the segment's growth. The rapid adoption of cloud gaming and mobile gaming is supporting the growth of the game streaming market. As smartphones have more processing power and the 5G network grows in popularity, games are expected to be more interactive and streaming-based. Countries that have generated a significant share of revenue in the gaming industry include China, Japan, the United States, Germany, South Korea, France, Canada, and the United Kingdom. Additionally, Esports is getting a lot of attention, with events being broadcast on social media and streaming sites like YouTube and Twitch.

MARKET RESTRAINTS

Poor internet infrastructure limitations in certain regions, issues of latency that impact real-time gaming experiences and lack of exclusive content and game titles are negatively impacting the global market growth. Concerns over data privacy and security, bandwidth constraints for high-quality streaming and resistance from traditional gaming platforms are impeding the global market growth. Compatibility issues with various devices and regulatory challenges in different jurisdictions are further hindering the growth of the global game streaming market.

MARKET OPPORTUNITIES

Cloud gaming service is growing rapidly and is expected to take the game streaming market to a whole new level in the coming years. As per the research, cloud gaming has risen by 975 percent during the past 5 years. In contrast to theory, in reality, purchasing it online has its challenges. Foremost, usually, the size of a high-graphic and good-quality game is massive, so downloading it is a time-consuming process, particularly from Sony PlayStation’s renowned slow servers. After this, another factor affecting the market is that the hardware may not meet standards, which most of the time causes performance problems. So, due to these issues, the acceptance of cloud gaming and streaming is gaining traction. It provides you with the facility to stream it live. In this way, gamers or players can utilize the greatest and latest hardware without the requirement to put money into it. That’s why, presently there are around 295 million cloud gaming customers globally.

MARKET CHALLENGES

Copyright problems, content moderation, and the possibility of weariness are derailing the growth trajectory of the game streaming market. The issue of reducing or softening disruptive gamer behaviour in online action-based competitive titles is a major problem for the market players. Within this, there are multiple challenges including a large quantity of data (imbalance and label noise). This makes it difficult to efficiently examine all reports utilizing human-focused moderation alone. For instance, close to 400 million gamers globally were preoccupied with ABK games in 2022. Also, on average, there are more than100 thousand players in COD: MWII alone at any one time as per the study. Additionally, the volume of innovative active gamers in 30 days usually goes up to between 7 million and 10 million with the average routine active players calculated at between 500 thousand and 900 thousand according to the forecast as the authorised gamer numbers are not published.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.56% |

|

Segments Covered |

By Offering, Solution, Revenue Model, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Amazon, Microsoft, Alphabet, Apple, Sony, Nvidia, Facebook, Tencent, Smashcast, AfreecaTV, Bigo Technology, Parsec Cloud, Vortex Cloud Gaming, Shadow, Douyu, Huya, Major League Gaming (MLG), Dlive, GosuGamers, and others. |

SEGMENTAL ANALYSIS

By Offering Insights

Based on the offering, the platform segment led the market in 2024 and is expected to register a healthy growth rate during the forecast period. The growth of the platform segment is primarily driven by the growing ads and premium account subscriptions. The services segment is another major segment in the global game streaming market.

By Solution Insights

Based on the solution, the web-based segment accounted for the largest share of the global market in 2024 and is expected to grow at a healthy CAGR during the forecast period, owing to the fact that many streaming providers are focusing on streaming via web browsers. On the other hand, the app-based segment is estimated to grow at a considerable share of the global market during the forecast period. With more and more mobile games gaining popularity in streaming, the app-based streaming segment is expected to increase its share in the global market during the forecast period.

REGIONAL ANALYSIS

North America is the main revenue generator in the game streaming market, with a significant share of the share from the United States. China is expected to have a notable revenue share in the game streaming market due to the popularity of eSports among youth and government support for the growth of the entire gaming industry. The most important platforms in China, such as YY Live (Huya) and Douyu, earn money through user donations to streamers. In fact, Huya has exceeded 100 million monthly active users. (MAU) in December 2018 and also started competing with Twitch in terms of MAU. With the increase in audience, we are expected to have a positive outlook on the market in the future.

KEY MARKET PLAYERS

Companies such as Amazon, Microsoft, Alphabet, Apple, Sony, Nvidia, Facebook, Tencent, Smashcast, and AfreecaTV are leading the global game streaming market.

RECENT HAPPENINGS IN THE MARKET

- In August 2024, NODWIN Gaming reported that it had signed a multiple-year strategic collaboration with Insider. in. NODWIN Gaming is a modern generation esports, gaming, and entertainment company, and Insider. is India’s platform for events and ticketing. This partnership signifies a significant achievement as Insider. in positions itself as the authorised ticketing partner for NODWIN Gaming’s major IPs in India, involving Comic Con India, NH7 Weekender and DreamHack.

- In August 2024, NuxGame, a provider of casino and betting software, incorporated live dealer content into their ever-growing aggregation platform. This is integrated from LuckyStreak.

MARKET SEGMENTATION

This research report on the global game streaming market has been segmented and sub-segmented based on offering, solution, revenue model, and region.

By Offering

- Platform

- Hardware

- Services

By Solution

- Web-Based

- App-Based

By Revenue Model

- Subscription

- Advertisement

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What factors are driving the growth of the game streaming market globally?

The main factors driving the growth include advancements in cloud technology, increased internet penetration, rising adoption of smartphones and smart TVs, and the growing popularity of e-sports. Additionally, the COVID-19 pandemic has accelerated the adoption of game streaming services as more people seek home entertainment options.

What are the key challenges faced by the game streaming market?

Key challenges include issues related to latency and bandwidth, the high cost of developing and maintaining cloud infrastructure, content licensing issues, and competition from traditional gaming consoles and PC gaming.

How are game streaming services impacting traditional gaming models?

Game streaming services are disrupting traditional gaming models by providing gamers with the ability to play high-quality games without the need for expensive hardware. This shift is making gaming more accessible and is likely to reduce the sales of traditional gaming consoles and physical game copies.

What future trends are expected in the game streaming market?

Future trends in the game streaming market include the expansion of 5G technology, which will improve streaming quality and reduce latency, the integration of augmented reality (AR) and virtual reality (VR) into game streaming, and the growth of niche streaming platforms catering to specific gaming communities. Additionally, more game developers are expected to adopt a streaming-first approach for new releases.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com