Global Healthy Snacks Market Size, Share, Trends & Growth Forecast Report - Segmented By Product (Dried Fruit, Cereal & Granola Bars, Nuts & Seeds, Meat and Trail Mix) and Region (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa) – Industry Analysis (2025 to 2033)

Global Healthy Snacks Market Size

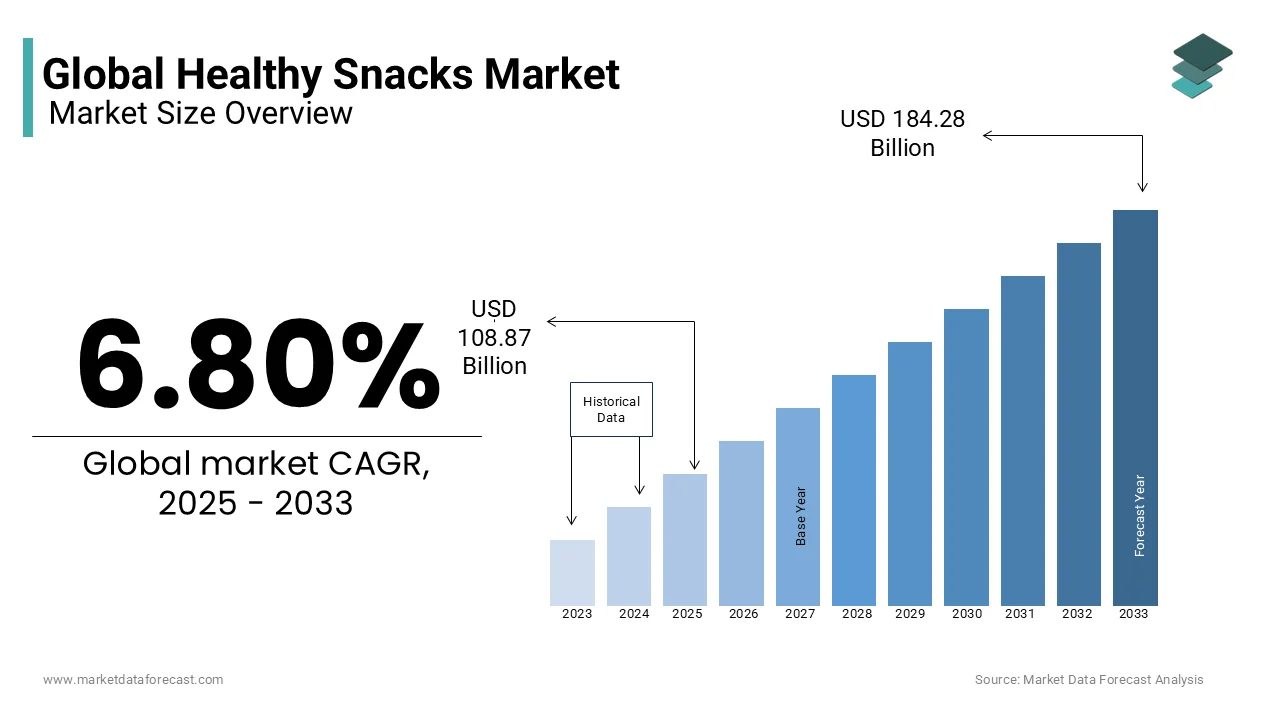

The global healthy snacks market size was valued at USD 101.94 billion in 2024. The global market size is expected to reach USD 184.28 billion by 2033 from USD 108.87 billion in 2024. The market's promising CAGR for the predicted period is 6.80%.

Snacks become a vital part of your diet to help you get essential nutrients and maintain your body's energy levels. Snacks are small portions of food or drinks that are consumed between regular meals. A healthy snack is a type of bag that is low in sodium and low in sugar, vitamins, nutrients, and saturated fat. Healthy snacks are high in fiber and protein and help maintain energy levels throughout the day. Healthy snacks include hard-boiled eggs, whole grains, seeds, nuts, vegetables, fruits, and low-fat dairy products. Eating snacks is a big part of your diet, so it has a big impact on your health. Healthy snacks have a number of benefits, including resistance to weight gain, suppressing the need for additional food, strengthening the brain, and promoting health. Healthy snacks also provide an effective alternative to essential nutrients like vitamins, minerals, carbohydrates, fiber, and protein in your diet. Snacks can always be eaten before or after meals, so avoid overeating during meals.

Current Scenario of the Global Healthy Snacks Markert

The healthy snacks market is witnessing rapid growth owing to the increasing number of cardiovascular diseases, stroke, type 2 diabetes, hypertension, and cancer patients. It also includes colon and rectum cancer, nasopharynx cancer, lip and oral cavity cancer, bronchus and lung cancer, and tracheal and esophageal cancer. The market got a major boost due to the global obesity crisis. Various studies and surveys have anticipated that close to 2.3 billion children and adults are suffering from obesity and overweight. And, if the ongoing pattern continues, this figure can rise to 2.7 billion adults with obesity or overweight by 2025.

The availability of mobile applications for ordering foods and groceries online is also contributing to the market growth. For instance, in the United States, the demand for healthy snacks is higher on Amazon than those of soda, baked goods and chips. This is probably due to the first kind of product which comes to the mind of consumers upon visiting the website or mobile application.

MARKET DRIVERS

The growing consumer interest in the nutritional value of products such as high vitamins and protein and low calories is majorly driving the growth of the healthy snacks market. The increasing need for snacks along the way, coupled with higher customer spending promote the global healthy snacks market growth. In addition, busy consumer lifestyles are expected to drive the market for years to come. Healthy snacks are widely consumed in mature economies. The rapid popularity of meat snacks is driving market growth. As consumer emphasis on high-end products increases in developed countries such as Europe and North America, the market will expand in the coming years as consumer production increases. The increase in the disposable income of consumers due to the modernization and expansion of the workforce is one of the central growth stimuli in the market. Families in the age group from the mid-30s to the mid-40s have been registered to increase spending on healthy snacks.

The growing investments from the major market participants to innovative products and product branding initiatives is boosting the global healthy snacks market growth. Customer health awareness due to awareness campaigns launched by governments, non-governmental organizations, and companies is expected to spur demand for healthy snacks in the coming years. Changing individual lifestyles and increasing propensity for healthy foods around the world is a crucial driver of target market growth. Healthy snacks offer a variety of health benefits and help people lose weight. It helps improve concentration, cognition, attention and memory. With attractive packaging, healthy meals of different flavors can be transported and used, increasing demand among children. It's also a healthy, versatile, edible snack that can be easily used at any age.

The need for meat snacks is assumed to increase in the coming years, as p urchasing power has increased tremendously in recent years. This factor is expected to promote market growth during the outlook period. The increased popularity of healthy snacks is presumed to drive global market growth due to health awareness, people's propensity to choose a healthy lifestyle, and product approvals from manufacturing companies. The growth of digitization makes it easier for consumers to access information, raising awareness of healthy snack options. Other trends in the healthy snack industry include an increase in living standards and an increase in the elderly population. Expanding current business to emerging economies through online channels and increasing sales of healthy snacks will provide many opportunities to grow in the global healthy snack market.

MARKET RESTRAINTS

The healthy snacks market growth is restricted by the higher dependence on agricultural products, strict regulations concerning quality and volatile raw material costs. As per the United Nations Conference on Trade and Development (UNCTAD), about 85 per cent of nations are developing which rely on commodities and almost 95 per cent of 20 nations which are also commodity dependent are highly exposed to climate change. The world is already experiencing a shift towards plant-based protein and nutrition from animal-based ones which is exerting extra pressure on the agriculture industry to ensure food security along with this demand. This ultimately leads to multiple consequences including the increase in costs of agricultural and related products, the rise in counterfeit food items, stricter laws, intensified checking for food quality and other criteria. All this together has surged the costs of raw materials worldwide.

Now, considering the unstable global economy, volatile energy and food industries have significantly toughened the conditions for the market. For instance, according to the data released by the International Food Information Council, 3 out of 4 Americans i.e. 76 per cent state that when deciding to purchase foods and beverages, their price is an extremely impactful factor compared to 68 per cent in 2022.

MARKET CHALLENGES

The rise of influencer and social media content regarding food and nutrition is leading to doubt and confusion which is hampering the expansion of the healthy snacks market. Today social media, especially content from influencers, has turned into an effective tool for food and beverage brands or companies to target and approach customers and boost sales. However, this has resulted in consumers being more delusional and confused, at last leading to wrong purchases by falling into this type of marketing campaign who are well-funded and deliberately designed. As per the research, younger generations who are highly exposed to vloggers and travel influencers encouraging fatty and sugary snacks moved on to consume 26 per cent greater calories compared to those that didn’t. An average campaign of food and beverage influencers has an engagement rate of roughly 7.38 per cent which is fivefold greater than the average.

Another factor hindering the growth of the market is sustainability and packaging concerns. Governments around the world are adopting and compelling their companies to use environmentally friendly materials for packaging. But, industry players are charging higher prices in the name of biodegradable or eco-friendly. Hence, the hidden costs of sustainable packaging and misleading content on social media are affecting the market growth.

MARKET OPPORTUNITIES

The rising inclination towards dried fruits and plant-based protein presents potential opportunities for the healthy snacks market. North America is believed to be the biggest market for dried fruits. In addition, it is extensively used in bakery products as stuffing and toppings around the world. However, now people have begun consuming it directly for maximum benefit. Moreover, launching new flavours, mixes and packaging formats can assist in distinguishing their items and lure a broader customer base. In the coming year, the sale of high-quality and pricey dried fruit with sustainable packing is likely to go up due to mislabeling, false marketing, the influence of social media, etc.

Herd mentality can be a way to healthy eating which is expected to create new customers for this market. As per a study by Flinders University in Australia, it was found that people’s decisions on what to eat probably have a positive effect if they feel attached to a social group. So, the USA, South Korea and the UK are providing opportunities for the healthy snacks market because these are highly fast food-consuming nations and considering the global shift to wellbeing.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.80% |

|

Segments Covered |

By Product,and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nestlé S.A, PepsiCo, Inc., Kellogg Company, Tyson Foods, Inc., General Mills, Inc., Hormel Foods Corporation, Kind LLC, B&G Foods, Inc., The Hain Celestial Group, Inc., Calbee, Inc., Select Harvests. |

SEGMENTAL ANALYSIS

By Product Insights

The dried fruit segment is the most popular category and is believed to maintain its position in the coming years. The rising awareness regarding several health advantages like low-carb, natural and nutritional diets is influencing its demand. Moreover, one of the major elements propelling the segment’s market share is the long expiration of frozen dried fruits without the need for any artificial preservatives or additives. In addition, the segment is also growing due to the consistent and widespread consumption to lower the danger of colon and liver cancer, cardiovascular diseases and other ailments. Customers are abandoning chocolate bars and opting for healthy snacks in their quest for foods which possess a considerable effect on fitness and health. Apart from these, the segment benefited from the increase in the tendency of consumers to look or check for nutritional data as a precondition, which shows they are becoming progressively educated about the ingredients and nutritional structure of the item.

According to a study, the overall production of dried fruit worldwide depicted a positive pattern in the past 10 years, crossing the mark of 3 million metric tons. This output trend has remained consistent for the last six seasons and for the season of 2022/2023, the total was 3.1 million MT.

REGIONAL ANALYSIS

North America holds immense potential for the healthy snacks market.Also, the results of a study reveal that among Americans there is a great willingness the pay for freeze-dried tofu chips. These have reduced calories and more protein compared to fried products, with a big difference. Moreover, US customers appreciate the crisp and crunchy texture and snacks which are made domestically, possibly because of this reason being a quality criterion. People following an active way of living pay attention more to quality, at the same time those people with an inactive living culture only worry about tastes and calories. In the case of tofu chips, which is a single plant-based snack, vegan and keto cause a little variance.

Europe is a huge healthy snacks market This is due to the effect of COVID-19 which shaped the snacking habits and also the reasons for munching among the European customers. Moreover, the most prevalent snack options are comfort items like soft drinks, candy, yogurt, cheese, crisps (chips) and biscuits are all consumed as the snacking for distraction rises. Further, within the regional customers, Italians dominate in the share of healthy lifestyle customers, a category that indulges in activities such as yoga, hiking and walking, hiking. In the United Kingdom, there is a higher percentage of people following an inactive life culture than compared to those of the European average.

Asia Pacific is an attractive region for the healthy snacks market owing to the presence of a wide customer base with significant overweight people.In the APAC countries, the most common forms of snacks are indulgent snacks and dairy, with more than 50 per cent of customers munching on milk, yogurt and cheese along with candy, sweet baked items and chips. In addition, India, Japan and China are the key markets. Similarly, in China, where people are more inclined to nutrients such as protein with healthy resistance, new foodstuff introductions of cereals and protein snacks are rising at huge rates. However, Japan spearheads the regional market greatly in sales of protein bars, Australia is at the second spot, and in China, the double-digit expansion for bars depicts it will shortly be APAC’s second-biggest protein bars market.

KEY PLAYERS IN THE GLOBAL HEALTHY SNACKS MARKET

Nestlé S.A, PepsiCo, Inc., Kellogg Company, Tyson Foods, Inc., General Mills, Inc., Hormel Foods Corporation, Kind LLC, B&G Foods, Inc., The Hain Celestial Group, Inc., Calbee, Inc., and Select Harvests are some of the major players in the global healthy snacks market.

RECENT HAPPENINGS IN THE MARKET

- In August 2024, Pegasus Tech Ventures, a global venture capital firm, announced that it has signed a partnership agreement with Calbee, Inc., a Tokyo-based snack food company to encourage uniqueness and expansion by investing in companies working on emerging technologies

- In September 2019, Tyson Foods, Inc. launched a new Pact® brand that offers functional benefits, a refrigerated snack.

MARKET SEGMENTATION

This research report on the global healthy snacks market has been segmented and sub-segmented based on product and region.

By Product

- Dried Fruit

- Cereal & Granola Bars

- Nuts & Seeds

- Meat

- Trail Mix

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1.What are some examples of healthy snack options available in the market?

Nuts and seeds: Almonds, walnuts, pumpkin seeds, and chia seeds are nutrient-dense snacks high in healthy fats, protein, and essential minerals.

Dried fruits: Dried apricots, raisins, cranberries, and mango slices provide natural sweetness and fiber, with no added sugars or preservatives.

2.What are the main drivers behind the growth of the healthy snacks market?

Increasing health consciousness: Consumers are becoming more mindful of their dietary choices and seeking healthier alternatives to traditional snacks high in sugar, salt, and unhealthy fats.

Rising prevalence of lifestyle-related diseases: Concerns about obesity, diabetes, heart disease, and other health conditions linked to poor diet habits are motivating consumers to adopt healthier eating patterns and snack options.

3.What are some emerging trends in the healthy snacks market?

Plant-based snacks: Increasing demand for plant-based and vegan snack options made from ingredients like fruits, vegetables, legumes, and grains, catering to consumers seeking sustainable, ethical, and environmentally friendly choices.

Functional snacks: Growth in functional snacks fortified with added nutrients, botanical extracts, probiotics, prebiotics, and adaptogens to support specific health benefits such as immunity, digestion, energy, and stress relief.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com