Global Process Automation Market Size, Share, Trends, & Growth Forecast Report – Segmented By System, Communication, User-Industry (Chemical and Petrochemical, Paper and Pulp, Water and Wastewater Treatment, Energy and Utilities, Oil and Gas, Pharmaceutical, Food and Beverages, Other End-user Industries) & Region - Industry Forecast From 2024 to 2032

Global Process Automation Market Size (2024 to 2032)

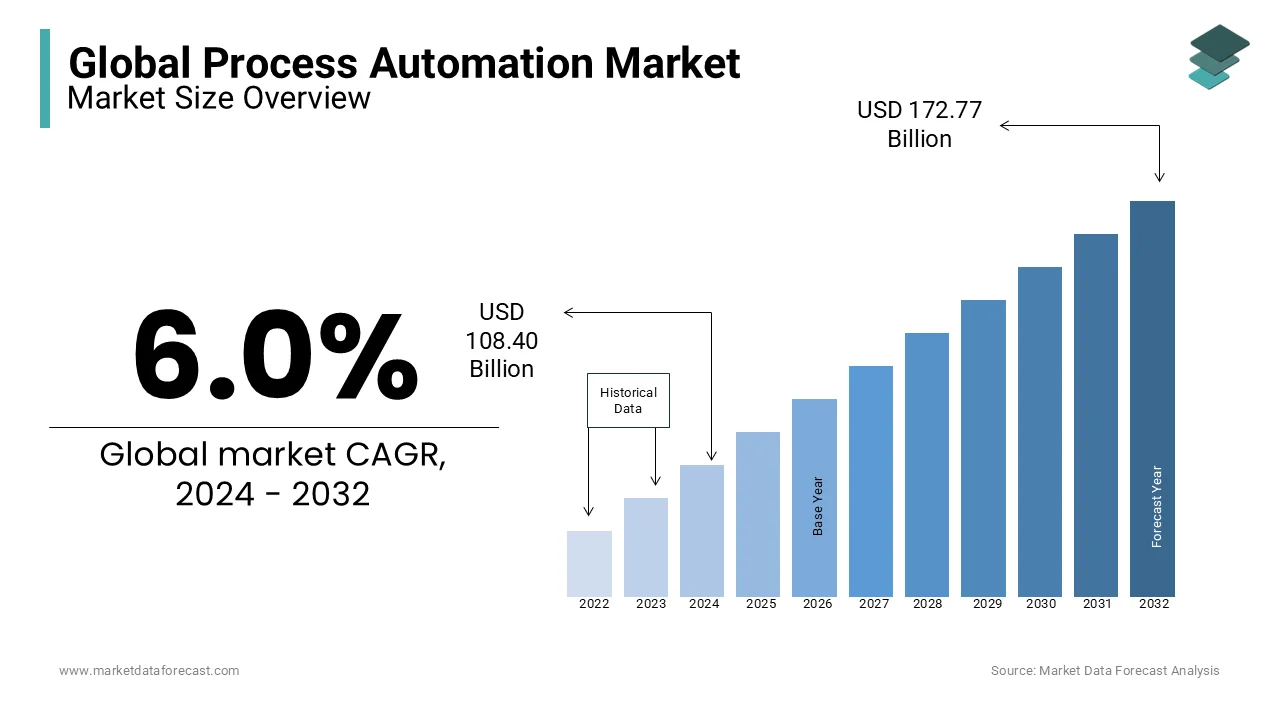

The global process automation market was valued at USD 102.26 billion in 2023. The global market is predicted to reach USD 108.40 billion in 2024 and USD 172.77 billion by 2032, growing at a CAGR of 6.0% during the forecast period.

Current Scenario of the Global Process Automation Market

Process automation is the use of software and technologies to automate the sequence of activities. It automates data collection, aggregation and synthesis for large information sets and facilitates informed and faster decision-making. Process automation has a broad range of applications. Several companies start by automating straightforward departmental or support operations, such as data collection and cost approval. Others use cutting-edge technologies to handle event-driven, mission-critical, core business operations by automating increasingly complicated, cross-functional tasks.

MARKET DRIVERS

Cost reduction and operational efficiency have become major goals for companies in many industries and companies have been adopting process automation to achieve these goals, which is one of the primary factors propelling the process automation market growth. The increasing demand for the end-to-end logistics chain in the digital revolution is majorly propelling the global process automation market growth. The trend of automation for quality and flexible output is likely to accelerate in the coming years and propel the global market growth. The growing popularity of the Internet of things (IoT), and the rise in the support from government policies is further fuelling the growth rate of the global market.

The processing industries such as oil and gas, chemical and mining industries are actively adopting process automation over manufacturing lines to automate repetitive tasks such as extracting, validating, and processing. This provides a huge opportunity for the process automation market. Furthermore, the rise in demand for safety automation systems to address several safety challenges in the oil and gas industry and industrial adoption of robotics and artificial intelligence to achieve a high level of efficiency and precision during production is providing numerous opportunities for the process automation market during the forecast period.

An increase in the adoption of cloud-based automation solutions, improved regulatory compliance, a growing number of digital transformation initiatives, rapid adoption of robotic process automation and rising efforts from companies to minimize human errors are further promoting the growth of the process automation market.

MARKET RESTRAINTS

Concerns about job displacement are one of the key restraints to the growth of the process automation market. Process automation is no less than automating the whole manufacturing process that results in the slack of many jobs, leaving the many people working in manufacturing lines unemployed. Compatibility issues with existing systems and security and data privacy concerns are further hindering the global market growth. The deployment of process automation within manufacturing lines requires high-level algorithms and requires a skilled workforce to monitor the systems, any ambiguity can hinder the process of production. Moreover, process automation needs heavy investments to automate the whole manufacturing plant.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.0% |

|

Segments Covered |

By Component, Business Function, Organization Size, Deployment Type, Industry Vertical and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Mitsubishi Corporation, Robert Bosch GmBH, ABB Ltd, Eaton Corporation, Dassault Systems, Emerson Electric Co., Honeywell International, Inc., Johnson Controls, Inc., Rockwell Automation, Inc., Schneider Electric SE and Others. |

SEGMENTAL ANALYSIS

Global Process Automation Market Analysis By System

Based on the system, the DCS segment dominated the global process automation market in 2023 and is estimated to hold the leading share of the global market during the forecast period.

The domination of the DCS segment in the global market is primarily driven by the rising need for integrated process control, safety, and reliability. DCS is a computerized control system for a process or plant usually with many control loops, in which autonomous controllers are distributed throughout the system that has central operator supervisory control. Several companies have been using DCS for increased production and improved yields. The growing usage of DCS in industries such as chemical plants, petrochemical (oil) and refineries, pulp and paper mills, food and food processing, agrochemical and fertilizer, metal and mines, automobile manufacturing, metallurgical process plants and pharmaceutical manufacturing is further boosting the growth rate of the DCS segment in the process automation market.

Global Process Automation Market Analysis By Communication

Based on communication, the wireless segment had the largest share of the global process automation market in 2023 and is estimated to hold the domination in the global market throughout the forecast period.

Industry 4.0 has given rise to increasingly intelligent machines and flexible, efficient automated facilities. Wireless communications have become more prevalent in industrial settings because of these increasingly complicated systems. The wireless protocol enables secure and adaptable control connectivity, work on the collection and continual adjustment of production-process values. Furthermore, wireless communication monitors machinery-condition for predictive maintenance routines remotely. Moreover, wireless technologies are the most economical choice over time. This is because wired communication-enabled devices have running cable through a production area, which is expensive. Even planning the cable and connector routing requires time and effort. These factors are driving the wireless protocol segment in the process automation market in the period.

Global Process Automation Market Analysis By End-User Industry

Based on end-user, the chemical and petrochemical segment occupied 21.4% of the global market share in 2023 and is expected to grow steadily during the forecast period due to the stringent regulations, rapid adoption of Industry 4.0, and growing emphasis on production efficiency.

On the other hand, the paper and pulp segment is expected to register a healthy CAGR during the forecast period. The paper and pulp industry involves numerous processes for producing the final product. Raw materials must go through numerous steps while being closely monitored for temperature and chemical content. Process automation makes it possible to accomplish this from a single location. even pulp and paper mills are operating under constant pressure to reduce production costs and meet the demand globally. These complex processes in the pulp and paper industry are driving manufacturers to adopt process automation in the plant.

REGIONAL ANALYSIS

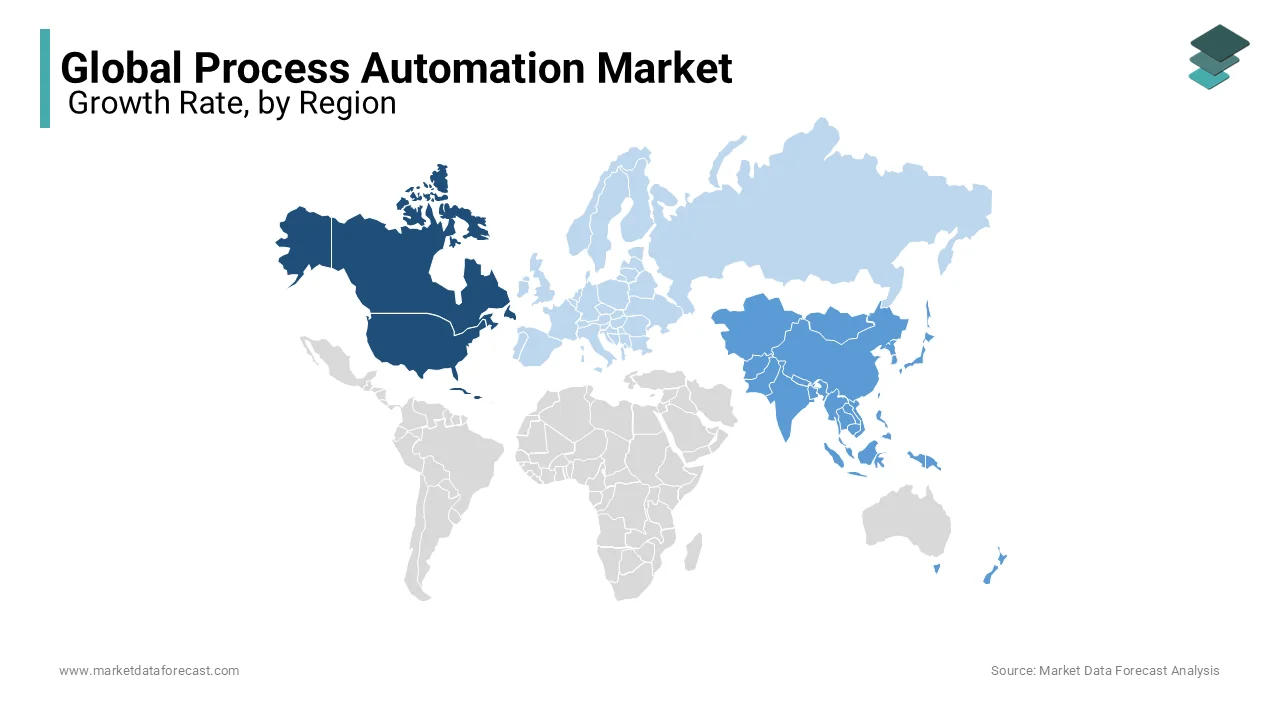

North America accounted for 35.9% of the global market share in 2023 and is expected to grow at a prominent CAGR during the forecast period. The strong R&D capabilities of several companies that are based out of North America, widespread adoption of automation in manufacturing and rising focus on smart technologies are driving the North American process automation market. The U.S. led the process automation market in North America and had the leading share of the regional market in 2023. The U.S. is projected to showcase promising growth during the forecast period owing to the increasing implementation of advanced process automation in U.S. refineries for enhanced efficiency and safety. Canada is another noteworthy regional segment in the North American market and is expected to account for a considerable share of the North American market during the forecast period. The growing in smart factories and digitalization in the manufacturing sector of Canada is propelling the Canadian process automation market growth.

Asia-Pacific was the second biggest regional segment in the worldwide market in 2023 and held 33.8% of the global market share. The growing industrialization and the presence of developing countries are propelling the growth of the APAC market. China followed by Japan and India are expected to hold the leading share of the APAC market during the forecast period.

Europe is a promising regional market for process automation worldwide and is anticipated to account for a substantial share of the global market during the forecast period. Factors such as growing emphasis on energy efficiency and stringent environmental regulations are propelling the European market growth. Germany, France, and the United Kingdom are the leading players in the European market.

KEY MARKET PLAYERS

Companies playing a key role in the global process automation market include ABB Ltd., Eaton Corporation, Dassault System, Schneider Electric SE, Emerson Electric Co., Honeywell International, Inc., Siemens AG, Rockwell Automation, Inc., General Electric Company, Mitsubishi Corporation and Robert Bosch GmBH.

RECENT DEVELOPMENTS IN THE MARKET

- In 2023, the Dassault system developed a new data science solution to allow Renault Group to optimize vehicle costs. the Dassault systems cost intelligence solution with artificial intelligence is allowing Renault group to simulate the impacts of raw material price increases.

- In 2023, Eaton Corporation acquires a 49% stake in Jiangsu Ryan Electrical Co.Ltd, a manufacturer company of power distribution and sub-transmission transformers in China. This acquisition enables Eaton to provide better service to customers in the Asia Pacific region.

DETAILED SEGMENTATION OF THE GLOBAL PROCESS AUTOMATION MARKET INCLUDED IN THIS REPORT

This research report on the global process automation market has been segmented and sub-segmented based on the component, business function, organization size, deployment type, industry vertical, and region.

By System

- Supervisory Control and Data Acquisition (SCADA)

- Programmable Logic Controller (PLC)

- Distributed Control System (DCS)

- Machine Execution System (MES)

- Valves and Actuators

- Electric Motors

- Human Machine Interface (HMI)

- Process Safety Systems

- Sensors and Transmitters

- Other Systems

By Communication

- Wired

- Wireless

By End-User Industry

- Chemical and Petrochemical

- Paper and Pulp

- Water and Wastewater Treatment

- Energy and Utilities

- Oil and Gas

- Pharmaceutical

- Food and Beverages

- Other End-user Industries

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

What are the key drivers for the growth of the global process automation market?

Key drivers include the increasing need for operational efficiency, the growing adoption of Industrial Internet of Things (IIoT), the rise in demand for industrial automation, and the need for compliance with stringent government regulations.

How is Industry 4.0 influencing the process automation market?

Industry 4.0 is significantly influencing the process automation market by integrating advanced technologies such as AI, machine learning, and big data analytics into automation systems. This integration enhances predictive maintenance, real-time monitoring, and decision-making processes.

How is the process automation market expected to evolve in emerging markets?

In emerging markets, the process automation market is expected to grow rapidly due to industrialization, government initiatives supporting automation, and the increasing need for efficient production processes. Countries in Asia, Africa, and Latin America are expected to see significant growth.

What are the emerging trends in the global process automation market?

Emerging trends include the adoption of digital twins, the increasing use of cloud-based automation platforms, the integration of IIoT with automation systems, and the rise of autonomous robots in industrial settings. These trends are shaping the future of process automation globally.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com