Global Sepsis Diagnostics Market Size, Share, Trends & Growth Forecast Report By Pathogen (Bacterial Sepsis. Fungal Sepsis and Other Pathogen Infections), Product (Instruments, Blood Culture Media, Assay Kits & Reagents and Software), Technology, Method, Usability and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), Industry Analysis (2025 to 2033)

Global Sepsis Diagnostics Market Size

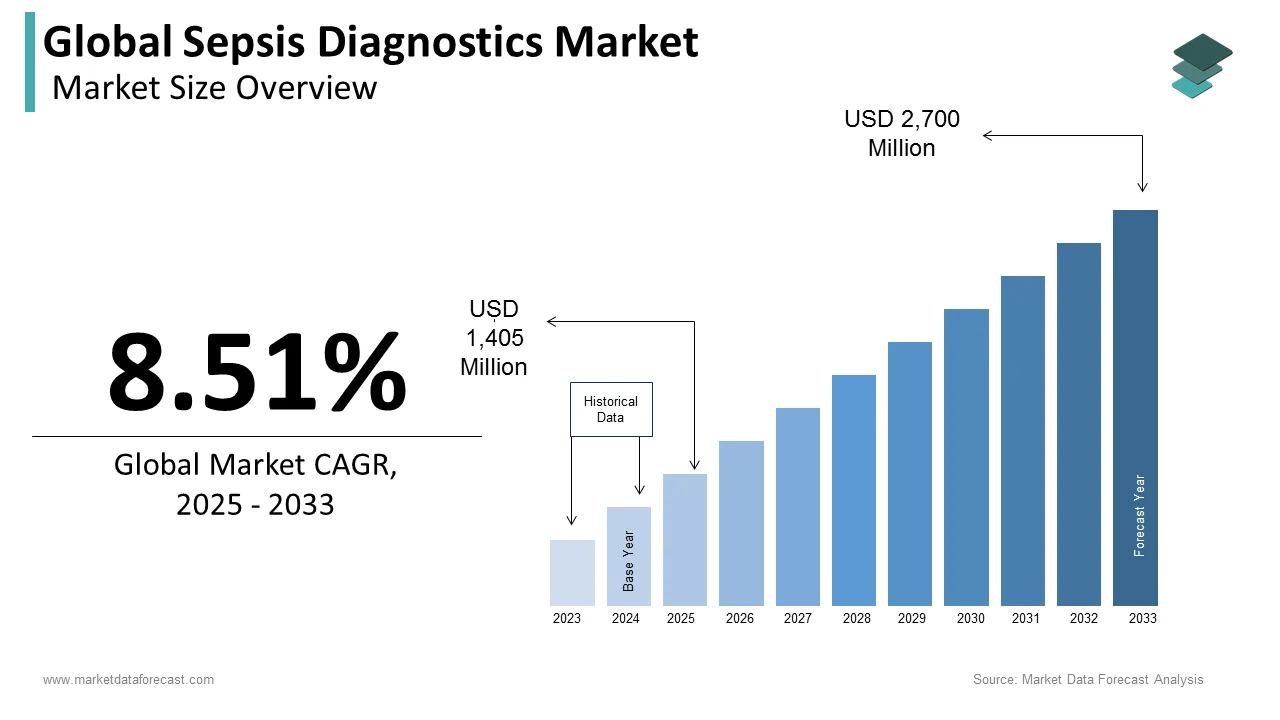

The size of the global sepsis diagnostics market was worth USD 1,295 million in 2024. The global market is anticipated to grow at a CAGR of 8.51% from 2025 to 2033 and be worth USD 2,700 million by 2033 from USD 1,405 million in 2025.

MARKET DRIVERS

The growth of the global sepsis diagnostic market is anticipated to be driven by factors such as the growing burden of infectious diseases and an increasing number of sepsis incidences globally. According to thelancet.com, an estimated 48.9 million sepsis cases were identified in 2017, in which 11.0 sepsis-related deaths were recorded. People with weak immune systems and chronic diseases such as diabetes, cancer, and AIDS are vulnerable to contracting sepsis, which is expected to drive market growth. In the US, sepsis amongst hospitalized sufferers is growing by 8.7% each year. It is anticipated that there are more than a million cases of sepsis amongst hospitalized sufferers yearly, driving the need for sepsis tests. The continuous expenditure in the healthcare sector is also boosting its infrastructure, making sepsis tests accessible to more people. Many manufacturers of sepsis diagnosis are expanding their product offerings with point-of-care technology to detect sepsis quickly and reduce the time required for overall diagnosis. BACTEC Plus, BacT / Alert, and BACTEC FX blood culture equipment manufactured by BD Company (USA) are automated microbial detection systems that enable rapid diagnosis of sepsis.

Hospital-received infections are a prime motive of morbidity and mortality worldwide. Urinary tract infections, pneumonia, and sepsis are the most common infections caused in hospitals. The senior population and people suffering from persistent illness are driving the demand for sepsis diagnostic products because they are more prone to hospital-acquired infections due to their weak immune systems. Furthermore, the increasing prevalence of antibiotic-resistant bacterial strains and rising concern about the health of people worldwide, and growing healthcare expenditure is projected to improve the market growth. Government incentives and investment expenditure to improve healthcare propel the sepsis diagnostics market during the forecast period.

MARKET RESTRAINTS

Poor awareness levels about sepsis and its early diagnosis among people is one of the key factors hampering the market growth. Limited access to diagnostic tools and technologies in under-developing countries and the scarcity of skilled personnel that can perform diagnostic tests for sepsis are further hindering the market growth. High costs associated with the tests and equipment of sepsis diagnostics, particularly among the low-resource settings, limit the market growth. In addition, factors such as the presence of a stringent regulatory environment for new diagnostic tests for sepsis, competition from alternative technologies such as biomarkers and imaging tests, and unfavorable reimbursement policies for sepsis diagnostics in some countries are inhibiting the market’s growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2025 to 2032 |

|

Segments Covered |

By Pathogen, Product, Technology, Method, Usability, End-User, Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

BioMérieux SA, T2 Biosystems Inc., Cepheid, Thermo Fisher Scientific Inc., Nanosphere Inc. |

SEGMENTAL ANALYSIS

By Pathogen Insights

The bacterial sepsis segment is forecasted to register the leading market share in the global sepsis diagnostics market during the forecast period. Since most patients suffering from blood poisoning are bacterial infections, the bacterial sepsis segment held the most significant share of the global sepsis diagnostics market in 2022. Gram-negative bacteria are the most frequent bacterial sepsis. Therefore, the gram-positive bacterial sepsis segment is anticipated to dominate the market during the forecast period. Extensive research and development activities and favorable regulatory approval of novel solutions are expected to support the segment's growth. Due to the rise of Candida infection resulting in septic poisoning, fungal sepsis should expand at an appealing CAGR. However, this disease comes from fewer viruses and parasites, so this segment accounted for a minimal share in 2022.

By Product Insights

The blood culture media segment is predicted to play the leading role in the global sepsis diagnostics market during the forecast period. The growing usage of blood culture media in clinical settings, as it is considered the gold standard for detecting bacterial or fungal infections in the blood, is majorly driving segmental growth. The cost-effectiveness of blood culture media is another notable attribute boosting the segment’s growth rate.

On the other hand, the assay kits and reagents segment is predicted to hold a considerable share of the worldwide market during the forecast period owing to their new diagnostic capability and the implementation of automated testing by key market participants. The growth of the segment is further driven by the rising usage of assay kits and reagents to detect the presence of specific biomarkers in blood that may indicate the presence of sepsis.

By Technology Insights

The microbiology segment is predicted to hold the leading share of the global sepsis diagnostics market during the forecast period owing to factors such as the growing use of blood cultures in microbiology for the diagnosis of sepsis, increasing incidence of sepsis and the need for accurate and timely diagnosis to prevent mortality. This is because microbiological techniques allow the use of media tests to detect and identify microorganisms for the accurate diagnosis of sepsis. In addition, key companies are driving segment growth through new strategic initiatives. For example, in April 2019, BD launched a new platelet quality control medium, BD BACTEC, to help detect and mitigate the occurrence of sepsis in patients undergoing platelet transfusions.

The molecular diagnostics segment held a considerable share of the global market in 2022 and is predicted to register a notable CAGR during the forecast period. The growing adoption of molecular diagnostics tests for the rapid detection of sepsis-causing pathogens and their resistance to antibiotics is majorly driving the growth rate of the segment. In addition, the rising availability of a wide range of molecular diagnostic tests, including polymerase chain reaction (PCR), nucleic acid sequencing, and microarrays, which offer high sensitivity and specificity for the detection of sepsis, fuels the segmental growth during the forecast period. Furthermore, the growing demand for personalized medicine and targeted therapy, which requires the identification of the specific pathogen and its resistance profile, is fuelling the segmental growth.

By Method Insights

Based on the method, the automated diagnostics segment had the leading share of the global sepsis diagnostics market in 2023 and the segmental domination is predicted to continue during the forecast period. Factors such as improved accuracy and speed, reduction in human error, growing demand for automated diagnostics and cost-effectiveness are propelling the growth of the segment.

By Usability Insights

During the forecast period, the laboratory testing segment is expected to hold the major share of the global sepsis diagnostics market. Factors such as the growing availability of a wide range of laboratory testing methods and the ability of laboratory testing methods to diagnose a wide range of pathogens and their resistance to antibiotics fuelling the laboratory testing segment growth. In addition, the rising prevalence of sepsis and the need for accurate and timely diagnosis to prevent mortality and the growing demand for advanced laboratory testing methods, such as MALDI-TOF MS are expected to contribute to the growth of the segment during the forecast period.

The POC testing segment is anticipated to grow at a steady CAGR during the forecast period owing to the rapid adoption of POCT devices for the rapid diagnosis of sepsis and the increasing availability of a wide range of POCT devices, including immunoassays, molecular diagnostics, and flow cytometry.

REGIONAL ANALYSIS

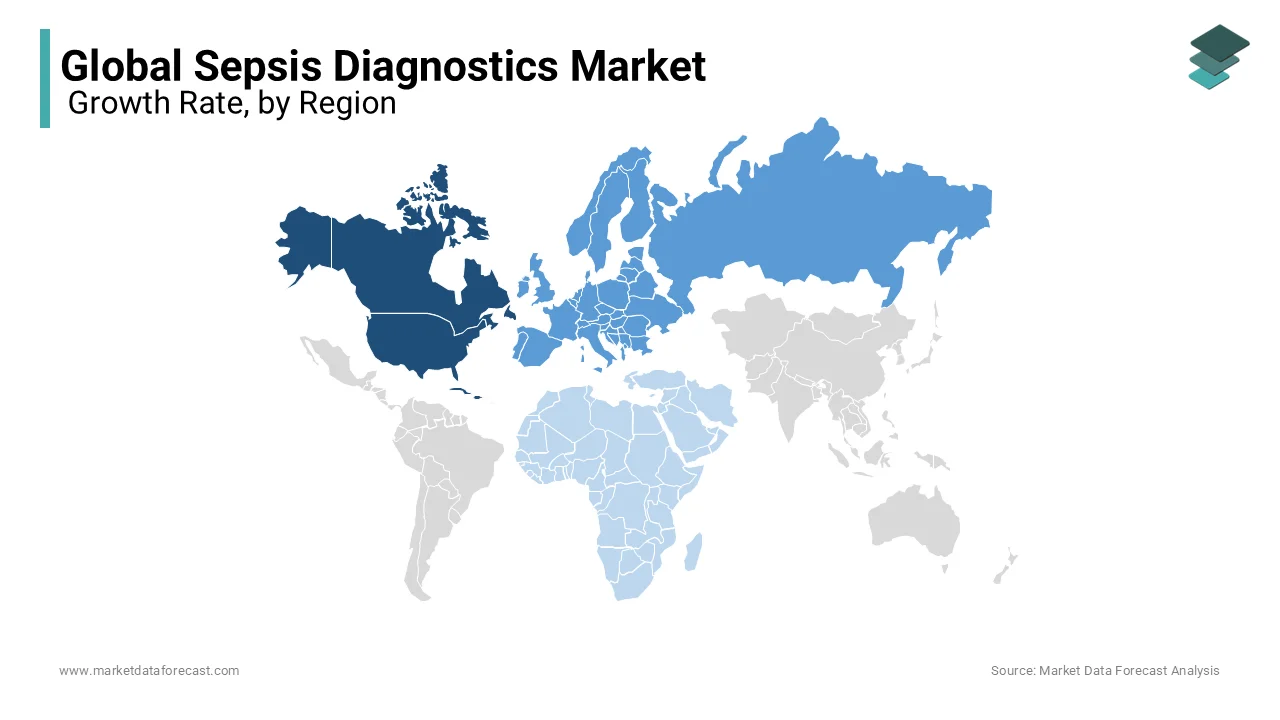

Regionally, the North American sepsis diagnostics market occupied the most significant share of the global market in 2023. The region is expected to maintain its lead throughout the forecast period due to its established healthcare infrastructure and the increasing adoption of advanced diagnostic solutions. In addition, the strong presence of major regional companies and supportive redemption frameworks are driving market growth. The United States holds a significant share of North America. Technological advancements, growing adoption of advanced diagnostic products, and high healthcare expenditure.

The European sepsis diagnostics market is projected to grow at a notable CAGR over the forecast period. The European market held the second-largest share of revenue in the global market in 2023. High incidence of healthcare expenditure and advanced medical procedures have augmented market growth.

The sepsis diagnostics market in the Asia Pacific is the quickest-growing region globally and is predicted to grow at a healthy rate during the forecast period. Improving healthcare infrastructure facilities, the availability of advanced diagnostic products, favorable government initiatives, and the rise in healthcare expenditure influence market growth in this region. In addition, the demand for sepsis diagnostic solutions is increasing in countries with a high prevalence of infectious diseases. Countries like China, Japan, and India have significantly contributed to the APAC regional market growth.

The Latin American sepsis diagnostics market is predicted to rise at a CAGR of 8.92% over the forecast period.

The sepsis diagnostics market in the Middle East & Africa was valued at USD 35.36 million in 2022, owing to the growing burden of infectious diseases. It is further projected to grow steadily during the forecast period. The increasing number of sepsis incidences in this region and rising awareness among healthcare people augment market growth.

KEY MARKET PLAYERS

Some notable companies operating in the global sepsis diagnostics market are BioMérieux SA, T2 Biosystems Inc., Cepheid, Thermo Fisher Scientific Inc., Nanosphere Inc., Abbott Laboratories, and Roche Diagnostics Limited, Becton Dickinson and Company, Bruker Corporation, and Beckman Coulter, Inc.

RECENT HAPPENINGS IN THE MARKET

- In April 2018, Curetis NV collaborated with partner Acumen Research Laboratories Pte. Ltd and received approval for Unyvero BCU Cartridge for bloodstream infections in Singapore.

MARKET SEGMENTATION

This market research report on the global sepsis diagnostics market has been segmented and sub-segmented based on the pathogen, product, technology, method, usability, end-user, and region.

By Pathogen

-

Bacterial Sepsis

-

Gram-Negative Bacterial Sepsis

- Gram-Positive Bacterial Sepsis

-

- Fungal Sepsis

- Other Pathogen Infections

By Product

- Instruments

- Blood Culture Media

- Assay Kits & Reagents

- Software

By Technology

- Microbiology

- Molecular Diagnostics

- Immunoassays

- Flow Cytometry

- Other Technologies

By Method

- Conventional Diagnostics

- Automated Diagnostics

By Usability

- Laboratory Testing

- Point-of-Care Testing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com