Global Infectious Disease Therapeutics Market Size, Share, Trends & Growth Forecast Report – Segmented By Mode of Treatment (Drugs, Vaccines), Target Organism, Infection type (Bacterial, Viral, Fungal, Parasitic and Others, Distribution Channels, and Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Infectious Disease Therapeutics Market Size

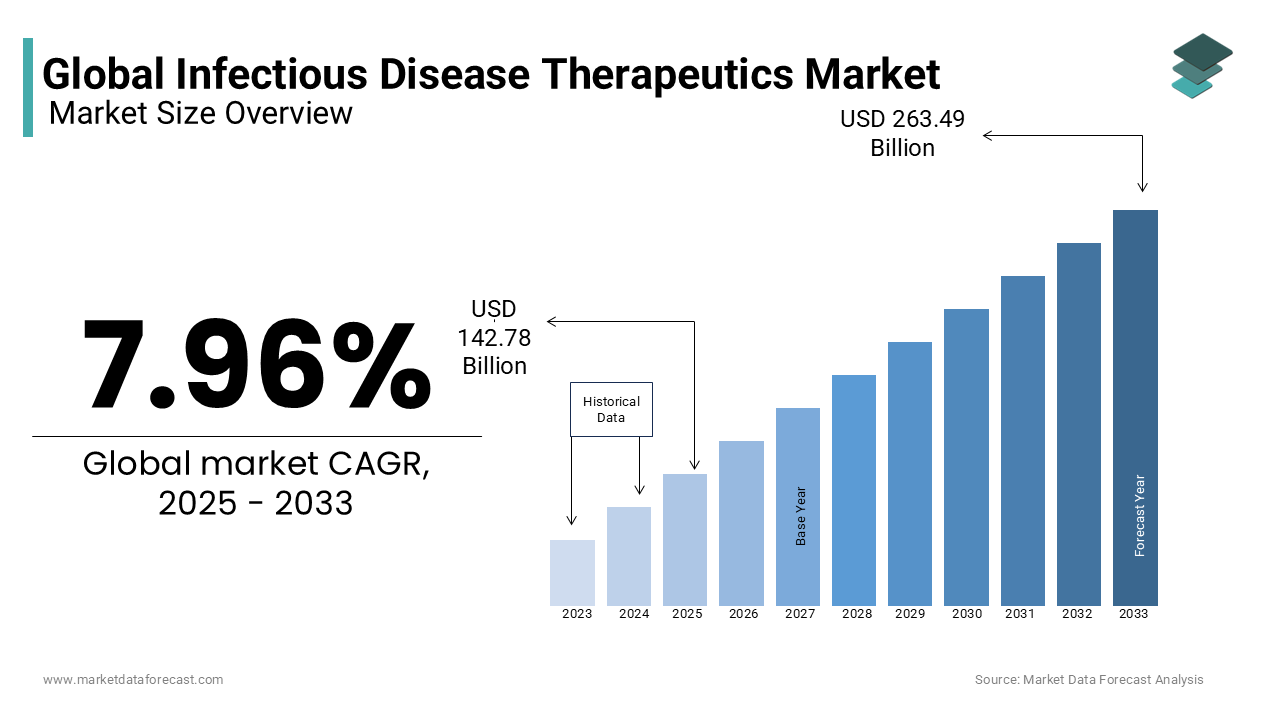

The global infectious disease therapeutics market size was valued at USD 132.25 billion in 2024 and is predicted to grow at a CAGR of 7.96% from 2025 to 2033. The market is forecasted to grow to USD 263.49 billion by 2033 from USD 142.78 billion in 2025.

Infectious diseases are caused by pathogens such as bacteria, viruses, fungi, and parasites. These diseases can be transmitted from one another by direct contact or indirect contact, and Anti-infective drugs are used to inhibit the disease's growth. These drugs can act through the host defense system and directly target the causative agent. Globally, significant problems to public health are posed by infectious diseases such as malaria, HIV, tuberculosis, influenza, hepatitis A, and hepatitis C. In addition, these diseases are the primary cause of death in the world.

MARKET DRIVERS

The growing incidence of infectious diseases is majorly propelling the infectious disease therapeutics market growth. The population suffering from infectious diseases is growing consistently worldwide. As per the statistics published by the Centers for Disease Prevention and Control (CDC), 8916 people from tuberculosis, 58,371 people from salmonella, 34,945 people from Lyme, and 371 from meningococcal diseases suffered in the United States in 2021. COVID-19, caused by the coronavirus, is the latest infectious disease and spread throughout the world and resulted in a pandemic. Such instances are further propelling the infectious disease therapeutics market.

The growing use of direct-acting antivirals, increasing healthcare expenditure, the growing geriatric population, rising healthcare awareness, and increasing government funding in developing countries are contributing to the global infectious disease therapeutics market growth. Furthermore, the growing prevalence of the acceptance of advanced technological developments in healthcare centers is ascribed to bolstering the market's demand. Furthermore, increasing disposable income in developed and developing countries also outshines the growth rate of this market. Moreover, raising awareness of various diseases and knowing the benefits of early diagnosis among individuals is lucrative for soaring growth opportunities in the infectious disease therapeutics market. Also, introducing reimbursement schemes in favor of ordinary people is lavishing the growth rate of the global market. Furthermore, the rising advancements in the drugs used to treat infectious diseases by pharmaceutical companies also support the expansion of the market. In addition, the continuous research and development of advanced treatment methods and the need to curb the death toll associated with infectious diseases are pushing the market's growth. According to WHO reports, communicable diseases, including infectious conditions, were a significant cause of death and, therefore, needed constant monitoring.

MARKET RESTRAINTS

The lack of skilled persons in manufacturing effective drugs hinders the growth of the infectious disease therapeutics market. Rapid changes in economic strategies may also negatively impact the development of the infectious therapeutics market. The availability of alternative methods at a lower cost and less knowledge of generic erosion are significant challenges to the market participants. On the other hand, the primary factors restraining the market's growth are generic erosion and patent expiration of infectious disease drugs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Mode of Treatment, Target Organism, Infection Type, Distribution Channels & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Market Players |

F. Hoffmann-La Roche, Gilead Sciences, GlaxoSmithKline, Johnson & Johnson, Merck & Co, Pfizer, Achillion Pharmaceuticals, Novartis, AbbVie, Astellas Pharma, AstraZeneca, Auritec Pharmaceuticals, Bayer, Bristol-Myers Squibb, Chimerix Pharmaceuticals, Cubist, Eli Lilly, Isis Pharmaceuticals and Mitsubishi Tanabe Pharma. |

SEGMENTAL ANALYSIS

By Mode of Treatment Insights

The drug mode of treatment is predicted to register the largest share of the global market during the forecast period. The rising elderly population worldwide and an increase in spending on healthcare, especially in well-developed countries, are promoting the market's growth rate.

However, the vaccine segment is also expected to grow significantly during the forecast period as all children from birth to a particular age must take certain essential vaccines. Moreover, with the increasing number of diseases, the use of essential vaccines keeps increasing. For example, the recent COVID-19 pandemic has made it essential for everyone to get two doses of vaccines against COVID-19 for disease prevention.

By Target Organism Insights

The antibacterial segment accounted for a significant share of the global market in 2024 and is estimated to continue its dominance during the forecast period. A rise in the number of people suffering from various infectious diseases like HIV, tuberculosis, influenza, hepatitis A, and hepatitis C increases market demand. In addition, growing disposable income in urban areas is further favoring the market's growth rate.

However, the antifungal and antiviral segments are also expected to account for a notable share of the global market during the forecast period owing to the growing cases of viral and fungal infections needing treatments. For instance, conditions such as AIDS, Common cold, Ebola, Genital herpes, Influenza, Measles, Chickenpox and shingles, Coronavirus disease, and others are all viral. In addition, Aspergillosis, Aspergillosis, Blastomycosis, Blastomycosis, Candidiasis, Coccidioidomycosis, C. neoformans Infection, C. gattii Infection, and Fungal Eye Infections are all fungal diseases.

By Infection Type Insights

The bacterial infection segment has been growing faster over the past few years and is also anticipated to reach the highest CAGR. Introducing innovative products manufactured with advanced technology boosts the market's growth rate.

However, as viral and fungal conditions become more common, the segments are expected to gain traction during the forecast period.

By Distribution Channel Insights

The hospital segment is forecasted to lead among all during the forecast period. A rise in hospitals' construction with the latest equipment is fuelling the growth rate of the infectious disease therapeutics market.

However, the clinics segment is expected to grow considerably during the forecast period due to the rising establishment of individual clinics worldwide. In addition, the rising number of healthcare professionals with individual healthcare settings separate from hospitals and the lack of appointments at hospitals are pushing the market for the segment.

REGIONAL ANALYSIS

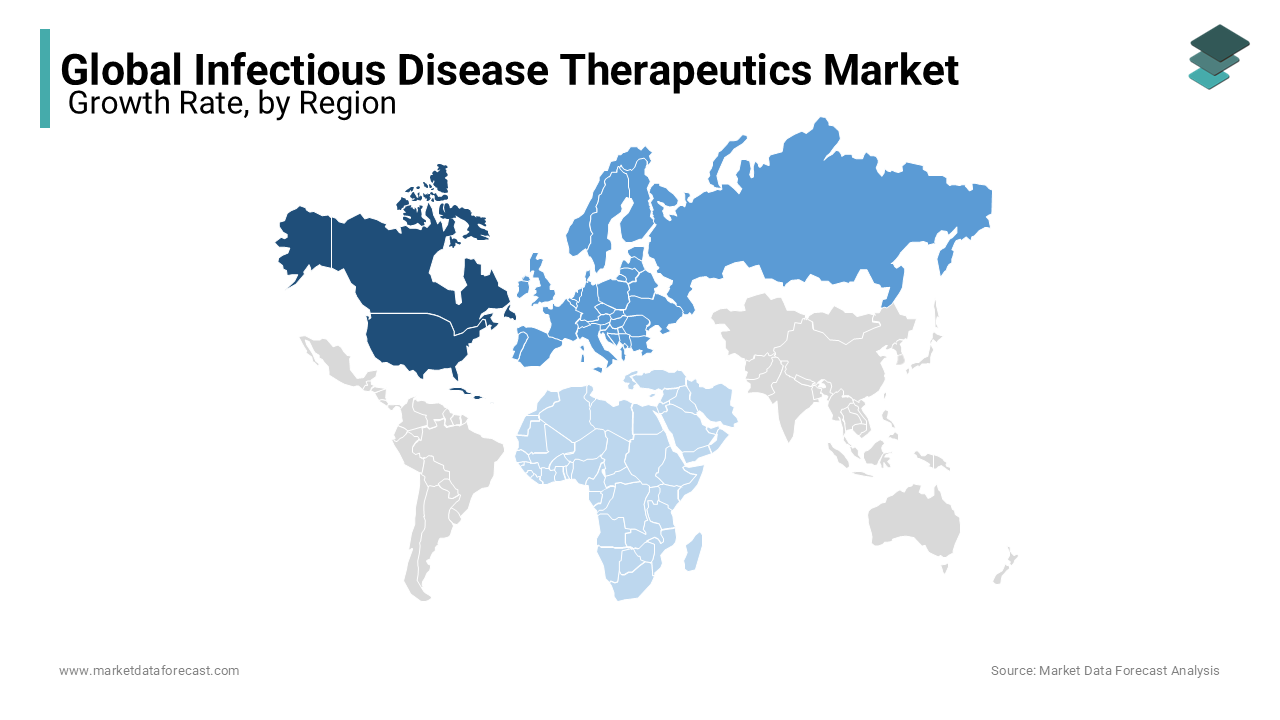

The North American region is expected to account for the highest share in the global market, followed by Asia-Pacific and Europe, owing to the rising incidence of infectious diseases and the increasing aging population. However, Asia-Pacific is projected to account for the highest CAGR over the forecast period due to increasing government funding in emerging countries such as India and China. North America dominated the infectious disease therapeutics market with the highest share of 38.6% worldwide. The market in this region is accredited because of the regular increase of infectious diseases, growing outgoings for healthcare, and mounting alertness in healthcare. In addition, escalating funds and investments from the government, especially in developed nations of the region, boosts market growth. The United States is leading the market due to manufacturers and many clinical trials developing novel drugs to treat infectious diseases. Canada is observed to have rapid growth in the region.

Europe was the second-largest regional market worldwide in 2024, and the growth of this regional market is majorly driven by the increased inpatient count, the vast amount spent on healthcare, and support from the European government towards research and development activities for the drug development used for treating infectious diseases in patients. Nearly 32,000 predicted mortalities with tuberculosis and approximately 323,000 new tuberculosis cases were recorded in Europe in 2015, as per the World Health Organization (WHO). In February 2018, more than 44,000 people died from lung diseases associated with seasonal influenza in Europe.

The Asia-Pacific region is anticipated to register rapid expansion in the worldwide market over the forecast period. Increasing patient population, acceptable government policies such as a decrease in excise and customs duty, and later exceptions in service tax, particularly in India, are accelerating the region's market growth. Rapid ongoing enhancements in countries like India and China. For instance, the Indian Institute of Science researchers have invented a novel drug combination to treat tuberculosis better.

The market in Latin America is predicted to have constant and fixed growth. The market in this region is driven because of the escalating older people population and increasing healthcare cognizance. Brazil is dominating the market in the area.

The market in the Middle East & Africa held a minimal share of the global market in 2024 and is estimated to register a healthy CAGR during the forecast period. The vast financial outgoings and the existence of improved economies like Kuwait, Saudi Arabia, and Qatar. In Africa, the majority of people are infected with malaria. Approximately 90% of the deaths occurred because of malaria in Africa, as per the World Health Organization (WHO) 2015. In Africa, the market is flourishing due to different measures centered on disease-stopping attempts in the region. For example, Pfizer combined with the UAE government in June to escalate awareness regarding infectious diseases, propelling the market's growth rate in this region.

KEY MARKET PLAYERS

Some of the promising companies leading the global infectious disease therapeutics market profiled in the report are F. Hoffmann-La Roche, Gilead Sciences, GlaxoSmithKline, Johnson & Johnson, Merck & Co, Pfizer, Achillion Pharmaceuticals, Novartis, AbbVie, Astellas Pharma, AstraZeneca, Auritec Pharmaceuticals, Bayer, Bristol-Myers Squibb, Chimerix Pharmaceuticals, Cubist, Eli Lilly, Isis Pharmaceuticals and Mitsubishi Tanabe Pharma.

RECENT HAPPENINGS IN THE MARKET

- In March 2021, Roche Diagnostics launched the Cobas SARS-CoV-2 Variant Set 1 assay to understand emerging coronavirus mutations better. The Cobas SARS-CoV-2 Variant Set 1 Test is intended to identify significant spike alterations in virus variants linked to enhanced transmission from person to person.

- In February 2021, Mesa Biotech, Inc., a privately held provider of point-of-care molecular diagnostics, was fully acquired by Thermo Fisher Scientific Inc., the industry pioneer in delivering science. Mesa Biotech is a crucial component of Thermo Fisher Scientific's strategy to increase the advantages of molecular diagnostics at the point of care, beginning with COVID-19 testing, leading to more market revenue.

- In December 2022, the biopharmaceutical company Everest Medicines, which focuses on the development, production, and commercialization of novel drugs and vaccines, announced today that the first phase of its global manufacturing site in Jiashan, Zhejiang Province, which is dedicated to the production of mRNA vaccines, has started operations and completed trial production runs.

- In December 2022, Brii Biosciences Limited, a biotechnology company developing therapies to improve patient health and choice across diseases with high unmet needs, announced progress against its strategic clinical development priorities, including various updates across its pipeline of candidates for infectious diseases and central nervous system diseases.

MARKET SEGMENTATION

This research report on the global infectious disease therapeutics market has been segmented and sub-segmented based on the mode of treatment, target organism, infection type, distribution channels & region.

By Mode of Treatment

- Drugs

- Vaccines

By Target Organism

- Antibacterial

- Antifungal

- Antiviral

- Antiparasite

- others

By Infection Type

- Bacterial

- Viral

- Fungal

- Parasitic

- Others

By Distribution Channels

- Hospitals

- Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global infectious disease therapeutics market going to be worth by 2033?

The global infectious disease therapeutics market size is projected to be valued at USD 263.49 billion by 2033.

Does this report include the impact of COVID-19 on the infectious disease therapeutics market?

Yes, we have studied and included the COVID-19 impact on the global infectious disease therapeutics market in this report.

Which segment by infection type accounted for the major share of the global infectious disease therapeutics market in 2024?

Based on the infection type, the bacterial infection segment led the market in 2024 and this segment is also is expected to register a healthy CAGR from 2025 to 2033

Which are the significant players operating in the infectious disease therapeutics market?

F. Hoffmann-La Roche, Gilead Sciences, GlaxoSmithKline, Johnson & Johnson, Merck & Co, Pfizer, Achillion Pharmaceuticals, Novartis, AbbVie, Astellas Pharma, AstraZeneca, Auritec Pharmaceuticals, Bayer, Bristol-Myers Squibb, Chimerix Pharmaceuticals, Cubist, Eli Lilly, Isis Pharmaceuticals and Mitsubishi Tanabe Pharma are some of the major players in the market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com