Global Thrombectomy Devices Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Mechanical, Ultrasonic, Aspiration and Hydrodynamic), Application (Peripheral Vascular, Neurovascular and Cardiovascular), End-User, Diseases (Coronary, Neural and Peripheral) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From 2025 to 2033

Global Thrombectomy Devices Market Size

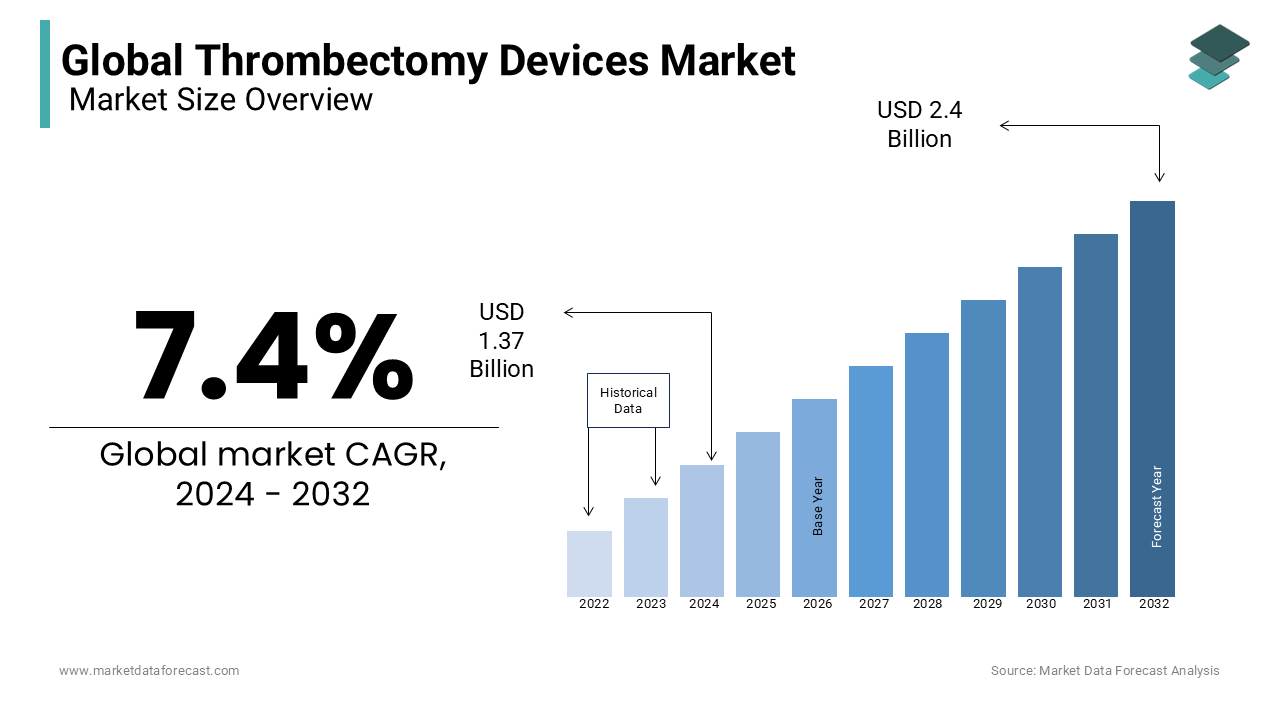

The global thrombectomy devices market size was valued at USD 1.37 billion in 2024. The size of the thrombectomy devices market is forecasted to value USD 2.60 billion by 2033 from USD 1.47 billion in 2025, growing at a CAGR of 7.4% during the forecast period.

Thrombectomy devices are used to remove clots from a blood vessel performed in an interventional procedure. It is generally used as a last resort as continuous blockage of blood flow to organs can lead to a situation known as necrosis. During a procedure, these devices will minimize the damage to the vessel wall. Thrombectomy devices can even be used to treat deep vein thrombosis, pulmonary embolism, neurovascular thrombosis conditions, and peripheral arterial, according to the size and diameter and depending on the affected area. Balloon embolectomy, aspiration embolectomy, and surgical embolectomy are the most used thrombectomy device procedures.

MARKET DRIVERS

The growing patient count suffering from CVDs is one of the major factors propelling the global thrombectomy devices market growth.

The usage of thrombectomy devices has increased with the growing population suffering from cardiovascular diseases. According to the data published by the Centers for Disease Prevention and Control (CDC), for every second, one person in the United States is getting a heart attack, and an estimated 805,000 heart attacks are being recorded in the United States every year. These devices help eliminate the blood clots from the blood vessels and can help restore the blood flow and prevent the complications of CVDs such as stroke and heart attack. Therefore, the increasing incidence of cardiovascular diseases worldwide is estimated to promote the demand for thrombectomy devices, as these conditions need immediate medical assistance to avoid serious health situations. In addition, rising awareness levels regarding the benefits associated with thrombectomy procedures and the growing adoption of minimally invasive surgeries are anticipated to result in the growth of the thrombectomy devices market.

The growing adoption of sedentary lifestyles and increasing demand for minimally invasive surgeries are accelerating the growth rate of the thrombectomy devices market.

The growing aging population is expected to contribute to the growing demand for thrombectomy devices in the coming years. The increase in the geriatric population leads to evolving various disease conditions, which must have surgical interventions for treatment. This promotes the demand levels for these devices and boosts the market’s growth rate. Moreover, increasing the target patient population is boosting the thrombectomy devices market. In addition, the rise in technological innovations in the medical field and the increasing prevalence of cardiovascular diseases are significant market growth opportunities. Moreover, the increase in research and development investments is boosting the thrombectomy devices market.

MARKET RESTRAINTS

The lack of skilled professionals is the major restrain to the thrombectomy devices market. In addition, the high cost associated with thrombectomy devices is hampering the global market. Moreover, the difficulty of using new equipment is constraining the thrombectomy devices market growth. In addition, the lack of awareness about peripheral vascular diseases in emerging countries is challenging market growth. Moreover, the side effects of using thrombectomy devices, such as bleeding from the catheter inserted and the presence of bruce in the area causing pain, are hindering the growth rate of the thrombectomy devices market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, End-User, Disease, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Stryker Corporation (U.S.), Medtronic Plc (U.S.), Boston Scientific Corporation (U.S.), Penumbra, Inc. (U.S.) Johnson & Johnson (U.S.), Terumo Corporation (Japan), Spectranetics Corporation (U.S.), Edwards Lifesciences Corporation (U.S.), Argon Medical Devices, Inc. (U.S.), and Teleflex Incorporated (U.S.). |

SEGMENTAL ANALYSIS

By Type Insights

The mechanical thrombectomy devices segment is anticipated to account for the largest share of the global thrombectomy devices market in 2024. The dominance of the segment is expected to continue during the forecast period. The growing requirement for stent retrievers and supportive reimbursement policies are propelling the growth of the mechanical thrombectomy devices segment. Acandis and Sela Medical are some of the notable manufacturers of mechanical thrombectomy devices. Moreover, mechanical thrombectomy devices are more effective in reducing stroke-related disability and mortality. Therefore, the segment of stent retrievers is estimated to showcase promising growth during the forecast period.

By Application Insights

The cardiovascular segment had the major share of the global market in 2024. The growing incidence of CVDs worldwide is one of the major factors driving segmental growth. In addition, the benefits of mechanical thrombectomy in heart surgeries and the rise in minimally invasive cardiac surgeries propel the cardiovascular disease segment.

On the other hand, the neurovascular application segment is gaining attention and is anticipated to grow at a prominent CAGR during the forecast period.

By End User Insights

The hospital surgical centers segment dominated the market in 2024 and is estimated to hold a notable share of the global market during the forecast period owing to the growing number of people suffering from chronic vascular diseases and the rise in ultrasonic thrombectomy clinical applications.

By Diseases Insights

The coronary diseases segment led the market in 2024. The segment’s dominance is anticipated to continue throughout the forecast period owing to rising awareness among people over the availability of quality treatment procedures in developed and developing countries.

REGIONAL ANALYSIS

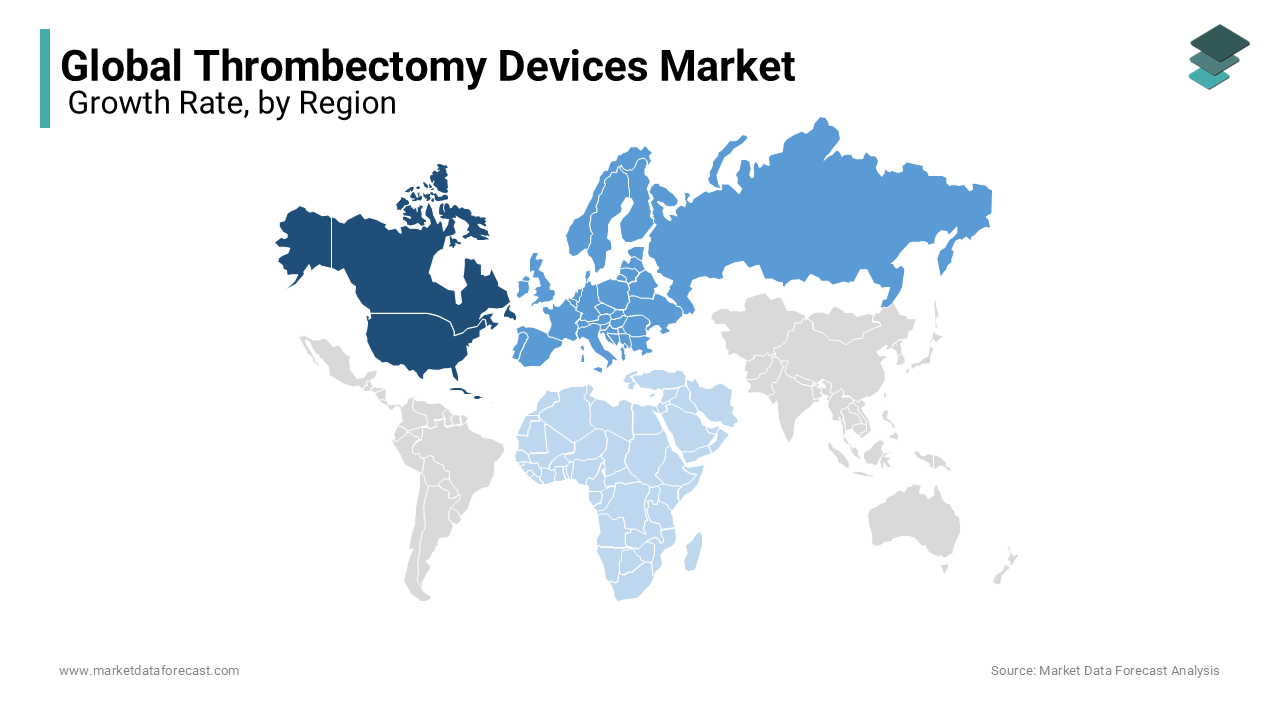

North America held the largest share of the global market in 2024, and the region’s dominance is expected to continue in the coming years. The presence of key market participants and increased adoption of technological developments in manufacturing thrombectomy devices propel the market growth in North America. In addition, the rising aging population and incidence of cardiovascular diseases are further fuelling the growth rate of the North American region. The major contributors to the North American market are the US and Canada. For instance, according to the CDC, Stroke is the fifth major cause of death in the United States, with 130,000 deaths yearly. Moreover, 800,000 people have a stroke every year. In addition, the increased incidence of cardiovascular diseases and technological advancements in the medical field propel the market. Furthermore, numerous vital players are boosting the thrombectomy devices market in North America.

The European market is expected to account for the second-largest market share in the world during the forecast period. During the forecast period, the European market is projected to grow at a healthy CAGR. The growing incidence of cardiovascular diseases and the increasing geriatric population contribute to the growth of the European thrombectomy devices market. Germany accounted for the largest share of the European region in 2023 and is estimated to continue dominating the European market in the coming years.

The Asia-Pacific region is the fastest-growing market globally. The presence of local manufacturers and growing distribution networks are accelerating the market growth in this region. India is a major contributor to the Asia-Pacific market. The rising adoption of thrombectomy devices and the rising patient count suffering from cardiovascular diseases support the thrombectomy devices market in the Asia-Pacific region. In addition, factors such as the large patient population and growing awareness among healthcare professionals regarding the advantages associated with using thrombectomy devices are favoring regional market growth.

Latin America is expected to grow steadily during the forecast period owing to the growing geriatric population, rising prevalence of cardiovascular diseases, growing adoption of a sedentary lifestyle, increasing demand for minimally invasive procedures, and technological innovations in the medical field. However, some of the restraints in this market are difficulty using new equipment, lack of skilled workers, and lack of awareness about peripheral vascular diseases.

The market in the Middle East & Africa is forecasted to grow at a sluggish growth rate and hold a moderate share of the global market in the coming years.

KEY MARKET PLAYERS

Companies playing a noteworthy role in the global thrombectomy devices market and profiled in this report are Stryker Corporation (U.S.), Medtronic Plc (U.S.), Boston Scientific Corporation (U.S.), and Penumbra, Inc. (U.S.) Johnson & Johnson (U.S.), Terumo Corporation (Japan), Spectranetics Corporation (U.S.), Edwards Lifesciences Corporation (U.S.), Argon Medical Devices, Inc. (U.S.), and Teleflex Incorporated (U.S.).

MARKET SEGMENTATION

This research report on the global thrombectomy devices market has been segmented and sub-segmented based on type, application, end-user, disease, and region.

By Type

- Mechanical Thrombectomy Devices

- Stent Retrievers

- Basket/Brush Retrievers

- Coil Retrievers

- Ultrasonic Thrombectomy Devices

- Aspiration Thrombectomy Devices

- Hydrodynamic Thrombectomy Devices

By Application

- Peripheral Vascular Application

- Neurovascular Application

- Cardiovascular Application

By End User

- Research Laboratories & Academic Institutes

- Ambulatory Surgical Centers

- Hospital Surgical Centers

By Diseases

- Coronary diseases

- Neural diseases

- Peripheral diseases

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the size of the thrombectomy devices market worldwide in 2024?

The global thrombectomy devices market size was valued at 1.37 billion in 2024.

Which region is growing the fastest in the global thrombectomy devices market?

The Asia-Pacific region is anticipated to grow the fastest in the global thrombectomy devices market during the forecast period.

Does this report include the impact of COVID-19 on the thrombectomy devices market?

Yes, we have studied and included the COVID-19 impact on the global thrombectomy devices market in this report.

What are some of the notable companies in the global thrombectomy devices market?

Stryker Corporation (U.S.), Medtronic Plc (U.S.), Boston Scientific Corporation (U.S.), Penumbra, Inc. (U.S.) Johnson & Johnson (U.S.), Terumo Corporation (Japan), Spectranetics Corporation (U.S.), Edwards Lifesciences Corporation (U.S.), Argon Medical Devices, Inc. (U.S.), and Teleflex Incorporated (U.S.) are some of the noteworthy companies in the thrombectomy devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com