Global TAVR Market Size, Share, Trends & Growth Analysis Report – Segmented By Surgery Method (Transfemoral Implantation, Transapical Implantation, Transaortic Implantation and Transcaval Implantation), Valve Frame Material, Valve Size, Valve Leaflets Material, End Users & Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global TAVR Market Size

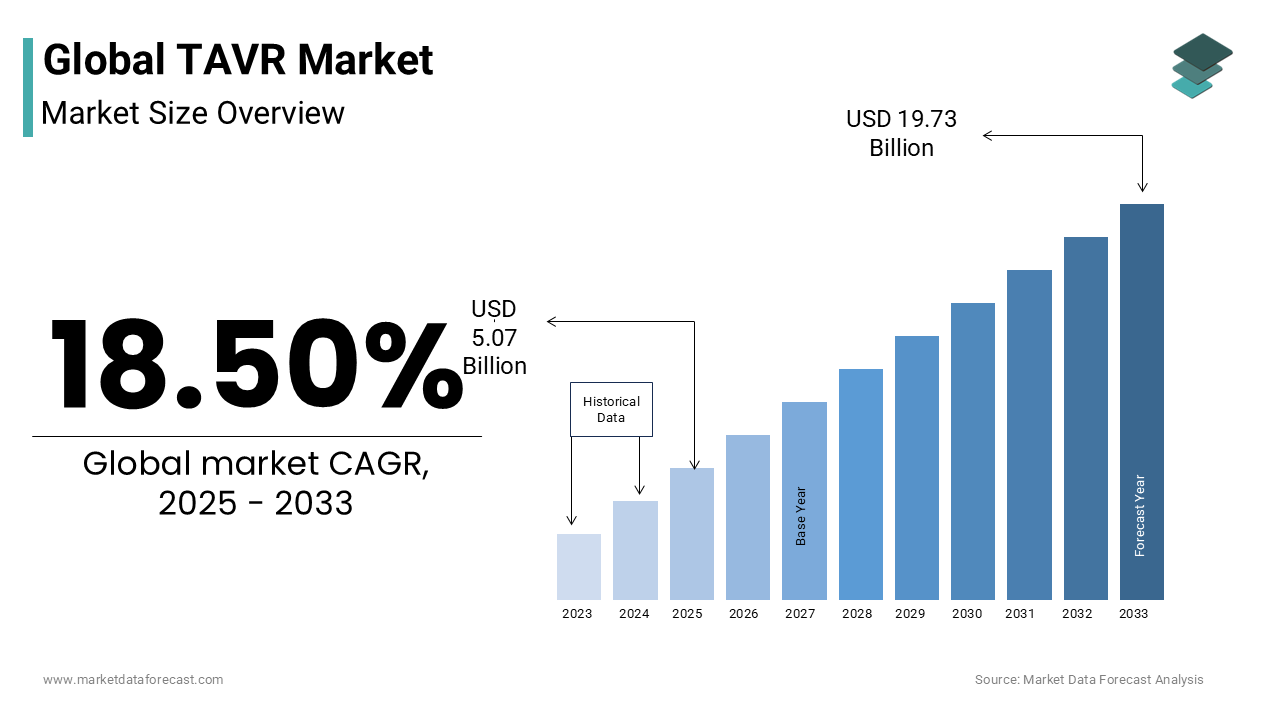

The global TAVR size was valued at USD 4.28 billion in 2024. The global TAVR market is projected to grow from USD 5.07 billion in 2025 to USD 19.73 billion by 2033, witnessing a CAGR of 18.50% during the forecast period.

Current Scenario of the TAVR Market

Transcatheter aortic valve replacement (TAVR) is a minimally invasive procedure that replaces the narrowed aortic valve with an animal tissue valve. The transcatheter aortic valve replacement uses smaller incisions than the open-heart valve surgery. The TAVR is a significant option for people who cannot have heart surgery for the replacement of the aortic valve. The TAVR helps reduce aortic valve stenosis symptoms, chest pain, and shortness of breath. This procedure is widely used in the treatment of aortic stenosis, in which the heart aortic valve thickens and becomes stiff and narrow, leading to reduced blood flow to the body. The global TAVR market has accounted for significant growth in the past years and is anticipated to record notable growth during the forecast period. The surgeon replaces the damaged aortic valve with the one made with cow or pig heart tissue, called the biological tissue valve. The doctors utilize small flexible and hollow tubes known as catheters to reach the heart, which is entirely different from open-heart surgery. These benefits are escalating the adoption of TAVR among people and healthcare professionals, leading to enhanced growth opportunities. According to the data provided by the Euro Heart Survey on Valvular Disease, Aortic Stenosis is the most common valvular heart disease in developing countries, and it stated that degenerative-calcific is mostly commonly observed in patients, around 81.9%.

MARKET DRIVERS

The rising prevalence of CVDs and aortic stenosis, the growing adoption rate of minimally invasive therapies, and the rising geriatric population worldwide are significant factors driving the global TAVR market growth.

The growing number of patients worldwide suffering from cardiovascular diseases such as heart failure, coronary artery disease, and hypertension is one of the significant trends fuelling the growth rate of the TAVR market. For instance, cardiovascular disease causes the aortic valve to malfunction, which increases the demand for effective valve replacement procedures. According to the World Health Organization (WHO), 17.9 million deaths happened because of cardiovascular diseases. Besides, increased funding for research and development activities, new product launches, and favorable reimbursement policies are expected to promote the transcatheter aortic valve replacement market growth during the forecast period. Furthermore, according to Frankel Cardiovascular Center (University of Michigan), an estimated 0.3 million people are diagnosed with severe aortic stenosis every year.

The growing adoption of minimally invasive surgery (MIS) and technological advancements in transcatheter aortic valve replacement procedures further drive the TAVR market growth. It, in turn, aims to reduce healthcare spending. Besides, geographic expansion, financing, and adoption of advanced procedural devices and methods are expected to drive market growth during the forecast period.

Favorable reimbursement policies for TAVR procedures, growing demand for transcatheter procedures, improving patient outcomes and safety profiles, high success rates and shorter recovery times compared to traditional surgery and rising preference for TAVR among high-risk and intermediate-risk patients promote the TAVR market growth. The growing number of clinical trials and research studies on TAVR, rising awareness among physicians and patients about TAVR benefits, increasing healthcare expenditure, an increasing number of collaboration between device manufacturers and healthcare providers, rising prevalence of comorbidities such as diabetes and obesity, favorable regulatory environment and approvals for TAVR devices and growing demand for less invasive alternatives to surgical valve replacement further propel the TAVR market growth.

MARKET RESTRAINTS

Various risks are associated with the TAVR procedure, such as vascular complications, which include aortic or iliofemoral dissection, vascular perforation, or vessel rupture.

The other risks, such as stroke, kidney damage, vessel damage, and other common risks like bleeding, bruising, or infection at the access site and damaged artery, are all estimated to hamper the global TAVR market growth. Vessel damage is the primary risk factor, as passing catheters through the arteries can damage the vessels. A few case scenarios demand the necessity of the pacemakers and the scenarios of the valve leaks where the replacement is insufficient or does not expand entirely hinder the market growth opportunities for the TAVR market. Another significant factor restraining the market growth is the high costs associated with the procedure and the availability and accessibility issues, especially in small and middle-income healthcare organizations. The need for more awareness among the people and the presence of stringent regulations by the regulatory authorities for device approval is complex and challenging to the market players—the need for more skilled professionals where the need for more skilled professionals impedes growth opportunities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Surgery Method, Valve Frame Material, Valve Size, Valve Leaflets Material, End Users and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Edwards Lifesciences Corporation (U.S.), Medtronic, Inc. (Ireland), Boston Scientific Corporation (U.S.), Abbott Laboratories (U.S.), St. Jude Medical Inc. (U.S.), JenaValve Technology, Inc. (Germany), Symetis SA (Switzerland), Direct Flow Medical, Inc. (U.S.), |

SEGMENTAL ANALYSIS

By Surgery Method Insights

The transfemoral implantation segment is estimated to command the largest share of the global TAVR Market in 2023. Furthermore, it is expected to grow at the highest CAGR during the forecast period due to technological advancements such as vascular closure systems. Furthermore, the transfemoral implementation is a minimally invasive surgery, requires a short hospital stay, and provides quick recovery. Therefore, tutors and surgeons mostly suggest transfemoral implantation due to its better outcomes.

The transapical implantation segment is forecasted to witness a healthy CAGR during the forecast period due to the rising number of patients opting for efficient therapy with fast recovery. In addition, Braile Biomedical introduced a transapical aortic valve in Brazil in 2012, and the product introduction is to extend its product portfolio and boost market expansion in the Latin American region.

By Valve Frame Material Insights

The nitinol segment is expected to account for the largest share of the global TAVR market during the forecast period by valve frame material. Since 2013, as the TAVR data registry, over 8000 procedures have been performed in Japan. Per Annals of Cardiothoracic Surgery, transcatheter aortic valve implementation (TAVI) devices are expected to be more efficient in treating high-risk patients. The shape memory properties of nitinol that allow better valve expansion and optimal fit within the aortic valve is one of the key factors propelling segmental growth. High flexibility, durability, biocompatibility, radial strength and conformability of nitinol material further drive the segmental growth. The rapid adoption of self-expandable valves that often utilize Nitinol frames due to their ease of deployment and retrievability and the growing number of R&D efforts to improve Nitinol-based TAVR devices to enhance performance and outcomes further contribute to the growth rate of the segment.

By Valve Size Insights

The 14mm to 18mm segment is likely to account for the highest share of the global market during the forecast period due to the increased number of minimally invasive surgeries and growth in the monitoring and detecting AAA. The presence of patients with smaller aortic valve anatomy requiring TAVR intervention, increasing recognition of the need for TAVR in patients with severe aortic stenosis and smaller valve sizes, advancements in technology and design to improve the feasibility and safety of TAVR procedures in smaller valve sizes and growing clinical evidence supporting the efficacy and safety of TAVR in the 14mm to 18mm range drive the segmental growth. The growing patient population, rising awareness among healthcare professionals about the benefits of TAVR in smaller valve sizes, favorable reimbursement policies and increasing coverage for TAVR procedures in this size range further contribute to the segment’s growth rate.

By Leaflets Material Insights

The bovine heart tissue segment is predicted to hold the most considerable market share during the forecast period. The rise in the medical tourism industry and growing awareness regarding the advantages of minimally invasive techniques, such as less traumatic surgical experience, technological advancements, and innovative products, are expected to accelerate the segment's growth.

By End-User Insights

Based on end-user, the hospital segment held the largest share of the global TAVR market in 2024 and the segmental domination is estimated to continue throughout the forecast period. The growing patient count primarily drives the segment's growth, sufficient availability of skilled and experienced medical surgeons, and highly advanced equipment. The availability of state-of-the-art cardiac care facilities, including catheterization labs and hybrid operating rooms in hospitals essential for performing TAVR procedures propels the segmental growth. The established referral networks with primary care physicians, clinics, and other healthcare providers further accelerate the growth rate of the segment.

The ambulatory surgical centers segment was the second-leading segment in 2024 and is predicted to register a healthy CAGR during the forecast period. The advantages of ASCs, such as shorter hospital stays and faster recovery times compared to traditional hospitals, majorly drive the segmental growth. Lower overhead costs of ambulatory surgical centers compared to hospitals further contribute to the growth rate of the segment.

REGIONAL ANALYSIS

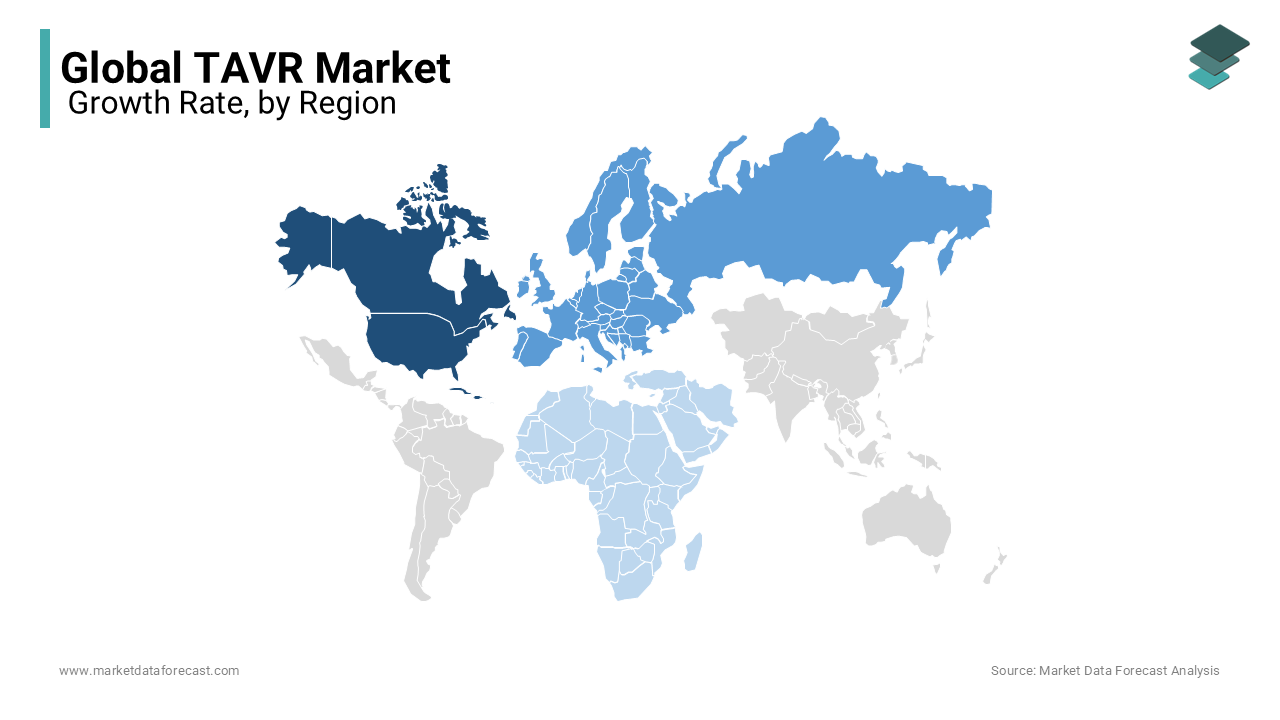

North America led the market and had the largest share of 34% of the global market in 2023. In contrast, Asia-Pacific is estimated to grow at the highest CAGR of 21.20% during the forecast period. The United States dominated the market in 2023, accounting for over 45% of the transcatheter aortic valve implant market. It can be attributed to the high adoption of technologically advanced products, mergers and acquisitions, and favorable reimbursement policies. For example, reimbursement from government organizations such as the Centers for Medicare and Medicaid Services (CMS) helps patients opt for a transcatheter aortic valve replacement procedure. The primary payer for almost 92% of TAVR procedures was Medicare in 2019. It reinforced the economic advantage of TAVR over surgical aortic valve replacement (SAVR). The well-established healthcare industry can drive market growth in the region. The presence of several reputable market players who release continuous iterations of existing products can also play a critical role.

Europe accounted for a substantial share of the global market in 2024. Europe has similar growth factors to the Americas due to the increasing diagnosis of endovascular disease and a large senior population. In addition, the global transcatheter market will thrive in the region due to favorable regulations and many patients with sustainable income levels to pay for high-standard treatment. Recently, FEops received a USD 4.1 million fund to promote research and development of structural heart interventions. The Feops HEART Guide is a predictive planning guide that can provide information about the device's size and position during surgery to reduce injury risk.

APAC is predicted to witness the fastest CAGR in the global market during the forecast period. The presence of emerging economies, the growing prevalence of valvular heart diseases, particularly aortic stenosis, the increasing aging population in the Asia-Pacific region who are more prone to cardiovascular diseases, including aortic valve disorders, the growing number of investments to improve healthcare infrastructure including cardiac care facilities and specialized centers for cardiovascular interventions like TAVR primarily drive the market growth in the APAC region. The growing availability of advanced imaging systems and catheterization labs, the increasing number of well-trained interventional cardiologists and cardiac surgeons, the rising number of initiatives from the governments of APAC countries and favorable reimbursement programs further contribute to the regional market growth. China, Japan, India, South Korea, and Australia are predicted to control the major share of the Asia-Pacific market during the forecast period.

Latin America is a noteworthy regional market for TAVR worldwide and is predicted to grow at a healthy CAGR during the forecast period. The MEA market accounted for a moderate share of the worldwide market in 2024 and is estimated to grow steadily during the forecast period.

KEY PLAYERS IN THE GLOBAL TAVR MARKET

Notable companies leading the Global TAVR Market profiled in the report are Edwards Lifesciences Corporation (U.S.), Medtronic, Inc. (Ireland), Boston Scientific Corporation (U.S.), Abbott Laboratories (U.S.), St. Jude Medical Inc. (U.S.), JenaValve Technology, Inc. (Germany), Symetis SA (Switzerland), Direct Flow Medical, Inc. (U.S.), Sorin Group (Italy), Meril Life Sciences India Pvt Ltd (India) and Braile Biomedica (Brazil).

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Boston Scientific Corporation announced the approval of the FARAPULSE Pulsed Field Ablation (PFA) System, designed to isolate pulmonary veins in treating drug-refractory, recurrent, symptomatic paroxysmal atrial fibrillation. This system acts as a novel alternative to traditional thermal ablation therapies.

- In January 2024, Eisenhower Health was the first hospital in the United States to introduce an Edwards Benchmark Program Case Observation Site for the treatment of stenosis for patients undergoing transcatheter aortic valve replacement.

- In March 2024, Medtronic plc, a global leader in healthcare technology, stated the receipt of U.S. Food and Drug Administration (FDA) approval for Evolut FX+ TAVR system for treating symptomatic severe aortic stenosis.

- In June 2023, Egnite, Inc., a digital health company, and JenaValve Technology, Inc., a developer and manufacturer of innovative TAVR systems, announced their partnership where the primary aim of this collaboration is to enhance the understanding of care paradigm and related outcomes for patients with aortic regurgitation.

DETAILED SEGMENTATION OF THE GLOBAL TAVR MARKET INCLUDED IN THIS REPORT

This research report has segmented and sub-segmented the global TAVR market based on surgery method, valve frame material, valve size, valve leaflets material, end users and region.

By Surgery Method

- Transfemoral Implantation

- Transapical Implantation

- Transaortic Implantation

- Transcaval Implantation

By Valve Frame Material

- Nitinol

- Stainless Steel

- Cobalt-Chromium

By Valve Size

- 14mm to 18 mm

- 18mm to 22 mm

- 22mm to 29mm

By Valve Leaflets Material

- Bovine Heart Tissue

- Cow Heart Tissue

- Other Valve Leaflets Material

By End Users

- Hospitals

- Ambulatory Surgical Centres

- Cardiac Catheterization Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the TAVR market?

Edwards Lifesciences Corporation, Medtronic, Boston Scientific Corporation, Abbott Laboratories, and JenaValve Technology, Inc. are some of the notable companies in the TAVR market.

What are the major players in the TAVR market?

The global TAVR market size was worth USD 4.28 billion in 2024.

What are the challenges facing the TAVR market?

The growth of the TAVR market is primarily driven by the increasing prevalence of heart valve diseases, the rising adoption of minimally invasive procedures, and advancements in technology.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com