Global Adulticide Market Size, Share, Trends & Growth Forecast Report, Segmented By Type (Synthetic, Natural And Biological), End Users (Government, Residential And Commercial) And Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa), Industry Analysis From 2025 to 2033

Global Adulticide Market Size

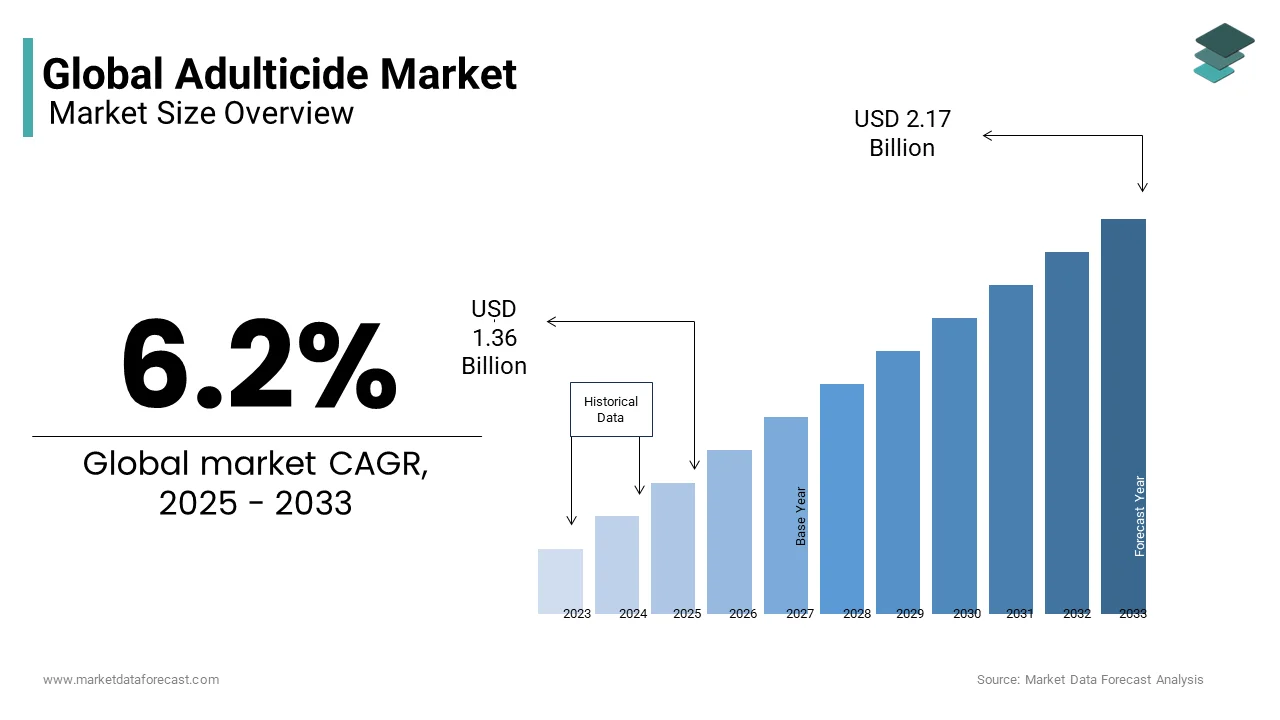

The global adulticide market was valued at USD 1.26 billion in 2024 and is anticipated to reach USD 1.36 billion in 2025 from USD 2.17 billion by 2033, growing at a CAGR of 6.2% during the forecast period from 2025 to 2033.

The simplest definition of an adulticide is a chemical or insecticide used to kill adult insects. Although adulticides come under insecticides, a recent boom in the adulticide segment has meant that it is now considered as a separate market. Whereas a pesticide controls pests by inhibiting their life cycle, most often in the larvae stage, adulticides function by killing the pests after they have reached the adult stage. Adulticides are the cure whereas pesticides are the preventive measure. The recent boom in the adulticide industry is due to the decrease in the effectiveness of pesticides targeted at larvae. Pests have started developing resistance to most pesticides and have no problem reaching adulthood. In order to tackle this problem, the use of adulticides to kill adult pests is the preferred method.

MARKET DRIVERS AND RESTRAINTS

The major factors affecting the adulticide market include the obvious reason for the increased demand for agricultural products. The increased demand for food production due to rising populations means maximum efficiency needs to be maintained on farms. Loss of crops to pests is not acceptable and on the off chance that normal pesticides fail, adulticides need to maintain crop productivity. As for the restraints of the market, as with any agrochemical, costs associated with its usage and ecological concerns are the main restraints.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, End Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bayer Environmental Science, Valent BioSciences, Clarke Central Life Sciences, BASF, Summit Chemical, Univa, UPL, Kadant GranTek, Babolna-Bio, MGK, Westham, AllPro Vector and Others. |

REGIONAL ANALYSIS

The adulticide market is dominated by North America in 2017 with the region accounting for 36% of the overall market share. North America was followed next in line by Europe and Asia-Pacific. Asia-Pacific is expected to grow rapidly in the coming years as is evident from the high CAGR value for the region. Another promising region for the market is Latin America, which is expected to show high growth rates in the coming years.

KEY MARKET PLAYERS

Bayer Environmental Science, Valent BioSciences, Clarke Central Life Sciences, BASF, Summit Chemical, Univa, UPL, Kadant GranTek, Babolna-Bio, MGK, Westham, AllPro Vector. Some of the market players that dominate the global adulticide market.

MARKET SEGMENTATION

This research report on the global adulticide market is segmented and sub-segmented into the following categories.

By Type

- Synthetic

- Natural

- Biological

By End-user

- Government

- Residential

- Commercial Usage

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com