Global Ancient Grain Market Size, Share, Trends & Growth Forecast Report - Segmented By Applications (Bakery, Confectionary, Sports Nutrition, Infant Formula, Cereals, Frozen Food And Others), Crop Type (Gluten Free Ancient Grains And Gluten Containing Ancient Grains) & Region(North America, Europe, Apac, Latin America, Middle East And Africa) - Industry Analysis 2025 to 2033

Global Ancient Grain Market Size

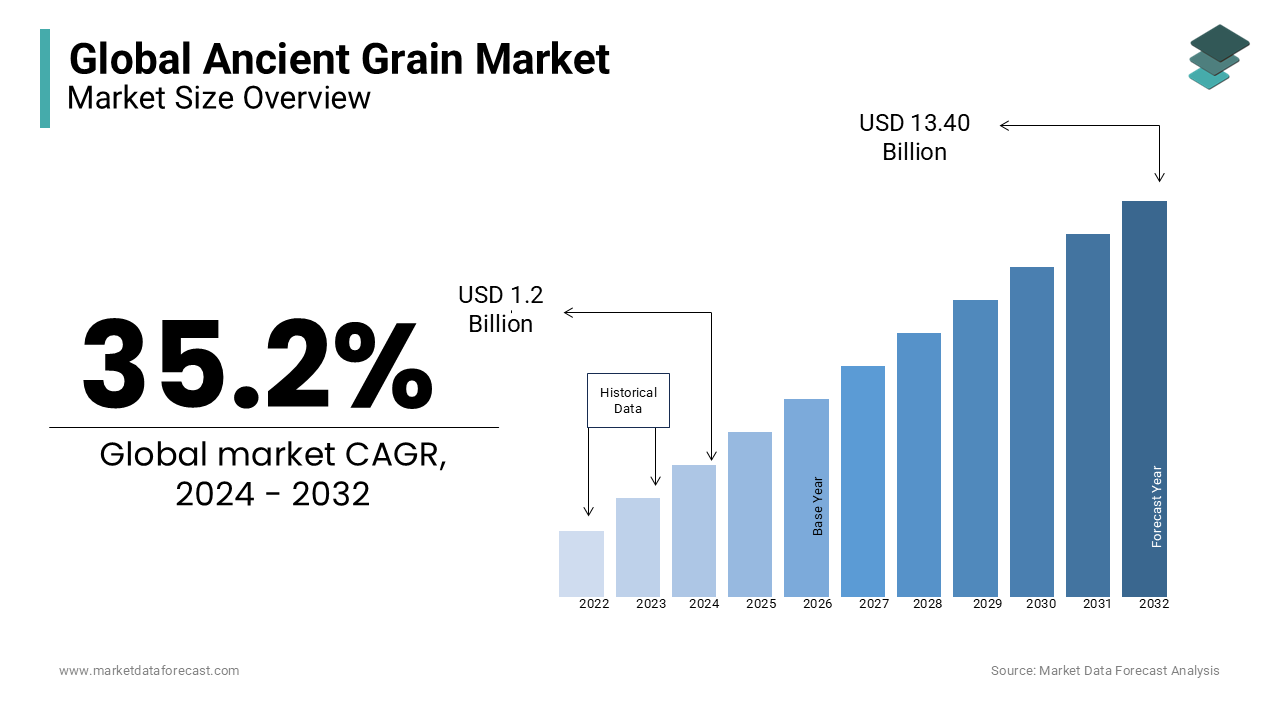

The global ancient grain market size was valued at USD 1.21 billion in 2024, and the global market size is expected to reach USD 18.20 billion by 2033 from USD 1.63 billion in 2025, growing at a CAGR of 35.2% from 2025 to 2033.

There is no official definition of what ancient grains are, and most whole grains can be considered "old" because they have been around since the dawn of humanity. According to the Whole Grains Council, however, they are loosely defined as grains that have remained mostly unchanged over the last few generations. Therefore, Modern wheat would not fall into this category, but certain varieties such as Einkorn, Farro, Kamut and Spelt would fall into this category. Heirloom varieties of other traditional grains— such as black barley, red and black rice, and blue corn — may also be called ancient grains. Certain grains primarily ignored until recently by Western palates (such as sorghum, chia, millet, quinoa, and amaranth) would also be widely regarded as ancient grains. Sometimes less popular grains, such as buckwheat or wild rice, are also included. Globally, there is a good demand for ancient grains with half of the shoppers involved and almost 40% claiming the use of ancient grains at least once a week. And of those shoppers who are interested, more than 20% are willing to pay a premium for products that include old grain.

MARKET DRIVERS

The consumer's attraction towards superfoods drives the growth of the Ancient Grain market.

The increased aversion to grain and wheat among consumers is expected to favor the pseudo-grain market, such as amaranth and quinoa. Minimal effort and requirements for the production of chia, amaranth and quinoa compared to other grains are expected to drive the Ancient Grain Market. The rising demand for organic and natural ingredients from the cosmetics industry is expanding the market for chia, amaranth and quinoa. Growing consumption and production limitations together lead to an increase in prices for pseudo-grains such as quinoa and amaranth.

MARKET RESTRAINTS

High labor costs and the lack of availability of irrigation facilities in many regions serve as obstacles to the growth of the global ancient grains market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

35.2% |

|

Segments Covered |

By Crop Type, Application and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Ardent Mills (U.S.), Snyder’s-Lance Inc. (U.S.), Crunchmaster Inc. (U.S.), SK Food International (U.S.), Purely Elizabeth Inc. (U.S.), Quinoasure Inc. (U.S.), Great River Organic Milling Inc. (U.S.), Urbane Grain Inc. (U.S.), Nature’s Path Foods (Canada), GFB Great Foods (India) |

SEGMENTAL ANALYSIS

By Crop Type Insights

The Gluten Containing Ancient Grain segment dominated the global market in 2023, accounting for more than 70% of the worldwide market share. Gluten Containing Ancient Grain is the most extensively used form.However, Gluten-Free Ancient Grains will become more and more popular in the future. This growth of the gluten-free market can be attributed to the rise in health consciousness in people, with an increase in the awareness, people are now moving towards healthier alternatives. Gluten can be responsible for osteoporosis (a kind of bone disease) and intestinal damage, which led many customers to reduce their intake of gluten intake.

By Application Insights

Out of these, the Food and Beverages segment takes a significant portion because of the increased number of applications of Ancient Grains. With the production of new and health-beneficial whole grain buns and bread, the segment is expected to dominate the Ancient Grain Market.

However, Infant formula is the fastest-growing market, accounting for the increasing acceptance of this product as a milk alternative and the rise in the working women population.

REGIONAL ANALYSIS

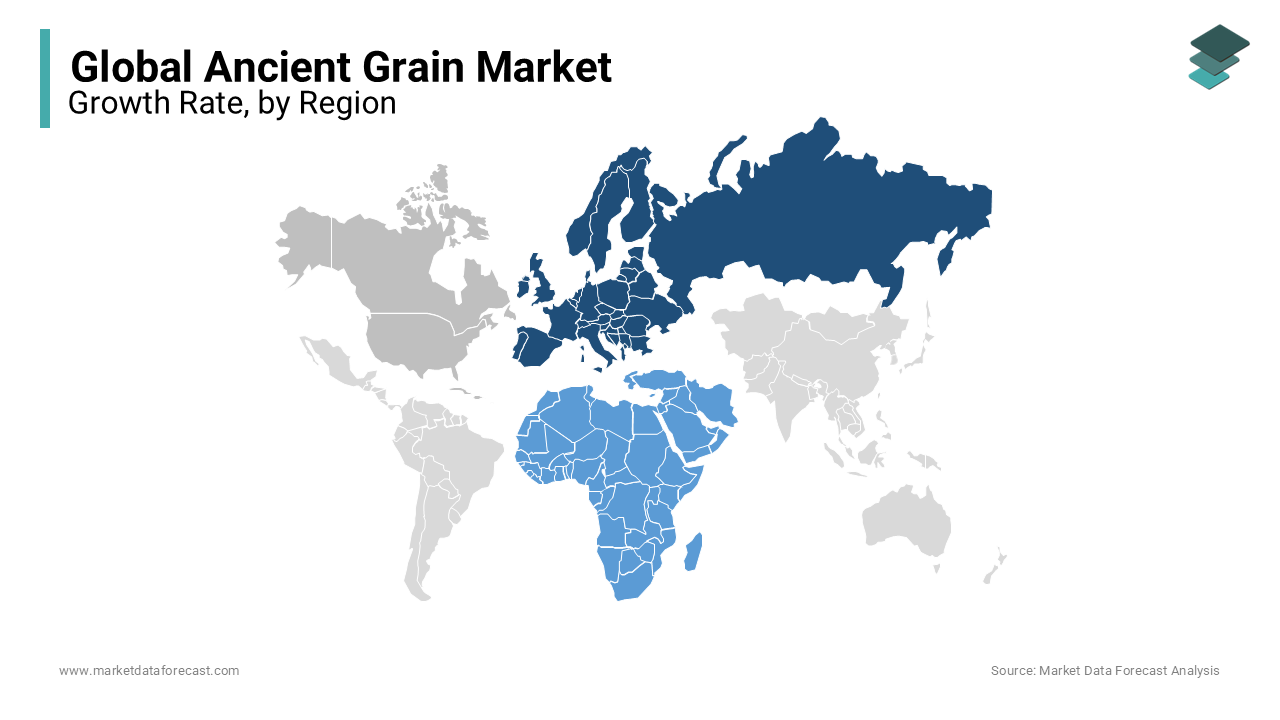

Europe took the largest market share of 43.06% in 2025, and this is pure because of the bread eaters are mostly centralized in Europe. Europe is followed by the Middle East and Africa, which accounted for 26% of the market share.

KEY PLAYERS IN ANCIENT GRAIN MARKET

Ardent Mills (U.S.), Snyder’s-Lance Inc. (U.S.), Crunchmaster Inc. (U.S.), SK Food International (U.S.), Purely Elizabeth Inc. (U.S.), Quinoasure Inc. (U.S.), Great River Organic Milling Inc. (U.S.), Urbane Grain Inc. (U.S.), Nature’s Path Foods (Canada) and GFB Great Foods (India) are some of the major companies in the global ancient grain market.

RECENT HAPPENINGS IN THE MARKET

- Ancient grains have been feeding humans since the beginning of civilization, but have been largely ignored by Western countries where selectively bred and processed grains have an economic advantage. But there have been few product developments in the area.

- Flowers Foods, for instance, is bringing out an ancient grain bun for the foodservice sector. Made of amaranth, buckwheat, Khorasan, millet and spelt, one bread contains 7 g of protein and 3 g of fibre.

- Kirkland Ancient Crackers from Costco were made from amaranth, millet, quinoa and teff. Boulder Canyon Ancient Grains Snack Chips from Utz Quality Foods are made of seven grains and seeds, including quinoa, millet, chia, amaranth, brown rice, brown teff and sorghum.

MARKET SEGMENTATION

This research report on the global Ancient Grain Market has been segmented and sub-segmented based on Crop Type, Application, & region.

By Crop Type

- Gluten Containing Ancient Grains

- Gluten-Free Ancient Grains

By Application

- Bakery and Confectionary

- Sports Nutrition

- Infant Formula

- Cereals

- Frozen Food

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Frequently Asked Questions

1.What are some examples of ancient grains?

Common examples of ancient grains include quinoa, amaranth, spelt, teff, millet, farro, einkorn, and kamut. These grains have been staples in various cultures around the world for thousands of years.

2.What makes ancient grains popular?

Ancient grains have gained popularity due to their nutritional benefits, including higher protein content, fiber, vitamins, and minerals compared to modern grains. They are also often gluten-free or lower in gluten, making them suitable for individuals with gluten sensitivities.

3.How is the ancient grain market growing?

The ancient grain market is experiencing significant growth as consumers become more health-conscious and seek out alternative grains with unique flavors and nutritional profiles. The increasing demand for gluten-free and plant-based products has also contributed to the market's expansion.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com